Daptomycin Market Outlook:

Daptomycin Market size was over USD 3.66 billion in 2025 and is poised to exceed USD 5.26 billion by 2035, witnessing over 3.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of daptomycin is estimated at USD 3.78 billion.

The proven efficacy of this element as an antibiotic solution is driving growth in the daptomycin market. The rising prevalence of bacterial infection, particularly during hospital stays inflates the demand for such therapeutics. According to a WHO report, published in May 2022, around 7 in high-income countries and 15 in low- and middle-income countries are affected by healthcare-associated infection (HAI) among every 100 patients admitted to acute-care hospitals. The report further stated that 24% of the total HAI patients and 52.3% of these affected patients being treated in an ICU die every year. Thus, growing mortality cases are concerning the public healthcare associations, pushing them to invest in availing effective treatments.

In addition, these infections often develop capabilities to resist antibiotic therapies, increasing the need for specific therapeutics. The offerings from the daptomycin market are well-efficient in combating such resistant bacterial strains, resulting in higher utilization. Moreover, growing reliance on advanced antibiotic products is creating a surge in this sector. According to the 2022 OEC data, the global trade value of antibiotics rose by 2.1% from 2021, reaching USD 10.7 billion in 2022. The exponential expansion of this industry is further inspiring pharmaceutical leaders to introduce more effective solutions such as daptomycin for solidifying their positions in the global landscape of this sector.

Key Daptomycin Market Insights Summary:

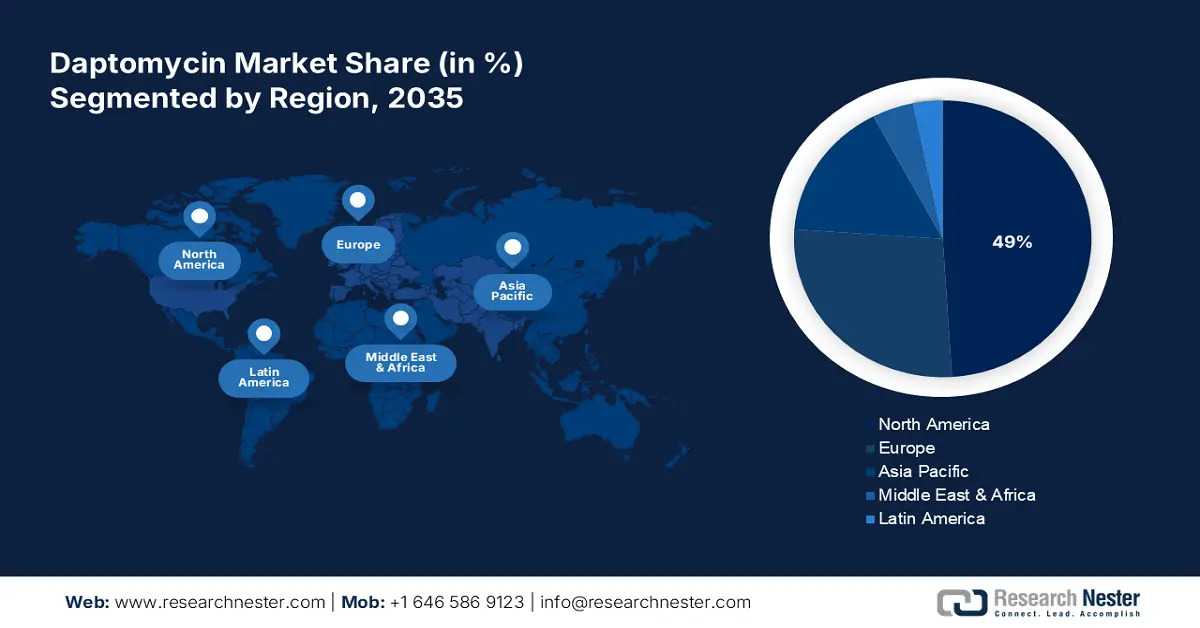

Regional Highlights:

- North America daptomycin market will account for 49% share by 2035, attributed to advanced healthcare infrastructure and HAI control efforts.

- Asia Pacific market will exhibit the fastest growth during the forecast period 2026-2035, driven by strong capabilities in biotech and R&D in microbials.

Segment Insights:

- The 500mg strength segment in the daptomycin market is projected to capture a 78.40% share by 2035, driven by increasing prevalence of HAIs and antibiotic resistance.

- The complicated skin structure infections segment in the daptomycin market is forecasted to achieve a significant share by 2035, influenced by the growing need for advanced antibiotics and positive clinical outcomes.

Key Growth Trends:

- Wide range of applications

- Increasing R&D activities

Major Challenges:

- Limitations in affordability and availability

- Highly competitive demographics

Key Players: Teva Pharmaceuticals Industries Ltd., Merck & Co., Cipla, Pfizer, BE Pharmaceuticals, Reddy’s Laboratories, Mylan, Fresenius Kabi, Novo Holdings A/S, Zhejiang Hisun.

Global Daptomycin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.66 billion

- 2026 Market Size: USD 3.78 billion

- Projected Market Size: USD 5.26 billion by 2035

- Growth Forecasts: 3.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Daptomycin Market Growth Drivers and Challenges:

Growth Drivers

-

Wide range of applications: The proven effectiveness of the products from the daptomycin market makes them preferable for wider healthcare applications. This encourages pharma companies to undergo various clinical trials, deepening the exploration of its potential. These efforts help diversify the product pipeline, attracting more consumers to invest. For instance, in February 2021, NLM published a study based on the clinical applications of high-dose daptomycin. The study highlighted its higher efficacy and limited safety concerns in cases of endocarditis, bacteremia, osteomyelitis & prosthetic joint infections, and meningitis/central nervous system infection.

Infection Type

Success Rate

Mortality Rate

Device-related Endocarditis

80%

0%

MSRA Bacteremia

84%

6.1%

Osteomyelitis and Prosthetic Joint Infections

85%

0%

- Increasing R&D activities: With the advancements in healthcare infrastructure, the frequency of innovation in the daptomycin market increases. The proactive research initiatives aim to mitigate issues with administration routes and develop new more effective formulations. They are also focusing on reducing the cost of therapeutics to make it more accessible for patients. This inspires healthcare professionals to prescribe more for single or hybrid daptomycin therapies. For instance, in July 2023, Camber Pharmaceuticals launched two new additions to its antibiotic portfolio, daptomycin injections in both 350 mg and 500 mg. This indicator can be used to treat cSSSI in patients aged between 1 to 17.

Challenges

- Limitations in affordability and availability: The products of the daptomycin market are expensive, which can create an economic barrier among patients from price-sensitive regions. This may limit the expansion of this sector. In addition to the volatility in general availability of these solutions often faces pricing issues during retail distribution, making it hard for patients to afford them. Moreover, high treatment costs may surpass the limited budget of resource-constraint hospitals, restricting product exposure across the healthcare industry.

- Highly competitive demographics: Despite having limited adverse reaction cases, growth in the daptomycin market can be hindered due to competition with cost-effective alternatives. In comparison to the first-line treatments such as vancomycin and linezolid, many of the onset uses of this element are still limited to clinical trials, limiting market penetration. This may further create a hurdle for this sector to captivate the optimum consumer base in the antibiotic industry. Moreover, this highly fragmented field can bring uncertainty in profit-making and consistent growth.

Daptomycin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.7% |

|

Base Year Market Size (2025) |

USD 3.66 billion |

|

Forecast Year Market Size (2035) |

USD 5.26 billion |

|

Regional Scope |

|

Daptomycin Market Segmentation:

Strength Segment Analysis

Based on strength, 500mg segment is projected to hold daptomycin market share of more than 78.4% by 2035. This drug works as an excellent indicator for Gram-positive infections such as skin and soft tissue infections (SSTIs), bacteremia, and endocarditis. This specific formulation of the medicine is effective for a wide range of chronic bacterial attacks such as bacteremia and endocarditis. Thus, the increasing prevalence of HAIs and antibiotic resistance is driving demand for this segment, inspiring pharma companies to introduce more of these formulations. For instance, in September 2019, Cipla launched a daptomycin Injection, 500mg/vial to beat the sales of Cubicin in the U.S., worth USD 606 million.

Indication Segment Analysis

In terms of indication, the complicated skin structure infections segment is projected to garner a significant share of the daptomycin market during the forecast period. This segment is pledged with the growing need for advanced antibiotics to cure such medical conditions. Clinical evidence of higher positive results in treating gram-positive pathogens, particularly MRSA multi-drug-resistant bacteria makes daptomycin preferable, inspiring companies to develop more effective solutions. For instance, in October 2021, Pfizer Hospital unveiled an additional formulation for both of its daptomycin injections of 350 mg and 500 mg strength. This formula features a faster and no-refrigeration constitution, while efficiently indicating cSSSI and bacteremia in adult patients.

Our in-depth analysis of the global market includes the following segments:

|

Strength |

|

|

Indication |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Daptomycin Market Regional Analysis:

North America Market Insights

North America in daptomycin market is anticipated to account for more than 49% revenue share by the end of 2035. Advanced healthcare infrastructure and increased expenditure for controlling the spread of HAIs are the major growth factors in this landscape. According to a report published by the U.S. Department of Health and Human Services, in 2020, sepsis is the major reason behind the illness of 1.7 million and the death of 270,000 people annually. The report further stated that around 258 million antibiotic prescriptions were issued from the OPD pharmacy terminals in the U.S. in 2017. This highlights the growing need for advanced antimicrobial drugs such as daptomycin in this region.

The U.S. has become the hub for global leaders in the daptomycin market due to its wide consumer base and excellent distribution channels. The country presents a golden opportunity for them to expand their business, making a crucial step in globalization. This further inspires other domestic participants to establish their footprint in this country by promoting the effectiveness of this drug. For instance, in July 2020, Sandoz Inc. launched daptomycin for injection of 500 mg in the U.S. to expand its injectable portfolio. This AP-rated generic version of Cubicin can treat cSSSI and some of the bloodstream infections.

Canada is steadily consolidating its position in the daptomycin market with proactive government initiatives and subsidiary policies. The concerning growth in HAI mortality cases is pushing the country to promote available treatment options and preventive measures. For instance, in May 2023, the government of Canada announced an investment of USD 6.3 million in antibiotic R&D to win the battle against the Antibiotic-Resistant Bacteria Biopharmaceutical Accelerator (CARB-X). This is further inflating demand in this sector due to the proven efficacy of daptomycin therapeutics in treating infectious conditions.

APAC Market Insights

Asia Pacific is expected to demonstrate the fastest growth in the daptomycin market with its strong captivity in biotechnology and R&D in microbials. The region is augmenting such growth with the developmental tendency of countries such as China, India, Japan, and Australia. The governing bodies in these countries are inspiring domestic leaders to elevate their production and supply across the world to take leadership in this sector. Thus, the growth in this region is further carried forward with the efforts of regional pharma leaders who are conducting R&D to bring innovations in this field.

India is propagating the regional daptomycin market with its strong pharmaceutical development and expansion. The country is accumulating the resources to leverage the accessibility of generic antibiotics. In addition, the rising burden of resistant pathogens in medical facilities across the country is fueling this sector. According to the 2022 OEC data, India became the 2nd largest exporter of antibiotics worldwide, achieving a value of USD 923 million. The country also accounted for the largest importer of these products, reaching USD 1.4 billion.

China is one of the biggest suppliers of the daptomycin market which is emerging as a great distribution source of this region. The country is also aiming to introduce more cost-effective solutions through mass production, offering a favorable business environment for both domestic and international leaders. According to the 2022 OEC data, China gained an export value of USD 4.5 billion for antibiotic products, making it the largest exporter of this category in the world. The report further highlighted the top export destinations to be India, Vietnam, Brazil, the U.S., and Italy.

Daptomycin Market Players:

- Teva Pharmaceuticals Industries Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck & Co.

- Cipla

- Pfizer

- BE Pharmaceuticals

- Reddy’s Laboratories

- Mylan

- Fresenius Kabi

- Novo Holdings A/S

- Zhejiang Hisun

- Biocon Pharma Ltd.

- Olon

The competitive demographic of the daptomycin market is inspiring global leaders to enforce their financial and academic resources in innovating more effective solutions. They are continuously putting efforts to promote adoption to push their territory forward for globalization. This is further dragging the focus of other competitor pharma companies to participate, enlarging the boundaries of this sector. For instance, in August 2024, Sunshine Biopharma, Inc. launched a new line of generic medicines, consisting of 9 prescription drugs in Canada. The pipeline contains several clinically proven drugs including daptomycin which is to be marketed and distributed in the country by its wholly owned subsidiary, Nora Pharma. Such key players include:

Recent Developments

- In August 2024, Biocon Pharma gained FDA approval for Daptomycin Injection ANDA (500mg vial), treating complicated skin and skin structure infections (cSSSI). The injection can also be used for Staphylococcus aureus infections in the bloodstream (bacteremia) in adult patients.

- In March 2024, Olon announced doubling the production capacity of new antibiotics to supply for the treatment of skin infections while celebrating 10 years of the approval for its daptomycin process launch. The company expressed its intention to invest in expanding the reach of this product by following sustainable manufacturing practices.

- Report ID: 7008

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Daptomycin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.