Cyclohexane Market Outlook:

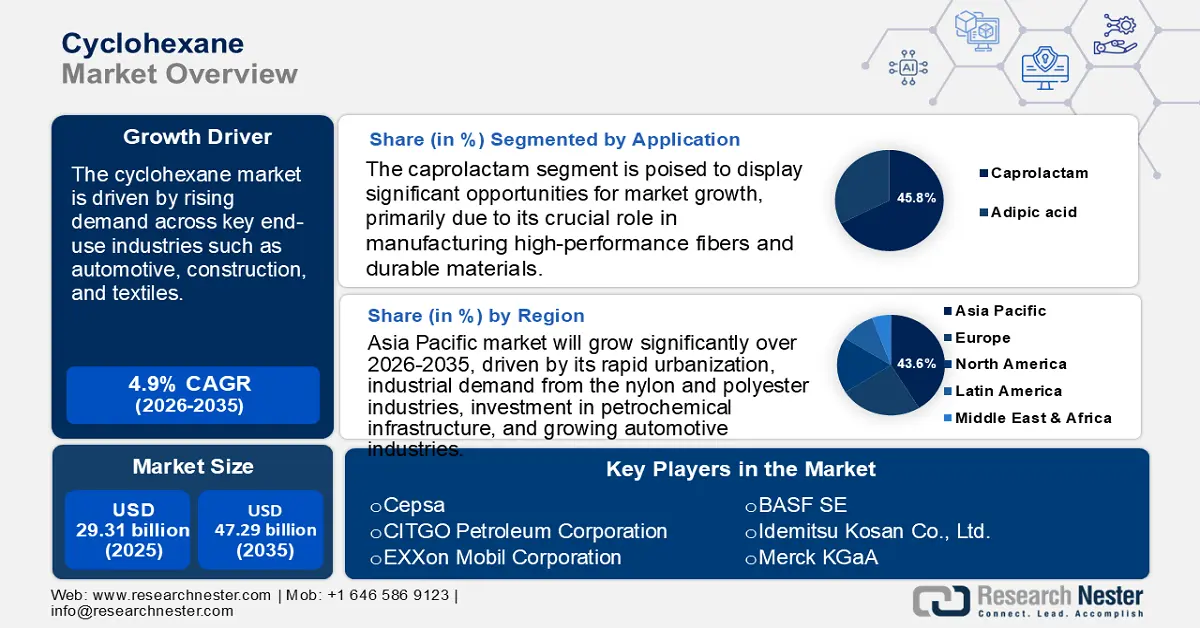

Cyclohexane Market size was over USD 29.31 billion in 2025 and is projected to reach USD 47.29 billion by 2035, witnessing around 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cyclohexane is evaluated at USD 30.6 billion.

The cyclone hexane market is poised for steady growth, driven by rising demand across key end-use industries such as automotive, construction, and textiles. Cyclohexane is a critical raw material for producing adipic acid, essential for manufacturing nylon 66, polyurethane resins, and plasticizers. The expanding construction and automotive sectors, which rely heavily on nylon-based products, are significantly boosting the demand for adipic acid and thereby cyclohexane. In the automotive industry, nylon 6 produced from cyclohexane derivatives is extensively used in components like airbags, carpets, and seat belts. As the global automotive sector recovers and advances towards high production volumes, the consumption of cyclohexane is expected to rise correspondingly.

Furthermore, the growing preference for nylon products, owing to their superior strength, durability, and abrasion resistance, is anticipated to further drive cyclohexane demand. For instance, Chevron Phillips Chemical Company LLC is the leading global producer of cyclohexane. They manufacture high-purity cyclohexane, mainly used as an intermediate in producing nylon. An emerging trend within the industry is the increasing focus on sustainable and bio-based alternatives. Environmental concerns and the global push towards sustainability are encouraging companies to innovate.

BioAmber has effectively created a bio-based adipic acid that serves as a substitute for traditional adipic acid, which is an essential derivative of cyclohexane utilized in the production of nylon 66 and polyurethane. Traditional adipic acid production relies heavily on petroleum-based cyclohexane, a process associated with significant greenhouse gas emissions. This shift towards renewable, eco-friendly raw materials represents a strategic pivot for companies aiming to reduce their carbon footprint while meeting regulatory requirements. Overall, the cyclohexane market is expected to benefit from the dual forces of traditional industrial growth and the progressive movement toward greener, more sustainable chemical production methods.

Key Cyclohexane Market Insights Summary:

Regional Highlights:

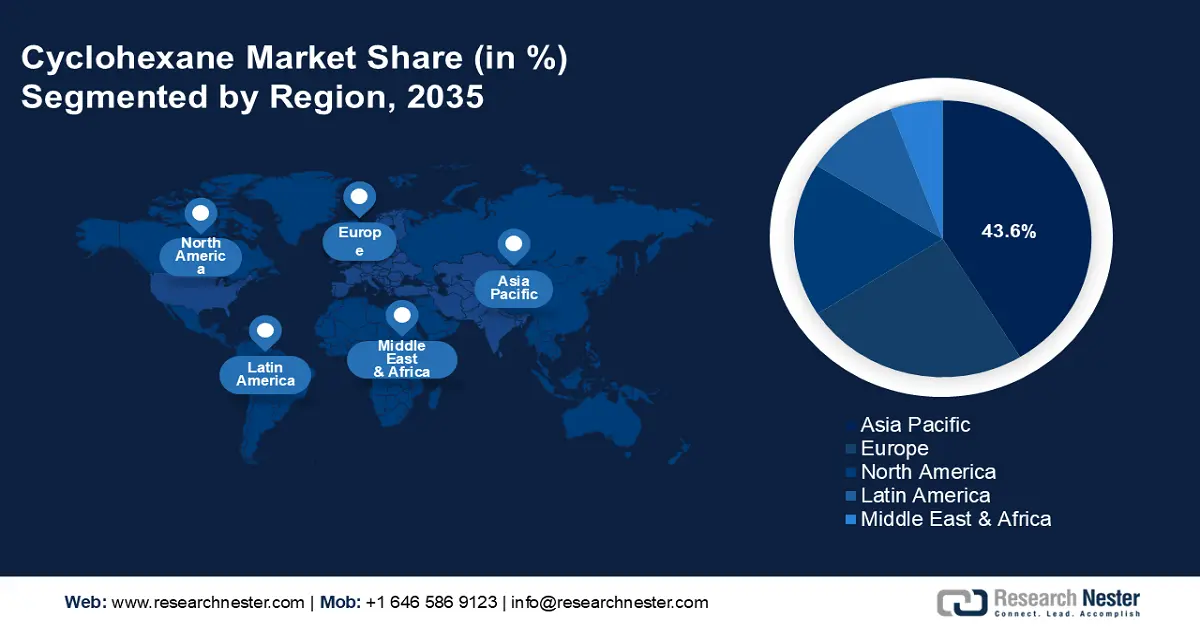

- Asia Pacific commands a 43.6% share in the Cyclohexane Market, propelled by demand from nylon, polyester, and automotive sectors in China and India, ensuring strong growth through 2035.

- Europe's cyclohexane market is achieving the second-largest share by 2035, fueled by industrial innovation and demand for high-performance materials.

Segment Insights:

- The Textile segment is projected to hold a substantial share by 2035, driven by rising consumer demand for durable, high-performance nylon textiles.

- Caprolactam segment is anticipated to hold a 45.8% share by 2035, driven by its crucial role in manufacturing nylon 6 for textiles.

Key Growth Trends:

- The increasing demand for nylon manufacturing

- Emerging bio-based alternatives and sustainability initiatives

Major Challenges:

- Volatility in raw material prices

- High energy consumption

- Key Players: Cepsa, Chevron Phillips Chemical Company LLC, CITGO Petroleum Corporation, Reliance Industries Limited, Exxon Mobil Corporation, Idemitsu Kosan Co., Ltd., PTT Global Chemical Public Limited, Merck KGaA, Cargill, Incorporated.

Global Cyclohexane Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.31 billion

- 2026 Market Size: USD 30.6 billion

- Projected Market Size: USD 47.29 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 12 August, 2025

Cyclohexane Market Growth Drivers and Challenges:

Growth Drivers

-

The increasing demand for nylon manufacturing: Cyclohexane is essential in producing adipic acid and caprolactam, which are two key intermediates in the creation of nylon 6 and nylon 66. The rising need for nylon products, especially in the automotive, textile, and industrial industries, is greatly influencing the worldwide usage of cyclohexane. Nylon’s superior properties, including high tensile strength, durability, elasticity, and abrasion resistance, make it a preferred material for a wide range of applications such as automotive components, industrial machinery parts, and textile products.

As industries increasingly seek lightweight and strong materials to enhance performance and reduce energy consumption, nylon’s prominence continues to rise, especially in automotive manufacturing aimed at improving fuel efficiency. This expanding demand for nylon products directly correlates to a surge in cyclohexane utilization. A notable instance is BASF SE, a global chemical leader actively involved in producing caprolactam and nylon materials called Ultamid. The materials originate from petrochemical feedstocks such as cyclohexane, p-xylene, and benzene. BASF’s strong focus on innovation and sustainability helps meet the growing needs of end-user industries, further supporting the cyclohexane market.

- Emerging bio-based alternatives and sustainability initiatives: The increasing global focus on environmental sustainability is driving significant investments in bio-based alternatives for cyclohexane production. Conventional methods of cyclohexane production, which depend on petrochemical processes, are linked to significant carbon emissions. To address these concerns, companies are developing bio-based adipic acid, a key intermediate in nylon production, using renewable resources. These sustainable methods not only minimize environmental impact but also help companies comply with stringent environmental regulations and cater to the growing consumer demand for eco-friendly products.

The shift towards greener chemical production aligns with broader industry trends of the circular economy and carbon neutrality. An instance is Genomatica, Inc., a biotechnology company that focuses on bioengineering sustainable chemical production. Genomatica has developed bio-based processes for producing key intermediates, offering a viable, environmentally friendly alternative to conventional petrochemical-derived products. Their innovation highlights the potential for bio-based adipic acid to reshape the future of the cyclohexane and nylon markets.

Challenges

-

Volatility in raw material prices: Cyclohexane is primarily derived from benzene, which in turn is sourced from crude oil. As a result, fluctuations in crude oil prices have a direct impact on benzene production costs, and consequently, on cyclohexane production. The volatility in crude oil prices introduces significant uncertainty into the cost structure, leading to potential price instability for cyclohexane. This instability can strain profit margins for producers and disrupt the supply chain, as companies may struggle to maintain consistent pricing. Such fluctuations require cyclohexane manufacturers to adapt quickly to the cyclohexane market shift to remain competitive.

-

High energy consumption: The production of cyclohexane is an energy-intensive process, requiring significant amounts of electricity and heat for various chemical reactions, including the hydrogenation of benzene. As energy costs continue to rise globally, cyclohexane manufacturers face increasing pressure to manage operational expenses while maintaining production efficiency. The high energy consumption not only contributes to rising production costs but also poses environmental concerns, as traditional energy sources may involve higher carbon emissions.

To mitigate these challenges, producers must invest in energy-efficient technologies and adopt sustainable practices to reduce energy usage. However, these initiatives often require substantial capital investment and long-term planning, adding additional complexity to the manufacturing process.

Cyclohexane Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 29.31 billion |

|

Forecast Year Market Size (2035) |

USD 47.29 billion |

|

Regional Scope |

|

Cyclohexane Market Segmentation:

Application (Adipic acid and Caprolactam)

The caprolactam segment is expected to capture the largest cyclohexane market share of 45.8% during the forecast period of 2035. Caprolactam serves as an essential raw material in the manufacturing of nylon 6, a substance extensively utilized in the textile, apparel, and carpeting industries. Its crucial role in manufacturing high-performance fibers and durable materials has been a key driver behind its dominant market position. The increasing global demand for nylon-based products, particularly in the growing automotive and apparel industries, continues to bolster caprolactam consumption.

Leading companies like UBE Corporation, based in Japan, are at the forefront of caprolactam production. UBE has strategically invested in advanced production technologies and sustainability initiatives to enhance product quality and operational efficiency. Their commitment to innovation and consistent supply capabilities positions them strongly in the global cyclohexane market, supporting the expanding demand for nylon and reinforcing the caprolactam segment’s positive growth outlook in the cyclohexane value chain.

End use (Automotive, Paints and Coatings, Textiles, and Construction)

The textile segment is expected to dominate the global cyclohexane market by holding a substantial share during the forecast period. Cyclohexane plays a vital role in the textile industry, especially in the production of nylon fibers that are widely utilized in apparel, carpets, and industrial textiles. The elasticity, durability, and wear resistance of nylon render it a favored option in the international textile sector. As consumer demand for high-performance, durable textiles rises, the reliance on cyclohexane-derived nylon continues to grow.

For instance, Toray Industries, Inc., a major player in Japan’s chemical and textile sectors, has been instrumental in advancing the use of cyclohexane in textile applications. Toray’s commitment to innovation and sustainability enables the production of high-quality nylon fibers that meet evolving consumer and industrial demands. Their strategic investments in research and development have strengthened their leadership position, allowing them to cater effectively to both traditional textile markets and emerging high-tech fabric applications globally.

Our in-depth analysis of the global cyclohexane market includes the following segments:

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cyclohexane Market Regional Analysis:

Asia Pacific Market Statistics

The cyclohexane market in Asia Pacific is expected to grow with a share of 43.6% by 2035, with India and China at the forefront of this growth trend. China's status as the leading global consumer and producer of cyclohexane is influenced by its swift urban development, the industrial requirements of the nylon and polyester sectors, investments in petrochemical facilities, and the expansion of its automotive industry. The country is also witnessing a gradual shift toward bio-based cyclohexane production, aligning with global sustainability trends and consumer awareness of eco-friendly products.

India, with its booming population and rising middle-class income levels, is experiencing increased demand for nylon-based products, boosting cyclohexane consumption. The expansion of India’s automotive and textile sectors further supports their growth, creating strong opportunities for cyclohexane producers. For instance, companies such as Reliance Industries Limited are strategically positioned to leverage the growing market needs, supporting the region’s continued dominance in the cyclohexane industry.

Europe Market Analysis

Europe ranks as the second-largest region, possessing a significant portion of the global cyclohexane market throughout the forecast period. Germany remains a leading contributor to Europe’s cyclohexane market, supported by its strong industrial base, advanced chemical manufacturing infrastructure, and significant demand for nylon and adipic acid production. Major German chemical companies such as LANXESS AG entered s strategic partnership with BP to procure sustainably produced cyclohexane, certified under the International Sustainability and Carbon Certification (ISCC) Plus scheme. This green cyclohexane is employed at LANXESS's manufacturing facility located in Antwerp, Belgium, where it acts as a precursor in the production of polyamide 6, a high-performance plastic extensively utilized in the consumer goods sector.

Similarly, the UK demonstrates consistent demand for cyclohexane, particularly within the automotive, construction, and textile sectors. UK-based companies such as INEOS Group, a global chemical giant, are pivotal players, contributing to cyclohexane production and supply for various applications. The UK’s chemical sector benefits from innovation-driven investments and a stable supply chain for raw materials. Both Germany and the UK are expected to maintain moderate growth in cyclohexane consumption, driven by industrial innovation, strong end-user demand, and ongoing development in high-performance materials.

Key Cyclohexane Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cepsa

- Chevron Phillips Chemical Company LLC

- CITGO Petroleum Corporation

- Reliance Industries Limited

- Exxon Mobil Corporation

- Idemitsu Kosan Co.,Ltd.

- PTT Global Chemical Public Limited

- Merck KGaA

- Cargill, Incorporated

- Procter & Gamble

- Idemitsu Kosan

- Mitsui Chemicals

- KANTO CHEMICAL CO., INC.

- Kishida Chemical Co., Ltd

Key players leverage advanced oxidation technologies, integrated production systems, and sustainable raw materials sourcing to maintain leadership in the cyclohexane market. Innovations in catalyst efficiency, energy optimization, and adoption of bio-based feedstock also help them meet rising demand, aligning with environmental regulations.

Recent Developments

- In December 2021, Cepsa Qumica introduced a new range of sustainable products, featuring recyclable and renewable materials, as a result of recent scientific advancements and innovations.

- In May 2021, Chevron Phillips Chemical announced its intention to enhance its alpha olefins division by constructing a second large-scale facility specifically for the production of 1-hexene aimed at specialized applications. This new plant, which will have a capacity of 266 KTA, is expected to begin operations in 2023 in Old Ocean, Texas. The initiative is expected to generate around 600 construction jobs and 50 permanent positions at its maximum capacity.

- Report ID: 7617

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cyclohexane Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.