Crystal Oscillator Market Outlook:

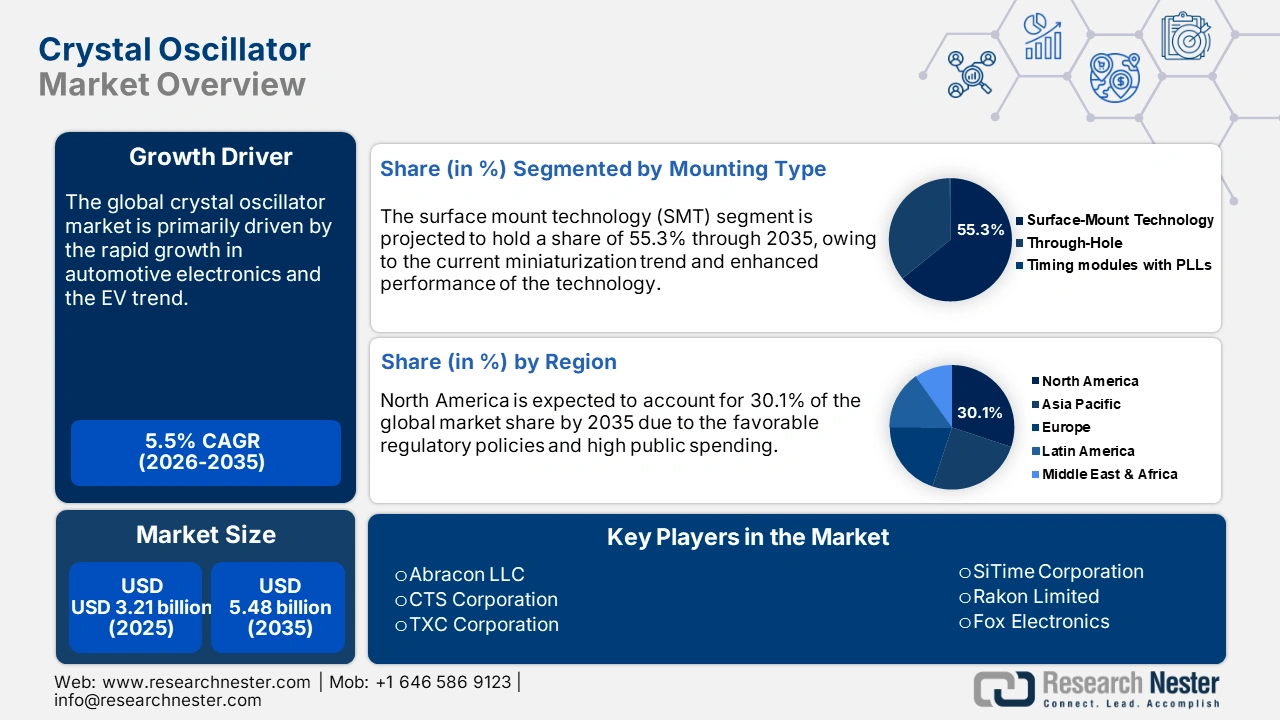

Crystal Oscillator Market size was valued at approximately USD 3.21 billion in 2025 and is projected to reach around USD 5.48 billion by the end of 2035, rising at a CAGR of approximately 5.5% during the forecast period 2026-2035. In 2026, the industry size of crystal oscillator is assessed at USD 3.39 billion.

The crystal oscillator supply chain plays a vital role in the global electronics manufacturing ecosystem. The seamless supply of raw materials is estimated to fuel the oscillator assembly and system integration in the coming years. A streamlined flow of raw material is crucial for upkeeping an unbroken production cycle and meeting the surging global demand. The extensive availability directly impacts the assemblage processes, allowing manufacturers to expand operations and further support a myriad of industries, such as consumer electronics, defense, aerospace, etc.

The production and supply chain of the crystal oscillators are closely associated with major trends in the electronics industry. Additionally, the prices for electronic components are rising, reflecting that these products are becoming indispensable. Prominent countries such as the U.S. still rely on global supply chains to procure crucial materials and finished components. This underscores that the country relies on global supply chains for finished components and semiconductors. The digital shifts and automation trends are likely to increase the use of crystal oscillators in the coming years.

Key Crystal Oscillator Market Insights Summary:

Regional Insights:

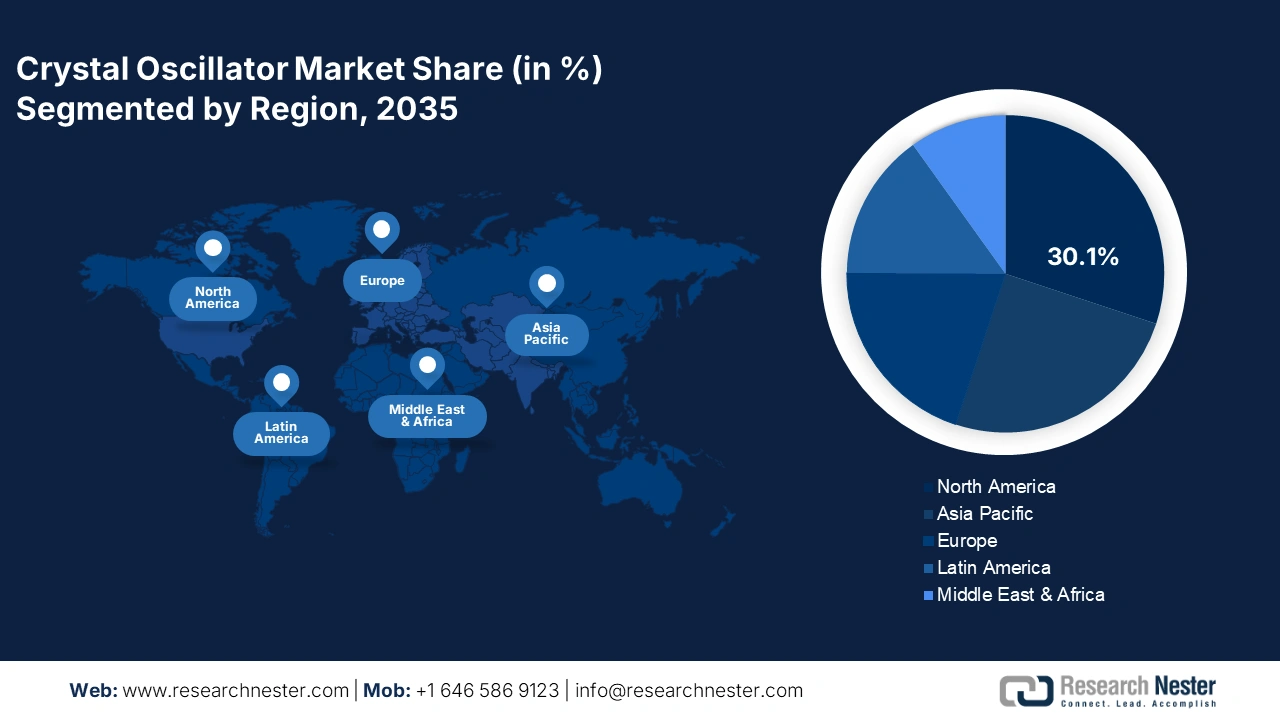

- The North America market is expected to capture 30.1% of the global revenue share by 2035, impelled by propelling smart manufacturing and automation activities.

- The Asia Pacific crystal oscillator market is foreseen to grow at a CAGR of 6.1% between 2026–2035, owing to the expanding IT & telecommunications sector.

Segment Insights:

- The electronics contract manufacturers segment is projected to account for 39.1% share by 2035, propelled by increasing demand for robust connectivity solutions for seamless device performance.

- The surface mount technology type segment is foreseen to hold 55.3% share by 2035, driven by the miniaturization trend and demand for automated PCB manufacturing processes.

Key Growth Trends:

- Advent of Industry 4.0

- Advancements in the 5G and communication networks

Major Challenges:

- Infrastructure gap

- Regulatory trade barriers

Key Players: Abracon LLC, CTS Corporation, TXC Corporation, SiTime Corporation, Rakon Limited, Fox Electronics, Ecliptek Corporation, Euroquartz Ltd, TXC America, Taitien Electronics, Syfer Technology, Sichuan Jiehong Electronic, CTS India, Texas Instruments

Global Crystal Oscillator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.21 billion

- 2026 Market Size: USD 3.39 billion

- Projected Market Size: USD 5.48 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Mexico, Vietnam, Indonesia

Last updated on : 30 September, 2025

Crystal Oscillator Market - Growth Drivers and Challenges

Growth Drivers

- Advent of Industry 4.0: With the advent of Industry 4.0, highly automated production lines are being extensively introduced that need precise timing for communication. According to the International Federation of Robotics, 276,288 industrial robots were installed in 2023. The inclusion of crystal oscillators renders a stable clock signal, ensuring accurate operations as well as synchronization. The smart manufacturing and factory automation trends are also increasing the sales of real-time monitoring crystal oscillators. End users are increasingly demanding of crystal oscillators with high thermal stability and shock resistance. Continuous technological innovations are estimated to fuel the adoption of industrial-grade crystal oscillators.

- Advancements in the 5G and communication networks: The increase in deployment of high-speed Ethernet networks is prominently fostering the demand for crystal oscillators. The data published by 5G Americans in March 2025 stated that the global telecommunication industry garnered a monumental milestone with worldwide 5G connections reaching a number of 2.25 billion. Furthermore, the rising adoption of M2M communication, which incorporates a plethora of interconnected devices, further fosters the requirement for efficient oscillators for conducting real-time exchange of data. The high-frequency communication system also relies heavily on crystal oscillators to handle precise clock signals and further reduce the chances of errors and confirm a consistent flow of data.

- Growth in automotive electronics & EV trend: The EV trend and increasing demand for autonomous vehicles are expected to propel the sales of crystal oscillators in the coming years. The increasing integration of innovative infotainment systems is poised to augment the sales of crystal oscillators for timing synchronization. The advanced driver assistance systems and EV powertrains are gaining traction across the world. According to the International Energy Agency, the sales of electric cars reached 17 million in the year 2024. EVs depend heavily on the intricate powertrain electronics, and the inclusion of the crystal oscillators ensures accurate timing in the motor controllers.

Global Electric Car Sales

|

Year |

Total Sales (millions) |

|

2018 |

1.5 |

|

2019 |

2.0 |

|

2020 |

3.0 |

|

2021 |

4.2 |

|

2022 |

6.5 |

|

2023 |

10.0 |

|

2024 |

17.0 |

Source: IEA

Challenges

- Infrastructure gap: The poor infrastructure is a prime barrier to the production and commercialization of crystal oscillators. The unavailability of advanced cleanroom facilities and precision assembly lines hinders the overall manufacturing process. This also lowers the entry of investors, hampering the economic growth of the country. However, many leading players are employing collaboration strategies to combat these issues.

- Regulatory trade barriers: The complex regulatory policies are expected to hinder the introduction of new crystal oscillators. The delay in the market entry leads to major revenue loss as manufacturers are not able to capitalize on trend opportunities. Furthermore, strict regulations also add to operational costs, which increases the price of the final products and offers low profit margins.

Crystal Oscillator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 3.21 billion |

|

Forecast Year Market Size (2035) |

USD 5.48 billion |

|

Regional Scope |

|

Crystal Oscillator Market Segmentation:

End Use Segment Analysis

The electronics contract manufacturers segment is projected to register 39.1% of the global crystal oscillator market share by the end of the year of 2035. The burgeoning demand for wearables, smartphones, and home devices is augmenting a high demand for high-performance materials. According to the Observatory of Economic Complexity in 2023, the worldwide trade of electronics and electrical machinery reached more than USD 3.51 trillion. This represents a lucrative earning opportunity for high-performance material producers. The increasing demand for robust connectivity solutions for seamless device performance is set to accelerate the sales of crystal oscillators.

Mounting Type Segment Analysis

The surface mount technology type segment is foreseen to hold 55.3% of the global crystal oscillator market share throughout the forecast period. The miniaturization trend and demand for automated PCB manufacturing processes are projected to propel the demand for surface-mount crystal oscillator technologies. Furthermore, the surge in usage of wearables and portable medical equipment is propelling the preference for SMT oscillators. The surge in the need for energy-efficient electronic systems in electric vehicles further augments the dominance of the surface mount segment.

Application Segment Analysis

The telecommunication sub-segment is set to witness astounding growth, mainly driven by the ubiquitous deployment of the 5G framework. Several telecom operators are investing significantly in the diversification of their networks, further raising the demand for crystal oscillators. Additionally, there has been a burgeoning adoption of cloud services that has further reinforced the dependence on state-of-the-art networking infrastructure. Other than this, the surge of massive IoT is another growth propelling factor of the sub-segment. Also, the mushrooming data traffic has placed significant pressure on the telecom networks, compelling companies to upgrade their infrastructure.

Our in-depth analysis of the market includes the following segments:

|

Subsegments |

|

|

|

|

Mounting Type |

|

|

Frequency |

|

|

Crystal cut |

|

|

Technology |

|

|

Application |

|

|

End user |

|

|

Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Crystal Oscillator Market - Regional Analysis

North America Market Insights

The North America market is expected to capture 30.1% of the global revenue share through 2035. The digital shift in SMEs and large enterprises is backing the growth of the crystal oscillator market. The favorable regulatory policies and public incentives are likely to boost the sales of crystal oscillators in the coming years. The propelling smart manufacturing and automation activities are set to fuel the demand for innovative crystal oscillators in the years ahead. The increasing investments in the expansion of robust wireless connectivity networks are estimated to fuel the sales of crystal oscillators in the U.S. The robust growth in the telecommunication sector is poised to fuel the demand for innovative crystal oscillators. According to data published by the US Telecom in 2022, U.S. broadband providers invested USD 102.4 billion in communications infrastructure.

The increasing demand for specialized material in the automotive, electronics, and aerospace & defense sectors of Canada is projected to boost the sales of crystal oscillators. The booming demand for robust wireless communication infrastructure is also set to propel the demand for crystal oscillators in the coming years. The increasing demand for digital tools is poised to fuel the production of AI and ML-powered crystal oscillators in the country. Additionally, the rising adoption of electric vehicles in the country is acting as a growth-promoting factor for the market growth.

APAC Market Insights

The Asia Pacific crystal oscillator market is foreseen to increase at a CAGR of 6.1% between 2026 to 2035. The expanding IT & telecommunications sector is poised to increase the sales of crystal oscillators in the coming years. The supportive government policies aimed at the expansion of ICT infrastructure are likely to accelerate the production of crystal oscillators. The ongoing advancements in automobile manufacturing are estimated to double the revenue of crystal oscillator manufacturers. China, Japan, South Korea, and India are the most opportunistic markets for crystal oscillator producers.

The booming semiconductor market of China is significantly contributing to the production of advanced crystal oscillators. Additionally, the swift 5G rollout and IoT adoption are contributing to the overall market growth. Other than this, the country is a global hub for the development of consumer devices, all of which depend heavily on the crystal oscillators. The country’s rising spending on satellite navigation is creating demand for high-reliability oscillators with temperature stability and durability.

The digital transformation moves are poised to drive the sales of crystal oscillators in India at a high pace during the study period. The supportive government policies are also backing the sales of crystal oscillators. Initiatives such as Digital Bharat and Make in India are also anticipated to propel the trade of crystal oscillators in the country. According to the Ministry of Electronics and Information Technology, the country’s electronics production will reach USD 300 billion by 2026. These factors are accelerating the demand for passive and timing components.

Europe Market Insights

The market in Europe is set to garner astounding growth driven by a significant 5G network rollout. This is thrusting the demand for more stable and reliable oscillators in numerous backhaul equipment. Additionally, in Europe, the rising focus on industry automation and the widespread establishment of smart factories is augmenting the usage of oscillators, particularly in robots. According to a report published by the European Parliament in February 2025, the coverage across the EU needs an investment of EUR 200 billion.

The market in the UK is expanding owing to a number of growth drivers such as extensive 5G rollout and rising usage of oscillators in the automotive sector. According to the data published by the Government of the UK, more than 85% of the premises in the country are currently accessing 5G coverage in standalone or non-standalone 5G coverage. The country is also emerging as a hub for cloud infrastructure and data centers, requiring oscillators for timing as well as storage. Also, factors such as the growth of the EV and aerospace sectors develop a backbone for the market growth in the UK.

Key Crystal Oscillator Market Players:

- Abracon LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CTS Corporation

- TXC Corporation

- SiTime Corporation

- Rakon Limited

- Fox Electronics

- Ecliptek Corporation

- Euroquartz Ltd

- TXC America

- Taitien Electronics

- Syfer Technology

- Sichuan Jiehong Electronic

- CTS India

- Texas Instruments

The global crystal oscillator market is dominated by U.S. and Japan-based companies, owing to their advanced technological know-how. Leading companies are focused on research and development activities to introduce next-generation crystal oscillators. The industry giants are also employing strategies such as new product launches, mergers & acquisitions, partnerships & collaborations, and regional expansions to maximize their reach. Key players are entering into strategic collaborations with other companies to enhance their product offerings. They are also expanding their operations in high-potential markets to earn high profits from untapped opportunities. Here is a list of companies in the market:

Recent Developments

- In January 2025, Abracon announced a broad new line of MEMS oscillators (≥ 50 series, ~1,700 part numbers) to expand its timing offerings. These strategic initiatives enable Abracon to more effectively meet customer needs and maintain its position as a trusted industry partner.

- In September 2025, SiTime Corporation launched the Titan Platform, a new family of MEMS resonators, marking its expansion beyond oscillators. Titan expands SiTime’s serviceable addressable market by USD 400 million now, growing to USD 1 billion annually within 3 years.

- Report ID: 5285

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Crystal Oscillator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.