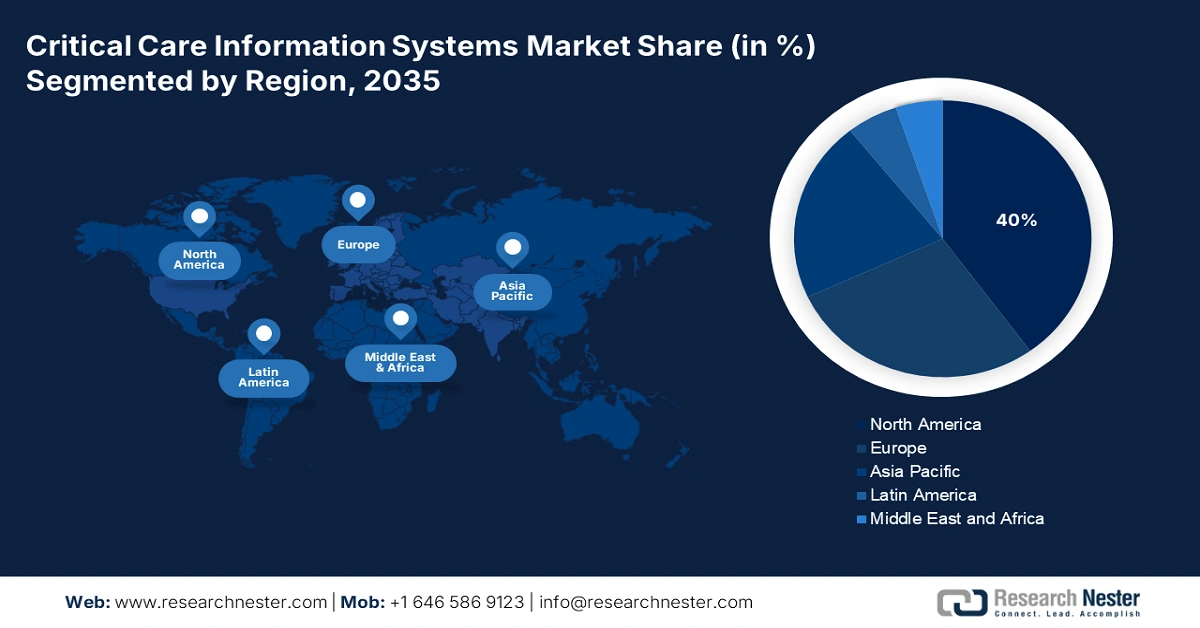

Critical Care Information Systems Market - Regional Analysis

North America Market Insights

North America is the dominant player in the critical care information systems market and is expected to hold the maximum share of 40% by 2035. The market is driven by the digital healthcare infrastructure and high ICU patient admissions across the region, including Canada and the U.S. Further, the increasing integration of cloud-based data platforms makes the hospital sector adopt digital solutions. As per the CDC and AHRQ report, the ICU-based digital solutions in the healthcare sector in the U.S. are increasing rapidly since 2021. Advancements in technologies such as AI decision tools and enhanced analytics dominate the market preferences.

The critical care information systems market in the U.S. is growing rapidly and is driven by the rising ICU admissions, federal policy alignment, and expanded reimbursement via Medicaid and Medicare. Adoption is further driven by FDA regulatory backing for clinical decision assistance software. The NLM report in September 2024 depicts that the AHRQ has funded over USD 711 million on digital healthcare innovations. This includes telehealth, clinical decision support, virtual care, and AI in healthcare. Hospitals in the U.S. are combining CCIS with telemetry and remote surveillance systems, especially in tertiary care networks.

Canada is the second largest country in the critical care information systems market in North America. The market is driven by the federal-provincial collaborations focused to modernize digital health infrastructure. The latest trend is the push for pan-Canadian interoperability standards, led by Canada Health Infoway, to make a secure sharing of critical patient data among the provinces and care settings. As per the DIGITAL’s data in July 2024, investment of USD 15.3 million to support the consortium of organizations, leveraged into a total project value of USD 44 million, further reflects the national commitment to expanding digital health capacity.

Description of Hospital Admissions in Canada

|

Variable |

January 2 to January 29, 2022 |

January 30 to February 26, 2022 |

February 27 to March 26, 2022 |

March 27 to April 23, 2022 |

||||

|

n |

% |

n |

% |

n |

% |

n |

% |

|

|

Admitted to ICU |

565 |

13.4 |

187 |

12.1 |

89 |

8.8 |

185 |

7.7 |

Source: Government of Canada 2024

Asia Pacific Market Insights

The APAC region is the fastest-growing sector in the market, fueled by the government digitization programs, urgent requirement of modernize critical care infrastructure, and rising ICU admissions. EHR-integrated dashboards, AI-powered clinical decision support systems, and real-time intensive care unit monitoring are becoming top priorities for nations in the area. Governments have accelerated investments in smart intensive care units and predictive analytics after the COVID-19 pandemic highlighted the serious gaps in ICU interoperability. Further the market is also driven by the government budget allocation for ICU and IT with the focus on reducing the mortality rate and improving the decision making speed.

Japan is rising steadily, holds the largest share in the APAC region and is expected to have the largest market share by 2035. As per the International Trade Administration report in December 2022, the Japan’s healthtech segment will grow to USD 2 billion by 2025, part of which is focusing on focusing on ICU monitoring systems, decision support, tele-ICU, and interoperability in high-acuity care settings. The Agency for Medical Research and Development in Japan has launched various innovative grants in the market specially in urban tertiary centers and university hospitals. Furthermore, the government also supported the real time EHR integration pilots in the hospital ICU by providing funds to minimize the average length of stay period.

The market in India is growing rapidly, driven by governmental digital health initiatives such as the Ayushman Bharat Digital Mission (ABDM), which aims to create a single national digital health ecosystem. The drive for digitization, in conjunction with an increased patient burden and the pressure to improve ICU efficiency, has led to substantial investment growth. In February 2025, a report was published in Express Healthcare, which stated that over 77% of health technology startups were investing in advanced technology for critical solutions (like machine learning and artificial intelligence). Some notable trends to consider include the development of scalable, cost-effective cloud-based solutions and an increasing focus on interoperability to support the integration of CCIS within other hospital management solutions given the multiplicity of health care systems across India's health system.

Europe Market Insights

The critical care information systems market in Europe is significantly expanding. The market has risen due to the adoption of AI in ICU units, public health investments, and expanding EHR infrastructure. Rising ICU admissions in post-COVID and in elderly patients across the EU are increasing the demand for real-time patient monitoring, predictive analytics, and decision support. National digital health missions, AI regulatory frameworks, and advantageous reimbursement practices all help to promote adoption. The increasing need in tertiary hospitals and regional health networks presents an opportunity for vendors with scalable, AI-integrated, and HL7/FHIR-compliant solutions.

The Germany is leading the critical care information systems market and is expected to hold the market share of 7.6% by 2035. Germany is fueled by the robust policy frameworks, including the Krankenhauszukunftsgesetz, which allocated nearly €4.3 billion, including for intensive care technology upgrades, as per the NSIDE ATTACK LOGIC report in 2025. Many hospitals in the Germany have integrated cloud-based platforms in 2023, featuring AI-powered predictive diagnostics. The market in Germany is benefited by the high volume of local vendors and consistent public funding.

UK is a well-established and growing market and is primarily aimed at the National Health Service's long-term plan to digitize healthcare and ultimately realize the integrated care systems. The market is driven by optimizing operational efficiency in intensive care units, reducing clinician burnout via automated workflow support, and fulfilling government mandates to deliver a paperless NHS. As per the Bulletin of the Royal College of Surgeons of England article in June 2025, the announcement was made in February 2025 that £83 million is funded for projects aiming to integrate artificial intelligence to diagnose and tackle cancer, hence drive the use of new technologies in healthcare.