Cristobalite Market Outlook:

Cristobalite Market size was valued at USD 40.17 million in 2025 and is projected to reach USD 67.08 million by the end of 2035, rising at a CAGR of 5.3% during the forecast period, i.e., 2026–2035. In 2026, the industry size of the cristobalite is estimated at USD 42.29 million.

The primary growth driver of cristobalite demand is a global surge in building activity for engineered stone, ceramic tiles, high durability coatings, and glass ceramic applications. The growth depends on the increased infrastructure and urbanization in key economies. The COVID-19 pandemic was the primary reason for the 17% decline in revenue in 2020. However, 2021 saw a recovery with $43.4 billion in revenue, or an 18% increase, just $928 million less than pre-pandemic 2019 figures. The industry's revenue was expected to reach $47.3 billion in 2022, a 9% increase, and there were 1,770 foundries, a 2.6% increase, with an average revenue of $26.7 million. According to the Construction & Economy Research Institute of Korea (CERIK) and the Construction Association of Korea (CAK), the Korean construction industry was valued at $166 billion (KRW 207 trillion) in 2023, representing a 6.7% decrease from 2022. Following a 2021 peak of $185 billion (KRW 212 trillion) and a 2022 peak of $178 billion (KRW 230 trillion), the industry is now slowing down.

The supply chain for cristobalite is dependent on the suppliers of high-purity silica sand produced by high-temperature transformation. Nevertheless, the trade statistics of siliceous products may serve as an important leading indicator in this respect. As per the Producer Price Index (PPI) for Korea, the average cost of materials increased by 19% in 2021 and another 15% in 2022. In 2021, the price of steel and metal climbed by almost 43%, while in 2022, the price of cement and ready-mixed concrete increased by 18%.

Key Cristobalite Market Insights Summary:

Regional Highlights:

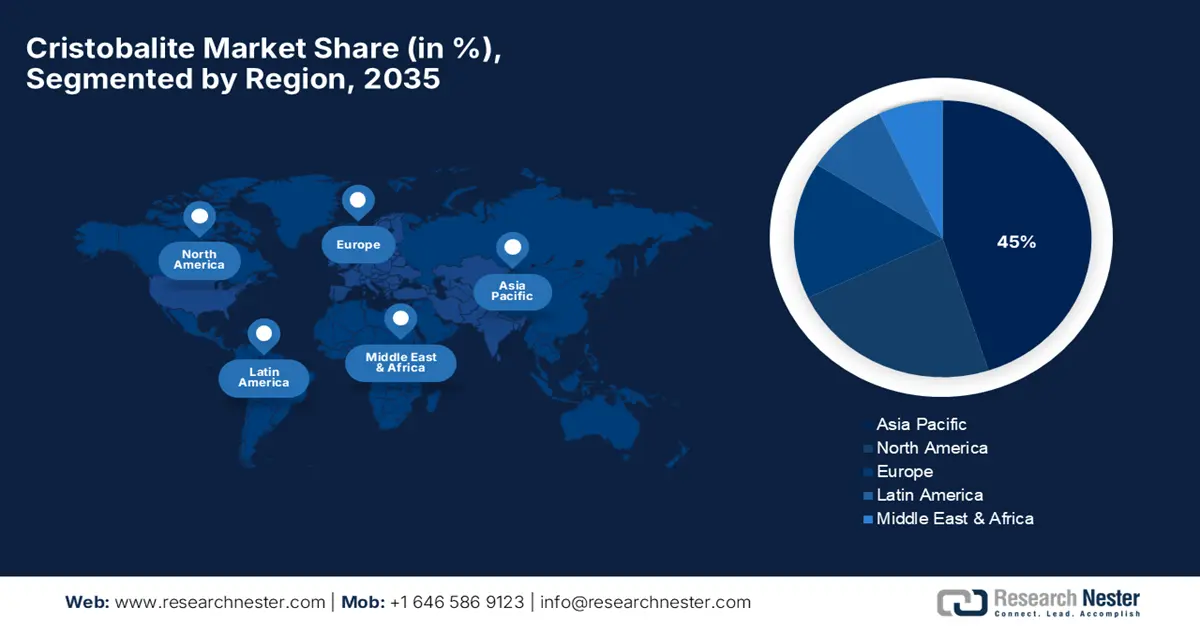

- Asia Pacific is projected to lead the cristobalite market with a 45% share by 2035, driven by rapid urbanization, industrialization, and strong demand from building, ceramics, and paint & coating industries.

- North America is expected to capture a 23% share by 2035, fueled by consistent demand in construction, automotive, and industrial ceramics, alongside sustainability-focused regulatory programs.

Segment Insights:

- The Construction Materials segment is projected to hold a 39% share by 2035 in the cristobalite market, driven by rising demand for energy-efficient and fire-resistant building materials globally.

- The Ceramics segment is expected to capture a 34% share by 2035, owing to growing infrastructure spending, technological innovation in autos and electronics, and Asia-Pacific’s dominance in ceramic production.

Key Growth Trends:

- Rising demand from the construction sector

- Growth in glass and ceramics manufacturing

Major Challenges:

- Raw material supply fluctuations

- Energy-intensive production processes

Key Players: Unimin Corporation (Sibelco Group), PQ Corporation, Santoku America Inc., Nippon Electric Glass Co., Ltd., Covia Holdings LLC, Sibelco Group, Minera y Metalurgica del Boleo, SCR-Sibelco, C-E Minerals, Dongwon Enterprise Co., Ltd., Tata Chemicals, Malaysian Minerals & Chemicals, Mitsubishi Materials Corporation, Shin-Etsu Chemical Co., Ltd., Tokuyama Corporation

Global Cristobalite Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 40.17 million

- 2026 Market Size: USD 42.29 million

- Projected Market Size: USD 67.08 million by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: South Korea, Brazil, Mexico, Indonesia, United Arab Emirates

Last updated on : 24 September, 2025

Cristobalite Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand from the construction sector: The construction sector is one of the major growth drivers for the cristobalite market. In July 2025, the revised June estimate of $2,140.5 billion was 0.1 percent (±0.8 percent) higher than the expected seasonally adjusted annual rate of $2,139.1 billion for construction spending. Spending on construction was $1,232.7 billion for the first seven months of this year, which is 2.2 percent (±1.0 percent) less than the $1,259.9 billion spent during the same period in 2024. Cristobalite is increasingly being applied to flooring, engineered stone, and façade products, which are all in high demand for mass residential and commercial developments globally.

- Growth in glass and ceramics manufacturing: Demand for cristobalite is increasing in the glass and ceramics industry as a structural reinforcement component and due to thermal resistance. According to estimates, glass clusters in the MSME sector use 2,76,777 tons of energy annually. While glass production facilities only make up 5% of the total energy usage, the melting industries account for about 95% of it. An estimated 5,87,225 tons of CO2 are released as equivalent GHG emissions. The sanitary ware cristobalite market in India was estimated to be worth USD 665.36 million in 2020 and is projected to grow at a compound annual growth rate (CAGR) of 7.38% from 2021 to 2027, reaching USD 1074.71 million. The ceramics sector in India is still expanding at a robust 15% annual rate. India is being planned as the second-largest producer in the world. Cristobalite enhances performance and durability in technical ceramics as well as specialty glass.

- Rising demand in the paints and coatings industry: Cristobalite is an important part of the paint and coating industry, particularly in high-durability, weather-resistant paints and coatings applied in construction, automotive, and industry. Its specific characteristics, including high brightness, low oil absorption, and improved scratch resistance, make it an ideal additive in high-quality coatings. The demand for architectural coatings globally is expected to increase by 2030, led by urbanization in developing countries. The UV stability and high surface hardness of cristobalite make it more significant in advanced coating systems.

- Emerging Trade Dynamics in the Cristobalite Market

Top 10 Exporting Countries of Silica Sands and Quartz Sands in 2023

|

Country / Region |

Exports (USD thousands) |

Quantity (Kg) |

|

China |

331,667.05 |

6,497,940,000 |

|

Canada |

273,851.14 |

5,929,410,000 |

|

European Union |

88,660.98 |

836,912,000 |

|

United Arab Emirates |

87,896.47 |

6,202,790,000 |

|

Mexico |

83,363.89 |

818,370,000 |

|

Italy |

80,430.77 |

1,393,830,000 |

|

Germany |

72,525.32 |

400,476,000 |

|

Other Asia, nes |

72,312.89 |

1,303,280,000 |

|

Japan |

70,943.70 |

950,873,000 |

|

Korea, Rep. |

56,899.38 |

921,250,000 |

Source: WITS

2. Construction Demand in the Market

Value of Construction Put in Place in the United States

|

Type of Construction |

Jul 2025 |

Jun 2025 |

May 2025 |

Apr 2025 |

Mar 2025 |

Jul 2024 |

|

Total Construction |

2,139,110 |

2,140,546 |

2,149,124 |

2,153,440 |

2,150,847 |

2,200,746 |

|

Residential |

898,686 |

897,878 |

903,854 |

906,503 |

909,661 |

946,982 |

|

Nonresidential |

1,240,425 |

1,242,668 |

1,245,271 |

1,246,937 |

1,241,186 |

1,253,764 |

|

Total Private Construction |

1,623,269 |

1,626,290 |

1,634,702 |

1,639,569 |

1,642,676 |

1,701,667 |

|

Total Public Construction |

515,842 |

514,256 |

514,423 |

513,871 |

508,171 |

499,080 |

Source: Census.gov

Challenges

- Raw material supply fluctuations: The cristobalite market is significantly affected by indefinite supply and pricing of high-purity silica sources as raw material. Supply chain disruptions, including mining quotas and transport blockages, caused delays and increased the cost. Large silica mining areas, for example, have experienced tightening regulations, limiting extraction levels. Such supply problems create uncertainty in manufacturing, raise the price of inputs, and reduce producers' ability to respond to rising demand, particularly for fast-growing sectors such as construction and ceramics.

- Energy-intensive production processes: High-temperature processing is needed for the production of cristobalite, a process that necessitates high energy consumption. Rising energy prices, driven by volatility in fuel prices internationally and concerns about the environment, involve high production costs. For instance, countries that are fossil fuel reliant witness their operational costs increase, impacting price competitiveness and profitability. All this reliance on energy limits the expansion in the production capacity, especially among developing economies, thereby limiting cristobalite market growth and suppressing cristobalite adoption by energy-intensive industries like glass and paint coatings.

Cristobalite Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 40.17 million |

|

Forecast Year Market Size (2035) |

USD 67.08 million |

|

Regional Scope |

|

Cristobalite Market Segmentation:

Application Segment Analysis

The application segment is dominated by the construction materials segment, which is expected to lead the cristobalite market with 39% share by 2035. Growth is fueled by the rising demand for energy-efficient and fire-resistant materials utilized in building in the global arena. The industry, with construction output valued at USD 22.26 trillion in 2020 and projected to reach USD 28.91 trillion by 2024, is witnessing stronger regulations favoring advanced insulation products that incorporate cristobalite. The Asia-Pacific alone is expected to grow construction output through 2030, putting further pressure on demand.

End Use Segment Analysis

Ceramics is estimated to hold a 34% cristobalite market share in 2035. Increased spending in infrastructure and technological innovation in autos and electronics fuels the demand. The ceramics sector in India is still expanding at a robust 15% annual rate. According to the U.S. Geological Survey, the glass and ceramics sectors continued to be the largest domestic consumers of boron products in 2023, consuming an estimated 65% of all boron. With Asia-Pacific leading the world's ceramic production, fueled by increased urbanization and higher spending on durable, heat-resistant products that feature cristobalite.

Product Type Segment Analysis

Fused cristobalite, projected to hold an estimated cristobalite market share of 27% by 2035, is preferred due to its higher purity and heat resistance. It is extensively utilized in high-performance glass and ceramic products where durability and heat resistance are needed. Its unique properties make it valuable in industries requiring reliable performance under extreme conditions. Similarly, fused silica-based products have seen rising demand, particularly in paints and coatings, where they enhance longevity, surface protection, and resistance to environmental factors, supporting broader industrial adoption.

Our in-depth analysis of the global cristobalite market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Application |

|

|

End use |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cristobalite Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific is expected to account for 45% of the global cristobalite market, the largest regional market. The region is driven by growing urbanization, industrialization, and growing demand from the building, ceramics, and paint & coating industries. China, India, Japan, and South Korea, among other leading economies, are heavily investing in infrastructure upgradation, driving steady demand for quality materials like cristobalite. India's ceramics and glassware exports reached a new high of USD 3464 million in 2021–2022. The Asia-Pacific construction market is expected to grow between 2026 and 2035 and thus directly contribute to the demand for hard fillers and structural material.

China’s green infrastructure, smart urban planning, and industrial efficiency drive towards green development in China's 14th Five-Year Plan is reshaping patterns of demand. The 2023 urbanization rate was 66.16%, which suggests a possible increase of more than 10% when compared to the 80% rate in industrialized nations. Over the last five years, China's urbanization has increased by an average of 0.93% annually, indicating that it is currently ongoing. Over 10 million people from rural areas move to cities every year, and this large number of new residents will lead to a high need for new homes. Thus, the rapid urbanization in China is helping in the growth of the construction sector.

Export and Import Trade of Ceramic Products in 2023

|

Exporters |

Value (USD Billion) |

Importers |

Value (USD Billion) |

|

China |

18.4 |

United States |

7.03 |

|

Italy |

5.32 |

Germany |

2.93 |

|

Spain |

4.38 |

France |

2.63 |

Source: OEC

The cristobalite market in India is experiencing a stable rate of growth as a result of fast-paced urban infrastructure advancement and increased utilization in glass, ceramic, and foundry applications. Demand for high-purity silica is increasing as a result of investments in construction materials and solar energy. The Indian government's "Make in India" initiative and commitment to renewable energy targets will support additional manufacturing capacity of cristobalite. Local sources of mineral resources and growing sectors in paints and coatings will continue to fortify India's position as an emerging player in the evolving cristobalite market in the Asia Pacific.

End use Application of Glass and Refractory

|

Sector |

Glass Consumption % |

Sector |

Refractory Consumption % |

|

Construction |

45% |

Cement |

15% |

|

Automobiles |

15% |

Glass |

5% |

|

Mirrors |

10% |

Others |

5% |

|

Value Added Glass |

15% |

Iron & Steel |

75% |

|

Furniture |

15% |

- |

- |

Source: sameeksha.org

North America Market Insights

By 2035, North America is expected to hold almost 23% of the global cristobalite market due to consistent demand in the construction, automotive, and industrial ceramics industries. Heightened regulatory focus on sustainability, low-carbon buildings, and energy efficiency continues to fuel product adoption. U.S.-led programs. Department of Energy (DOE), such as renewable building material tax credits and the Weatherization Assistance Program, uses DOE funds to weatherize about 32,000 homes annually and supports 8,500 jobs. A national study of the program found that these households save an average of USD372 or more a year through weatherization renovations and enhancements.

The U.S. is expected to hold about 18.5% of the cristobalite market share by 2035. Federal government spending is the main driver, with the total U.S. federal budget spent on energy efficiency, industrial innovation, and infrastructure modernization. According to the IEA Government Energy Spending Tracker's June 2023 update, governments had allotted USD 1.34 trillion for clean energy investment support since 2020. The sharp increase in clean energy investment since 2020, which increased by almost 25% between 2021 and 2023 and surpassed the growth of fossil fuels within the same time frame, has been largely attributed to government spending. Target programs like the Better Buildings Initiative, the Advanced Manufacturing Office (AMO) programs, and the research sponsored by NIST on durability have specific applicability to the application of sustainable fillers and additives, like cristobalite, in new buildings and ceramic systems. The DOE building programs are also aimed at the materials that establish the cutting edge in advanced insulation, durability, and emission performance for which cristobalite has corresponding technical applicability.

Canada is expected to maintain around 4.6% of the global share by 2035 for the cristobalite market. Green building codes, green city development, and clean R&D material leading to growth are priorities for the government. Low-carbon technology and high-value building materials are supported by the federal government in the Clean Growth Program. More than $900 million is allocated in Budget 2024 to implement the CGBS through three main projects. $800 million for the Canada Greener Homes Affordability Program, a home retrofit initiative that will begin in 2025–2026 and target low- and median-income households. In 2024–2025, $30 million was allocated to continue establishing a national approach to home energy labeling. Beginning in 2024–2025, $73.5 million will be used to update and modernize energy-saving technologies, including the ENERGY STAR Portfolio Manager and the ISO 50001 Energy Management Systems Standard. In addition, provincial building codes such as the Ontario Building Code Energy Efficiency Amendments and British Columbia's Step Code encourage the use of performance additives such as cristobalite in glass, coatings, and ceramic building products to enhance lifecycle strength and energy performance in buildings.

Europe Market Insights

Europe is expected to have a cristobalite market share of around 16% in 2035 through the presence of a well-developed construction and eco-friendly ceramics industry with an emphasis on circularity. The European Union's Circular Economy Action Plan and Green Deal reinforce active promotion of low-carbon, high-performance use of materials in infrastructure, manufacturing, and industrial design. Consequently, Europe's growing demand is expected to be concentrated towards high-durability coatings, insulating glass, and architectural ceramics containing cristobalite.

Germany is in a commanding position in the European cristobalite market and is expected to hold approximately 7.3% of global market share in the year 2035. Germany has a strongly industrialized core and strict Baugesetzbuch (Building Code) building codes, hence requires materials that provide strength, thermal insulation, and environmental compatibility, which closely resemble cristobalite properties. The German government provided 5.7 billion euros in budgetary resources for global climate funding in 2023. This was less than the 6.4 billion euros in 2022, which had been an exceptionally successful year. Industrial upgrading and advanced material design, with recurring appropriation in the form of BMWK (Federal Ministry for Economic Affairs and Climate Action).

France is expected to hold approximately 5% of the cristobalite market share of cristobalite in 2035 due to its local renovation growth, coating requirements, and smart city infrastructure upgrade. The French government, in its "Energy Transition for Green Growth" Law, devotes the nation's budget to green building activity, eco-innovation, and material sustainability R&D. The market for cristobalite-strengthened coatings and thermal-resistant ceramics just doesn't appear to slow down, particularly in France, where there is industrial capacity and environmental control.

Export Data of Roofing Tiles, Ceramic in 2023

|

Region/Country |

Export Value (USD 1,000) |

Quantity (kg) |

|

European Union |

162,382.84 |

488,743,000 |

|

United Kingdom |

1,890.47 |

2,014,570 |

|

Germany |

152,680.19 |

340,174,000 |

|

France |

96,877.24 |

191,450,000 |

|

Italy |

22,614.58 |

103,627,000 |

|

Spain |

76,243.99 |

- |

Source: WITS

Key Cristobalite Market Players:

- Unimin Corporation (Sibelco Group)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PQ Corporation

- Santoku America Inc.

- Nippon Electric Glass Co., Ltd.

- Covia Holdings LLC

- Sibelco Group

- Minera y Metalurgica del Boleo

- SCR-Sibelco

- C-E Minerals

- Dongwon Enterprise Co., Ltd.

- Tata Chemicals

- Malaysian Minerals & Chemicals

- Mitsubishi Materials Corporation

- Shin-Etsu Chemical Co., Ltd.

- Tokuyama Corporation

The cristobalite market is led by key multinational manufacturers predominantly based in the USA, Japan, and Europe, with Unimin Corporation and PQ Corporation holding the largest shares. Japanese players like Santoku America, Mitsubishi Materials, and Tokuyama Corporation contribute significantly through technological innovation and specialization in ceramics and coatings. Companies are actively pursuing capacity expansion, sustainable material development, and supply chain integration to meet growing demand from the construction, glass, and coatings sectors. Strategic mergers, R&D investments, and geographic diversification remain crucial to maintaining competitive positioning and addressing evolving market needs.

Here is a list of key players operating in the cristobalite market:

Recent Developments

- In November 2023, SCR‑Sibelco NV completed the divestment of its cristobalite facility in Russia, selling it to FSK Group, a leading construction materials company. This strategic move was part of Sibelco’s global re-optimization of its supply chain and reinforced its focus on higher-growth regions such as Asia and North America.

- In early 2023, Quarzwerke GmbH introduced a new line of high-performance cristobalite products designed for the construction sector, enhancing strength and durability in concrete and mortar formulations. This product launch supports adoption in low-carbon infrastructure and advanced coatings applications.

- Report ID: 8118

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cristobalite Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.