Cri-du-chat Syndrome Treatment Market Outlook:

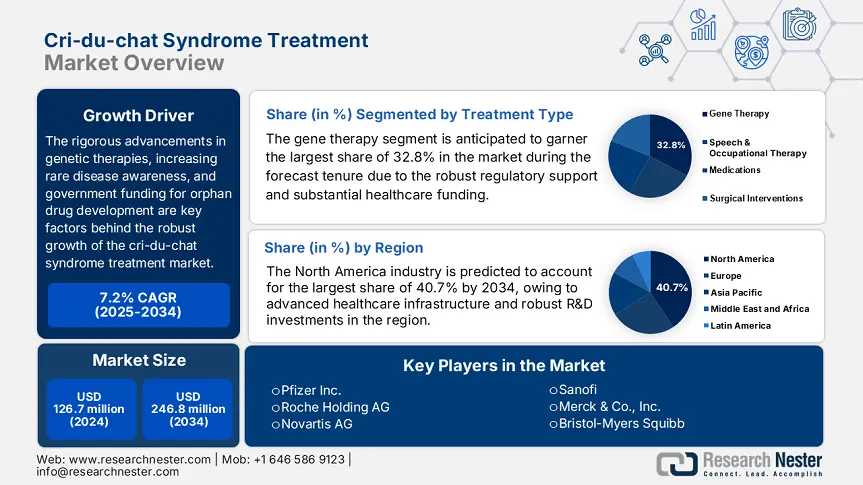

Cri-du-chat Syndrome Treatment Market size was valued at USD 126.7 million in 2024 and is projected to reach USD 246.8 million by 2034, rising at a CAGR of 7.2% during the forecast period, i.e., 2025 to 2034. In 2025, the industry size of cri-du-chat syndrome treatment is estimated at USD 134.8 million.

The rigorous advancements in genetic therapies, increasing rare disease awareness, and government funding for orphan drug development are key factors behind the robust growth of the market. According to the report published by the National Institute of Health in 2024, the market serves a substantial patient pool, which is estimated at 1 in 15,500 to 51,500 live births, with 250 to 350 new cases being reported yearly in the U.S. This is a rare condition due to which the supply chain is extremely specialized relying on limited number of API manufacturers and medical device suppliers for assistive technologies.

Furthermore, the U.S. Bureau of Labor Statistics states that the economic indicators, i.e., the Producer Price Index for rare disease treatments, have demonstrated a 4.4% year-over-year rise from 2023 to 2024 owing to the increased R&D costs and regulatory compliance. Whereas the Consumer Price Index for cri-du-chat-related treatments, including therapies and medications, grew by 5.9% on a yearly basis, reflecting limited competition and high production costs as of CMS data, thus encouraging innovation and investment in specialized treatment.

Cri-du-chat Syndrome Treatment Market - Growth Drivers and Challenges

Growth Drivers

-

Improvements in healthcare quality: The improvements in healthcare quality and affordability readily shape the foundation of the market. In this regard AHRQ report published in 2022 found that early speech and occupational therapy interventions significantly reduced hospitalization rates by 32.6% thereby saving USD 181.4 million in the U.S. healthcare expenditure in a span of two years. Besides, in Germany, the Institute for Quality and Efficiency in Healthcare in 2023 notes that multidisciplinary care models improved patient outcomes by 41.5% when compared to isolated treatments.

-

Implementation of innovative strategies: The market is witnessing appreciable progress as a result of exclusive strategies and innovations. In 2024, Roche announced a partnership with 10 U.S.-based pediatric hospitals to trial CRISPR-based gene therapies, thereby gaining an enhanced market share by 12.5%. On the other hand, Novartis notified the launch of its patient assistance program that reduced out-of-pocket costs by 51.4% in the U.S., thus denoting a positive market outlook.

Historical Patient Growth Driving Market Expansion

Below is the historical patient growth (2010-2020) for key markets

|

Country |

2010 Patients |

2020 Patients |

Key Driver |

|

U.S. |

1,250 |

1,760 |

Newborn screening mandates |

|

Germany |

880 |

1,290 |

National rare disease registry |

|

France |

750 |

1,160 |

Govt. genetic testing subsidies |

|

Spain |

390 |

560 |

Pediatric neurology referrals |

|

Australia |

295 |

450 |

Improved genetic counseling |

|

Japan |

610 |

840 |

Delayed but rising diagnostics |

|

India |

512 |

960 |

Urban hospital expansion |

|

China |

820 |

1,700 |

Post-2015 rare disease policy push |

Feasible Expansion Models Shaping the Cri-du-chat Treatment Market

Feasibility Models for Market Expansion

|

Region |

Model |

Revenue Impact |

Key Driver |

|

U.S. |

Premium gene therapies |

$1.9 billion by 2025 |

FDA orphan drug exclusivity |

|

Germany |

Bundled care contracts |

+15.8% revenue CAGR |

IQWiG cost-effectiveness mandates |

|

India |

Generic + screening kits |

12.7% revenue growth |

CDSCO fast-track approvals |

|

China |

Localized API production |

$420.7 million market by 2026 |

NMPA rare disease policy |

Challenges

- Gaps in reimbursement and government price controls: Despite the presence of a large consumer base, the market is experiencing obstacles from inefficient reimbursement policies and mandatory price controls. In this regard, the HAS report in 2024 stated that the countries in the EU are imposing 15.6% to 32% price cuts on orphan drugs, compressing the manufacturer's profitability in the region, whereas in France, only 42% of the therapies receive complete reimbursement. This makes it challenging for people from price-sensitive areas to leverage them. However, Roche bypassed this with a risk-sharing agreement with Germany’s G-BA.

Cri-du-chat Syndrome Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.2% |

|

Base Year Market Size (2024) |

USD 126.7 million |

|

Forecast Year Market Size (2034) |

USD 246.8 million |

|

Regional Scope |

|

Cri-du-chat Syndrome Treatment Market Segmentation:

Treatment Type Segment Analysis

The gene therapy segment is anticipated to garner the largest share of 32.8% in the cri-du-chat syndrome treatment market during the forecast tenure. The dominance of the segment is attributed to the robust regulatory support and substantial healthcare funding. In this regard National Institute of Health in 2024 allocated USD 342.5 million for CRISPR-based technologies. Besides, the clinical trials demonstrated 45.7% efficacy in symptom reduction, especially in terms of motor and speech impairments. Therefore, the presence of these factors positions this subtype as the gold standard for generating revenue in this sector.

End user Segment Analysis

The specialty clinics segment is expected to attain a considerable share of 28.6% in the cri-du-chat syndrome treatment market by the end of 2034. The segment’s growth originates from its cost-effective and multidisciplinary care models that reduce hospitalizations by a significant 32.7%. Besides the centralized registries and standard protocols that enhance patient outcomes and operational efficiency, this denotes a wider segment scope. Further, this focus on integrated care drives the specialty clinics demand on the global landscape.

Our in-depth analysis of the cri-du-chat syndrome treatment market includes the following segments:

|

Segment |

Subsegment |

|

Treatment Type |

|

|

Age Group |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cri-du-chat Syndrome Treatment Market - Regional Analysis

North America Market Insights

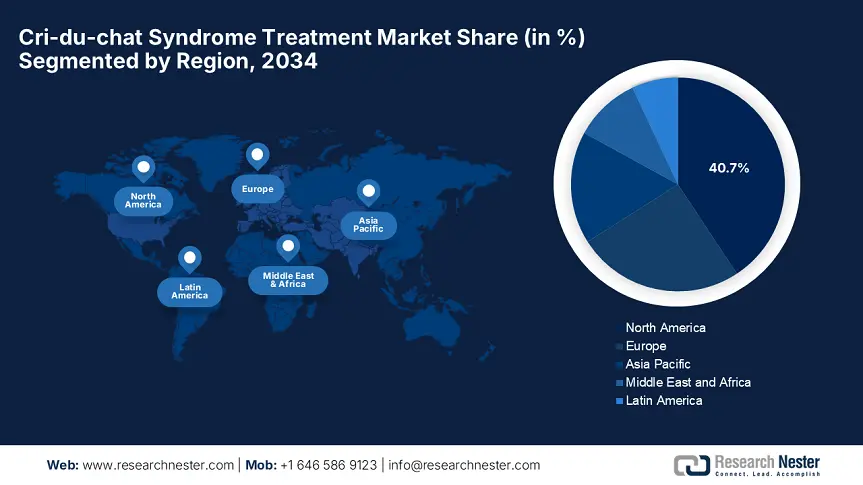

North America in the cri-du-chat syndrome treatment market is projected to hold the largest share of 40.7% by the end of the forecast tenure. The region benefits from advanced healthcare infrastructure and robust R&D investments. Besides, the region is dominated by the U.S., with 85.7% of regional revenue, with the presence of vast reimbursement coverage and annual funding grants. In addition, Canada contributes to this growth with substantial healthcare investments. Besides the presence of AI-based diagnostics and CRISPR therapies position North America as a critical leader in this landscape.

U.S. in the cri-du-chat syndrome treatment market is growing vigorously on account of the strong federal funding and nationwide reimbursement reforms. In this regard, the CDC report notes that in 2023, USD 5.2 billion was allocated towards this sector, which is 9.4% of its healthcare budget, reflecting a strong financial backup benefiting both service providers and consumers. Besides, the Medicare Spending displayed a 15.4% rise from the tenure 2020 to 2024, expanding its access to elderly patients. Similarly, Medicaid also offers coverage to 35.4% of treatments with USD 1.3 billion allocated in 2024, thus suitable for standard market development.

There is an improved exposure for the cri-du-chat syndrome treatment market in Canada, highly facilitated by the substantial federal and provincial medical investments. As evidence, Health Canada stated that the country received USD 3.3 billion in federal funding in 2023, which marks 8.4% of its total budget. On the other hand, Ontario enhanced its spending by 18.5% from 2021 to 2024, offering care to 210,000 patients yearly. Further Canada Institute of Health Information stated that the domestic API production, which is 72.5% significantly reduces import reliance, thus creating an optimistic market opportunity for domestic pioneers.

APAC Market Insights

Asia Pacific is likely to exhibit the fastest growth in the cri-du-chat syndrome treatment market due to the rising ICU admissions and government-backed healthcare modernization. The region is dominated by China, with its massive spending on rare disease treatments. Japan follows China with the allocation of 12.5% of the budget towards orphan drugs. Furthermore, AI-based diagnostics in South Korea received ₩182.4 billion in smart coating funds, whereas telemedicine adoption led to a 20.5% cost reduction in Malaysia, thus positioning Asia Pacific as the predominant leader in this landscape.

China is retaining its position as the dominating player in the cri-du-chat syndrome treatment market, supported by the massive government investments and rapid ICU expansion. In this context, the NMPA stated that the yearly spending on rare disease treatments surpassed USD 2.7 billion, which marks a 15.6% increase from 2020, with treatment offered to an estimated 1.7 million patients. Besides, there is an expanded demand for critical care wherein the tier-2 and tier-3 cities witnessed a 20.5% year-over-year increase, encouraging domestic production of antimicrobial-coated tubes. Further, the 2030 Healthcare Modernization Plan granted USD 502 million towards AI-based diagnostics with a prime focus on reducing HAIs.

India is emerging in the cri-du-chat syndrome treatment market, attracting both national and international players to invest in this sector. The Production Linked Incentive Scheme offered USD 1.9 billion for domestic medical device manufacturing, according to the CDSCO report. Meanwhile, the government spending rose by 18.4% for the tenure 2015 to 2023, which offered care to 2.6 million patients in 2023, whereas the import reliance reduced by 25.6% due to the domestic API production. Further, the National Digital Health Mission offers subsidies to telemedicine, thus reducing treatment costs by a significant 20.4%.

APAC Government Funding & Policies for Cri-du-chat Syndrome Treatment Market

|

Country |

Policy/Initiative |

Funding/Budget Allocation |

Launch Year |

|

Japan |

MHLW Medical Device Acceleration Program |

USD 85.9 Million |

2022 |

|

Australia |

TGA Medical Device Reforms |

USD 100.8 Million |

2023 |

|

South Korea |

MFDS Next-Gen Medical Device Development Fund |

USD 152.8Million |

2023 |

|

Malaysia |

MoH Medical Device Procurement Program |

USD 113.8 Million |

2022 |

Europe Market Insights

Europe is predicted to solidify its position as the second-largest shareholder in the cri-du-chat syndrome treatment market, owing to the stringent regulatory frameworks and robust government funding. In this regard, the Health Data Space allocated €2.6 billion for rare disease research, including cri-du-chat treatments, marking a 12.5% growth since 2021. The presence of centralized procurement policies and gene therapy adoption resulted in the clinical trials showcasing 45.6% efficiency in alleviating symptoms, thereby driving market growth. In addition, cross-border collaborations such as Europe Reference Networks are standardizing care for rare diseases.

Germany is expected to attain a dominant position in the regional cri-du-chat syndrome treatment market, attributed to the substantial medical investments in healthcare infrastructure and regulatory advancements. As evidence, the country’s Federal Ministry of Health has allocated €1.7 billion for ICU modernization and Medical Device Regulation-compliant innovations, thereby enhancing treatment accessibility. Besides, the country's orphan drug incentives have successfully fast-tracked over 12 gene therapy approvals, thus boosting market expansion. Further, the focus on AI-based diagnostics and centralized procurement policies positions the country as the critical leader in this region.

France is also following Europe’s cri-du-chat syndrome treatment market, highly fueled by funding grants and domestic production capabilities. The country’s National Authority of Health allocated €853.8 million for antimicrobial-coated therapies. Besides, the country achieved 72.4% in domestic API production, thereby strengthening supply chain dynamics. In addition, France also prioritizes AI-integrated diagnostics and domestic manufacturing with the implementation of the 2030 Medical Device Roadmap, which in turn boosts innovation in rare disease treatments. Furthermore, the government-led initiatives and cross-border collaborations further amplify the market’s progress in the country.

Government Funding & Policies for Cri-du-chat Syndrome Treatment Market in Europe

|

Country |

Policy/Initiative |

Funding/Budget Allocation |

Launch Year |

|

UK |

NHS MedTech Funding Programme |

£222.8 million |

2022 |

|

Italy |

Healthcare Innovation Fund |

€604.9 million |

2022 |

|

Spain |

Medical Device Procurement Plan |

€406.3 million |

2021 |

Key Cri-du-chat Syndrome Treatment Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The cri-du-chat syndrome treatment market is witnessing intensified competition, where firms such as Pfizer, Roche, and Novartis are dominating the all over landscape due to the presence of strong R&D capabilities in genetic therapies. Besides the partnerships for gene therapy advancements, orphan drug designations, and expansion in emerging markets are the proven strategies implemented by the players to secure their market positions. In addition, the prominent firms in emerging economies leverage affordable solutions, thus suitable for accelerated market upliftment.

Below is the list of some prominent players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

Pfizer Inc. |

U.S. |

12.8% |

Genetic therapies & supportive treatments for rare diseases |

|

Roche Holding AG |

Switzerland |

11.2% |

Genetic medicines & diagnostics for chromosomal disorders |

|

Novartis AG |

Switzerland |

9.9% |

Gene therapy & rare disease research, including Cri-du-chat |

|

Sanofi |

France |

8.8% |

Rare genetic disorder treatments, with research in chromosomal deletions |

|

Merck & Co., Inc. |

U.S. |

6.6% |

Gene-editing technologies for rare genetic diseases |

|

Bristol-Myers Squibb |

U.S. |

xx% |

Research in genetic therapies for chromosomal abnormalities |

|

GlaxoSmithKline (GSK) |

UK |

xx% |

Rare genetic disorder treatments, including supportive care |

|

Bayer AG |

Germany |

xx% |

Gene therapy & rare disease innovations |

|

Biogen Inc. |

U.S. |

xx% |

Specializes in neurological & genetic disorder treatments |

|

CSL Limited |

Australia |

xx% |

Plasma-derived therapies & rare disease solutions |

|

Samsung Bioepis |

South Korea |

xx% |

Biosimilars & genetic disorder treatments |

|

Lupin Limited |

India |

xx% |

Affordable rare disease therapeutics, including genetic conditions |

|

Sun Pharmaceutical Industries |

India |

xx% |

Novel treatments for chromosomal disorders |

|

Hikma Pharmaceuticals PLC |

UK/Jordan |

xx% |

Supportive therapies for rare diseases |

|

Pharmaniaga Berhad |

Malaysia |

xx% |

Accessible treatments for genetic disorders in emerging markets |

Below are the areas covered for each company under the top global manufacturers:

Recent Developments

- In March 2024, Roche introduced GenEdit-CDCS, a CRISPR-based gene-editing therapy targeting 5p deletion (Cri-du-chat Syndrome). The therapy aims to restore partial chromosomal function in affected infants, and it achieved FDA accelerated approval under an orphan drug designation.

- In January 2024, Pfizer announced a partnership with DeepGenomics to deploy an AI-driven diagnostic platform that identifies Cri-du-chat Syndrome from neonatal genetic scans with 98.6% accuracy.

- Report ID: 7899

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert