Corian Acrylic Solid Surface Market Outlook:

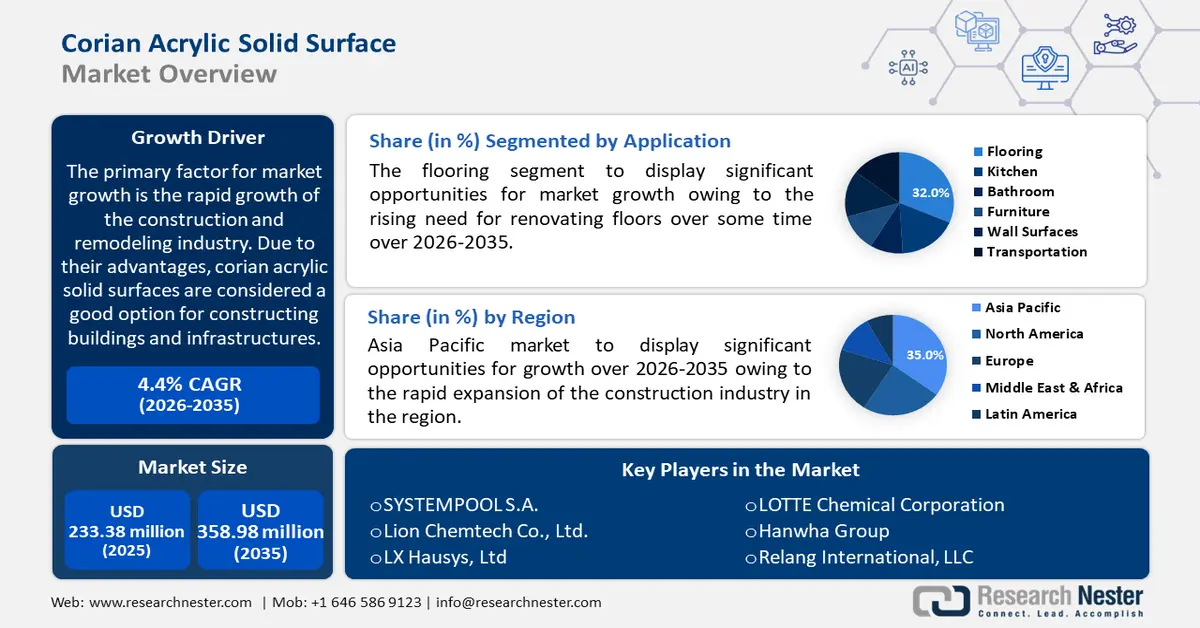

Corian Acrylic Solid Surface Market size was over USD 233.38 million in 2025 and is poised to exceed USD 358.98 million by 2035, growing at over 4.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of corian acrylic solid surface is evaluated at USD 242.62 million.

The primary factor for market growth is the rapid growth of the construction and remodeling industry. Corian acrylic solid surfaces are considered a good option for constructing buildings and infrastructures owing to their advantages such as mechanical strength, flexibility, high durability, and cost-effectiveness. Therefore, with the recent boom in the construction industry, the utilization rate of Corian acrylic solid surfaces is expected to increase subsequently. This factor is expected to bring lucrative growth opportunities for market growth during the forecast period.

In addition to the aforementioned factors, the popularity of Corian acrylic solid surface is constantly rising owing to its usage in various types of applications such as kitchen countertops, sinks, bathtubs, flooring, and others. Also, the increasing preference for aesthetically pleasing designs with various colors and shapes to beautify homes is propelling the usage of Corian acrylic solid surfaces in homes. These factors couple up to increase the utilization rate in residential properties as well as commercial infrastructure too and aid in the expansion of market size during the forecast period. Moreover, the rapid urbanization and industrialization in developing countries and rising investment in the development of advanced materials such as Corian acrylic solid surface for use in residential and commercial segments are estimated to create substantial revenues for market players.

Key Corian Acrylic Solid Surface Market Insights Summary:

Regional Highlights:

- Asia Pacific is projected to command a revenue share of 35% by 2035 in the corian acrylic solid surface market, owing to the the rapid expansion of the construction industry.

- The North America is registering the share of about 24% by the end of 2035, underpinned aassive investments in the construction industry along with the rising focus to build single-family housing.

Segment Insights:

- The flooring segment is estimated to gain the largest market share of about 32% in the year 2035 in the corian acrylic solid surface market, propelled by the rising need for renovating floors over some time.

- The household segment is expected to garner a significant share of around 42% in the year 2035, supported by growing residential construction activities in developed as well as emerging economies.

Key Growth Trends:

- Growing Construction Projects Across the World

- Rapid Growth in the Real Estate Industry

Major Challenges:

- High Cost of the Product

- Increase Costs of Raw Materials

Key Players: DuPont de Nemours, Inc., SYSTEMPOOL S.A., Lion Chemtech Co., Ltd., LX Hausys, Ltd., LOTTE Chemical Corporation, Hanwha Group, Relang International, LLC, ARISTECH SURFACES LLC, American Bath Group, Monerte Surfaces Materials.

Global Corian Acrylic Solid Surface Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 233.38 million

- 2026 Market Size: USD 242.62 million

- Projected Market Size: USD 358.98 million by 2035

- Growth Forecasts: 4.4%

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, United Arab Emirates

Last updated on : 20 November, 2025

Corian Acrylic Solid Surface Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Construction Projects Across the World – As the world is seeing rapid urbanization and industrialization, the need for infrastructure and buildings has grown considerably for sustenance and economic growth. As a result, the governments of different nations are investing huge money in initiating construction projects all over the world. As a result of growing construction projects, the utilization rate of Corian acrylic solid face is estimated to increase subsequently. Hence, this factor is expected to create favorable opportunities for market growth during the forecast period. For instance, as of May 2022, India has the most infrastructure construction projects totaling more than USD 25 million in planning or operation. Moreover, it has been estimated that construction processes on the global level are projected to increase by 12% by 2035.

-

Rapid Growth in the Real Estate Industry – Nowadays, in urban areas, there has been a constant demand for commercial buildings, complexes, residential properties, and other infrastructure development work. Construction firms prefer to use high-quality Corian acrylic solid surfaces for the development of aesthetically pleasing as well as robust buildings. Thus, with the quick development of the real estate industry, it is anticipated to create favorable options for an increased utilization rate of Corian acrylic solid surfaces. Hence, this factor is anticipated to help in expanding in market size during the forecast period. According to recent statistics, it was revealed that the revenue generation of real estate companies presents across the world was around USD 9 billion in 2021. This figure is estimated to increase and reach almost USD 15 billion by 2030 with a CAGR value of 5%.

-

Increasing Disposable Income of the Global Population - As the economies are growing, so is the disposable income of the people. As a result, individuals have more spending capacity to spend on the appearance and looks of the rooms by adopting modern products such as Corian acrylic solid surfaces. Hence, the high adoption rate of Corian acrylic solid surface among the high-income population is projected to expand the market size in the assessment period. The disposable personal income in the US rose by about 1 percent in August 2022 compared to the same month the previous year.

-

High Rate of Urbanization and Industrialization – Presently, a huge number of people are residing in urban areas, and more people have been shifting towards urban cities because of better opportunities and enhanced services. Thus, the ratio of urbanization has been increasing rapidly, which is to leading the growth of construction activities across the globe. Such a factor is fueling up the utilization rate of Corian acrylic solid surfaces in buildings and infrastructures, which is subsequently projected to positively contribute to the growth of the market over the forecast period. For instance, in 2018, 55% of the world's inhabitants lived in cities, and by 2050, that number is projected to rise to 68%.

-

Rising Trend of Remodeling and Renovation of Houses – People nowadays are propelled towards renovating their houses to enhance their appearance and make them last longer. Therefore, people are spending a huge amount of money for improving their houses with high-quality construction equipment such as Corian acrylic solid surface. Therefore, this trend is expected to fuel the global market in the next few years. It was observed that in 2021, a hefty amount of USD 550 billion was spent by Americans for home improvement purposes 2021. Also, it has been calculated that the United States remodeling industry earned approximately USD 1 billion in revenue in 2021 and is expected to continue to grow with a CAGR of 4% till 2027.

Challenges

-

High Cost of the Product – Corian acrylic solid surfaces are being utilized in limited business settings and residential rooms owing to their exorbitant cost. Also, the high cost of Corian acrylic solid surface is an added expense in the construction process which increases the overall cost of the infrastructure. As a result, people with low incomes are not able to afford it. Therefore, the high cost of Corian acrylic solid surface is considered to be a major obstacle to their expansion in residential buildings and ultimately hamper the growth of the global market during the assessment period.

-

Increase Costs of Raw Materials

- Stringent Rules by the Government

Corian Acrylic Solid Surface Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.4% |

|

Base Year Market Size (2025) |

USD 233.38 million |

|

Forecast Year Market Size (2035) |

USD 358.98 million |

|

Regional Scope |

|

Corian Acrylic Solid Surface Market Segmentation:

Application (Kitchen, Flooring, Bathroom, Furniture, Wall Surfaces, Transportation)

The global Corian acrylic solid surface market is segmented and analyzed for demand and supply by application into the kitchen, flooring, bathroom, furniture, wall surfaces, transportation, and others. Out of these segments, the flooring segment is estimated to gain the largest market share of about 32% in the year 2035. The primary factor for segment growth is the rising need for renovating floors over some time. Also, with the rising disposable income and spending capacity, people are focusing on the adoption of high-quality materials for the flooring to make them last longer. Moreover, as Corian acrylic solid surface is good for a smooth, clean, hard, and attractive surface to the floors and along with its cost-effectiveness, Corian acrylic solid surface is considered to be a preferred option over others. All these factors add up to positively contribute to segment growth.

End-user (Households, Hotels, Hospitals)

The global Corian acrylic solid surface market is also segmented and analyzed for demand and supply by end-user into households, hotels, hospitals, and others. Amongst these segments, the household segment is expected to garner a significant share of around 42% in the year 2035. The growth of the segment is attributed to growing residential construction activities in developed as well as emerging economies such as China, India, Brazil, and South Korea, along with rapidly increasing urbanization which generates a high demand for household construction. The United States Census Bureau stated that there were around 142,153,010 housing units in the U.S. as of June 2021. Also, the advantages of using Corian acrylic solid surface make it applicable for every nook and corner of a house; kitchen, bathroom, wall surfaces, furniture, and floors. This factor is anticipated to fuel segment growth during the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Corian Acrylic Solid Surface Market - Regional Analysis

APAC Market Statistics

Asia Pacific industry is estimated to hold largest revenue share of 35% by 2035. The primary factor for market growth in the region is the rapid expansion of the construction industry in Asia Pacific. In addition to other factors, the constantly rising disposable income of the burgeoning population in the region is expected to increase the demand for non-residential and residential building construction which is further anticipated to bloom the demand for the Corian acrylic solid surface market.

North American Market Forecast

The North American Corian acrylic solid surface market is estimated to be the second largest, registering a share of about 24% by the end of 2035. Massive investments in the construction industry along with the rising focus to build single-family housing is a major factors that will bring growth opportunities to the market. Moreover, the presence of major key players and strict government regulations over using of high-quality sustainable products for environmental protection are also projected to propel fuel market growth during the assessment period.

Europe Market Forecast

Further, the market in the European region, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The large investments made by the government in construction development along with the rising need for repair and renovation in many buildings of the region is anticipated to drive the market. Moreover, the burgeoning population in the region along with the penetration of urbanization and industrialization in the region is projected to create a positive outlook for the expansion of market growth during the forecast period.

Corian Acrylic Solid Surface Market Players:

- DuPont de Nemours, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SYSTEMPOOL S.A.

- Lion Chemtech Co., Ltd.

- LX Hausys, Ltd.

- LOTTE Chemical Corporation

- Hanwha Group

- Relang International, LLC

- ARISTECH SURFACES LLC

- American Bath Group

- Monerte Surfaces Materials

Recent Developments

-

October 2020- DuPont Performance Building Solutions and Corian Design announced the business’s sustainability goals for 2030, which also includes the reduction of greenhouse gas emissions from operations by 75 percent from 2019 levels.

-

March 2020- LX Hausys introduced new colors to its HI-MACS Aurora and Terrazzo collections of solid surfaces. The new colors provide versatile design operations for education, corporate, and hospitality environments.

- Report ID: 3774

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Corian Acrylic Solid Surface Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.