Contrast Injector Systems Market Outlook:

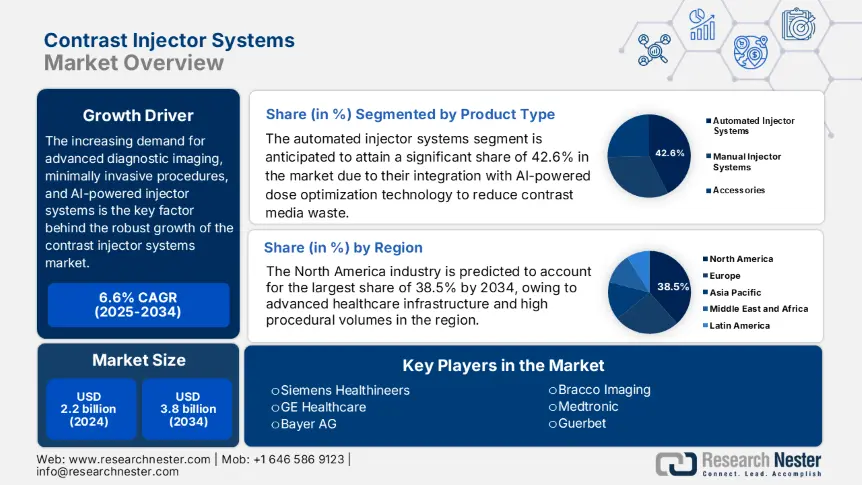

Contrast Injector Systems Market size was valued at USD 2.2 billion in 2024 and is projected to reach USD 3.8 billion by the end of 2034, rising at a CAGR of 6.6% during the forecast period, i.e., 2025 to 2034. In 2025, the industry size of contrast injector systems is estimated at USD 2.3 billion.

The increasing demand for advanced diagnostic imaging, minimally invasive procedures, and AI-powered injector systems is the key factor behind the robust growth of the market. The market also serves a substantial patient pool, where the World Health Organization report published in 2023 demonstrated over 500 million radiology procedures performed yearly, which includes CT, MRI, and angiography. On the other hand, the ITC Trade data in 2024 revealed that the active pharmaceutical ingredients for contrast media are critically drawn from China, Germany, and the U.S.

Furthermore, the U.S. Bureau of Labor Statistics notes that the Producer Price Index for medical imaging devices, including injector systems, has displayed a 4.3% year-over-year rise owing to the increased manufacturing costs and supply chain disruptions. Whereas the Consumer Price Index for radiology services grew by 5.8% reflecting higher operational costs for healthcare providers as of the CMS 2024 report. In addition, the OECD 2024 study unveiled that key assembly lines located in North America, Europe, and East Asia with automated production, reducing labor costs by a significant 15.6%.

Contrast Injector Systems Market - Growth Drivers and Challenges

Growth Drivers

-

Clinical validation and recommendation: The worldwide recognition of clinical and economic benefits pushes healthcare providers to leverage offerings from the market. As evidence AHRQ study in 2022 stated that automated contrast injectors reduced diagnostic errors by a significant 18.6% and reduced hospital readmissions by 12.4% thus saving USD 1.5 billion in the U.S. healthcare expenditure in a span of two years. Besides NIH study in 2023 revealed that hospitals utilizing standardized contrast protocols witnessed a 20.3% quick scan times and lower contrast-induced nephropathy (CIN) rates, thus driving the market expansion.

-

Vigorous technological advancements: The market is growing at a notable pace on account of continuous technological advancements and AI integration. In this regard, the U.S. FDA report in 2023 stated that AI-based injectors such as Siemens’ Naeotom Alpha reduce contrast waste by a significant 30.2%. In addition, the OECD study in 2024 revealed that dual-head injectors currently dominate 45.6% of the market, owing to the efficiency gains, hence attracting more players to invest in this sector.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010-2020) - Contrast Injector Systems Users

|

Country |

2010 Patients (Million) |

2020 Patients (Million) |

CAGR (2010-2020) |

Key Growth Driver |

|

U.S. |

12.7 |

18.9 |

4.3% |

Medicare expansion + aging population |

|

Germany |

5.4 |

7.9 |

4.3% |

Universal healthcare coverage |

|

France |

4.3 |

6.4 |

4.6% |

Early adoption of interventional radiology |

|

Spain |

2.9 |

4.3 |

4.1% |

Public hospital modernization |

|

Australia |

2.1 |

3.2 |

4.9% |

Private imaging center boom |

|

Japan |

8.7 |

12.6 |

3.9% |

High geriatric imaging demand |

|

India |

3.7 |

9.4 |

10.4% |

Tier-2/3 hospital expansion |

|

China |

7.9 |

22.3 |

11.2% |

Government radiology subsidies |

Manufacturer Strategies Driving Market Expansion

Revenue Expansion Opportunities (2023-2024)

|

Strategy |

Company Example |

Revenue Impact (2023) |

Market Share Gain |

|

AI-Powered Injectors |

Siemens Healthineers |

+$322.2 million |

+12.2% |

|

Emerging Market Entry |

GE Healthcare |

+$182 million |

+8.6% |

|

Hospital Partnerships |

Bayer AG |

+$152.2 million |

+5.1% |

|

Cost-Optimized Models |

Bracco Imaging |

+$93.5 million |

+3.2% |

Challenges

-

Government-imposed price controls: The price caps imposed by certain governments create a major obstacle in the market, hindering the manufacturer's profitability across most of nations. In this regard, the World Health Organization report published in 2023 states that France capped contrast injector prices at €850 per unit, which forced manufacturers to cut R&D budgets. However, Siemens Healthineers bypassed this by collaborating with Germany’s G-BA to bundle injectors with maintenance contracts, thereby gaining 10.6% market access.

-

Delayed regulatory approvals: Despite the booming demand, the contrast injector market still faces difficulty in terms of delayed regulatory approvals. In this context MHLW report published in 2023 stated that the reforms implemented by PMDA caused a 6-month delay for the injector market entry, resulting in the hindrance of USD 210.4 million revenue. However, GE Healthcare appreciably addressed this by pre-submitting AI injector trial data, which resulted in a reduction of approval time by 42.5%.

Contrast Injector Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

6.6% |

|

Base Year Market Size (2024) |

USD 2.2 billion |

|

Forecast Year Market Size (2034) |

USD 3.8 billion |

|

Regional Scope |

|

Contrast Injector Systems Market Segmentation:

Product Type Segment Analysis

The automated injector systems segment is anticipated to attain a significant share of 42.6% in the market during the assessed timeframe. Their integration with AI-powered dose optimization technology to reduce contrast media waste makes this subtype widely preferable. Exemplifying this, the U.S. FDA evaluations found that they reduced contrast media wastes by 32.5%. These systems also enhance procedural efficiency with the presence of precision dosing algorithms that automatically adjust injection parameters relying on patient BMI and scan type, thus denoting a wider segment scope.

End user Segment Analysis

The hospitals segment is expected to grab the largest share of 55.4% in the market by the end of 2034. The segment’s growth originates from expanded Medicare coverage of outpatient diagnostic imaging procedures that enhanced its adoption by 15.4% year-over-year as of CMS 2024 data. Besides, there is a shift towards value-based care models, which has fueled health systems to invest in advanced injector technologies that appreciably improve patient throughput and reduce complications, hence denoting a prolific market opportunity.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

Modality |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Contrast Injector Systems Market - Regional Analysis

North America Market Insights

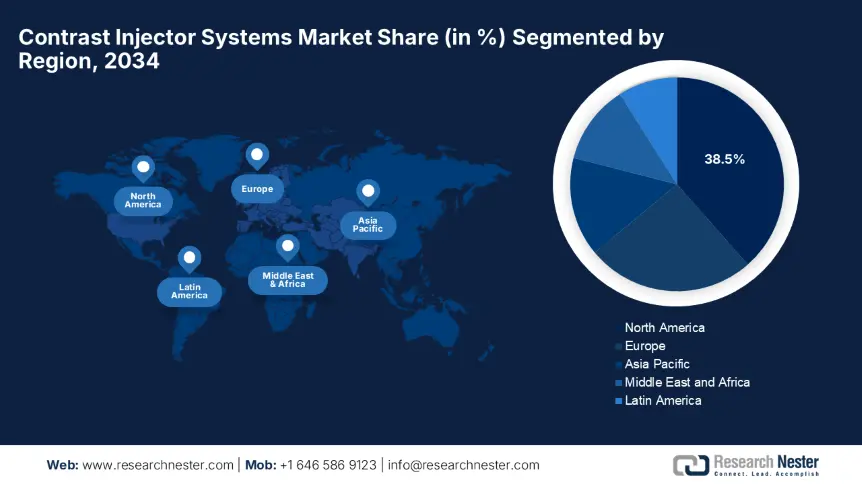

North America is predicted to maintain its dominance in the global market with the largest share of 38.5% throughout the discussed timeline. The leadership of the region is effectively propelled by its advanced healthcare infrastructure and high procedural volumes. The U.S. accounts for 85.4% of regional demand with support from expanded reimbursement policies. On the other hand, Canada contributes to this growth with substantial healthcare investments. Furthermore, there is a rapid adoption of AI, with 45.4% of hospitals currently deploying smart injectors to optimize contrast use.

U.S. also represents strong growth in the regional contrast injector systems market on account of Medicare and Medicaid expansions offering coverage to 90.4% of contrast-enhanced imaging. Besides, there is a huge demand for advanced injectors with AI-based injectors accounting for 45.3% of sales, which reduced contrast wastes by a remarkable 30.4% as of FDA 2024 data. In addition, the governing bodies are extending their support with 5 new injector models approved in 2024. Therefore, all of these factors responsibly uplift progress in the country, thus providing a great opportunity for the players to capitalize on this sector.

Canada is readily expanding in the North America contrast injector systems market owing to the expedited federal and provincial healthcare investments. For instance, a Health Canada report published in 2024 stated that Ontario allocated USD 322.1 million towards this sector, ensuring a strong financial backup for underprivileged areas. Besides Canadian Institute of Health Information during the same time period noted that under the universal coverage, 95.3% of contrast procedures are reimbursed. Furthermore, 60.5% of injectors are provided through domestic production, ensuring a stable supply in the country.

APAC Market Insights

Asia Pacific is likely to demonstrate the fastest growth in the contrast injector systems market from 2025 to 2034. This accelerated growth in the region is propelled by rising chronic disease prevalence and government-led healthcare modernization. China dominates the overall region with the expanded healthcare expenditure. Japan follows this dominance with the presence of advanced injectors, highly supported by the MHLW’s 12.5% healthcare budget allocation. Further, the prominent countries, South Korea and Malaysia, focus on smart hospital integration with USD 250.6 million and USD 181.5 million invested, thus indicating a wider market scope.

China is augmenting its position in the contrast injector systems market owing to the massive government spending and the fast-track approvals by governing bodies. Testifying, this NMPA states that it has approved over 12 injector models since 2022 and recorded USD 2.2 billion yearly government spending on imaging infrastructure. Besides, the country’s patient pool is expanded by 16.6% year-over-year that reaching USD 1.9 million procedures in 2023 on account of the urban hospital upgrades and rural tele-radiology initiatives. Further, the domestic manufacturers such as Mindray are currently supplying 40.4% of the country’s demand, thereby reducing import reliance.

India is also following the regional growth in the contrast injector systems market that is projected to reach USD 1.6 billion by the end of 2034. The country receives huge support from PMJAY, offering coverage to over 510.7 million beneficiaries and PLI scheme incentives for domestic production. In addition, the government spending surpassed USD 1.9 billion in 2024, which enabled 2.5 million yearly procedures, marking 2.6 times increase since 2018. NITI Aayog report published in 2024 states that the public-private partnerships are aiming to bridge the healthcare disparities, thus positioning India as a critical leader in this landscape.

Country-wise Government Provisions

|

Country |

Government Initiative / Policy |

Budget/Funding (USD) |

Launch Year |

|

Japan |

Healthcare Industry Vision 2030 (METI) |

$342.5 Million |

2023 |

|

Australia |

Medical Research Future Fund (MRFF) |

$154.6 Million (diagnostics focus) |

2023 |

|

South Korea |

K-BioHealth 2030 (Ministry of Health) |

$253 Million |

2022 |

|

Malaysia |

12th Malaysia Plan (Healthcare Modernization) |

$184.5 Million |

2021 |

Europe Market Insights

Europe is expected to retain its position as the second largest stakeholder in the contrast injector systems market, highly attributed to the rapidly aging population and universal healthcare coverage. Germany is the leading player in the region, followed by the U.K. and France, which are displaying a strong focus on affordable AI adoption. The EC report in 2024 stated that the EU Health Data Space allocated €2.6 billion for injector R&D, thereby boosting interoperability. On the other hand, the bundled procurements, as in France, facilitate a sustained development in the market.

Germany, in contrast injector systems market is readily dominating the regional landscape, propelled by the huge government investments. In this context, BMG in 2024 stated that it allocated €502.5 million in investment in AI-powered injector systems, reflecting the government’s strong commitment towards this sector. The advanced healthcare infrastructure is the key factor supporting higher adoption that resulting in 40.7% of hospitals currently leveraging automated dose-tracking technology. Furthermore, the presence of a universal healthcare system offering reimbursement for contrast-enhanced procedures positively impacts the overall market upliftment.

The U.K. also portrays steady growth in Europe’s contrast injector systems market owing to the strong healthcare investments and cost-efficiency initiatives. In this regard NHS in 2024 stated that it granted a £310.6 million fund to improve rural access to advanced imaging technologies. Besides, the ABPI 2024 data revealed that smart injectors delivering 30.8% savings through optimized contrast usage are proven to be extremely successful, attracting players to invest in this sector. Moreover, recent policy changes in the country have significantly accelerated the replacement cycle for outdated injector systems in terms of NHS facilities, hence creating a greater market opportunity.

Country-wise Government Provisions

|

Country |

Government Initiative / Policy |

Budget/Funding (USD) |

Launch Year |

|

France |

Health Innovation 2030 (Ministry of Health) |

USD 860.5 Million |

2023 |

|

Italy |

Piano Nazionale di Ripresa e Resilienza (PNRR) |

USD 540.7 Million |

2022 |

|

Spain |

Digital Health Strategy (Ministry of Health) |

USD 215.8 Million |

2023 |

Key Contrast Injector Systems Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international market is extremely consolidated, with Siemens, GE Healthcare, and Bayer controlling maximum revenue shares through AI integration and strategic mergers and acquisitions. Europe-based pioneers lead in terms of precision dosing, whereas the U.S.-based players focus on interoperability with EHRs. Besides the manufacturers in Asia, such as Mindray and Trivitron, are gaining traction as a result of cost-optimized models, thus denoting a prolific market opportunity.

Here is the list of some prominent players operating in the global market:

|

Company Name (Country) |

Industry Focus |

Market Share (2024) |

|

Siemens Healthineers (Germany) |

Leader in AI-powered injectors (e.g., Artis pheno) |

22.6% |

|

GE Healthcare (U.S.) |

Advanced injectors for MRI/CT (Omniscan, Visipaque) |

18.3% |

|

Bayer AG (Germany) |

Contrast media + injector systems (Medrad Stellant) |

15.2% |

|

Bracco Imaging (Italy) |

Specialty injectors for interventional radiology |

10.8% |

|

Medtronic (Ireland) |

Cardiac imaging injectors (Avanta) |

8.3% |

|

Guerbet (France) |

Contrast media-integrated injectors (Xenetix) |

xx% |

|

DKSH (Malaysia) |

Distribution partnerships for regional OEMs |

xx% |

|

Philips Healthcare (Netherlands) |

Wireless injectors (MedSight) |

xx% |

|

Ulrich GmbH (Germany) |

Compact injectors for ambulatory centers |

xx% |

|

Vivid Imaging (U.S.) |

Cost-effective models for emerging markets |

xx% |

|

APOLLO RT (South Korea) |

AI-driven injectors for precision dosing |

xx% |

|

Mindray (China) |

Localized injectors for Chinese hospitals |

xx% |

|

Trivitron Healthcare (India) |

Budget-friendly systems under the "Medton" brand |

xx% |

|

IMIX (Australia) |

Tele-radiology compatible injectors |

xx% |

|

Taejoon Pharm (South Korea) |

Contrast media + injector combos |

xx% |

Below are the areas covered for each company under the top global manufacturers:

Recent Developments

- In June 2024, Guerbet introduced Artemid, a sustainable contrast agent injector with 30.7% lower energy consumption. The product is marketed in Europe and the U.S., and it captured 8% of the injector systems market within three months.

- In March 2024, Bayer announced the launch of its next-gen Medrad Stellant FLEX contrast injector, integrating AI for precise dosing in CT scans. The system reduced contrast waste by 20.7% and improved scan efficiency, with enhanced workflow in hospitals.

- Report ID: 7898

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Contrast Injector Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert