Continuous Testing Market Outlook:

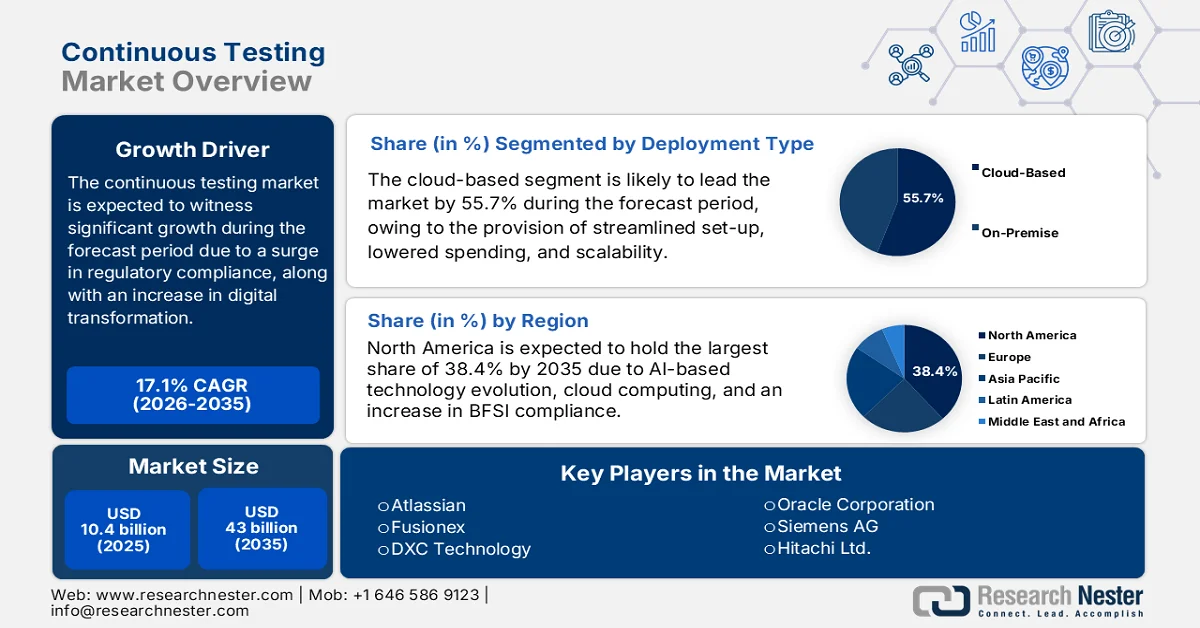

Continuous Testing Market size was over USD 10.4 billion in 2025 and is estimated to reach USD 43 billion by the end of 2035, expanding at a CAGR of 17.1% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of continuous testing is assessed at USD 12.1 billion.

The international continuous testing market is rapidly evolving since enterprises seek faster, secure, and reliable software delivery. While the adoption is highly fueled by regulatory compliance and digital transformation, the market is also significantly shaped by forces that are escalating the demand and also redefining organizations, integrating testing into ICT ecosystems. According to official statistics published by the ITA in 2023, the computer systems and design-based services industry effectively added USD 489.2 billion in valuation as of 2023, particularly to the U.S. economy. Additionally, in the same year, internet publishing, data processing, and other information services added a USD 469.4 billion valuation. Besides, there have been an estimated 585,000 IT and software services companies, facilities management organizations, and computer systems design firms, thus making it suitable for uplifting the market’s growth globally.

Furthermore, the aspects of artificial intelligence (AI)-based predictive analytics in testing, an expansion in the Internet of Things (IoT) and edge computing, and the integration with DevSecOps frameworks are readily responsible for bolstering the continuous testing market internationally. As stated in a data report published by Eman Publisher in September 2025, AI-powered predictive analytics comprises 32% of prediction, along with 26% of consumer behavior analysis. In addition, with this analytics adoption, 65% of survey participants deliberately revealed their ability to gain suitable forecasting accuracy, while 70% successfully make decisions at a rapid pace. Therefore, this diminishes downtime and readily boosts consumer trust, especially in healthcare and BFSI sectors, thus denoting an optimistic outlook for the market’s growth and demand internationally.

Key Continuous Testing Market Insights Summary:

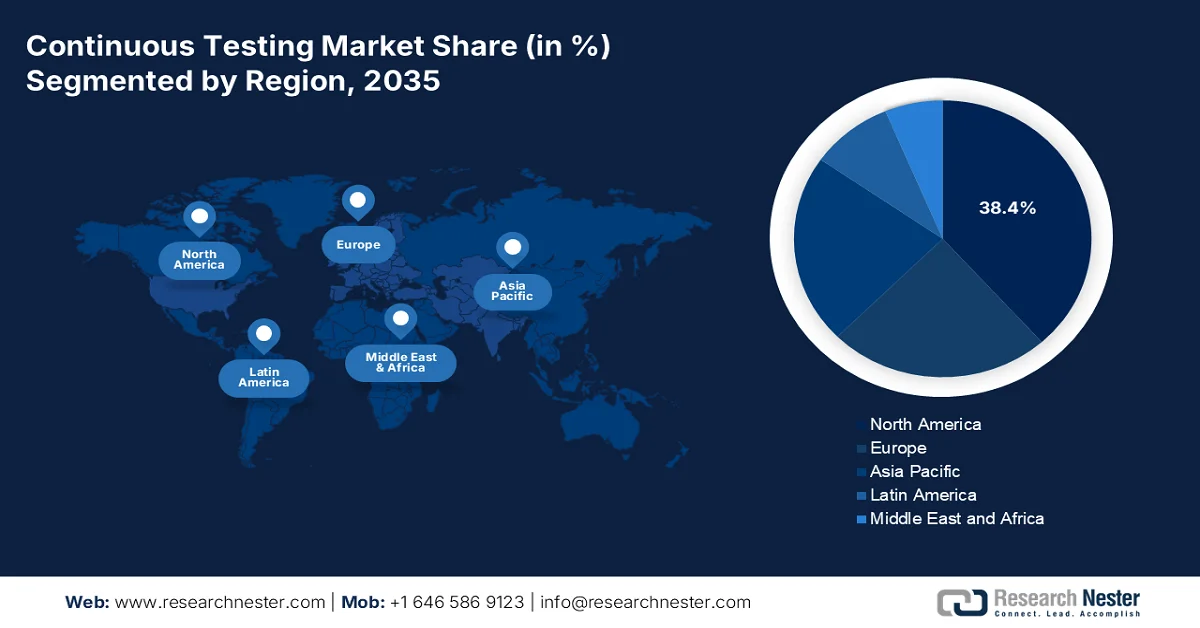

Regional Highlights:

- North America is projected to command a 38.4% share of the continuous testing market by 2035, impelled by AI-based evaluation techniques, rising BFSI compliance, and accelerating cloud computing adoption.

- Asia Pacific is expected to register the fastest growth in the continuous testing market during 2026–2035, attributable to expanding cloud-native adoption, strengthened BFSI compliance frameworks, increasing government ICT funding, and rapid digital transformation.

Segment Insights:

- In the continuous testing market, the cloud-based segment is anticipated to account for a dominant 55.7% share by 2035, propelled by streamlined setup, parallel evaluation, reduced costs, enhanced collaboration, and scalability.

- The BFSI segment is poised to capture the second-largest share over 2026–2035, driven by stringent compliance requirements, escalating cybersecurity risks, and the demand for seamless digital customer experiences.

Key Growth Trends:

- Transition to low-code or no-code testing platforms

- Rise in cloud-native microservices testing

Major Challenges:

- Integration complexity with legacy systems

- Data security and compliance risks

Key Players: IBM (U.S.), Accenture (U.S.), Capgemini (France), Cognizant (U.S.), Infosys (India), Wipro (India), TCS – Tata Consultancy Services (India), Tricentis (Austria), Micro Focus (UK), Tech Mahindra (India), HCL Technologies (India), Samsung SDS (South Korea), NEC Corporation (Japan), Atlassian (Australia), Fusionex (Malaysia), DXC Technology (U.S.), Oracle Corporation (U.S.), Siemens AG (Germany), Hitachi Ltd. (Japan), Naver Corporation (South Korea).

Global Continuous Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.4 billion

- 2026 Market Size: USD 12.1 billion

- Projected Market Size: USD 43 billion by 2035

- Growth Forecasts: 17.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Canada, United Kingdom, France, Australia

Last updated on : 18 February, 2026

Continuous Testing Market - Growth Drivers and Challenges

Growth Drivers

- Transition to low-code or no-code testing platforms: Enterprises are integrating low-code testing tools to significantly empower non-technical teams. This democratizes testing, diminishes dependency on specialized talent, and escalates deployment cycles, thus boosting the continuous testing market. For instance, in February 2025, Fujitsu Limited and AKOS AI declared that Fujitsu has offered the Italy-specific start-up with AI Trust technologies, comprising of 5 notable tools from its Fujitsu Kozuchi AI service. Besides, AKOS AI provides AKOS HUB, which in turn, offers a set of packages of no-code or low-code tools, as well as AI governance that supports organizations of all industries and sizes. Therefore, with such organizational contributions, there is a huge growth opportunity for the market internationally.

- Rise in cloud-native microservices testing: Organizations are deliberately migrating to microservices architectures, due to which the continuous testing market is evolving to validate containerized applications across multi-cloud and hybrid environments. As stated in a data report published by the Europe Journal of Computer Science and Information Technology in 2025, 83% of enterprises have successfully implemented microservices for the newest application development, with container adoption witnessing an outstanding 347% growth. Besides, organizations readily embracing cloud-native architectures denote 65% rapid time-to-market and 78% optimization in deployment frequency in comparison to those maintaining conventional monoliths, thereby bolstering the market’s exposure.

- Increased adoption of digital twin testing models: The presence of industries such as automotive and manufacturing is significantly leveraging digital twins to stimulate real-world conditions. Therefore, continuous testing applied to these models enables performance and reliability before physical deployment. According to official statistics published by Decision Analytics Journal in March 2023, 75% of IoT-based organizations utilize digital twin technology, and meanwhile more than 40% of large-scale organizations globally are expected to utilize the technology in projects to enhance revenue by the end of 2027. Besides, the digital twin industry is valued at USD 8 billion as of 2022, and is further projected to grow at almost 25% by 2032, thereby positively impacting the continuous testing market globally.

Challenges

- Integration complexity with legacy systems: Different enterprises operate on legacy IT systems that are not designed for continuous testing frameworks. Therefore, integrating continuous testing into these environments is complex, requiring extensive customization and middleware solutions. Legacy systems often lack APIs or compatibility with cloud-native platforms, making automation difficult. This integration challenge leads to longer implementation timelines, higher costs, and increased risk of system downtime. Industries such as BFSI and healthcare, which rely heavily on legacy infrastructure, face significant hurdles in adopting continuous testing. Moreover, compliance requirements in these sectors demand rigorous validation, further complicating integration, thereby negatively impacting the continuous testing market.

- Data security and compliance risks: The continuous testing market involves handling sensitive data across multiple environments, including cloud platforms. This raises concerns about data privacy, security breaches, and compliance with regulations such as GDPR, HIPAA, and PCI DSS. Enterprises in BFSI and healthcare are particularly cautious, as testing often requires real-time access to confidential information. Mismanagement of test data can lead to regulatory penalties and reputational damage. Additionally, integrating third-party tools introduces vulnerabilities that may compromise system integrity. The challenge is heightened by the growing complexity of cyber threats, requiring enterprises to adopt robust security measures within testing frameworks.

Continuous Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.1% |

|

Base Year Market Size (2025) |

USD 10.4 billion |

|

Forecast Year Market Size (2035) |

USD 43 billion |

|

Regional Scope |

|

Continuous Testing Market Segmentation:

Deployment Type Segment Analysis

The cloud-based segment, which is part of the deployment type, is anticipated to garner the largest share of 55.7% in the continuous testing market by the end of 2035. The segment's upliftment is highly driven by the aspects of streamlined setup, parallel evaluation, diminished expenses, collaboration, and scalability. According to official statistics published by the Computer Science Review in May 2025, 50% of IT decision-makers across different industries readily perform a few application security testing procedures during the DevOps process. Besides, the cloud computation adoption by small and medium-sized enterprises (SMEs) has successfully improved the public administration, which is readily fueling the segment’s growth. Meanwhile, as per the National Center for Science and Engineering Statistics published in August 2022, the Broadband Equity, Access, and Deployment Program authorized USD 42.4 billion for digitalized infrastructure investment, thus catering to the segment’s growth and development.

Industry Vertical Segment Analysis

The BFSI segment in the continuous testing market is projected to account for the second-largest share during the forecast period. The segment’s growth is highly propelled by stringent compliance requirements, cybersecurity risks, and the need for seamless digital customer experiences. Financial institutions are under constant regulatory oversight, including frameworks such as PCI DSS, GDPR, and Basel III, which mandate secure and reliable IT systems. Continuous testing ensures that applications meet these standards while reducing downtime and vulnerabilities. The rise of digital banking, mobile payments, and blockchain-based financial services has accelerated demand for automated testing solutions that validate transactions in real time.

Organization Size Segment Analysis

By the end of the stipulated timeline, the large enterprises sub-segment, which is part of the continuous testing market, is expected to hold the third-largest share in the continuous testing market. The sub-segment’s development is highly propelled by managing thousands of applications across multiple geographies, requiring robust testing frameworks to ensure reliability and compliance. Continuous testing enables large enterprises to accelerate software delivery while maintaining quality, a critical factor in industries such as telecom, healthcare, and manufacturing. The adoption of DevOps and cloud-native architectures has further increased reliance on automated testing solutions. Large enterprises also face heightened cybersecurity risks, making security and compliance testing essential. Their budgets allow investment in commercial tools, AI-driven automation, and hybrid cloud deployments, giving them a competitive edge over SMEs.

Our in-depth analysis of the continuous testing market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Type |

|

|

Industry Vertical |

|

|

Organization Size |

|

|

Service Type |

|

|

Tool Type |

|

|

Testing Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Continuous Testing Market - Regional Analysis

North America Market Insights

North America, in the continuous testing market, is anticipated to garner the largest share of 38.4% by the end of 2035. The market’s upliftment in the region is highly propelled by AI-based evaluation techniques, an increase in BFSI compliance, along with a surge in cloud computing adoption. Besides, based on government estimates published by the Congress Government in February 2025, there has been an announcement of a private joint venture with potential investment of almost USD 500 billion to fund an AI facility, with the inclusion of developing almost 20 data centers in the U.S. In addition, the request for comments (RFC) declared the importance of providing approximately USD 175 billion of suitable funds to U.S.-funded international AI infrastructure projects to combat risks experienced by domestic data centers, thus bolstering the market’s demand in the overall region.

The continuous testing market in the U.S. is growing significantly, owing to the existence of digital equity programs, broadband extension, modernization in ICT, nationwide 5G deployment, and an increase in emphasis on secure supply chains. According to official statistics published by 5G Americas in April 2025, the U.S., along with Canada, accounted for over 182 million 5G connections, demonstrating an almost 20% year-over-year (YoY) growth rate. This has effectively put the overall region at the 5G penetration forefront in terms of coverage and integrated technology across enterprise and consumer segments. Besides, the domestic 5G network performance has deliberately advanced, highly driven by 5G standalone deployment. In the fourth quarter of 2024, the country reached a median 5G standalone download speed of 388.4 Mbps, denoting a rise from 305.3 Mbps in 2023, thereby creating an optimistic outlook for the market’s growth.

The aspects of AI-based testing integration, robust growth in AI, quantum computing, and cybersecurity, as well as domestic Digital Technologies/ICT strategy emphasizing cutting-edge networks and digital equity, are responsible for bolstering the continuous testing market in Canada. According to the 2024 Government of Canada article, there exist more than 48,390 organizations in the domestic ICT industry, and the majority of over 44,870 are categorized under the computer and software services industries. This industry consists of small-sized companies, with an estimated 41,000 firms readily employing less than 10 people. Additionally, 153 large-scale organizations are employing more than 500 individuals, such as subsidiaries of international multinational corporations, thus making it suitable for boosting the market in the overall country.

Companies’ Presence in the Canada-Based ICT Sub-Sector (2024)

|

ICT Company Type |

Presence (%) |

|

Software Computer Services |

92.7 |

|

ICT Wholesaling |

3.2 |

|

Communications Services |

2.4 |

|

ICT Manufacturing |

1.7 |

Source: Government of Canada

APAC Market Insights

The Asia Pacific continuous testing market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly attributed to an increase in cloud-native adoption, BFSI compliance, government-based ICT funding, and rapid digital transformation. According to official statistics published by the Asia Society Policy Institute in 2025, the rapid growth of the public cloud industry exceeded USD 210 billion as of 2025, and is further projected to surpass USD 530 billion by the end of 2030. Besides, a few economies in the region have readily implemented cloud-based policies and developed enabling environments to support rapid adoption, as well as identifying both enhanced security capabilities and operational efficiencies. Therefore, with such development, there is a huge growth opportunity for the market in the region.

The continuous testing market in China is gaining increased traction, owing to government-based investment, growth in enterprise adoption, along with the aspect of quality assurance and regulatory compliance. As per an article published by NLM in February 2022, projects have been successfully unveiled in the country, with the intention of strengthening regional and national network coverage by offering over USD 32 billion as investment in ICT integration. Besides, projects including School Network Popularization, Class Network Popularization, and Distance Education in Rural Areas (DERA) have been successfully implemented. This has led to significant progress in competence, resources, and infrastructure, thus enhancing the market’s growth in the country. Moreover, the National Medical Products Administration (NMPA) has emphasized validation and testing, thus driving the market’s demand across regulated sectors.

The aspects of emphasized automation, an increase in cybersecurity, businesses' incorporation, and strong investments in 5G infrastructure are factors that are positively impacting the continuous testing market in India. Based on government estimates published by the PIB Government in February 2026, 5G networks have been significantly rolled out across all union territories and states and are readily available in 99.95 of districts. These particular districts comprise a population coverage of 85%, with 5.0 lakh 5G Base Transceiver Stations (BTSs) installed in December 2025. In addition, the median mobile broadband has also observed a generous increase to 131.4 Mbps as of October 2025. Therefore, with the government’s objective to establish such infrastructures, there is a huge growth opportunity for the market in the overall country.

Europe Market Insights

Europe's continuous testing market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly fueled by regional ICT funding, the presence of GDPR compliance, an increase in BFSI digitalization, and a surge in cloud computing. According to official statistics published by Europe Commission in 2025, as of 2024, 13% of regional businesses utilized AI technologies, with 80% of the population expected to possess basic digital skills by the end of 2030. Additionally, to adopt basic digital skills, people are required to be aware of at least 1 activity in each of 5 various competence areas. Besides, as of 2023, more than 90% of people in the overall region utilized the internet at least once a week. Moreover, the share of people with basic digital skills as of 2023 was highest in the Netherlands with 83%, 82% in Finland, 73% in Ireland, 70% in Denmark, and 69% in Czechia, thereby boosting the market’s growth.

People with Basic and Above Basic Digital Skills in Europe (2023)

|

Countries |

Percentage of People |

|

Austria |

64.7% |

|

Belgium |

59.4% |

|

Romania |

27.7% |

|

Slovenia |

46.7% |

|

Portugal |

56.0% |

|

Sweden |

66.4% |

Source: Europe Commission

The continuous testing market in the UK is gaining increased exposure, owing to the provision of government ICT policy and budget allocation, digital and telecom infrastructure expansion, as well as supply chain security and diversification. As stated in an article published by the UKRI in October 2023, the network reliability is expected to reach more than 5 times, accounting for 99.9%, thereby ensuring minimal errors and failures in severe scenarios. The aspect of sensing capability and high precision positioning constitutes the ability to sense the physical environment and offer high precision positioning for devices and users, within the resolution of 1cm to 10 cm. Besides, the network provision for massive connected devices tends to support almost 100 million connected devices per square kilometer, thereby proliferating the market’s exposure in the overall country.

The aspects of regulatory compliance, enterprise-based digitalized transformation, as well as the provision of robust government spending, are factors uplifting the continuous testing market in Germany. Based on government estimates published by the ITA in August 2025, the digital economy in the country is significantly growing, amounting to USD 250 billion as of 2024, denoting an increase from USD 239 billion in 2023. Besides, the country’s 2022 gigabit strategy has aimed to constitute 50% of connections by fiber to the premises (FTTP) as of 2025, and is also projected to be 100% by the end of 2030. In addition, as of 2024, FTTP has been at 29.8% in the country, and meanwhile, the strategy comprises USD 12.6 billion in government subsidies and USD 52.6 billion for private sector investments by telecommunication companies, thereby bolstering the market’s upliftment in the nation.

Key Continuous Testing Market Players:

- IBM (U.S.)

- Accenture (U.S.)

- Capgemini (France)

- Cognizant (U.S.)

- Infosys (India)

- Wipro (India)

- TCS – Tata Consultancy Services (India)

- Tricentis (Austria)

- Micro Focus (UK)

- Tech Mahindra (India)

- HCL Technologies (India)

- Samsung SDS (South Korea)

- NEC Corporation (Japan)

- Atlassian (Australia)

- Fusionex (Malaysia)

- DXC Technology (U.S.)

- Oracle Corporation (U.S.)

- Siemens AG (Germany)

- Hitachi Ltd. (Japan)

- Naver Corporation (South Korea)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- IBM is one of the leading players in continuous testing, leveraging its AI-powered testing tools and integration with hybrid cloud platforms. Its focus on enterprise-scale DevOps solutions positions it strongly in the BFSI and healthcare sectors.

- Accenture readily drives adoption of continuous testing through consulting-led digital transformation projects. Its partnerships with cloud providers and investment in automation frameworks enhance scalability for global enterprises.

- Capgemini significantly emphasizes continuous testing in agile and DevOps environments, offering tailored solutions for Europe-based enterprises. Its expertise in compliance-driven industries strengthens its market share.

- Cognizant integrates continuous testing into digital engineering services, focusing on speed-to-market and cost efficiency. Its strong presence in IT and telecom accelerates adoption across North America.

- Infosys combines AI-driven automation with cloud-native testing platforms, catering to BFSI and retail clients. Its global delivery model and innovation hubs make it a competitive force in the continuous testing market.

Here is a list of key players operating in the global continuous testing market:

The international continuous testing market is highly competitive, with leading players adopting strategies such as AI-driven automation, cloud-native testing platforms, and strategic partnerships to strengthen market presence. U.S. firms such as IBM and Accenture dominate through enterprise-scale solutions, while Europe-based players such as Capgemini and Tricentis focus on innovation in DevOps integration. India-specific companies, including Infosys, Wipro, and TCS, leverage cost-efficient delivery models and global reach. Meanwhile, Asia firms such as Samsung SDS and NEC emphasize digital transformation initiatives. Emerging players in Australia and Malaysia are expanding through niche offerings and regional partnerships, intensifying competition across all major ICT markets. For instance, in November 2025, Essity collaborated with Microsoft and Accenture to accelerate the adoption of artificial intelligence agents to drive growth and productivity through optimized business agility, thereby proliferating the continuous testing industry globally.

Corporate Landscape of the Continuous Testing Market:

Recent Developments

- In October 2025, Tricentis introduced its vision for the future of artificial intelligence-based quality engineering at the Tricentis Platform, which is its very flagship international event at London and Nashville, thus marking a defining moment in enterprises developing, evaluating, and delivering software.

- In May 2025, Sauce Labs Inc. declared that it has surpassed 8 billion tests that have been executed on its platform, denoting a significant milestone that underscores the immense scale of Sauce Labs’ facility and the trust placed in it by notable enterprises globally.

- In April 2025, Accenture, through an extension of its tactical relationship with Google Cloud, launched newest capabilities to assist organizations upscale the upgraded artificial intelligence and cloud technologies.

- Report ID: 8398

- Published Date: Feb 18, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Continuous Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.