Continuous Passive Motion Devices Market Outlook:

Continuous Passive Motion Devices Market size was over USD 1.09 billion in 2025 and is poised to exceed USD 2.01 billion by 2035, growing at over 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of continuous passive motion devices is estimated at USD 1.15 billion.

The market is expanding due to the growing awareness on orthopedic conditions, knee and hip arthroplasty, and ligament reconstruction, treatments by an ageing population with high vulnerability to musculoskeletal ailments. For instance, in December 2022, the company's strategic clinical guidance for musculoskeletal and behavioral health initiatives was expanded by Quantum Health's clinical advisory boards, which began its operations in 2024. This enabled employers, employees, and their families to better manage the healthcare journey. It is further supported by medical professionals as well as patients themselves through emphasis on innovation.

Further R&D emphasis is on developing more patient-focused models such as wearable CPM devices and incorporating digital health technology for improved management of therapy as well as tracking of improvement. For instance, in September 2024, the team's smart joint trial liner is being developed with the help of a USD 1.5 million Invention for Innovation (i4i) Product Development Award from the National Institute for Health and Care Research (NIHR). It is equipped with thin and flexible sensors that are based on innovative microfluidic technology created in the Department of Materials Science and Metallurgy at the University of Cambridge (UoC).

Key Continuous Passive Motion Devices Market Insights Summary:

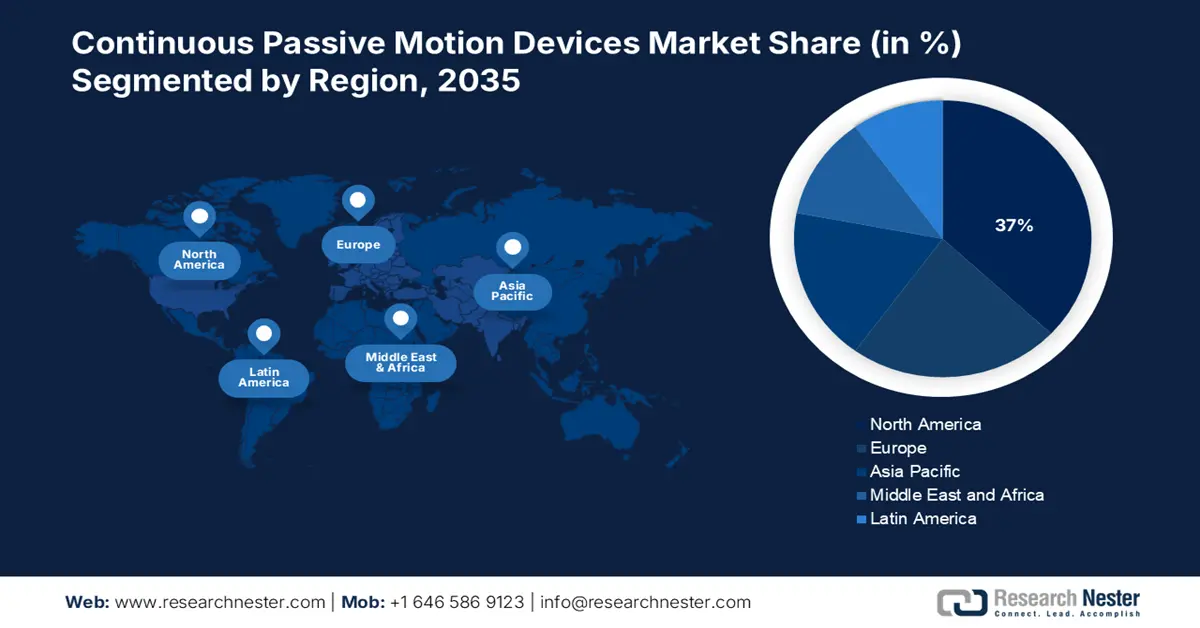

Regional Highlights:

- North America continuous passive motion devices market will account for 37% share by 2035, fueled by the presence of prominent players striving for innovation in patient care.

- Asia Pacific market will grow rapidly during the forecast period 2026-2035, attributed to lightweight, portable designs and stringent regulations ensuring patient safety.

Segment Insights:

- The portable segment in the continuous passive motion devices market is projected to hold a 59.20% share by 2035, driven by portability facilitating use across clinical and home settings.

Key Growth Trends:

- Increasing prevalence of orthopedic disorders

- Demand for non-invasive, drug-free pain management

Major Challenges:

- Limited patient compliance

- Competition and market dynamics

Key Players: DJO Global, Inc. (Colfax Corporation), BTL Corporate, Kinetec SAS, Chattanooga Group (DJO Global), OrthoLogic Corp., Rimec S.r.l., Bio-Med Inc., Surgi-Care, Inc., OPED GmbH, Zimmer Biomet Holdings, Inc.

Global Continuous Passive Motion Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.09 billion

- 2026 Market Size: USD 1.15 billion

- Projected Market Size: USD 2.01 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Continuous Passive Motion Devices Market Growth Drivers and Challenges:

Growth Drivers

- Increasing prevalence of orthopedic disorders: One of the major drivers for the growth of the market is the growing incidence of orthopedic diseases, including osteoarthritis and post-trauma injury. For instance, in October 2023, the health data from IHME stated that, in 2020, there were 494 million instances of musculoskeletal illnesses worldwide. It is anticipated that the number of cases of musculoskeletal disorders will rise by 115% (107–124) between 2020 and 2050, reaching an estimated 1060 million instances in 2050. Higher strain for such therapeutic interventions drives market growth in the healthcare sector.

- Demand for non-invasive, drug-free pain management: The growing need for drug-free, non-pharmacological pain-relief methods drastically fuels the market. For instance, in April 2025, the Luxembourg Institute of Health (LIH) has announced SmILE project, a ground-breaking endeavor aimed at utilizing smart technologies to address musculoskeletal non-communicable diseases (MSK-NCDs). It seeks to improve patient autonomy, preventative measures, early intervention, and individualized therapies. Thus, demand for conservative treatments directly translates to increased use and expanding market base of CPM technology.

Challenges

- Limited patient compliance: Poor patient compliance is a main hindrance to general application and effectiveness of continuous passive motion devices market. Furthermore painful usage, discomfort of long-term wear, and lack of awareness about the therapeutic benefit are a few reasons behind differential compliance with prescribed CPM regimens. Thus, such poor patient compliance can deter best rehabilitation outcomes as well as limit the full market potential of CPM devices in the health care environment.

- Competition and market dynamics: The market competes and shows dynamical complexity. The production sector and availability of other rehabilitation treatments, such as physiotherapy, enhance the competition level. In addition, factors such as changes in reimbursement regimes, regional differences in the healthcare facilities, and a need for economical solutions introduce complexity in the dynamics that may create market development difficult and thus can obstruct the growth.

Continuous Passive Motion Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 1.09 billion |

|

Forecast Year Market Size (2035) |

USD 2.01 billion |

|

Regional Scope |

|

Continuous Passive Motion Devices Market Segmentation:

Design Segment Analysis

The portable segment is estimated to dominate continuous passive motion devices market share of over 59.2% by 2035, attributed their in-built nature makes it easy for them to be portable and used across all clinical and home settings. For instance, in December 2024, with the successful first clinical application of its Lantern Hip portable device, OrthAlign, Inc. reported a noteworthy milestone towards improving its product line which puts company in a strong position to grow both in the hospital and the ambulatory surgical center (ASC). The in-built mobility factor supports the increased popularity of cheaper and convenient modes of rehabilitation, thus justifying the superiority of portable devices in the CPM market.

Type Segment Analysis

The knee joint CPM devices segment is emerging as one of the most prominent segments in the continuous passive motion devices market as the rising incidence of knee injury and surgery requiring postoperative rehab is very high. For instance, in October 2024, Exactech received FDA approval for its 3D-printed tibial knee implant, the Truliant porous tibial tray. Using additive manufacturing technology, it has a porous structure that resembles cancellous bone that facilitates both initial and biological attachment to support active lifestyles. Consequently, acute clinical demand for successful knee joint mobilization has turned knee CPM devices into the most pervasive product category in continuous passive motion devices.

Our in-depth analysis of the global market includes the following segments:

|

Design |

|

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Continuous Passive Motion Devices Market Regional Analysis:

North America Market Insights

North America in continuous passive motion devices market is set to dominate over 37% revenue share by 2035, characterized by the presence of prominent players in the market striving for innovation in patient care. For instance, in March 2025, at the annual meeting of the American Academy of Orthopaedic Surgeons (AAOS) 2025, in San Diego, Johnson & Johnson MedTech showcased their most recent developments in digital orthopaedics. The company launched state-of-the-art implants, sophisticated procedures, and data-driven technology featuring the clinically validated ATTUNE Knee System, and the VELYS Robotic-Assisted Solution.

The most significant growth driver in the U.S. market is the critical role of these devices in helping patient’s recovery and reducing hospital readmissions and medical costs. For instance, in April 2023, the first implantable shock absorber, the MISHA Knee System for patients with early-stage osteoarthritis (OA) was approved by the U.S. FDA. The technology alleviates joint stress by lowering the typical weight-bearing load on the medial (inside) side of the knee by one-third.

In Canada the growth in the market is growing rapidly due to the focus of manufacturers on innovation and precision in delivering the outcomes and maximized satisfaction. For instance, in March 2025, by utilizing the Zimmer Biomet's ROSA Knee System, Brampton Civic Hospital conducted the 1,000th robot-assisted complete knee replacement surgery. It enables surgeons with soft tissue assessment and bone resections, providing for increased precision and flexibility during treatments.

Asia Pacific Market Insights

The Asia Pacific continuous passive motion devices market is expanding at a rapid pace. The creation of lightweight and portable designs, has increased the usefulness and usability of CPM devices, resulting in their widespread use. These features allow manufacturers to guarantee appropriate limb motion as the initial phase of rehabilitation after soft tissue medical procedures and catastrophes. In addition, stringent regulations implementations ensure patient safety and treatment efficacy within the region.

In India, the continuous passive motion devices market is spurred by the through research on the enhanced significance of these devices in enhancing patient outcomes and quickening the healing process. For instance, in November 2024, researchers at IIT Ropar have revealed a novel and patented (No. 553407) way to lower the cost and increase the accessibility of continuous passive motion therapy. It is a major advancement for post-surgical knee rehabilitation, and is a off-grid solution.

In China, the market is witnessing substantial growth owing to the greater emphasis on R&D with the goal of creating and improving CPM devices. For instance, in May 2022, The Orthopaedic Data Evaluation Panel (ODEP), a preeminent international rating organization for the orthopedic sector, awarded MicroPort Orthopedics' Advance Medial-Pivot knee system the highest rating of "15A" in 2021. This innovation is a component of a larger strategy used by market leaders to improve their product offerings.

Continuous Passive Motion Devices Market Players:

- Surgi-Care Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Furniss Corporation

- Bio-Med Inc.

- BTL Corporate

- Chattanooga

- OPED

- Chinesport Rehabilitation

- Medival

- Rimec

The presence of key players in the continuous passive motion devices market is characterized with their efforts to strengthen their position, and adapt to the changing demands of the healthcare industry. For instance, in February 2022, Smith+Nephew announced the commercial launch of its next generation handheld robotics platform, the CORI Surgical System, in Japan. This robotic solution incorporated 3-D intraoperative imaging with an advanced robotic precision milling tool to sculpt bone and can preserve anatomy in ligament sparing procedures.

Here's the list of some key players:

Recent Developments

- In August 2024, Alkem MedTech Pvt Ltd announced a technology transfer agreement

- with Exactech Inc., Florida, USA. This agreement intended to produce and sell Exactech's big joint replacement implants in India.

- In June 2024, Meril introduced MISSO, an indigenously designed surgical robotic system. Its characteristics enabled accurate bone resections and allowed real-time assessment of soft tissue laxity guarantee exact knee joint alignment.

- Report ID: 7554

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.