Containerized Data Center Market Outlook:

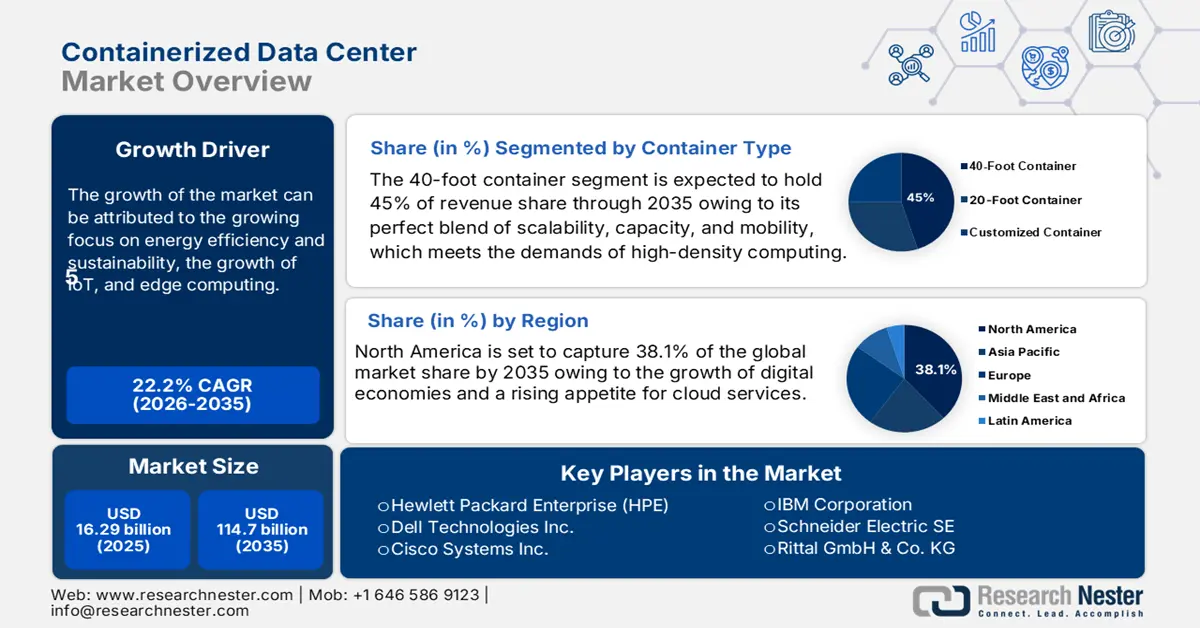

Containerized Data Center Market size was valued at USD 16.29 billion in 2025 and is projected to reach USD 114.7 billion by the end of 2035, rising at a CAGR of 22.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of containerized data centers is estimated at USD 19.86 billion.

The market for containerized data centers has witnessed significant growth as a result of surging interest in scalable, modular, and energy-efficient IT infrastructure. Companies are beginning to adopt containerized data centers to rapidly deploy facilities in isolated areas with space restrictions, as well as to support edge computing and IoT uses. In addition to helping geography-constrained businesses, the benefit of a containerized data center is the ability to grow their capacity while minimizing upfront capital expenditures incrementally. The growing deployment and use of cloud services, as well as increasing developments around data sovereignty, are only increasing the need for containerized data centers, especially within telecommunications, healthcare, and federal services. Finally, the use of advanced cooling techniques and renewable energy included an additional layer of energy efficiency and sustainability for a continued rollout.

Moreover, technologies like artificial intelligence (AI), deployment of 5G networks, and automation are spurring the growth of containerized data centers. The implementation of 5G is resulting in an increased demand for edge or regional data centers. Hyperscale cloud providers and telecom providers are also putting more money into the market in order to reduce latency and increase bandwidth. World disruptions such as supply chain issues and regulatory change are shifting market dynamics to local, modular solutions for resiliency and compliance. In conclusion, containerized data centers are abundant, and they will continue to see very strong growth as various technologies continue the necessary innovation along with the demand for flexible and scalable infrastructure.

Key Containerized Data Center Market Insights Summary:

Regional Highlights:

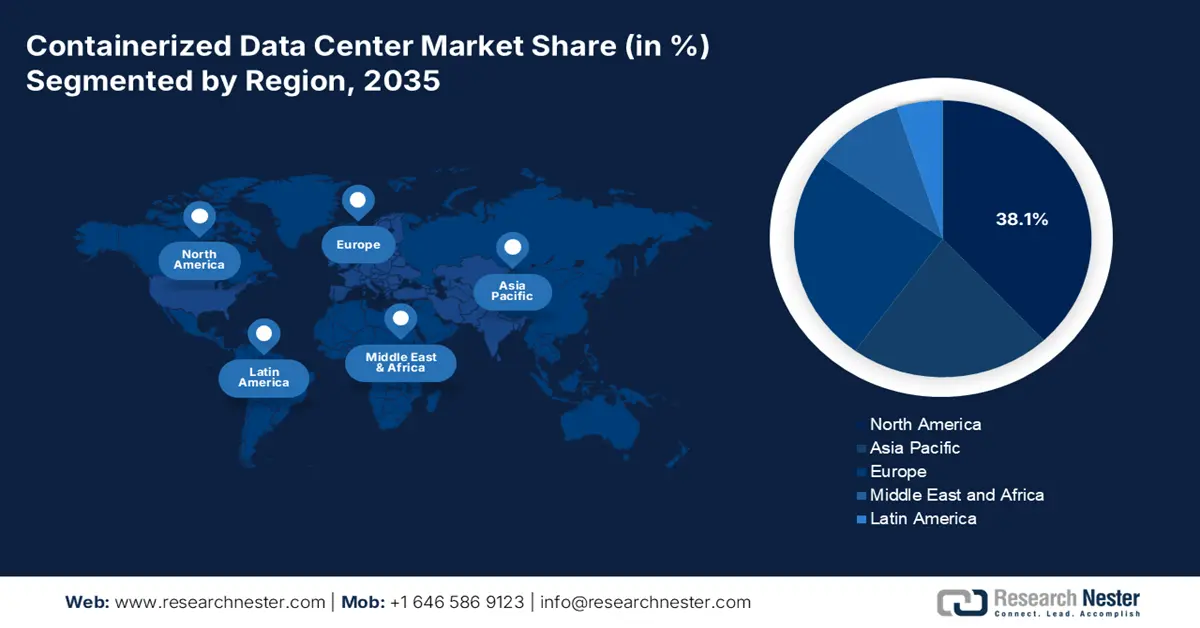

- North America is projected to hold 38.1% share by 2035, driven by the growth of digital economies, cloud adoption, and government initiatives like NTIA’s BEAD program.

- Asia Pacific is expected to capture 22.9% share by 2035, impelled by digitalization, 5G adoption, and government investments in smart cities and edge computing.

Segment Insights:

- The 40-Foot Container segment is projected to account for 45% share by 2035, driven by its scalability, capacity, and mobility for high-density computing.

- The large enterprises segment is anticipated to hold a significant revenue share by 2035, owing to the need for scalable, flexible, and secure data center solutions.

Key Growth Trends:

- Growing focus on energy efficiency and sustainability

- Growth of IoT and edge computing

Major Challenges:

- Limited Capacity and Customization Constraints

- Complex Cooling and Thermal Management

Key Players: Hewlett Packard Enterprise (HPE), Dell Technologies Inc., Cisco Systems Inc., IBM Corporation, Schneider Electric SE, Rittal GmbH & Co. KG, Huawei Technologies Co., Ltd., Fujitsu Limited, Vertiv Group Corp., Delta Electronics, Inc., ZTE Corporation, AdaniConneX, AIMS Data Centre, Leading Edge Data Centres, KT Corporation

Global Containerized Data Center Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.29 billion

- 2026 Market Size: USD 19.86 billion

- Projected Market Size: USD 114.7 billion by 2035

- Growth Forecasts: 22.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: UUnited States, Germany, United Kingdom, Japan, Canada

- Emerging Countries: China, India, Singapore, Australia, South Korea

Last updated on : 3 October, 2025

Containerized Data Center Market - Growth Drivers and Challenges

Growth Drivers

- Growing focus on energy efficiency and sustainability: Concerns over sustainability and rising energy costs are driving businesses to consider energy-efficient data center options. Containerized data centers utilize advanced cooling methods—including liquid cooling or free air, which provide significant reductions in energy consumption. Containerized data centers also allow for increased use of renewable energy and modular deployment close to renewable energy use. As more regulatory pressure for energy reduction and commitments to corporate responsibility continue, energy-efficient data centers that provide a low-carbon footprint become even more attractive to organizations looking to mitigate their impact on the environment without an impact on performance.

- Growth of IoT and edge computing: The rise of edge computing and IoT (Internet of Things) applications has led to demand for data centers that are in containers, at the edge, or near the end-user. Containers can be deployed to a remote or decentralized location, such as cell towers, factories, smart cities, or other locations, to locally process data to remove latency and lower bandwidth on the central data center edge. Edge computing technology will become even more critical with the expansion of 5G networks, which are the backbone for real-time analytics, autonomous vehicles, and other latency-sensitive applications.

- Rapid deployment and scalability: Containerized data centers can be deployed far more quickly than traditional data centers. The modular units can be shipped, installed, and operational in a matter of weeks, making them worthwhile for enterprises that need to scale up capacity with little advance notice. This efficiency can be a key capability where there is uncertainty in the marketplace because companies can experience spikes in data transmission or need to activate a new project relatively quickly. Containerized data centers include the capability to allow for incremental scalability as additional containers can be purchased when needed, thus providing the enterprise the opportunity to not make a capital investment in advance.

Major Foreign and Corporate Investments in the United States by Sector and Focus

|

Investor/Company |

Investment |

Sector |

Investment Focus |

|

UAE (Foreign Investment) |

$1.4 Trillion |

Manufacturing & Industry |

Technology, aerospace, and energy |

|

Qatar (Foreign Investment) |

$1.2 Trillion |

Manufacturing & Industry |

Technology and manufacturing |

|

Japan (Foreign Investment) |

$1 Trillion |

Manufacturing & Industry |

Auto plants and U.S. Steel |

|

Apple |

$600 Billion |

Technology & AI |

Manufacturing and training |

|

Saudi Arabia (Foreign Investment) |

$600 Billion |

Manufacturing & Industry |

Technology and manufacturing |

|

EU Firms (Trade Deal) |

$600 Billion |

Various sectors |

General investment |

|

Softbank, OpenAI, and Oracle |

$500 Billion |

Technology & AI |

AI infrastructure (Project Stargate) |

Challenges

- Limited Capacity and Customization Constraints: Containerized data centers intentionally have limitations on space and power usage. The physical size of each container is fixed, making it impossible to add as many servers, cooling, and storage components as desired. Containers can be built to be scalable, but 'scaling' in this context typically means adding containers, which may not be practicable depending on site constraints. Finally, because containers are typically built to be volume efficient, the standardized specification can result in limited customizations, which are often required for specialized enterprise requirements or complex legacy system integrations.

- Complex Cooling and Thermal Management: While containerized data centers can utilize more efficient cooling technologies, addressing heat in a small enclosed space can still pose a significant challenge. When hardware is densely populated in a small volume, there is a higher risk of overheating regardless of the effectiveness of cooling technologies. Containerized data centers would be subject to more complications if deployed in hot or severe operating conditions; further studies into thermal management will again be required for that situation.

Containerized Data Center Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

22.2% |

|

Base Year Market Size (2025) |

USD 16.29 billion |

|

Forecast Year Market Size (2035) |

USD 114.7 billion |

|

Regional Scope |

|

Containerized Data Center Segmentation

Container Type Segment Analysis

The 40-Foot Container segment of the containerized data center market is projected to hold the largest revenue share of 45% by the end of 2035. The growth is driven by its perfect blend of scalability, capacity, and mobility, which meets the demands of high-density computing. According to the U.S. Department of Energy, data centers accounted for more than 4.4% of the nation’s electricity usage in 2023. The National Institute of Standards and Technology (NIST) points out that these designs allow for quick deployment in edge computing, hold more servers and storage.

Organization Size Segment Analysis

The large enterprises segment is likely to garner a major revenue share in the market. Typically, large enterprises have a huge and complicated set of IT infrastructure needs that involve scalable, flexible, and secure data center solutions. Containerized data centers give these enterprises the option to add computing power easily and move securely when necessary, without the lead times and capital investment associated with traditional data centers. Containerized units provide a modular and standardized way to deliver predictable performance and compliance standards for large enterprises that are operating from multiple sites or around the world.

End-Use Industry Segment Analysis

The containerized data center market continues to be led in revenue share by the IT and telecommunications industries, as they share the perpetual need for rapid data processing, low latency, and rapid scalability. Owing to the meteoric and astonishing growth of data traffic comprising mobile devices, cloud services, and streaming applications, telecom operators and IT companies must operate with infrastructure that allows them to have flexibility to accommodate various workloads. Containerized data centers allow organizations to deploy modular computing capacity near the end-user more rapidly and specifically at the edge of the network, improving service quality and reducing latency.

Our in-depth analysis of the containerized data center market includes the following segments:

|

Segment |

Subsegments |

|

Container Type |

|

|

Organization Size |

|

|

End-Use Industry |

|

|

Ownership Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Containerized Data Center Market – Regional Analysis:

North America Market Insights

The North America containerized data center market is anticipated to account for a leading share of 38.1% by the end of 2035. The growth is supported by the growth of digital economies and a rising appetite for cloud services. Containerized solutions are helping to cut costs with their modular designs. Additionally, government initiatives like NTIA’s BEAD program are working to enhance rural connectivity. This further drives demand for containerized data centers. Strong data privacy regulations and a focus on cybersecurity support local secure containerized options. Also, investment in renewable energy and sustainability is aligned with energy-efficient designs.

The U.S. containerized data center market is growing at an impressive CAGR. The growth is driven by the rise of edge computing, the integration of AI, and a strong push for sustainability. Furthermore, Government initiatives, like the Department of Energy’s funding for cooling solutions in 2024, are addressing power density challenges. Trends such as modular designs for quick deployment and zero-trust architectures are further prompting investments in cybersecurity. The growing need for edge computing in smart cities, autonomous vehicles, and 5G deployments fuels an accelerating adoption. Similarly, robust financial support for renewable energy and sustainability initiatives will drive energy-efficient modular data centers.

The growth of Canada is supported through the progression of digital transformation initiatives across industries such as banking, healthcare, and government services. Data sovereignty, privacy regulations, and geographical concerns necessitate the build-out of modular, in-region data centers. Containerized solutions offer a low-cost and scalable means to extend IT infrastructure to reach difficult or harsh environments, such as the northern portion of Canada. Canada's green energy initiative further aligns with the energy-efficient characteristics of containerized data centers.

Asia Pacific Market Insights

Asia Pacific is expected to hold a revenue share of 22.9% throughout the forecast period, led by growing digitalization and the adoption of 5G. The presence of major players and trends like liquid cooling and edge computing is further driving the regional market growth. Moreover, huge investments by the government are boosting market growth. Government initiatives towards encouraging smart cities, digital governance, and the deployment of a 5G network will augment the need for edge data centers. Data localization regulations in countries like India and China require organizations to deploy local containerized infrastructure.

Containerized data center demand in India is propelled by its rapidly growing digital economy, the rising internet penetration, and observed government initiatives such as Digital India. The telecom industry is quickly rolling out 5G services, which exhibit an extreme demand for edge computing infrastructure; such infrastructure is employed in highly modular containerized systems. Data localization compliance propels enterprise forces to deploy modular data centers close to their end-users, per laws mandating data storage onshore. The scalability and cost-effectiveness of containerized solutions accommodate India's growing diversity in markets and sectors utilizing IT.

By 2035, the Asia Pacific containerized data center market is anticipated to be dominated by China. This is driven by a significant capital outlay in cloud infrastructure and AI. Additionally, trends towards using green data centres and liquid cooling will also contribute to the growth of this market, as will initiatives from governments. Stringent regulatory-compliant data sovereignty legislation is also likely to favour locally contained modular data centres. Strong investment trends towards sustainable energy sources in the region will also support the adoption of energy-efficient containerized solutions.

Europe Market Insights

A key growth driver in Europe is its strict data protection regulations (for example, GDPR), which ensures organizations store data within the country. In addition, sustainability and carbon awareness are contributing to demand for energy-efficient modular data centers. As well, the fast-track digital transformation movement occurring throughout various sectors, such as manufacturing, healthcare, and financial services, is driving demand for scalable and flexible IT infrastructure. Finally, the expansion of 5G cellular networks and edge computing technologies is considered a growth driver for the data center market across Europe.

France is reaping the rewards of government initiatives to drive digital innovation and sustainability, which is driving interest in modular data centers. In addition, France adopted strict data privacy laws (i.e., GDPR) that require data to be processed and stored in data centers located in France. Containerized data centers offer flexible, scalable infrastructure for multiple industries. Finally, France's pursuit of a low carbon footprint aligns with modular data centers that are designed to minimize energy and waste.

German manufacturing and industry are adopting IoT and Industry 4.0 technologies that need distributed computing power at the production edge. Containerized data centers help support this transition while optimizing modular and expandable IT infrastructure at the edge of production. Environmental restrictions and commitments to energy efficiency will also contribute to containerized data centers. German data protection laws and requirements for on-prem data storage will strengthen investments in modular and compliant infrastructure.

Key Containerized Data Center Market Players:

- Hewlett Packard Enterprise (HPE)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dell Technologies Inc.

- Cisco Systems Inc.

- IBM Corporation

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Huawei Technologies Co., Ltd.

- Fujitsu Limited

- Vertiv Group Corp.

- Delta Electronics, Inc.

- ZTE Corporation

- AdaniConneX

- AIMS Data Centre

- Leading Edge Data Centres

- KT Corporation

The containerized data center market is thriving with the presence of U.S. giants like HPE and Dell due to their innovative modular designs and smart AI integration. Companies like Schneider Electric in Europe are advancing with their focus on energy-efficient cooling solutions. Asian firms such as Huawei and Fujitsu are taking advantage of the increasing demand for 5G and IoT technologies. Partnerships and sustainability initiatives will further boost cost efficiency and acquire a stronger position in the market.

Here is a list for keyplayers dominating in the market:

Recent Developments

- In February 2023, Huawei announced the launch of the industry's first dual-engine container solution to build a carrier-grade and fully-converged telco cloud base to improve network performance and reliability, striding into a 5.5G future.

- In November 2024, Spectro Cloud introduced a new integrated edge in a box solution featuring the Hewlett Packard Enterprise (HPE) ProLiant DL145 Gen11 server to help organizations deploy, secure, and manage demanding applications for diverse edge locations.

- Report ID: 5050

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Containerized Data Center Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.