Contact Thermometer Market Outlook:

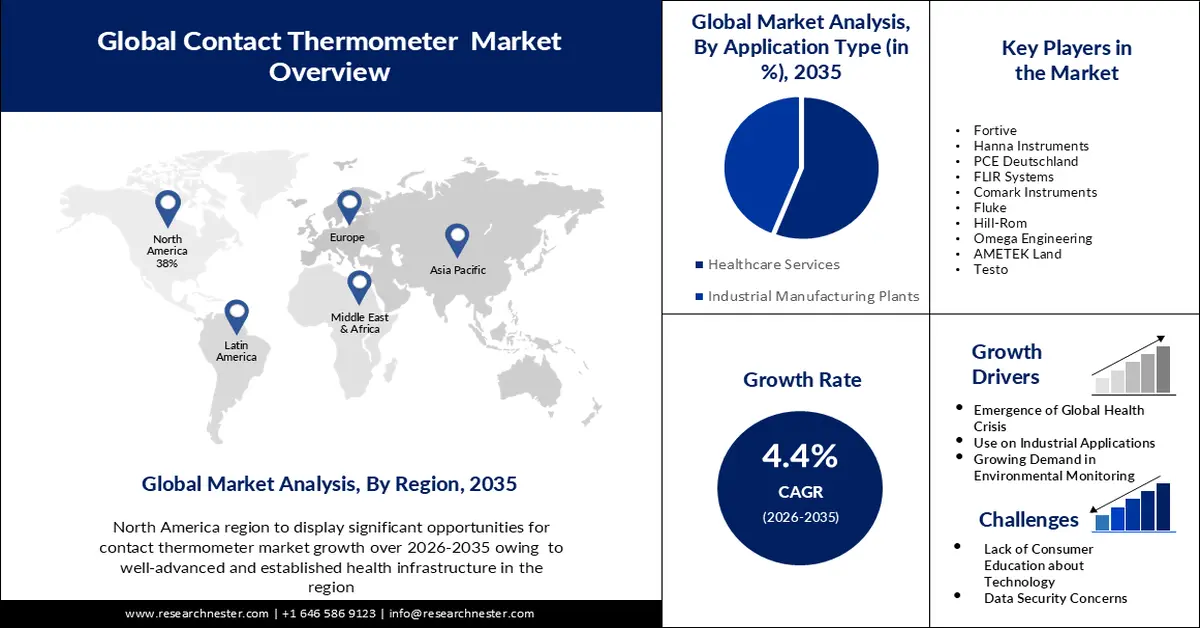

Contact Thermometer Market size was over USD 2.05 billion in 2025 and is projected to reach USD 3.15 billion by 2035, growing at around 4.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of contact thermometer is evaluated at USD 2.13 billion.

Which is attributed to the increasing demand for contact thermometer in the healthcare sector due to rise in number of fever and other health related conditions. According to World Health Organization, there were approximately 9 million cases of typhoid fever in the year 2019. Furthermore, growing use of contact thermometer among athletes and sports persons to measure their body temperatures before and after the sports activity or competition is expected to encourage the use of contact thermometer.

In addition, contact thermometers are used by the food service professionals to check the food temperatures before cooking or serving the hot cooked food to their customers. Moreover, contact thermometer plays important role in food processing, storage and transportation to maintain the proper and accurate temperature control and prevent spoilage.

Key Contact Thermometer Market Insights Summary:

Regional Highlights:

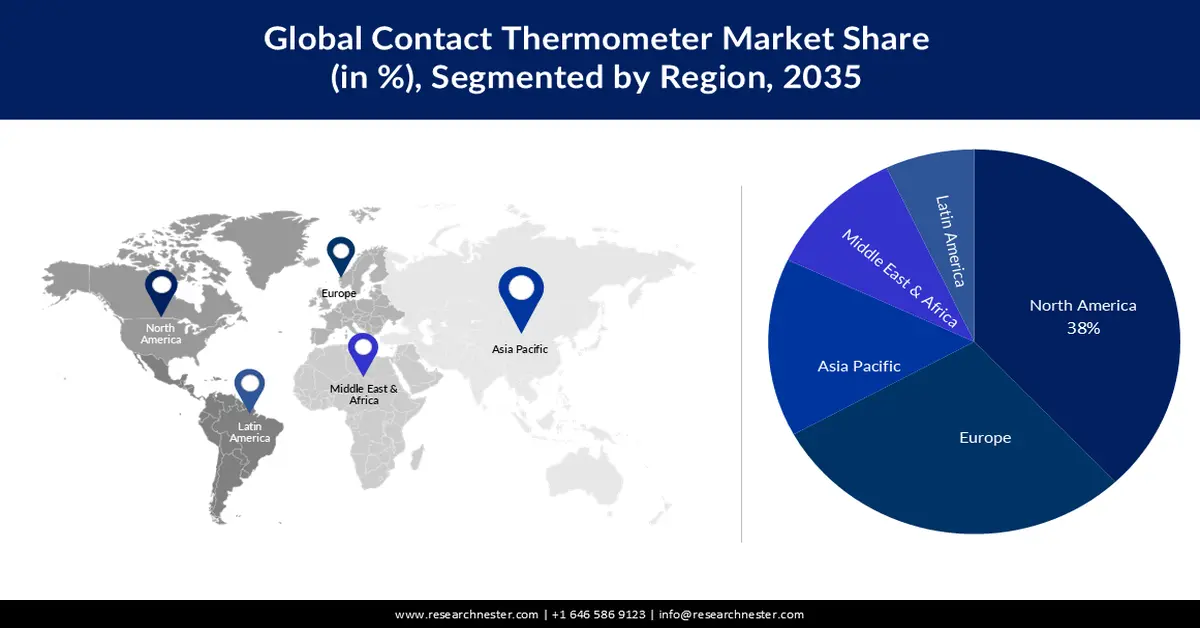

- North America in the contact thermometer market is expected to capture a 38% share by 2035, underpinned by advanced healthcare infrastructure and rising adoption of smart, connected temperature-monitoring devices.

- Europe is projected to hold about 29% of the market by 2035, sustained by stringent product-safety regulations and increasing demand for precise temperature-measurement technologies across key industries.

Segment Insights:

- The contact thermometer with thermistor sensors segment in the contact thermometer market is projected to account for 57% of revenue by 2035, propelled by the high-precision and energy-efficient performance of thermistor-based temperature sensing.

- The healthcare services segment is anticipated to secure a 56% share by 2035, supported by rising focus on preventive healthcare and seamless integration of temperature data into electronic health records.

Key Growth Trends:

- Emergence of Global Health Crisis

- Use in Numerous Industrial Applications

Major Challenges:

- Lack of Consumer Education about Technology

Key Players: Fortive, Hanna Instruments, PCE Deutschland, FLIR Systems, Comark Instruments.

Global Contact Thermometer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.05 billion

- 2026 Market Size: USD 2.13 billion

- Projected Market Size: USD 3.15 billion by 2035

- Growth Forecasts: 4.4%

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdo

- Emerging Countries: India, South Korea, Brazil, Mexico, Singapore

Last updated on : 28 November, 2025

Contact Thermometer Market - Growth Drivers and Challenges

Growth Drivers

-

Emergence of Global Health Crisis- The global health crisis like the pandemic highlights the important role of temperature monitoring, increasing the demand for reliable contact thermometers. Moreover, the general public becomes aware of personal health monitoring during severe health crises, which leads to increased consumer purchases of contact thermometers for home use. According to reported data, there were approximately 6.8 million deaths worldwide in 2019 due to coronavirus. In addition, health organizations and governments invest heavily in medical equipment such as contact thermometers to enhance their preparedness for controlling the spread of severe diseases which leads to bulk purchases and a surge in products of contact thermometers.

- Use in Numerous Industrial Applications- The role of contact thermometers in manufacturing industries such as chemical and food processing is increasing to monitor and control temperatures during production processes which ensures the quality and efficiency of the products. For example, in the chemical industry to ensure high-quality products, accurate measurement tools such as contact thermometers are needed to measure very high temperatures for monitoring the chemical reactions. In addition, industries are dependent on contact thermometers for precise temperature measurements for quality control checks which is crucial in adhering to regulatory standards and prevention of any defect in final industrial output.

- Growing Demand in Environmental Monitoring- The use of contact thermometers involves the measurement and analysis of temperatures to assess and understand environment conditions such as climate change studies to measure specific temperatures at specific locations over time. This helps the scientists to analyze trends, understand climate patterns, and assess the impact of climate change on ecosystems. In addition, in ecology contact thermometers are used to measure water temperatures in rivers, lakes, and oceans. Moreover, temperature variations impact aquatic life and influence the distribution and variations of aquatic organisms which leads to stimulating the contact thermometer market.

Challenges

-

Lack of Consumer Education about Technology- Many consumers may not fully understand the technology behind contact thermometer such as infrared sensors and limited awareness of thermometer features which leads to improper usage and affect the accuracy of temperature readings.

- Economic fluctuations may impact the consumer purchasing power which affect the demand for contact thermometers.

- There are data security concerns when contact thermometer are integrated with smart devices, ensuring the sensitive health data becomes important.

Contact Thermometer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.4% |

|

Base Year Market Size (2025) |

USD 2.05 billion |

|

Forecast Year Market Size (2035) |

USD 3.15 billion |

|

Regional Scope |

|

Contact Thermometer Market Segmentation:

Product Type Segment Analysis

The contact thermometer with thermistor sensors segment in the contact thermometer market is estimated to hold the 57% of the revenue share by 2035. The segment growth can be attributed to high precision in temperature sensing, which allows contact thermometers to provide accurate readings. This precision is crucial in various applications, such as industrial and environmental monitoring. Furthermore, thermistors are energy-efficient temperature sensors that consume minimal power during operation as this is essential for those thermometers that are designed for continuous and battery-operated use, contributing to extended device battery life.

Application Type Segment Analysis

The healthcare services segment in the contact thermometer market is estimated to gain the largest revenue share of about 56% in the year 2035. The segment growth can be attributed to the growing emphasis on preventive healthcare services encouraging individuals to monitor their health regularly as contact thermometers offer quick and non-invasive temperature readings and become essential tools for routine health checks. According to recent reports, global spending on health reached USD 9 trillion in 2020. In addition, the integration of contact thermometers with electronic health records enhances healthcare service by providing accurate and easily accessible temperature data.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Application Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Contact Thermometer Market - Regional Analysis

North American Market Insights

North America industry is predicted to account for largest revenue share of 38% by 2035. The regional growth is attributed to the well-established and advanced healthcare infrastructure in the region. The demand for thermometers is influenced by the need for accurate and efficient temperature monitoring in various healthcare settings. According to the Peter G. Peterson Foundation, United States healthcare spending reached USD 4.5 trillion with the US having one of the highest costs of healthcare in the world. In addition, the technological advancement in contact thermometer designs and integration with smart devices like wearable technology attracts consumers which stimulates the market in the region. Furthermore, there is a high level of health consciousness among the people in North America which contributes to the adoption of contact thermometers for personal use.

European Market Insights

The Europe contact thermometer market is estimated to the second largest, revenue share of about 29% by the end of 2035. The market’s expansion can be attributed to the diverse range of applications and growing demand for advanced temperature measurement technologies in industries such as healthcare, food and beverages, automotive, and manufacturing which contribute significantly to the market. Furthermore, the stringent regulatory environment in Europe region regarding overall product safety, accuracy, and quality which ensures no defect in any product shapes the landscape for contact thermometers. Moreover, there is a high presence of major key players in the region such as EASYWELL BIOMEDICALS, Beurer GmbH, Briggs Healthcare among others. In addition, there are environmental concerns and also energy efficiency considerations that are driving the development of eco-friendly and sustainable temperature measurement solutions which stimulate the market in the region.

Contact Thermometer Market Players:

- Fortive

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hanna Instruments

- PCE Deutschland

- FLIR Systems

- Comark Instruments

Recent Developments

- February 2023: Omega Engineering unveiled its new face of its IIoT product suites to emphasized its commitment to further data connectivity whenever sensors are required in industrial environments. Omega IIoT solutions is designed to meet the needs of industrial applications in which design flexibility and configuration matter. Furthermore, Omega is a global leader in the manufacturing of sensors, controllers and other products used in the industries and also it designs and manufacture more than 100000 innovative products for control of temperature, pressure and humidity. It offers a wide range of sensing technologies which help in expanding data connectivity system to the customers.

- September 2022: Comark Instruments, who is the leading manufacturer of temperature measurement products announced the general availability of diligence 600 WiFi monitoring system and diligence cloud. The medical grade temperature monitoring system which consists of wireless transmitters with measurements points transmit data to diligence cloud. The diligence 600 WiFi monitoring system and diligence cloud enables organisations to save employee time by automotive static temperature monitoring to keep medicines, blood products and samples at right temperatures. Moreover, it provides always on monitoring to recognize when the temperature goes outside the set range and alert the users until the alarm is acknowledged.

- Report ID: 5817

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Contact Thermometer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.