Constant Velocity Universal Joint Market Outlook:

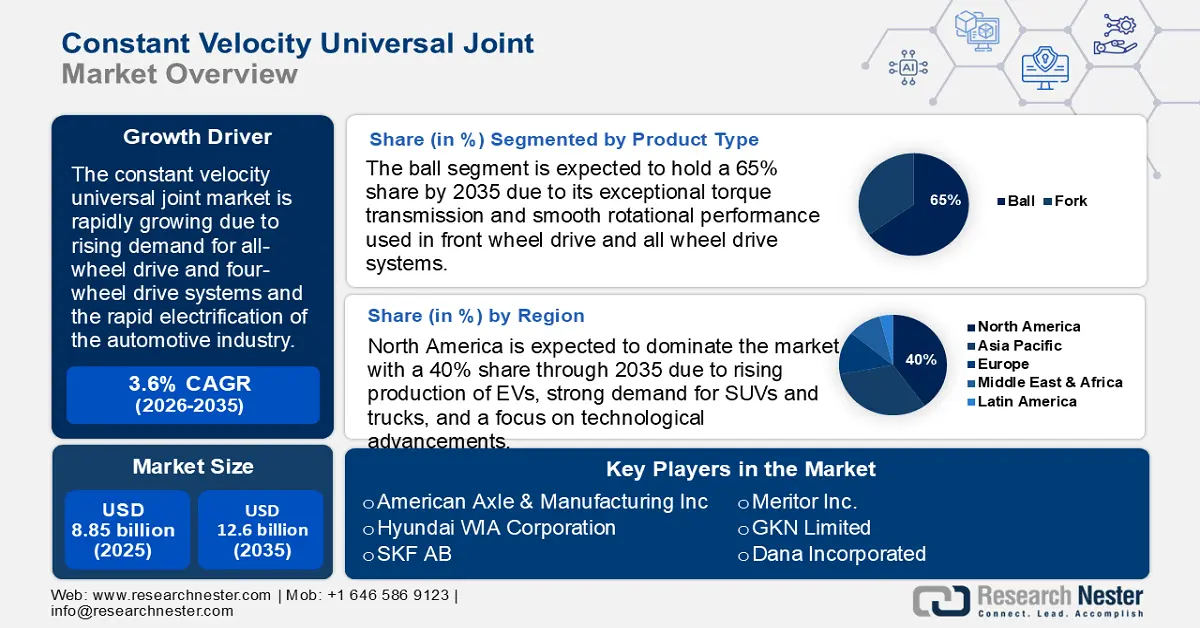

Constant Velocity Universal Joint Market size was valued at USD 8.85 billion in 2025 and is set to exceed USD 12.6 billion by 2035, expanding at over 3.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of constant velocity universal joint is estimated at USD 9.14 billion.

The rising demand for all-wheel drive and four-wheel drive systems is one of the important factors driving growth in the constant velocity universal joint market. The global shift towards all-wheel drive (AWD) and four-wheel drive (4WD) vehicles is a major contributor to CV joint market expansion. Consumers increasingly prefer SUVs, crossovers, and off-road vehicles that offer superior handling and stability, driving OEMs to integrate complex driveline systems. Each AWD/4WD configuration requires multiple high-performance CV joints, amplifying component demand across passenger and commercial vehicle segments. According to a report by the U.S. Department of Energy (DOE) published in February 2023, nearly 60% of light-duty vehicles produced in the U.S. in 2022 had all-wheel or 4-wheel drive.

Constant velocity universal joints enable smooth power transfer to all four wheels, making them essential in AWD systems. This demand directly increases the production and integration of CV joints in all vehicle models. For instance, in April 2025, Ford reported a surge in 4WD truck sales, led by its F-Series lineup. The F-Series lineup, including gasoline, diesel, hybrid, and electric models, saw a 38% spike in March, resulting in 190,389 trucks sold for the quarter. These vehicles heavily depend on multiple high-performance CV joints for reliable torque distribution, especially in off-road and adverse conditions.

Key Constant Velocity Universal Joint Market Insights Summary:

Regional Highlights:

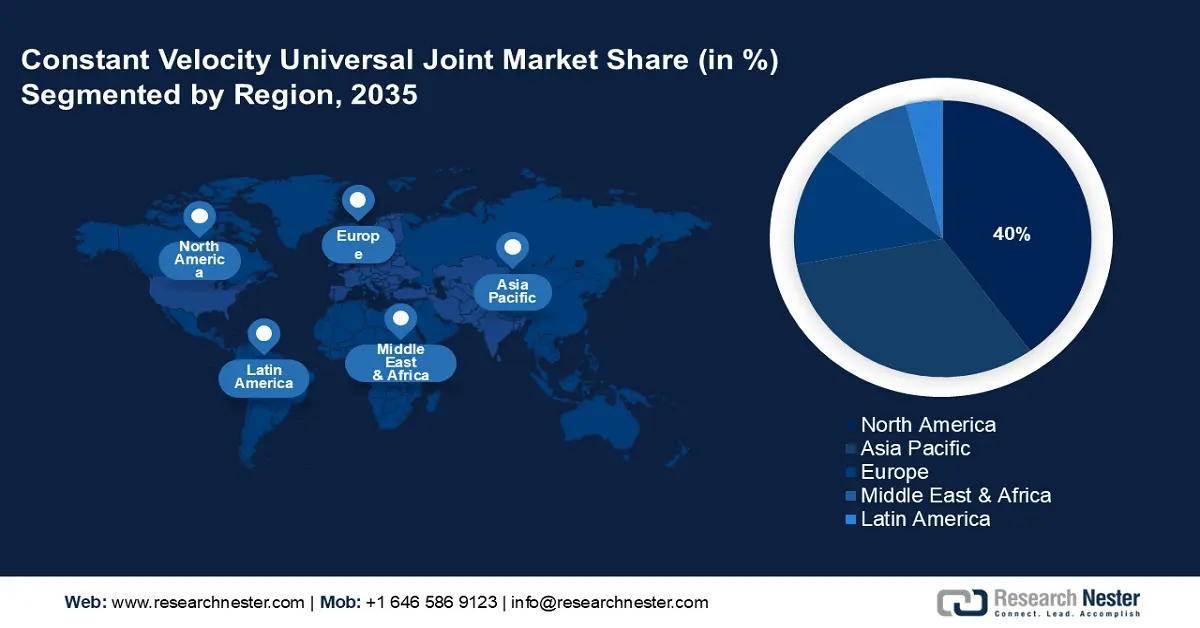

- North America holds a 40% share in the Constant Velocity Universal Joint Market, driven by the strong presence of key industry players and technological advancements, ensuring robust growth through 2026–2035.

- Asia Pacific’s constant velocity universal joint market is set for rapid growth through 2026–2035, attributed to rising vehicle ownership in emerging economies and government-backed EV programs.

Segment Insights:

- The Ball segment is expected to achieve a 65% share by 2035, driven by superior torque transmission and suitability for EVs and hybrids.

- The Passenger Vehicle segment of the Constant Velocity Universal Joint Market is expected to capture a 76% share from 2026 to 2035, driven by demand for smoother, quieter rides and efficient drivetrains in vehicles.

Key Growth Trends:

- Rapid electrification of the automotive industry

- Expansion of off-highway, construction, and agricultural sectors

Major Challenges:

- High material and manufacturing costs

- Durability issues under extreme conditions

- Key Players: Nexteer Automotive Group Limited, Meritor, Inc., HYUNDAI WIA Corporation, GKN Limited, Dana Incorporated, American Axle & Manufacturing, Inc.

Global Constant Velocity Universal Joint Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.85 billion

- 2026 Market Size: USD 9.14 billion

- Projected Market Size: USD 12.6 billion by 2035

- Growth Forecasts: 3.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, Germany, United States, China, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 12 August, 2025

Constant Velocity Universal Joint Market Growth Drivers and Challenges:

Growth Drivers

- Rapid electrification of the automotive industry: The electrification of vehicles is redefining CV joint specifications. Electric vehicles generate instant torque, placing higher mechanical stresses on driveline components. To address these challenges, manufacturers are developing lightweight, durable CV joints tailored for EV e-axles and hub motors. The push toward sustainable mobility and increasing EV adoption rates is creating fresh growth avenues for CV joint suppliers. In November 2022, Hyundai Motor Company launched its new E-GMP vehicles, including the IONIQ 5 and IONIQ 6, featuring advanced e-axle systems requiring specialized CV joints designed for instant torque delivery.

- Expansion of off-highway, construction, and agricultural sectors: Infrastructure development and mechanization trends are boosting the demand for off-highway vehicles, construction machinery, and agricultural equipment. These heavy-duty machines operate under extreme conditions that require rugged and reliable CV joints for consistent performance. In October 2024, CNH Industrial introduced new Case IH tractors with enhanced driveline systems to improve durability and efficiency on challenging agricultural terrains. This includes the new Quadtrac 715 AFS Connect with uprated powershift driveline and heavy-duty track system, as well as the new Farmall C models with a 24-speed ActiveDrive 2 (Hi-Lo) transmission. As global investments in construction, mining, and large-scale farming accelerates, the demand for specialized, high-durability CV joints seems to rise.

- Increasing focus on vehicle safety, comfort, and efficiency: Increasing regulatory pressure and consumer expectations for vehicle safety, drivability, and efficiency are fueling innovation in CV joint technology. Modern CV joints are being engineered to reduce noise, vibration, and harshness that enhance durability, and optimize energy transmission. This shift supports automotive manufacturers’ goals to meet stringent emission standards and deliver superior ride experiences, further driving CV joint adoption. For instance, Mercedes-Benz updated its S-Class driveline in 2024 to improve energy efficiency and meet stricter Euro 7 emission and safety standards, with particular emphasis on driveline smoothness through advanced CV joint technologies.

Challenges

- High material and manufacturing costs: The demand for lightweight, durable, and high-performance CV joints, especially for electric vehicles and heavy-duty machinery, has escalated material and production costs. Advanced materials such as high-strength steel alloys, carbon composites, and specialized coatings significantly increase the cost of manufacturing. Additionally, precision engineering requirements to meet higher torque loads and durability standards push production costs higher. This cost pressure impacts profit margins for suppliers and raises pricing challenges for OEM partnerships.

- Durability issues under extreme conditions: As vehicles and equipment operate in harsh environments such as off-road terrains, construction sites, and high torque EV applications, CV joints are exposed to severe stress, temperature fluctuations, and contamination risks. Even slight failures can lead to driveline damage, vehicle downtime, and high warranty costs for manufacturers. Thus, designing CV joints that maintain long-term performance without significant wear remains a technical and operational challenge as vehicles are expected to last longer with minimal maintenance.

Constant Velocity Universal Joint Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.6% |

|

Base Year Market Size (2025) |

USD 8.85 billion |

|

Forecast Year Market Size (2035) |

USD 12.6 billion |

|

Regional Scope |

|

Constant Velocity Universal Joint Market Segmentation:

Product Type (Ball, Fork)

The ball segment in constant velocity universal joint market is expected to hold a 65% share by 2035 due to its exceptional torque transmission and smooth rotational performance. It is widely used in front wheel drive and all wheel drive systems where consistent velocity and minimal vibration are critical. The rise of electric and hybrid vehicles demands low-noise, high-efficiency joints, strengthening the demand for ball-type CV joints. Additionally, advancements in materials and manufacturing precision are enhancing durability and reducing maintenance cycles for these components.

Application (Passenger Vehicle, Commercial Vehicle)

The passenger vehicle segment in constant velocity universal joint market is poised to hold around 76% share through 2035 due to rising consumer expectations for smoother and quieter rides. Modern drivetrains, especially in front-wheel and all-wheel drive vehicles, rely on high-precision CV joints for seamless power delivery. As cities expand, daily commuting demands more durable and maintenance-free components, encouraging OEM and aftermarket CV joint demand. The transition to electric and hybrid passenger vehicles further accelerates the need for advanced CV joints that support high torque and efficiency.

Our in-depth analysis of the global constant velocity universal joint market includes the following segments:

|

Product Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Constant Velocity Universal Joint Market Regional Analysis:

North America Market Analysis

North America is expected to dominate the constant velocity universal joint market with a 40% share through 2035 due to the strong presence of key industry players and a focus on technological advancements. The region’s emphasis on vehicle safety, efficiency, and performance drives continuous innovation in CV joint materials and designs. Moreover, the growing aftermarket segment, fueled by an aging fleet, contributes to the sustained demand for CV joint replacements and upgrades.

The U.S. constant velocity universal joint market is expanding due to the increasing production of electric and hybrid vehicles, which require specialized CV joints to handle higher torque loads and ensure efficient power transmission. Major automotive manufacturers are investing in research and development to innovate CV joint designs to meet the demands of modern drivetrains. For instance, in April 2022, American Axle & Manufacturing Holdings Inc. completed the acquisition of Tekfor Group for USD 147.5 million. This acquisition was intended to leverage core strengths, diversify geographic presence, and enhance electrification, including CV joints. Additionally, the rise in demand for all-wheel-drive vehicles, particularly SUVs and trucks, further propels the need for advanced CV joints.

In Canada, the growth of the constant velocity universal joint market is influenced by the well-established automotive sector and the increasing adoption of electric vehicles. Government incentives and environmental policies are encouraging consumers to switch to EVs, creating the development of CV joints that can withstand the unique challenges of electric powertrains. Furthermore, Canada’s harsh weather conditions and diverse terrains demand durable and reliable CV joints for optimal vehicle performance.

APAC Market Analysis

Asia Pacific constant velocity universal joint market is predicted to be the fastest-growing region from 2026 to 2035 due to rising vehicle ownership in emerging economies. The expansion of domestic manufacturing hubs and government hubs, and government-backed EV programs in China, South Korea, and Japan is fueling demand for advanced driveline components. Local OEMs are increasingly investing in high-efficiency CV joints to support exports and meet regional emissions and fuel economy standards. Additionally, the region's cost-effective labor and raw materials attract global automakers to localize CV joint production.

The constant velocity universal joint market in China is growing due to the country’s expansion of its domestic electric vehicle system, led by brands such as NIO and BYD. According to a report by the China Passenger Car Association (CPCA) in January 2025, sales of electric and hybrid vehicles in China in 2024 surged by over 40%, with nearly 11 million new energy vehicles sold, accounting for approximately 47.6% of all retail vehicle sales. This surge highlights the development and production of advanced CV joints capable of handling the unique torque and performance demands of EVs. Further, China’s emphasis on vertical integration in auto parts manufacturing ensures large-scale, cost-efficient CV joint production.

The constant velocity universal joint market in South Korea is witnessing steady growth due to strong R&D investments from Hyundai Motor Group and Kia into next-generation drivetrains. As these automakers scale global EV and hybrid exports, the need for lighter, more durable CV joints with advanced noise and vibration control is surging. Additionally, government-led smart mobility initiatives are accelerating the adoption of modular vehicle platforms with optimized driving systems.

Key Constant Velocity Universal Joint Market Players:

- SKF AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nexteer Automotive Group Limited

- Meritor, Inc.

- HYUNDAI WIA Corporation

- GKN Limited

- Dana Incorporated

- American Axle & Manufacturing, Inc

The constant velocity universal joint market is dominated by top players such as NTN Corporation, GKN Automotive, and Dana Incorporated, who focus on innovation, lightweight materials, and EV-compatible driveline solutions. Thus, strategic partnerships, technological advancements and global OEM collaborations contribute to building the market stronger. Here are some leading players in the constant velocity universal joint market:

Recent Developments

- In October 2024, MOOG introduced a new range of Constant Velocity (CV) Axles, built for performance and reliability. MOOG, known as the problem solver, designed these axles to meet strict quality standards for both professionals and car enthusiasts. These CV axles are made with strong materials and go through thorough testing to ensure they fit different vehicle models accurately. They include tough neoprene boots to block dirt and moisture, heat-treated parts for extra strength, and top-grade grease for better lubrication. The product is designed to be easy to install with the necessary bolts and parts included, which makes vehicle maintenance simpler.

- In January 2024, Hyundai Wia Corp. announced it received overseas orders worth USD 781 million in 2023 from European and North American car manufacturers. These orders were for constant velocity joints, which connect a vehicle’s transmissions to its wheels. This is the first time the company’s international sales of such parts exceeded 1 trillion won in a year.

- Report ID: 7632

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.