Cone Beam CT Scanner Market Outlook:

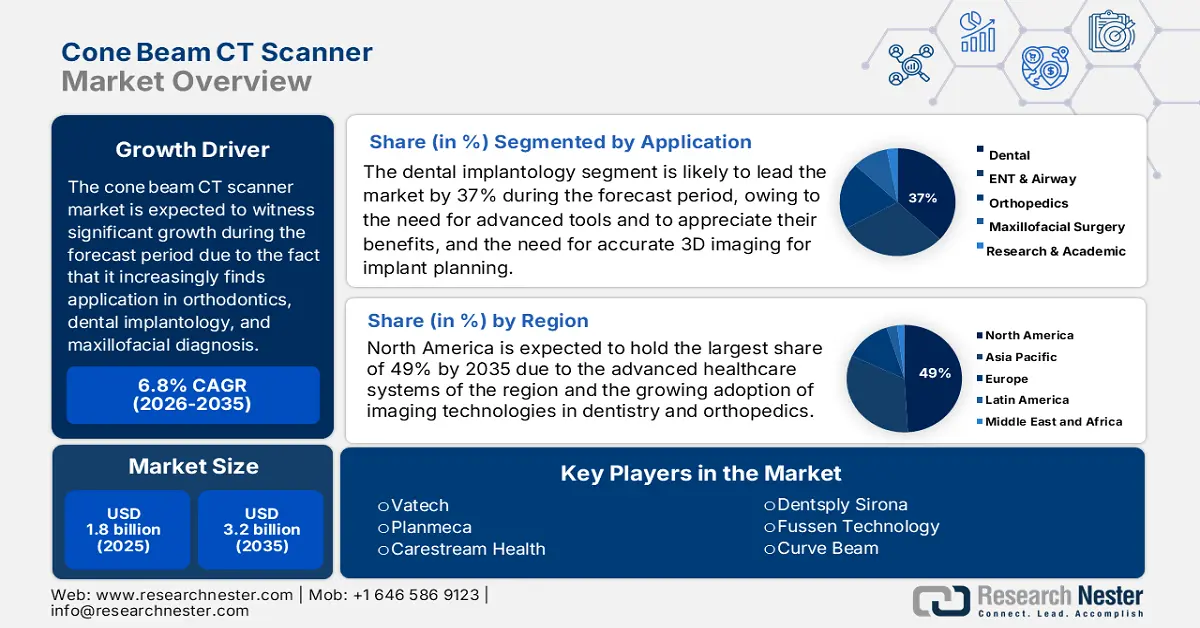

Cone Beam CT Scanner Market size was USD 1.8 billion in 2025 and is anticipated to reach USD 3.2 billion by the end of 2035, increasing at a CAGR of 6.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cone beam CT scanner is estimated at USD 1.9 million.

The global market is expanding rapidly, primarily due to the fact that it increasingly finds application in orthodontics, dental implantology, and maxillofacial diagnosis. As per a report published by NLM in November 2023, in some surveyed specific hospitals, patient visits for the use of dental CBCT increased steadily from 355 to 488 in 2022 over 2 years at a rate of 37.4%. This increasing trend shows the continuous increase in the global demand for high-accuracy 3D imaging. Additionally, as oral health awareness is improving, the developing and developed nations are focusing on advanced CBCT technology, driving the global market expansion.

Moreover, the import and export facility in the international market reflects a growing global demand and evolving supplier capabilities, and present opportunities for cross-border partnership and distribution expansion. It also indicates increasing demand and changes in supplier capabilities. The use of a cone beam CT scanner requires safe and quality imaging, which is a basic requirement. Hence, a need to balance diagnostic efficacy and radiation safety is coming up. In an attempt to minimize radiation risk, dental professionals should be prudent in the choice of imaging modality. As demonstrated in the study in NLM April 2024, CBCT can be a valuable tool in this regard, as it offers a radiation dose reduction of approximately 29.6% compared to medical CT. Continuous compliance with regulations and dose reduction technological development contribute to credibility for CBCT to facilitate broader clinical and commercial use.

Key Cone Beam CT Scanner Market Insights Summary:

Regional Insights:

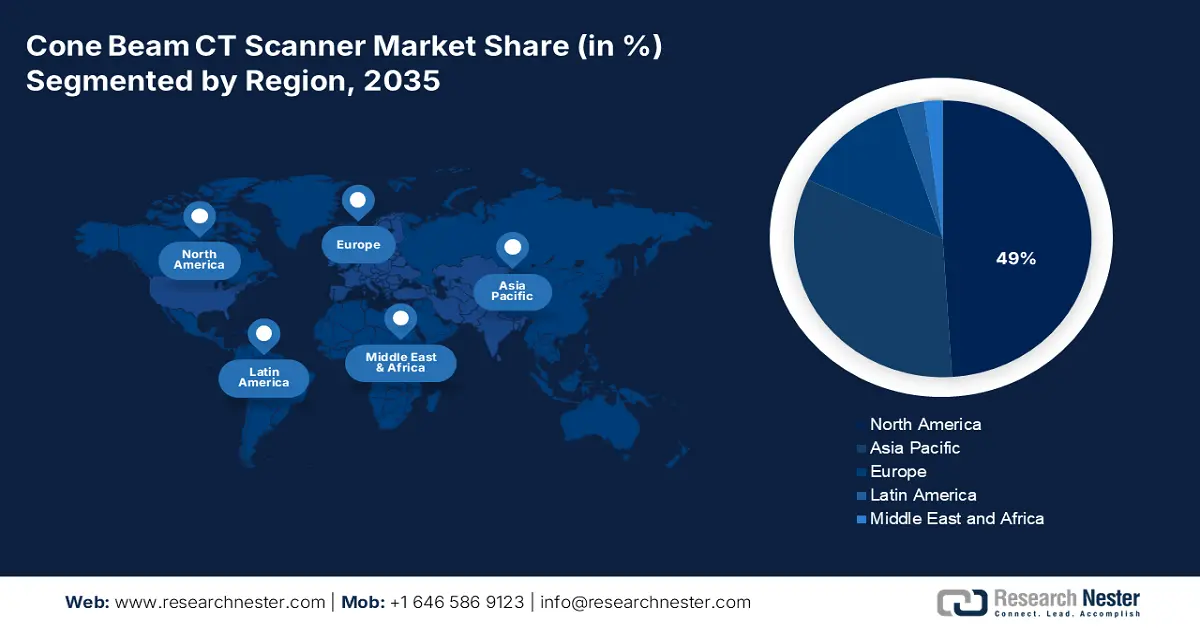

- The Cone Beam CT Scanner Market in North America is predicted to hold a 49% share by 2035, owing to advanced healthcare systems and the growing adoption of imaging technologies in dentistry and orthopedics.

- Europe is expected to witness the fastest-growing share during the forecast period, impelled by an increasing elderly population and rising cases of dental and orthopedic illnesses.

Segment Insights:

- In the application segment, the dental implantology subsegment is projected to account for a 37% share by 2035, propelled by the need for accurate 3D imaging for implant planning.

- In the patient position segment, the standing position subsegment is forecast to hold the highest share by 2035, driven by quicker patient positioning and improved workflow in clinics.

Key Growth Trends:

- Technological advantage in maxillofacial imaging

- Pre-surgical planning and risk reduction in Sinus Floor Elevation (SFE)

Major Challenges:

- High Equipment and Operational Costs

- Regulatory and Radiation Safety Compliance

Key Players: Vatech, Planmeca, Carestream Health, Dentsply Sirona, Fussen Technology, Curve Beam, Varian Medical Systems, Cefla, PreXion, LED Dental, PointNix, LargeV Instrument, ClaroNav, 3Shape AS, Ray Medical.

Global Cone Beam CT Scanner Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.8 billion

- 2026 Market Size: USD 1.9 million

- Projected Market Size: USD 3.2 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, Canada, United Kingdom

- Emerging Countries: China, India, Brazil, South Korea, Australia

Last updated on : 22 September, 2025

Cone Beam CT Scanner Market - Growth Drivers and Challenges

Growth Drivers

- Technological advantage in maxillofacial imaging: The market provides 3D high-resolution images of the maxillofacial skeleton using significantly less radiation than conventional CT. Besides, one of their key growth drivers is that they have an effective imaging process using a 2D sensor and a cone-shaped X-ray beam. As per a report by NLM in April 2023, the system scans 180 to 360 degrees around the head of the patient to gather information in one scan. Small in stature and similar in size to panoramic radiography units, CBCT systems are ideal for dental and ENT offices. Their precision, low-dose scanning, and ease of use are fueling adoption in implantology, orthodontics, and oral surgery.

- Pre-surgical planning and risk reduction in Sinus Floor Elevation (SFE): The increasing demand for precise, low-risk sinus floor elevation (SFE) procedures is driving the adoption of the cone beam CT scanner market into dental offices. Lateral window and transalveolar procedures both require accurate visualization of the maxillary sinus anatomy, remaining bone height, and alveolar crest width to select the appropriate surgical approach. As per a report by NLM in May 2023, CBCT provides accurate 3D imaging critical in evaluating these parameters, especially in complex cases where alveolar bone height is less than 5 mm. The technology allows clinicians to reduce postoperative complications such as sinus membrane perforation, thereby improving surgical success and patient safety, making CBCT an essential tool for modern implantology.

- Rising demand for chairside diagnostics and same-day treatment planning: The shift towards same-day dental treatments and real-time diagnostics is driving the need for the cone beam CT scanner market. The growing expectation demands quicker patient treatment, particularly in endodontics, implantology, and orthodontics. Cone beam CT scanner enhances patient treatment by enabling maintenance of steps related to 3D images, removing the need to wait for the next patient appointment, and thus optimizing the treatment process. This improves patient care and reduces the need for referrals. Private dental practices and group clinics now have the upper hand from an operational standpoint. The benefits provided by these practices are driving faster adoption of CBCT technology in the mature and emerging dental markets.

Global X-Ray Machine Export and Import Data: International Trade Trends

X-Ray Machines 2023 Trade Overview

|

Country |

Export Value (USD) |

Import Value (USD) |

|

U.S. |

3.5 million |

33.9 million |

|

Bangladesh |

763,000 |

- |

|

Egypt |

603,000 |

- |

|

South Korea |

- |

565,000 |

|

China |

172,000 |

49.1 million |

|

Japan |

115,000 |

20.1 million |

|

Israel |

107,000 |

3.4 million |

Source: OEC, July 2025

Challenges

- High Equipment and Operational Costs: There are complicated operational safety protocols and quality assurance regulations that are related to the use of cone beam CT scanners and other imaging devices. Furthermore, every region has its own regulations regarding safety and standards in imaging. Compliance with such standards necessitates a great deal of monitoring, compliance documentation, and periodic auditing. The use of such devices also raises safety concerns, especially in areas where the personnel are not adequately trained. Apart from adding to the operational compliance burden of the healthcare facilities, such regulations also serve as entry barriers to smaller players and startups aiming to provide CBCT imaging services, which affects the cone beam CT scanner market in general in terms of availability.

- Regulatory and Radiation Safety Compliance: There are complicated operational safety protocols and quality assurance regulations that relate to the use of cone beam CT scanners and other imaging devices. Furthermore, every region has its own regulations regarding safety and standards in imaging. Compliance with such standards necessitates a great deal of monitoring, compliance documentation, as well as periodic auditing. The use of such devices also raises safety concerns, especially in areas where the personnel are not adequately trained. Apart from adding to the operational compliance burden of the healthcare facilities, such regulations also serve as entry barriers to smaller players and startups aiming to provide cone beam CT scanner imaging services, which affects the cone beam CT scanner market in general in terms of availability.

Cone Beam CT Scanner Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 1.8 billion |

|

Forecast Year Market Size (2035) |

USD 3.2 billion |

|

Regional Scope |

|

Cone Beam CT Scanner Market Segmentation:

Application Segment Analysis

The dental implantology subsegment is expected to hold the highest market share of 37% in the application segment within the forecast period in the cone beam CT scanner market, as dental professionals continue to use the advanced tools available to them and appreciate their benefits, the need for accurate 3D imaging for implant planning. As per a report by the Harvard School of Dental Medicine published in September 2024, the number of people with dental implants in the US stands at 3 million and is increasing by 500,000 every year, alongside the increasing awareness that implantology is gaining. This trend not only highlights the importance of dental implants but also the need for advanced imaging methods such as CBCT, which enables proper evaluation of the bone structure and ideal placement of the implant, thereby leading to improved clinical results.

Patient Position Segment Analysis

The standing position subsegment is expected to hold the highest market share in the patient position segment within the forecast period in the cone beam CT scanner market due to standing CBCT devices allowing for quicker patient positioning and quicker workflow, which is of great importance in busy ENT and dental clinics. Additionally, it accommodates many patients, such as those who do not feel comfortable lying down or sitting. Moreover, the standing units are of compact size, which makes them ideal for small clinics. The ease of use of standing units improves patient comfort as well as shortens the examination time.

End user Segment Analysis

The dental clinics subsegment is expected to hold the largest market share in the end user segment for the cone beam CT scanner market during the forecast period. This is due to dental treatments increasingly use cone beam CT scanners to improve precision, especially in oral surgery, implantology, and orthodontics. The small size and relatively lower cost of CBCT units make them suitable even for small and private clinics. Additionally, patient satisfaction increases due to shorter waiting times and fewer referrals, thanks to in-clinic 3D imaging. The growing focus on minimally invasive procedures also encourages dentists to adopt CBCT technology.

Our in-depth analysis of the cone beam CT scanner market includes the following segments:

|

Segment |

Sub-segments |

|

Application |

|

|

Patient Position |

|

|

End user |

|

|

Device Type |

|

|

Technology Enhancement |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cone Beam CT Scanner Market - Regional Analysis

North America Market Insights

The cone beam CT scanner market in North America is expected to hold the largest market share of 49% during the forecast period, driven by advanced healthcare systems of the region and the growing adoption of imaging technologies in dentistry and orthopedics. Growing awareness and rising prevalence of dental disorders are also increasing the demand. The shift in awareness and the rising occurrence of dental illnesses are contributing factors to the growing demand. The strong reimbursement frameworks, the continuous innovation by key market participants, and the widespread availability of trained experts further enhance the region’s dominance.

The cone beam CT scanner market in the U.S. is expected to expand and hold the market due to the growing investments in healthcare technologies and the increasing use of minimally invasive diagnostic methods. This is supported by the increasing need for precise dental and ENT imaging. Furthermore, as per a report by NLM in March 2023, the funding from the FDA is bolstered by user fees covering 35% (USD 228 million) of the medical devices program budget in the financial year of 2022, which supports regulations about the timely review and approval of advanced medical imaging devices, including cone beam CT scanners.

The cone beam CT scanner market in Canada is expected to grow during the forecast period due to the expansion of healthcare facilities and government initiatives promoting advanced diagnostic tools. Raising patient awareness of early disease detection accelerates the deployment of cone beam CT scanners. According to a report by NLM in August 2024, Canada is positioned in the bottom 15% of OECD countries for units per million population and the top 45% for OECD countries for the average volume of publicly funded CT exams per 1,000 population. This is a strong indication that there is a need for improved imaging infrastructure, which suggests strong opportunities for market growth in the coming years.

Europe Market Insights

The cone beam CT scanner market in Europe is expected to hold the fastest-growing market share during the forecast period, driven by the increasing number of elderly people and rising cases of dental and orthopedic illnesses. The growth is also fueled by reimbursement policies that are advantageous and technological innovations. According to a report published by Eurostat in February 2025, the region’s population reached 449.3 million people in 2024, of which 21.6% were aged 65 and above. An increasing geriatric population highlights the change in demography. Also fueling market growth are advanced reimbursement methodologies and new technology.

The cone beam CT scanner market in the UK is expected to grow within the forecast period, due to the increasing healthcare IT infrastructure investments and the growth of dental diagnostics is a fundamental factor contributing to IT infrastructure. Expansion of markets is facilitated by government initiatives in relation to digital healthcare technologies. According to the February 2024 NHS report, NHS England has spent more than £400 million (USD 510 million) on assisting 150 NHS trusts in either implementing or upgrading Electronic Patient Records (EPRs), with 189 trusts currently working with advanced record systems that include newly activated systems at Hillingdon Hospitals and Sheffield Health and Social Care NHS Trusts.

The cone beam CT scanner market in Germany is expected to grow within the forecast period due to the rising need for accurate imaging in dental clinics and hospitals, along with the strong dental device manufacturing sector fuel the growth of the market. Moreover, the market growth is fueled by the growing use of advanced diagnostic equipment and the increasing understanding of minimally invasive imaging methods. Effective healthcare regulations and an advanced infrastructure also help in the adoption of cone beam CT technology in diverse medical facilities. The middle-aged group is crucial for market growth as it represents the primary working population with higher healthcare awareness and preventive health technologies such as cone beam CT scanners.

X-Ray Machines 2023 Export-Import Overview in Europe-based Countries

|

Country |

Export Value (USD) |

Country |

Import Value (USD) |

|

Germany |

1.0 million |

Germany |

11.8 million |

|

Spain |

511,000 |

Italy |

million |

|

Russia |

110,000 |

France |

692,000 |

|

Poland |

54,100 |

UK |

506,000 |

|

Denmark |

38,400 |

Belgium |

357,000 |

|

Austria |

8,960 |

Denmark |

157,000 |

|

- |

- |

Switzerland |

123,000 |

|

- |

- |

Finland |

106,000 |

Source: OEC, July 2025

Asia Pacific Market Insights

The cone beam CT scanner market in the Asia Pacific is expected to grow steadily within the forecast period due to healthcare and advanced diagnostic imaging devices becoming more well-known. The cone beam CT scanner market is also boosted by the dental tourism market. The healthcare infrastructure and the rising number of dental specialty clinics drive growth. Demand for cone beam CT scanners and other advanced dental imaging devices is expected to increase due to initiatives to improve healthcare standards and access. The rise in hospitals and specialty clinics is also supported by increasing urbanization and a growing middle-class population.

The cone beam CT scanner market in China is expected to grow due to investments in modernizing healthcare and the increasing prevalence of dental diseases during the forecast period. To meet demand for specialized diagnostic devices, the government of China is acquiring advanced medical equipment, including CBCT scanners. According to a report by the State Council of the People's Republic of China in March 2025, the medical device market in China reached 1.3 trillion yuan (approximately USD 188.2 billion) in 2024. In 2024, leading companies in the medical device industry recorded revenues over 540 billion yuan, marking nearly a decade of steady, rapid growth.

The cone beam CT scanner market in India is expected to grow within the forecast period due to the growing healthcare infrastructure and medical tourism. The need for early diagnosis and minimally invasive procedures also drives demand. Both private and public sector investments in medical technology increase access to advanced imaging modalities. The increasing number of cases of dental and oral diseases also supports the growth of this market. The government’s initiative to upgrade healthcare and promote the use of digital healthcare plays an important role in growing the cone beam CT scanner market.

Key Cone Beam CT Scanner Market Players:

- Vatech

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Planmeca

- Carestream Health

- Dentsply Sirona

- Fussen Technology

- Curve Beam

- Varian Medical Systems

- Cefla

- PreXion

- LED Dental

- PointNix

- LargeV Instrument

- ClaroNav

- 3Shape AS

- Ray Medical

The cone beam CT scanner market is growing due to huge competition, and this can be attributed to the global key players. Leading companies such as Planmeca, Carestream, and Vatech invest in user-friendly, high-definition imaging devices that integrate smoothly with digital workflows for better diagnosis. Concurrently, Asahi Roentgen, J. Morita, and other companies of Japan focus on precision and durability to retain their market share. Furthermore, companies are shifting their focus toward the development of lower-cost CBCT products for developing markets. There is continuous growth through mergers, acquisitions, and collaborations, and companies can enter new markets and improve technology, enabling continuous growth sustained growth in the cone beam CT scanner market through 2035.

Here is a list of key players operating in the global market:

Recent Developments

- In June 2025, Philips declared the CE-marking of its newest SmartCT image reconstruction solution, which has been designed to support rapid and informed decision making for aiding stroke and neurovascular diseases.

- In September 2024, Medtronic introduced new hardware, software, and imaging solutions to expand its AiBLE spine surgery system at NASS. Collaborating with Siemens Healthineers, Medtronic seeks to make advanced imaging more accessible for better outcomes from spinal and cranial procedures.

- Report ID: 5419

- Published Date: Sep 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cone Beam CT Scanner Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.