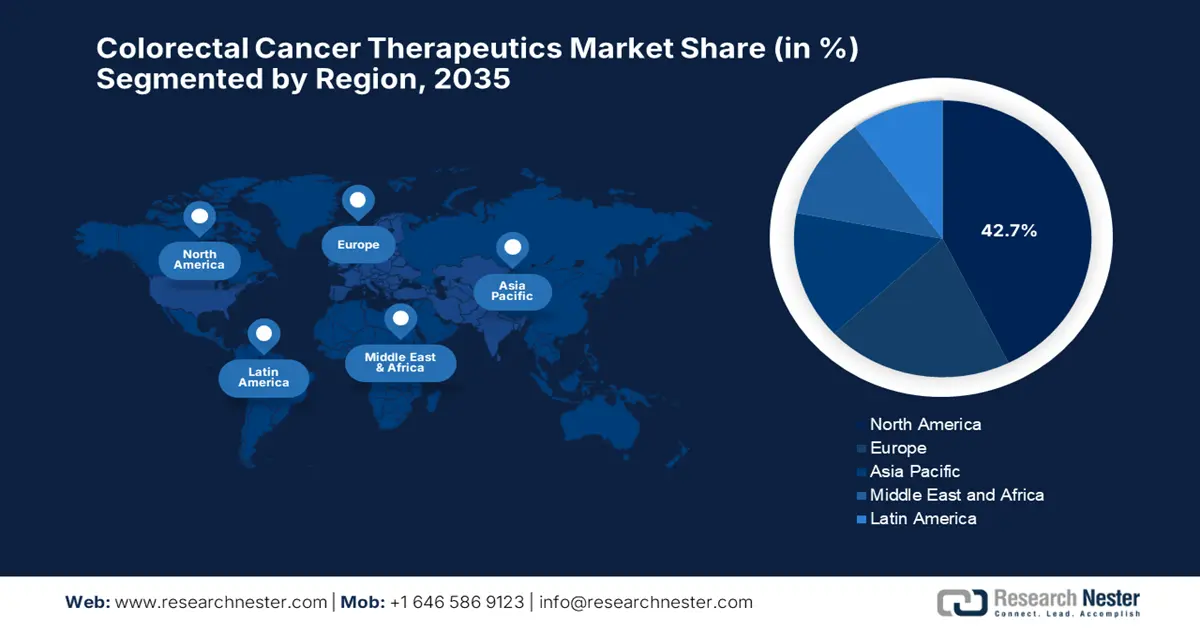

Colorectal Cancer Therapeutics Market - Regional Analysis

North America Market Insights

The North America colorectal cancer therapeutics market is expected to hold the largest market share of 42.7% during the forecast tenure. The proprietorship of the region is effectively attributable to the accelerated adoption of next-generation therapies, with CAR-T and bispecific antibodies entering late-stage trials for refractory cases. With the evidence from the 2025 NIH report, the cancer cases registered in the U.S. is 2,041,910 in 2025, out of which 618,120 people have a severe health condition. Further, the government funding for oncology research is solidifying its dominance in the market.

The U.S. is steadily augmenting its position in the regional colorectal cancer therapeutics industry with the dominance of immunotherapy and liquid biopsy adoption. The International Agency for Research on Cancer in 2022 announced that the cases of colorectal cancer in the next five years are expected to hold 552,771 cases, including both men and women, with the proportion of 165.1 per 100,000 people expected to suffer from colorectal cancer. To reduce this ratio, several drugs have been invented. Recently FDA in January 2025 approved Therascreen KRAS RGQ PCR Kit, which is a diagnostic device for identifying patients suffering from colorectal cancer.

Colorectal Cancer in U.S. and Canada

|

Country |

Year |

Sex |

Incidence (as per 100,000 standard population) |

Death (as per 100,000 standard population) |

|

U.S. |

2025 |

Male |

41.4 |

15.1 |

|

U.S. |

2025 |

Female |

32.5 |

10.7 |

Source: CDC, June 2025

|

Country |

Year |

Sex |

Incidence (% distribution of in the population) |

Death (% distribution of in the population) |

|

Canada |

2023 |

Male |

10.9% |

11.2% |

|

Canada |

2023 |

Female |

9.2% |

10.2% |

Sources: Canadian Cancer Statistics, 2023

Europe Market Insights

Europe is estimated to retain its position as the second-largest revenue holder in the colorectal cancer therapeutics market through the assessed timeframe. The region’s standard in upliftment is attributed to precision medicine adoption and nationwide healthcare initiatives. Further, the European Commission report has announced that the cancer cases is expected to rise by 24% by 2035. Apart from the rising cases, the region has also allocated €4 billion of funding towards cancer plan which includes €1.25 billion from the EU4Health programme.

Germany is prospering in a profitable atmosphere with a dominating share in the regional market. This is propelled by its robust ecosystem in terms of innovation and development. According to the evidence of European Cancer Inequalities Registry in 2022, colorectal cancer is the second common cancer registered in the Germany, with 11% of total cancer cases occurrence in the country. On the other hand, the German Cancer Society has shown advances in targeted therapies including immune checkpoint inhibitors and EGFR, to improve the survival rate and expand oncology centers. The combination of an aging population and investment rate by government in driving the market.

APAC Market Insights

Asia Pacific is anticipated to exhibit the fastest growth rate of 8.5% in the colorectal cancer therapeutics market throughout the assessed timeframe. The vigorous burden of colorectal cancer, improved diagnostics, and government-led healthcare reforms are key factors contributing to the growth of the region. Japan is leading the market with innovations and has allocated with a budget of 47.3 trillion yen for healthcare, stated by Pharma Japan article in September 2024. Besides reimbursement reforms for targeted therapies in South Korea and public-private collaborations in Malaysia, fosters appreciable growth on a larger scale.

China is maintaining its regional dominance in the colorectal cancer therapeutics market, owing to the disease incidence and government medical expenditure. Testifying to the same, the country reports 517,106 CRC cases in 2022 stated in World Cancer Research Fund article. Furthermore, the domestic manufacturers such as Hengrui Pharma and others are leading the market with domestic production, denoting an intensifying landscape. This growth trajectory is aided by national initiatives under the Healthy China 2030 plan, which emphasize early cancer screening and expanded access to advanced therapeutics.

Country-Wise Government Initiatives

|

Country |

Government Health Funding & Agencies |

Budget (USD) |

Year |

Focus Area |

|

Australia |

Medical Research Future Fund (MRFF) |

$24 billion |

June 2025 |

Transform health and medical research and innovation to improve lives |

|

India |

Government Health Expenditure |

₹9,04,461 crore |

January 2025 |

Universal access to high-quality healthcare, strengthened public health infrastructure, and advancements in medical education |

|

Malaysia |

Ministry of Health |

RM45.3 billion |

2025 |

Enhancing hospital infrastructure and quality care |

Source: CodeBlue, PIB, Australia Government