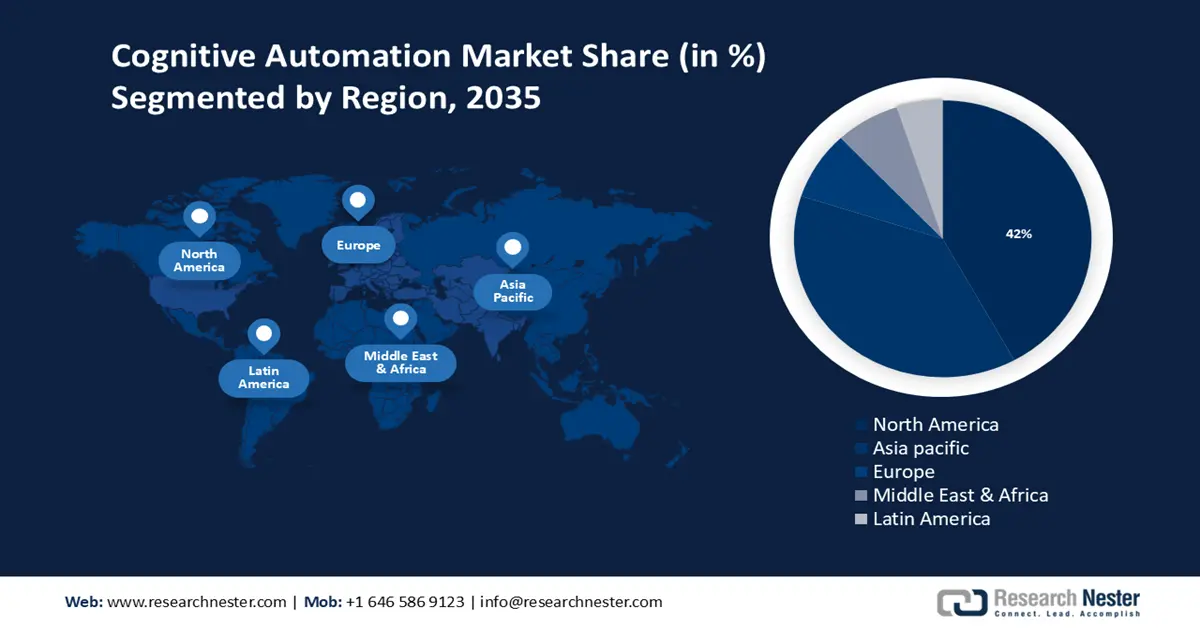

Cognitive Automation Market Regional Analysis:

North America Market Insights

North America industry is expected to dominate majority revenue share of 42% by 2035. The North America cognitive process automation market is witnessing substantial growth as a result of the increasing usage of artificial intelligence technology and the need for enterprises to automate cognitive functions. Intelligent virtual assistants, such as those employed for customer care and sales assistance, are commonly utilized for interactions in North America. These virtual assistants utilize cognitive process automation to understand and address client inquiries, do activities, and improve customer experiences.

The U.S. in 2023, held the largest revenue share owing to the growth of the automobile sector. Furthermore, the presence of prominent players including Blue Prism, IBM, IPsoft, and Kryon Systems is fostering market growth in the U.S.

The Canada market is driven by the rapid scaling of robotics & cognitive automation (R&CA) capabilities and ongoing investment in exponential technologies such as ML and chatbots. For instance, in November 2022, Sanctuary Cognitive Systems received USD 30 million in SIF funding from the Government of Canada to support its mission of building automation to address labor shortages. It is expected to help position Canada in the global knowledge-based economy.

APAC Market Insights

Asia Pacific region is set to witness significant growth till 2035, owing to rapid digitization and a surge in interest in automation and artificial intelligence (AI) technology. Organizations are implementing cognitive process automation to enhance productivity, save expenses, and optimize operations. China, India, Japan, and South Korea, play a pivotal role by actively investing in AI research, development, and innovation support. As a result, the market for market is poised for significant growth.

The prominent players in the India cognitive automation market are keen on introducing intelligent process automation (IPA), digital process automation (DPA), intelligent business process automation, and hyper-automation to fill gaps between programming interface tools and RPA, in tandem with low-code applications. TCS’ Cognitive Automation Platform has widespread adoption in front- and back offices, particularly catering to the BFSI sector. The domestic launch of advanced solutions by leveraging pre-trained models and configurations is aiding to rapid market expansion.

Cognitive automation market in China held a significant revenue share in 2023. The number of new units of automated robots installed annually reached 290,258 in 2022. To cater to the ever-changing demands of this thriving market, both local and global manufacturers of robots have set up production facilities in China and consistently expanded their production capabilities. The average annual growth rate of robot installations from 2017 to 2022 is 13%.

The number of cognitive automated robot installations in Japan increased by 9% to reach 50,413 units, surpassing the pre-pandemic level of 49,908 units recorded in 2019. Japan holds the dominant position in the global robot manufacturing industry, accounting for 46% of the total global robot production.