Coated Endotracheal Tube Market Outlook:

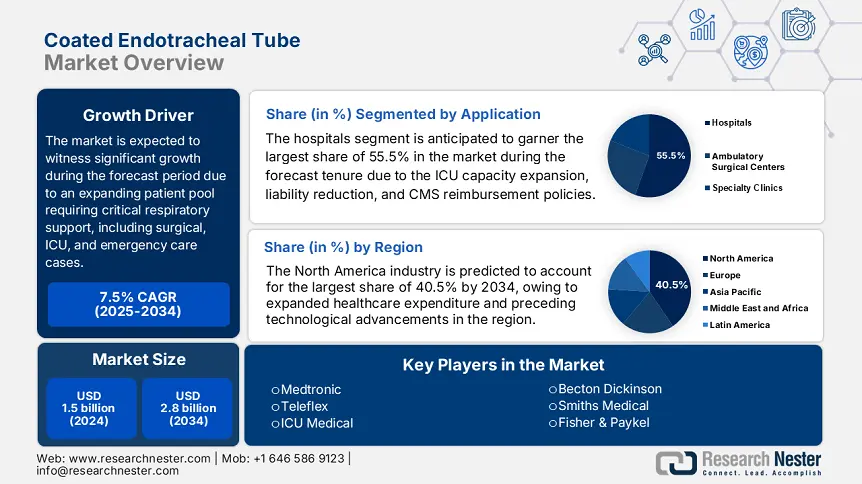

Coated Endotracheal Tube Market size was valued at USD 1.5 billion in 2024 and is projected to reach USD 2.8 billion by the end of 2034, rising at a CAGR of 7.5% during the forecast period, i.e., 2025 to 2034. In 2025, the industry size of coated endotracheal tube is assessed at USD 1.6 billion.

The market is gaining immense exposure owing to the presence of a large patient pool requiring critical respiratory care, in terms of surgical, intensive care units, and emergency care instances as well. Indicating the same, the World Health Organization report published in 2023 stated that around 12 million to 20 million patients undergo mechanical ventilation yearly, where ventilator-associated pneumonia affects 10% to 30% of the cases, creating a sustained demand for infection-resistant endotracheal tubes. On the other hand, the supply chain of these medical devices involves multiple stages such as raw material procurement (polyvinyl chloride, silicone, antimicrobial agents), manufacturing, sterilization, and distribution.

Furthermore, on the economic aspect, the Producer Price Index for medical grade polymers has demonstrated a 4.4% year-over-year rise owing to the increased raw material and sterilization costs as of the U.S. Bureau of Labor Statistics, 2024 data. Simultaneously, the Consumer Price Index reflected a 3.9% annual growth due to the hospital procurement trends and reimbursement policies. The ITC trade data in 2024 revealed that the exports are dominated by the U.S., Germany, and China, whereas the 2024 World Bank report notes that the assembly lines in Mexico and Malaysia have witnessed 15.8% annual capacity expansion due to nearshoring trends.

Coated Endotracheal Tube Market - Growth Drivers and Challenges

Growth Drivers

- Infection control regulations: The market is effectively driven by the infection control regulations imposed with a prime focus on reducing hospital-acquired infections (HAIs). Exemplifying this, CMS denotes that its penalties for HAIS have pushed over 92% of hospitals in the U.S. to emphasize antimicrobial-coated tubes in 2024. In addition, in the EU, the Medical Device Regulation 2024 guidelines imposed a mandatory coating for reusable tubes, thereby boosting the demand in Europe.

- Strategic market collaborations: The implementation of strategic activities is readily shaping the foundation of the market. For instance, in 2024, Medtronic announced a partnership with Apollo Hospitals in India that remarkably increased the coated tube adoption in the country by 36.4%. Besides, in 2023, Teleflex acquired a silicone coating startup that boosted its market share by 12.6% in Europe, thus denoting a positive market outlook.

Manufacturer Strategies Driving Market Expansion

Revenue Potential for Manufacturers (2023-2025)

|

Company |

Strategy |

Revenue Impact (USD) |

|

Medtronic |

Hydrogel-coated tube launch (2023) |

+$120.7 million in 2024 |

|

Teleflex |

FDA-cleared antimicrobial tube (2024) |

+$75.4 million in 2025 |

|

ICU Medical |

U.S. government contracts (2024) |

$48.4 Million in new deals |

|

Fuji Systems |

Expansion in India (2025) |

+$32.6 million projected |

Feasible Expansion Models Shaping the Coated Endotracheal Tube Market

Feasibility Models for Market Expansion (2022 - 2024)

|

Region |

Model |

Outcome |

|

India |

Hospital partnerships |

+12% revenue growth |

|

Brazil |

Government bulk procurement |

$27.6 million in new orders |

|

U.S. |

Medicare-backed adoption |

18% revenue increase (2023) |

Challenges

- Gaps in reimbursement and government price controls: The market is experiencing risks from reimbursement gaps and price control policies, leading to a compressed margin. In this regard, it is reported that Medicaid offers coverage to only 35.7% of the coated tube costs, imposing a financial strain on the markets. On the other hand, the price caps imposed by nations in Europe were successfully bypassed by Medtronic with bulk procurement margins in collaboration with the Healthcare System in France, which increased market access by 10.6% thus encouraging navigational strategies to cope with these restraints.

Coated Endotracheal Tube Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.5% |

|

Base Year Market Size (2024) |

USD 1.5 billion |

|

Forecast Year Market Size (2034) |

USD 2.8 billion |

|

Regional Scope |

|

Coated Endotracheal Tube Market Segmentation:

Application Segment Analysis

The hospitals segment is anticipated to garner the largest share of 55.5% in the coated endotracheal tube market during the forecast tenure. The ICU capacity expansion, liability reduction, and CMS reimbursement policies make this segment the gold standard to generate revenue in this landscape. Testifying to such facts, WHO states that from 2022 to 2024, the U.S. hospitals added 28,500 new ICU beds, necessitating monthly 3 to 5 tubes. In addition, an NIH study in 2024 stated that malpractice lawsuits associated with HAIs were appreciably reduced by 33.4% in hospitals using coated tubes, thus denoting a wider segment scope.

Product Type Segment Analysis

The antimicrobial-coated tubes segment is predicted to attain a considerable share of 42.7% in the coated endotracheal tube market by the end of 2034. The growth in the segment is subject to the infection prevention mandates, regulatory acceleration, and cost-benefit validation. In this regard, the CDC guidelines imposed in 2024 recommend the antimicrobial coatings to reduce ventilator-associated pneumonia, with the clinical studies demonstrating a 27.5% reduction in VAP rates while utilizing silver-ion or chlorhexidine-coated tubes, hence a positive market outlook.

Our in-depth analysis of the global market includes the following segments:

| Segment | Subsegment |

|

Application |

|

|

Product Type |

|

|

Coating Material |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Coated Endotracheal Tube Market - Regional Analysis

North America Market Insights

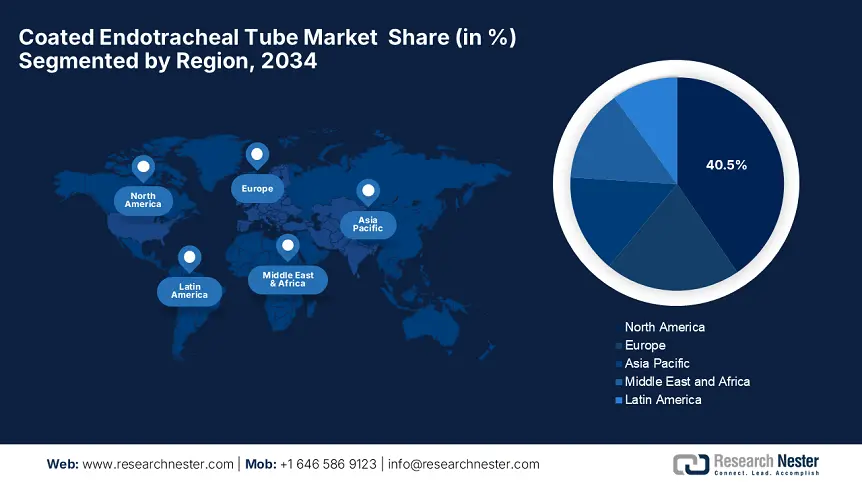

North America in the coated endotracheal tube market is projected to hold the largest share of 40.5% by the end of the forecast tenure. The leadership of the region is effectively attributed to its expanded healthcare expenditure and preceding technological advancements. The U.S. is readily contributing to this growth with its robust federal funding, whereas Canada showcases upliftment in terms of provincial healthcare expansions. Besides the rising surgical volumes and increased adoption of coated tubes in critical care units, further propels development, thereby positioning North America as a critical leader in this landscape.

The U.S. is propagating in the regional coated endotracheal tube market that is anticipated to reach USD 1.9 billion by 2034, owing to the presence of expanded reimbursement policies. For instance, in 2024, Medicare expanded its coverage to USD 810.5 million, which marks from 16.7% since 2020, offering coverage to 95.6% of elderly patients in the ICU. Besides, the FDA successfully fast-tracked 12 new clearances from 2023 to 2024 for AI-based coatings. The antimicrobial and drug-eluting coatings are gaining increased traction in alignment with regulatory emphasis to reduce HAIs.

The coated endotracheal tube market in Canada is gaining enhanced recognition as a result of provincial procurement initiatives. The country’s market is anticipated to surpass USD 452.5 million within the forecast period, reflecting a strong opportunity for both national and international players. Besides the British Columbia’s 2024 tender prioritized antimicrobial tubes, which resulted in enhanced sales by 25.6%. In addition, CIHI data revealed that its coated tubes reduced ICU stays by 1.8 days, which saved USD 11,000 per patient. Further, the AMED offered USD 52.5 million for nanotech coatings by 2026, thus suitable for standard market development.

APAC Market Insights

The coated endotracheal tube market in Asia Pacific is likely to exhibit the fastest growth from 2025 to 2034, owing to the rising surgical volumes, increasing ICU admissions, and government initiatives with an increased focus on healthcare modernization. China is the dominating player in this landscape, followed by Japan and South Korea, facilitated by technological adoption, especially in terms of antimicrobial and smart coatings. The region further benefits from USD 2.9 billion through the combined government grants for the tenure 2021 to 2025, thus highlighting its extensive captivity in this sector.

China is solidifying its dominance in the global as well as regional coated endotracheal tube market, attributed to its massive government healthcare investments and robust ICU capacity expansion. According to the National Medical Products Administration, the yearly spending on endotracheal tubes surpassed USD 2.6 billion as of 2024 data, which marks a 15.5% up since 2020. It also underscored that over 1.6 million patients received care in 2023, reflecting the presence of a wider consumer base. Further, there has been a 20.3% year-over-year growth in critical care demand, especially in tier 2 and 3 cities.

India is emerging in the Asia Pacific’s coated endotracheal tube market, effectively propelled by favorable government schemes and expanding hospital infrastructure. The government of India undertook a Production Linked Incentive (PLI) scheme, which granted USD 412.6 million towards domestic medical device manufacturing, thereby providing a strong opportunity for pioneers in the country. On the other hand, the government spending surpassed USD 1.9 billion in 2023, which marks an 18.5% up since the last decade, offering care to 2.5 million patients. The CDSCO’s 2023 guidelines mandate antimicrobial coatings in the ICU settings, thus highlighting the market’s improved exposure.

APAC Government Funding & Policies for Coated Endotracheal Tube Market (2021 - 2025)

|

Country |

Policy/Initiative |

Funding/Budget Allocation |

Launch Year |

Key Focus |

|

Australia |

Medical Device Reforms (TGA) |

AUD 150.5 million (2023 - 2025) |

2023 |

Antimicrobial coating adoption |

|

Japan |

MHLW Medical Device Acceleration Program |

USD 85.8 Million (2022 - 2024) |

2022 |

ICU infrastructure upgrades |

|

South Korea |

MFDS Next-Gen Medical Device Development Fund |

USD 152.6 Million (2023 - 2026) |

2023 |

Smart/intubation-ready coatings |

|

Malaysia |

MoH Medical Device Procurement Program |

USD 113.5 Million (2022 - 2024) |

2022 |

Public hospital standardization |

Europe Market Insights

Europe in the coated endotracheal tube market is steadily consolidating its position to capture the 2nd largest revenue share during the assessed time frame. This upliftment is a result of aging populations, rising surgical volumes, and stringent regulations imposed on device safety. The region also benefits from strong healthcare funding, where its Health Data Space allocated €2.5 billion for medical device innovation. Besides, the antimicrobial coatings, single-use tube adoption, and nationwide standardization have become more prominent, providing an optimistic opportunity for the market to expand more.

Germany is leading in the coated endotracheal tube market, capturing 30.4% of the regional share. This is facilitated by the country’s strong ICU infrastructure and regulatory leadership in Medical Device Regulation compliance. In this regard, the Federal Ministry of Health notes that it allocated €1.3 billion to coated tubes with a prime focus on infection control. Furthermore, AI-based intubation devices and anti-biotic eluting coatings, with the support of governing bodies, propel upliftment in the country, thereby positioning Germany as a regional hotspot in this sector.

There is an exceptional exposure for the coated endotracheal tube market in the U.K., effectively fueled by NHS reforms and post-pandemic critical care investments. In this context, the Association of the British Pharmaceutical Industry reports that there has been a 15.6% surge in demand for antimicrobial tubes, where £305.6 million annual procurement was witnessed. On the other hand, the affordable single-use tubes, ICU monitoring are gaining traction on account of the country’s Medical Device Regulations, hence suitable for standard market development.

Government Funding & Policies for Coated Endotracheal Tube Market in Europe (2021-2025)

|

Country |

Policy/Initiative |

Funding/Budget Allocation |

Launch Year |

Key Focus |

|

UK |

NHS MedTech Funding Programme |

£222.5 Million (2022-2025) |

2022 |

HAI reduction technologies |

|

Germany |

BMG Hospital Modernization Fund |

€1.6 Billion (2021-2024) |

2021 |

ICU equipment upgrades |

|

France |

HAS Medical Device Innovation Initiative |

€853 Million (2023-2026) |

2023 |

Antimicrobial coating R&D |

|

Italy |

MEF Healthcare Innovation Fund |

€604.7 Million (2022-2025) |

2022 |

Emergency care equipment |

|

Spain |

MoH Medical Device Procurement Plan |

€405 Million (2021-2024) |

2021 |

Public hospitals |

Key Coated Endotracheal Tube Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The worldwide coated endotracheal tube market is highly consolidated, with the pioneers Medtronic, Teleflex, and ICU Medical capturing the maximum revenue share. The leading firms are undertaking numerous strategies to secure their market positions, such as R&D in antimicrobial coatings, mergers & acquisitions, and domestic production in Asia. For instance, in 2022, ICU Medical finalized the acquisition of Smiths Medical, enhancing its product portfolio. Besides, the regulatory partnerships are also assets to propel upliftment in the global market.

Below is the list of some prominent players operating in the global market:

|

Company Name (Country) |

Market Share (2024) |

Industry Focus |

|

Medtronic (U.S.) |

18.8% |

Market leader; offers antimicrobial/silver-coated tubes |

|

Teleflex (U.S.) |

15.5% |

Pioneers in laser-resistant and subglottic suction tubes |

|

ICU Medical (U.S.) |

10.4% |

Focus on infection control |

|

Becton Dickinson (U.S.) |

8.1% |

Drug-eluting coatings for critical care |

|

Smiths Medical (UK) |

7.2% |

Neonatal/pediatric specialty tubes |

|

Fisher & Paykel (New Zealand) |

xx% |

Humidification-compatible coated tubes |

|

Dräger (Germany) |

xx% |

Anesthesia-focused coatings |

|

Flexicare (UK) |

xx% |

Latex-free and single-use tube solutions |

|

Vyaire Medical (U.S.) |

xx% |

Cost-effective ICU tubes for emerging markets |

|

Ambu (Denmark) |

xx% |

Disposable coated tubes with AI-integrated designs |

|

Intersurgical (UK) |

xx% |

Custom coatings for niche applications |

|

Armstrong Medical (UK) |

xx% |

Eco-friendly biodegradable coatings |

|

Medline (U.S.) |

xx% |

Bulk procurement for hospitals |

|

SunMed (U.S.) |

xx% |

Anti-biofilm coatings for long-term intubation |

|

Well Lead Medical (China) |

xx% |

Low-cost alternatives for Asian markets |

|

BROS Medical (India) |

xx% |

PLI Scheme-backed local manufacturing |

|

Unimed (South Korea) |

xx% |

Smart coatings with pH monitoring |

Below are the areas covered for each company under the top global manufacturers:

Recent Developments

- In June 2024, Medtronic announced the launch of its Microcuff Hydrogel-coated Ventilation Tube, which features an advanced low-friction hydrogel coating to reduce tracheal damage. The launch aligns with CDC guidelines pushing for antimicrobial-coated tubes in high-risk patients.

- In March 2024, Teleflex introduced SealGuard EVAC, a subglottic secretion-draining tube with a proprietary silver-ion coating, which successfully reduced ICU stays by 2.5 days on average in trials, and the design targets multi-drug-resistant infections.

- Report ID: 7894

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Coated Endotracheal Tube Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert