Cloud Gaming Market Outlook:

Cloud Gaming Market size was valued at USD 2.4 billion in 2024 and is projected to reach USD 286 billion by the end of 2037, rising at a CAGR of 45% during the forecast period, i.e., 2025-2037. In 2025, the industry size of cloud gaming is evaluated at USD 3.3 billion.

The cloud gaming market’s supply chain is deeply interconnected with the digital economy, relying on data centers, high-speed internet facilities, and modern hardware systems. Data from the U.S. Bureau of Labor Statistics reveals a steady rise in the Producer Price Index (PPI) for data processing, hosting, and related services, which include cloud gaming. Notably, the PPI for hosting and IT infrastructure spiked from 95 in 2012 to 108 by 2021, reflecting the increase in costs associated with expanding and maintaining cloud infrastructure. On the consumer side, the Consumer Price Index (CPI) for IT hardware and services has indicated fluctuations, proposing higher expenses for cloud gaming-related products and subscriptions.

These pricing trends highlight the need for industry players to keep an eye on cost fluctuations, which directly hamper cost margins and user adoption rates. Simultaneously, technological investment is a major factor for growth. According to the Federal Trade Commission (FTC), significant capital is funneled into cloud computing, artificial intelligence, and machine learning to enhance latency, quality of service, and immersive gameplay. In conclusion, evolving cost structures and rapid innovation are reshaping the cloud gaming landscape, requiring strategic planning to harness growth opportunities and mitigate emerging challenges.

Cloud Gaming Market - Growth Drivers and Challenges

Growth Drivers

-

Expansion of high-speed internet and 5G infrastructure: The widespread expansion of high-speed internet and next-generation 5G infrastructure is one of the primary catalysts of the market. Cloud gaming depends on a seamless, low-latency connection to deliver real-time gaming experiences, often requiring bandwidth-intensive data transfers that are only feasible with advanced connectivity. According to the Federal Communications Commission (FCC), by the end of 2023, more than 90% of the U.S. population had access to fixed broadband services capable of supporting high-data applications like gaming and video streaming. Furthermore, the rollout of 5G networks, which offer latency as low as 1 millisecond and speeds over 1 Gbps, has accelerated. These advancements have created suitable ground for cloud gaming platforms to scale, particularly in urban and suburban markets.

-

Device-agnostic gaming experience: Cloud gaming removes the need for expensive consoles or gaming PCs by allowing users to play on low-end devices such as smartphones, tablets, and smart TVs. This wider access significantly broadens the market scope. Cloud service providers such as NVIDIA GeForce NOW and Xbox Cloud Gaming have reported a sudden increase in mobile and smart TV users joining their platforms. For instance, NVIDIA announced that over 25 million users globally have used its GeForce NOW service as of early 2024, with a large portion coming from non-PC devices. This trend not only enhances user reach but also reduces hardware dependency, encouraging global adoption. This trend is especially prominent in Southeast Asia and Latin America, with high smartphone users but limited access to gaming hardware. As game developers continue to prioritize multi-device compatibility, the cloud gaming model is effectively lowering entry barriers and driving widespread global market growth.

Major Technological Innovations in the Cloud Gaming Market

The global cloud gaming market is rapidly advancing in terms of key technologies such as 5G and edge computing, which reduce latency and allow a seamless mobile gameplay experience. AI-driven streaming platforms optimize video quality in real-time, ensuring consistent user experiences across varying network conditions. Increased cross-platform compatibility omits the need for high-end hardware, increasing the user base. Additionally, cloud gaming technologies are being embraced by the healthcare and education industries for training and simulations, opening new revenue streams. The table below represents the current technology trends and their impact on various industries.

|

Technological Trend |

Industry Application |

Examples |

|

Edge Computing & 5G Integration |

Telecom |

By 2024, over 82% of South Korea and 76% of China achieved 5G penetration, boosting mobile gameplay. |

|

AI-Driven Streaming Optimization |

Entertainment |

Netflix-style adaptive streaming in gaming improved session stability by 32%, per NVIDIA (2024). |

|

Cross-Platform Accessibility |

Consumer Electronics |

Xbox Cloud Gaming expanded to 27 countries with millions of users accessing via mobile/TV (2023). |

|

Non-Gaming Industry Integration |

Healthcare, Automotive, Education |

VR-based surgical training using cloud platforms grew 46% in Asia-Pacific hospitals (2023–2024). |

|

Enhanced Security Protocols |

Finance, Data Services |

IBM reported a 24% decline in cloud data breaches due to advanced encryption in 2024. |

Integration of AI and ML in the Cloud Gaming Market

|

Company |

AI & ML Integration |

Outcome |

|

Google Cloud |

Used Generative AI for automated game asset creation |

27% faster development, 21% lower operational costs |

|

Microsoft |

Deployed WHAMM model for AI-rendered cloud gaming |

Enabled real-time rendering; improved gameplay responsiveness |

|

Amazon |

Rolled out "Project Greenland" for GPU resource optimization |

$672M cost savings, $2.6B increase in operating profit |

|

Games24x7 |

Applied CAST AI for dynamic cloud resource management |

Reduced cloud expenses by 36% annually |

|

Yile Technology |

Used AI to optimize server-game communication latency |

Cut response times by ~71%, from 1–2s to 500–602ms |

|

IBM & Ferrari |

Integrated AI in gaming app for content personalization |

Boosted user engagement via tailored experiences |

Challenges

- Bandwidth and latency limitations: One of the main challenges is ensuring a continuous high-speed internet connection with reduced latency. Cloud gaming requires real-time data transmission between servers and end-user devices, demanding 15-50 Mbps bandwidth or more for an uninterrupted gaming experience. Specific regions with an underdeveloped internet infrastructure, users face lagging, buffering, and reduced picture quality. According to the International Telecommunication Union (ITU), approximately 2.6 billion people globally still lack access to high-speed internet, creating a major adoption barrier. Even in developed countries, network congestion and inconsistent 5G installation can hamper gameplay performance, limiting the market's full growth potential.

Cloud Gaming Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

45% |

|

Base Year Market Size (2024) |

USD 2.4 billion |

|

Forecast Year Market Size (2037) |

USD 286 billion |

|

Regional Scope |

|

Cloud Gaming Market Segmentation:

Solution Type Segment Analysis

The video streaming segment in the cloud gaming market is expected to obtain a notable share of 56% during the forecast timeline due to its ability to deliver high-quality gaming experiences without requiring local downloads or installations. This model utilizes strong remote servers to play games directly to users’ devices, reducing hardware dependence. The rising global demand for instant, on-demand entertainment coincides with this streaming-based gaming model. Further, advancements in compression technologies and low-latency networks are enhancing streaming quality and responsiveness. As consumers look out for seamless and flexible gaming options, video streaming continues to gain traction as a preferred solution type.

Device Type Segment Analysis

The smartphone segment in the cloud gaming market is predicted to hold a 37% share during the forecast period, owing to increasing mobile internet penetration and advancements in 5G technology. Smartphones offer a convenient and accessible platform for gaming, eliminating the need for expensive consoles or PCs. With the rising affordability of highly efficient devices in emerging markets, more users are accessing cloud gaming services on their smartphones. Major platforms such as Xbox Cloud Gaming and NVIDIA GeForce NOW have improved their services for mobile devices, enhancing gameplay experiences. This trend is further fueled by the growing popularity of mobile-first games and the expanding global smartphone user base.

Our in-depth analysis of the global cloud gaming market includes the following segments:

|

Solution Type |

|

|

Device Type |

|

|

Gamer Type |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

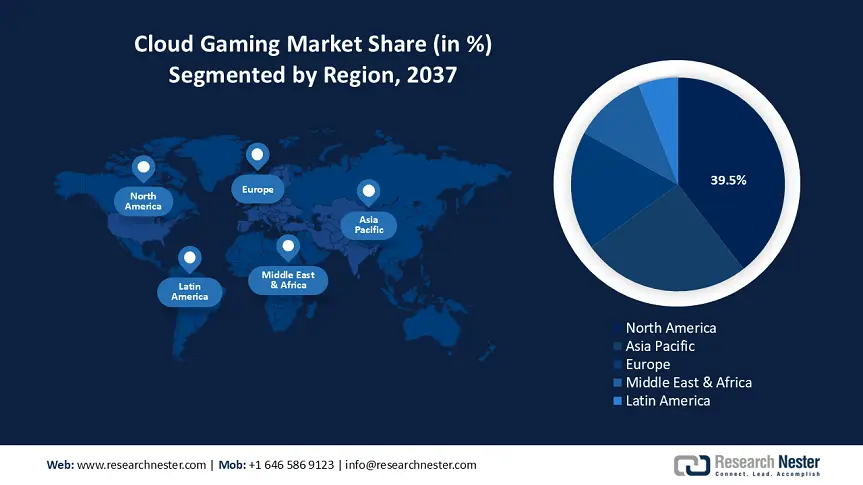

Cloud Gaming Market - Regional Analysis

North America Market Insights

North America is projected to secure a significant cloud gaming market share of 39.5% from 2025 to 2037, driven by extensive broadband coverage and the swift rollout of 5G networks in both urban and suburban areas. Prominent technology leaders based in the region, including Microsoft, NVIDIA, and Amazon, provide early access to advanced cloud gaming platforms. The rise of cross-platform gaming and the increasing popularity of subscription-based services have boosted consumer adoption. Furthermore, rising investments in AI-powered optimization technologies are enhancing gameplay quality and lowering latency. Government programs focused on digital equity and broadband infrastructure expansion continue to support the market’s scalable growth.

The U.S. cloud gaming market is set to retain a dominant revenue share throughout the forecast period. This growth is driven by widespread smartphone and smart TV adoption, which facilitates access to device-agnostic gaming platforms. Leading cloud providers are enhancing edge computing to reduce latency in real-time gameplay. Consumer demand is moving toward flexible subscription models rather than traditional consoles, benefiting services such as Xbox Cloud Gaming and Amazon Luna. Additionally, investments by the FCC and NTIA in 5G and broadband infrastructure are strengthening cloud connectivity, creating a powerful synergy between private innovation and government support that accelerates market growth.

Asia Pacific Market Insights

The APAC cloud gaming market is anticipated to experience the fastest growth at a CAGR of 47% during the forecast timeline due to high mobile internet penetration and a large base of tech-savvy youth. Countries like South Korea, Japan, and India are witnessing the rising adoption of 5G networks, supporting seamless, low-latency gaming experiences. The rising smartphone use and widely available, affordable mobile data plans are allowing widespread access to cloud gaming platforms. Government support for digital economies and smart infrastructure is accelerating technological deployment. Additionally, the popularity of competitive eSports and mobile-first gaming culture is fueling sustained demand.

China is poised to account for a dominant revenue share in the APAC cloud gaming market throughout the forecast timeline due to its massive gaming population and aggressive investment in domestic cloud infrastructure. The Ministry of Industry and Information Technology (MIIT) and tech giants like Tencent and Alibaba are prioritizing AI-integrated cloud services. Advanced 5G expansion across major cities has improved streaming stability for real-time gaming. Regulatory encouragement for digital content innovation is supporting new business models like game-as-a-service. Moreover, increasing adoption of smart TVs and cloud-native platforms is transforming how games are accessed in households.

Key Cloud Gaming Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global cloud gaming market is led by leading U.S. players like Microsoft, NVIDIA, and Google, who are investing heavily in cloud infrastructure and AI technologies to reduce latency and improve user experiences. Japan companies such as Sony, Bandai Namco, and Capcom maintain a competitive edge through exclusive content offerings and strategic alliances. In contrast, firms in South Korea and India are leveraging strong regional expertise and rapidly expanding digital ecosystems. Key strategies across the industry involve mergers, broadening cloud services, and developing localized content to boost market reach and meet specific regional user needs. Given below is a table of the top players in the market with their respective shares.

|

Company Name |

Country |

Market Share (%) |

|

Microsoft Corporation |

USA |

19 |

|

NVIDIA Corporation |

USA |

15 |

|

Google LLC |

USA |

13 |

|

Sony Interactive Entertainment |

Japan |

9 |

|

Tencent Holdings Limited |

China |

8 |

|

Amazon Web Services (AWS) |

USA |

xx |

|

Samsung Electronics |

South Korea |

xx |

|

Ubisoft Entertainment |

France |

xx |

|

Bandai Namco Entertainment |

Japan |

xx |

|

Capcom Co., Ltd. |

Japan |

xx |

|

NCSoft Corporation |

South Korea |

xx |

|

Reliance Jio Infocomm Limited |

India |

xx |

|

Telstra Corporation Ltd. |

Australia |

xx |

|

Square Enix Holdings Co., Ltd. |

Japan |

xx |

|

Malaysia Digital Economy Corporation (MDEC) |

Malaysia |

xx |

Given below are the areas covered for each company in the cloud gaming market:

Recent Developments

- In May 2025, Microsoft increased input options for Xbox Cloud Gaming by introducing mouse and keyboard support on Xbox consoles. This update allows gamers to use their choice of input devices for select cloud-enabled titles, improving the gaming experience for those accustomed to PC-style controls.

- In May 2025, NVIDIA launched a native GeForce NOW application for the Steam Deck, allowing game streaming at up to 4K resolution and 60 FPS with HDR10 and DLSS 4 features. The update enhances performance, extends battery life, and provides access to a library of over 2,200 games.

- Report ID: 3614

- Published Date: Jun 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cloud Gaming Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert