Clinical Trials Market Outlook:

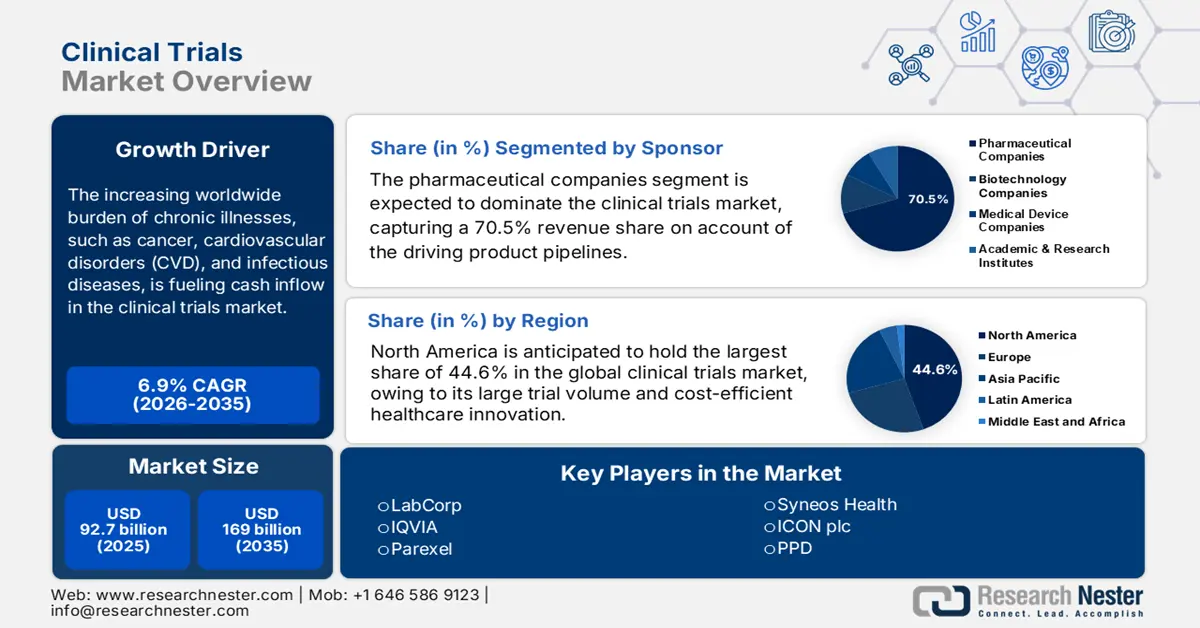

Clinical Trials Market size was USD 92.7 billion in 2025 and is expected to reach USD 169 billion by the end of 2035, increasing at a CAGR of 6.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of clinical trials is evaluated at USD 99.1 billion.

The increasing worldwide burden of chronic illnesses, such as cancer, cardiovascular disorders (CVD), and infectious diseases, is fueling cash inflow in the market. According to an article published by NLM in October 2022, ClinicalTrials.gov, since its unveiling, currently comprises more than 400,000 registered clinical studies, which are readily available across 220 nations. In addition, there has been an increase in the number of trials, particularly when the International Committee of Medical Journal Editors (ICMJE) demanded clinical trials. Besides, as stated in the 2023 OECD data report, circulatory diseases readily accounted for almost 33% of overall deaths in Germany, due to which there is a huge opportunity for the market to rise, with the intention of providing standard treatment solutions.

Moreover, despite the inflated participation, cost pressures in the market are still persistent due to a significant rise in payers' pricing of R&D and regulatory compliance. As per an article published by the World Health Organization in December 2024, the total number of clinical trials conducted in Europe as of 2022 is 14,888, followed by 11,683 in America, 7,872 in the West Pacific, 248 in the East Mediterranean, and 18 in Africa. Therefore, all these clinical trial conductions are readily increasing the market’s exposure globally. Besides, sponsors and CROs are focusing on optimizing trial efficiency while maintaining compliance to positively impact the market across different nations.

Key Clinical Trials Market Insights Summary:

Regional Highlights:

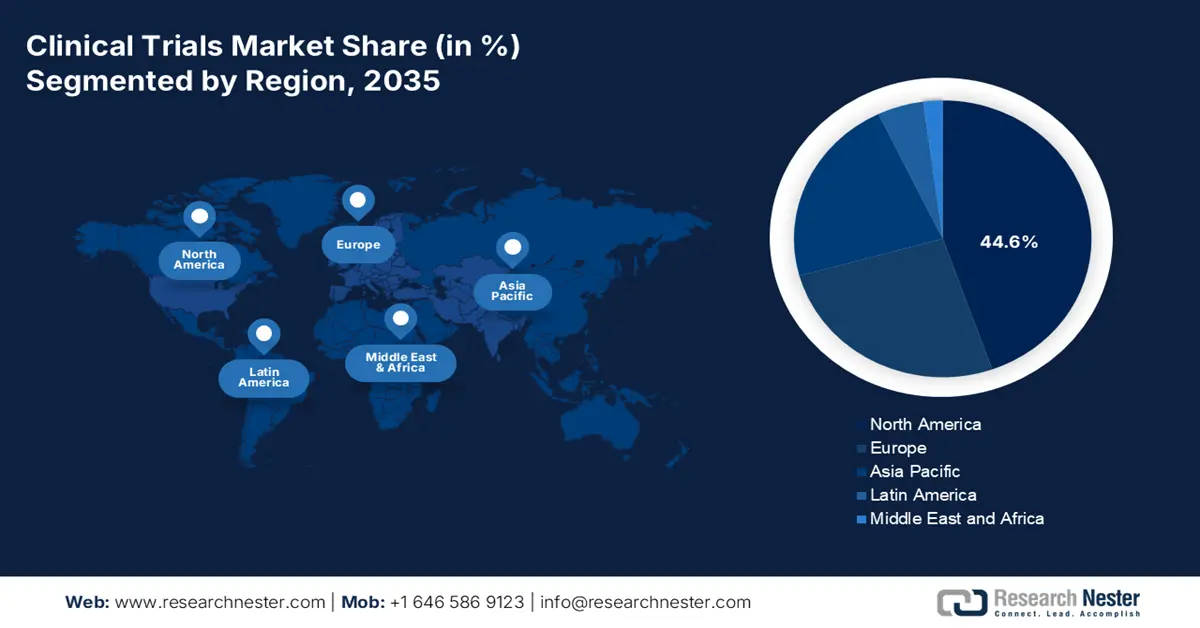

- North America in the Clinical Trials Market is anticipated to secure a 44.6% share by 2035, bolstered by expanding patient pools and intensifying oncology trial enrollments.

- Asia Pacific is projected to accelerate at the fastest pace through 2026–2035, supported by cost-efficient recruitment and progressive regulatory reforms.

Segment Insights:

- The pharmaceutical companies segment in the Clinical Trials Market is estimated to command a 70.5% share by 2035, propelled by substantial R&D investments aimed at advancing biologics and precision therapeutics.

- The phase III segment is projected to attain the second-highest share by 2035, supported by rising demand for large-scale pivotal studies in high-burden therapeutic areas.

Key Growth Trends:

- An increase in pharmaceutical R&D investment

- Tactical innovations and industrial partnerships

Major Challenges:

- Constraints in profitability and government price controls

- Data privacy and ethical regulations

Key Players: IQVIA, LabCorp, Parexel, PPD, Syneos Health, ICON plc, Charles River Labs, Covance, Medpace, PRA Health Sciences, WuXi AppTec, SGS SA, Eurofins Scientific, Novotech, Samsung Bioepis, Jubilant Biosys, Pharmaron, Clinigen Group, Bioequivalence Sdn Bhd.

Global Clinical Trials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 92.7 billion

- 2026 Market Size: USD 99.1 billion

- Projected Market Size: USD 169 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 1 October, 2025

Clinical Trials Market - Growth Drivers and Challenges

Growth Drivers

- An increase in pharmaceutical R&D investment: The growing demand for suitable therapeutics, healthcare authorities, and pharma companies from across the globe are heavily investing in the market. Moreover, the current trend of investing in pharmaceutical R&D is ensuring a steady capital influx in this sector. As per an article published by NLM in June 2024, approximately USD 172.7 million is required for developing new drugs, which includes USD 72,5 million for genitourinary, while USD 297.2 million is readily needed for anesthesia and pain. However, there has been a surge to USD 515.8 million, owing to cost failures, resulting in an increased drug development capitalization cost of USD 879.3 million.

- Tactical innovations and industrial partnerships: Strategic partnerships and tech innovations are the key driving factors in the pipeline expansion and progress of the market. For instance, in 2024, Johnson & Johnson successfully reached over 1 million health workers globally, which strengthened its care whenever required. Moreover, as stated in the October 2023 NLM article, in May 2022, BeenvolentAI indicated that AstraZeneca selected an additional notable target for idiopathic pulmonary fibrosis for initiating its drug development process through AI-based drug discovery. Therefore, these commercial moves and tech-based integrations demonstrate higher cost efficiency and faster outcomes, encouraging more organizations to invest in this sector.

- Surge in the global aging population: This plays an essential role in the market since it ensures treatments and medications are safe for the elderly population, the majority of whom utilize therapies. In this regard, as per the October 2024 WHO report, 1 in 6 people will be aged more than 60 years by the end of 2030, and by the end of 2050, the global population will account for 2.1 billion. In addition, the number of people aged over 80 years is projected to triple by 2050 and reach 426 million, denoting an increase from 12% to 22%. Therefore, this is extremely suitable for the market’s upliftment across different nations.

Clinical Trials Conduction by Different Income Groups

|

Groups/Years |

2022 |

2023 |

|

High income |

31,477 |

28,758 |

|

Low income |

368 |

291 |

|

Lower middle income |

16,599 |

19,047 |

|

Unknown |

3,872 |

4,816 |

|

Upper middle income |

23,800 |

21,776 |

Source: WHO

Clinical Trials Conduction by Countries (2024)

|

Countries |

Number of Trials |

|

U.S. |

186,497 |

|

China |

135,747 |

|

India |

74,031 |

|

Japan |

65,167 |

|

Germany |

54,902 |

|

UK |

49,145 |

|

France |

46,309 |

|

Canada |

35,700 |

Source: WHO

Challenges

- Constraints in profitability and government price controls: The aspect to make pharmaceutical products and drugs cost-effective, administrative bodies across price-sensitive regions frequently impose strict guidelines for pricing, which often limit branded commodities and profit margins. This particular criterion inevitably hinders the acquisition compliance process, since it becomes difficult for organizations to maintain lower expenses while delivering quality. For instance, the AMNOG law commencement in Germany has readily mandated affordability evidence, which caused a delay in oncology trials. However, to combat this issue, players are effectively partnering with insurance companies to bypass these demands under reimbursement.

- Data privacy and ethical regulations: Besides clinical safety and therapeutic efficiency, the mandated compliance with ethical and data privacy-related regulations presents a notable hurdle in the market. As is evident, the GDPR criterion in Europe added an average amount per trial in legal expenses, which frequently caused an overflow in the manufacturing budget, along with an increase in the product price. To overcome these burdens, pharmaceutical leaders, including Johnson & Johnson, successfully adopted blockchain-specific consent tools, which eventually diminished compliance costs, thereby making it suitable for uplifting the overall market internationally.

Clinical Trials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 92.7 billion |

|

Forecast Year Market Size (2035) |

USD 169 billion |

|

Regional Scope |

|

Clinical Trials Market Segmentation:

Sponsor Segment Analysis

Based on the sponsor, the pharmaceutical companies segment in the clinical trials market is expected to garner the highest share of 70.5% by the end of 2035. The segment’s growth is highly attributed to sustained and immense R&D investment to readily drive its product pipelines. In addition, these firms are facing patent expirations, especially for blockbuster drugs, due to which they are initiating heavy investments. The purpose is to create notable biologics, complex therapeutics, and precision medicines for rare and oncology disorders, which demand expensive and extended clinical evaluation. Besides, pharmaceutical companies’ in-depth financial resources permit funding large-scale and multi-phase international trials, which in turn is positively impacting the segment.

Phase Segment Analysis

Based on the phase, the phase III segment in the clinical trials market is projected to capture the second-highest share during the projected timeline. The segment’s upliftment is highly fueled by an increase in the demand for large-scale pivotal studies in areas such as oncology and cardiovascular diseases, which has a direct impact on the segment's leadership, with greater participation and capital influx. As per the May 2023 NLM article, a logical regression was performed on 24,295 cases from phase 1 to phase 4 trials on new molecular entities and biologics. This resulted in a success ratio of 120.2% for model 1, 112.9% for model 2, and 115.2% for model 3, particularly during phase III clinical trials, thus suitable for the segment’s growth.

Therapeutic Area Segment Analysis

Based on the therapeutic area, the oncology segment in the clinical trials market is anticipated to garner the third-highest share by the end of the predicted duration. The segment’s development is highly driven by the ongoing surge in the international cancer prevalence, resulting in the latest incidences across different nations. This demographic expansion reflects the urgent need for innovative treatments worldwide, making this segment a priority for pharma developers. As per the March 2023 NLM article, there has been the existence of 19.3 million cancer incidents. Besides, the May 2025 National Cancer Institute article noted that approximately 2,041,910 new cancer cases will be successfully diagnosed in the U.S. by the end of 2025, thus creating an optimistic outlook for the overall segment internationally.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Sponsor |

|

|

Phase |

|

|

Therapeutic Area |

|

|

Design |

|

|

Service Type |

|

|

Product and Solution |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Clinical Trials Market - Regional Analysis

North America Market Insights

North America in the clinical trials market is anticipated to hold the largest share of 44.6% by the end of 2035. The market’s exposure in the overall region is highly driven by an increase in the patient pool and continuous oncology trials for total enrollments. The region’s impact on the market also extends beyond recruitment, as early-stage diabetes trials demonstrated a reduction in hospitalizations and saved patient lives. Besides, an article published by NLM in November 2022 indicated that the total population-based diabetes hospitalizations surged from 3,079.0 to 3,280.8 per 100,000 in the U.S., which positively impacts the overall market.

The U.S. is solidifying its leadership in the regional market with a strong government-backed capital influx, a large patient pool, and expansion in insurance coverage. This is further supported by a data report published by the KFF Organization in April 2022, which indicates that Medicare expenditure per person increased from USD 5,800 to USD 16,700 between 2020 and 2023, representing a 4.7% average yearly growth over the 3-year period. Besides, as per the August 2025 Medical Buyer article, the medical device regulatory affairs market is worth USD 6.7 billion, which is poised to surge to USD 18.3 billion by 2034, thus positively impacting the market’s exposure in the country.

The Canada clinical trials market is expanding at a steady pace and is bolstered by an increase in federal healthcare investments. According to the January 2025 Ontario article, the domestic government readily approved 18 latest Homelessness and Addiction Recovery Treatment (HART) centers to effectively support safer communities by generously allocating USD 529 million to develop an overall 27 HART facilities across the province, while also successfully banning drug injection centers from operating across 200 meters of licensed child-care centers and schools. Therefore, this denotes a huge growth opportunity for the market in the country.

APAC Market Insights

Asia Pacific is predicted to attain the fastest pace of growth in the global clinical trials market over the analyzed timeline. Its progress is primarily accelerated by cost-optimized recruitment, recent regulatory reforms, rising chronic disease occurrence, and the emergence of the pharmaceutical industry. Besides, in this landscape, countries are readily leading in precision medicine, with AMED investments, along with research and development (R&D) tax credits for chronic disease trials. Meanwhile, Malaysia and South Korea are effectively centralizing as notable innovation facilities by providing lower costs. This rapid expansion highlights the transformative and significant role of APAC in the sector's global expansion.

China is propagating the APAC market with dominance, accounting for the majority of the National Medical Products Administration (NMPA) in 2023 and deliberately slashing approval times. According to an article published by NLM in September 2024, the country’s overall health expenditure reached 8,532.7 billion yuan (USD 1,268.6 billion), further accounting for 7.0% of GDP. In addition, the per capita total healthcare spending in the country has been 6,044.0 yuan (USD 898.6) as of 2022, thus creating an optimistic outlook for the overall market’s exposure in the country.

India is emerging as a key player in the APAC clinical trials market, with its remarkable patient pool expansion and consistent growth in biologics production. The government is further pushing the country's capacity to extend its domestic resources for establishing a strong emphasis on the biopharmaceutical and medical instruments segment. As stated in the August 2024 PIB data report, the healthcare industry in the country readily caters to an overall 7.5 million people, and the public expenditure has been 2.5% currently, thus denoting a positive impact of the market’s development in the country.

2022 Healthcare Spending in the Asia Pacific

|

Countries |

% of GDP |

|

Australia |

9.9 |

|

China |

5.3 |

|

Indonesia |

2.6 |

|

Japan |

11.4 |

|

Malaysia |

3.9 |

|

Singapore |

4.9 |

Source: World Bank Organization

Europe Market Insights

Europe is estimated to experience a considerable growth in the clinical trials market between 2025 and 2037. Regulatory advancements and strong government support, including the EHDS initiative, which enhanced cross-border data sharing and streamlined approvals, are the major driving factors in this region. According to an article published by the EMA in July 2023, the EU Network is gradually transitioning, initiating 18 months after introducing the Clinical Trials Information System (CTIS). This included more than 1,700 clinical trial applications, which have been readily submitted in CTIS, and more than 700 clinical trials are authorized under the CTR, thus suitable for boosting the market’s development.

The UK is maintaining its leadership in the Europe clinical trials market by allocating the majority of its healthcare budget to trials in 2023, which reflects an increase over the past five years. According to an article published by the UK Government in July 2025, the Medicines and Healthcare products Regulatory Agency (MHRA) has readily notified the essential step to achieve accessibility for localized patients to the newest medical technologies that are deliberately available in the region. Besides, the integrated system, introduced by the National Health Service (NHS), enables efficient recruitment, supporting the majority of active trials, thus making it suitable for the market’s growth.

Germany is augmenting the region's second-largest position in the global clinical trials market. This is significantly backed by an increase in Federal Ministry of Health (BMG) spending over the past four years to readily prioritize oncology and rare disease research. Besides, the country's robust trial ecosystem is also evidenced by an increase in the number of active trials on account of strong academic-industry collaborations, as stated by the German Medical Association. This strategic investment and collaborative framework continue to drive the nation's leadership in this sector, thereby bolstering the market’s exposure.

Historical Phase I to Phase 4 Clinical Trials Conducted in Europe

|

Phases/Years |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

|

Phase 1 |

84 |

88 |

105 |

86 |

82 |

97 |

138 |

132 |

110 |

122 |

8 |

|

Phase 2 |

266 |

239 |

229 |

255 |

258 |

305 |

330 |

271 |

214 |

236 |

14 |

|

Phase 3 |

316 |

316 |

269 |

314 |

310 |

350 |

344 |

305 |

311 |

284 |

14 |

|

Phase 4 |

70 |

81 |

51 |

48 |

44 |

48 |

52 |

46 |

25 |

32 |

7 |

Key Clinical Trials Market Players:

- IQVIA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LabCorp

- Parexel

- PPD

- Syneos Health

- ICON plc

- Charles River Labs

- Covance

- Medpace

- PRA Health Sciences

- WuXi AppTec

- SGS SA

- Eurofins Scientific

- Novotech

- Samsung Bioepis

- Jubilant Biosys

- Pharmaron

- Clinigen Group

- Bioequivalence Sdn Bhd

The present scenario of the clinical trials market comprises advanced competency among international leaders. In this landscape, the U.S.-based CROs, such as Parexel, LabCorp, and IQVIA, are effectively leading through decentralized and AI-based trial integration. Besides, pioneers in Europe, including Eurofins and ICON, are readily utilizing their respective excellence in regulatory compliance and real-world data. Simultaneously, organizations in the Asia Pacific, including Novotech and WuXi AppTec, are immensely focused on leveraging rapid recruitment and cost efficiencies. Meanwhile, the commercial dynamics of the market are further intensified by the tactical mergers and acquisitions, along with increased AI penetration, thereby bolstering the overall market.

Here is a list of key players operating in the global market:

Recent Developments

- In March 2025, Italfarmaco S.p.A. notified a wide-ranging upgrade on clinical and regulatory advancement for givinostat, which is the organization’s drug for aiding Duchenne muscular dystrophy (DMD), highlighting ongoing clinical trials.

- In February 2025, AbbVie, along with Xilio Therapeutics, Inc. declared a collaboration and option-to-license agreement to create novel tumor-activated, antibody-based immunotherapies, including masked T-cell engagers, to leverage Xilio's proprietary technology.

- In February 2025, Novotech successfully signed a memorandum of understanding (MOU) with Wonju Severance Christian Hospital to develop a tactical collaboration with focus on optimizing medical innovation and clinical research.

- In January 2024, Accenture proclaimed that it has successfully made a tactical investment through QuantHealth and Accenture Ventures, permitting biotech and pharmaceutical organizations to cost-effectively and rapidly develop standard treatments for patients.

- Report ID: 4215

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Clinical Trials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.