Clinical Disorder Treatment Market Outlook:

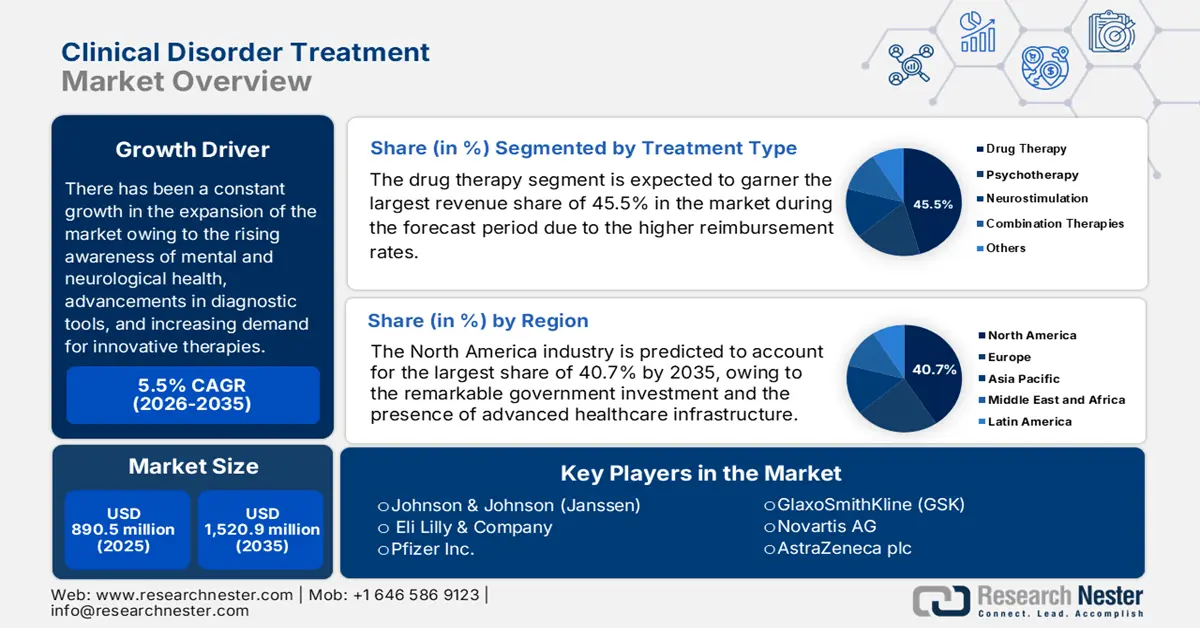

Clinical Disorder Treatment Market size was valued at USD 890.5 million in 2025 and is projected to reach USD 1,520.9 million by the end of 2035, rising at a CAGR of 5.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of clinical disorder treatment is estimated at USD 939.4 million.

There has been a constant growth in the expansion of the clinical disorder treatment market owing to the rising awareness of mental and neurological health, advancements in diagnostic tools, and increasing demand for innovative therapies. According to the article published by the World Health Organization in June 2022, one out of every eight people, which is around 970 million people, is residing with a mental health disorder, showcasing the heightened demand for effective treatment measures.

Additionally, supportive healthcare policies and growing investment from both public and private sectors & increasing economic burden are also significantly enhancing the market expansion. For instance, in August 2025, the study by the Centers for Disease Control and Prevention revealed that mental and neurological disorders contribute substantially to health care spending, wherein mental health and chronic conditions together make up 90% of the U.S.’s USD 4.9 trillion in annual health expenditures, representing the strong potential for the pioneers to capitalize in this field.

Key Clinical Disorder Treatment Market Insights Summary:

Regional Highlights:

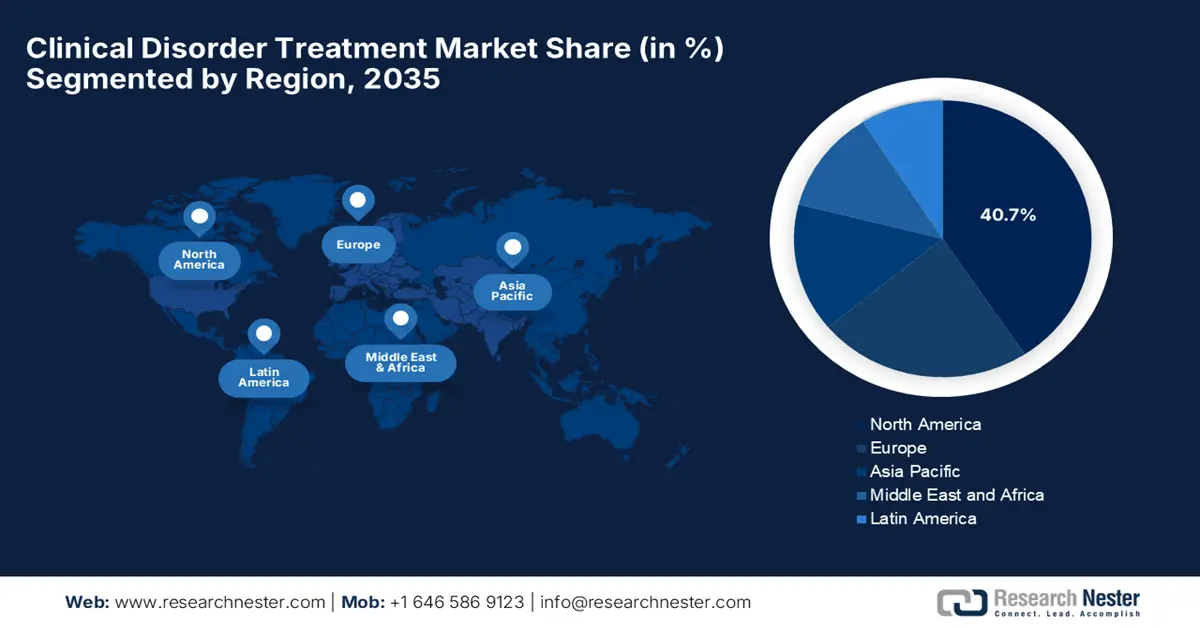

- By 2035, North America is projected to command a 40.7% share in the Clinical Disorder Treatment Market, attributable to expanding funding grants and strengthened healthcare infrastructure.

- By 2035, the Asia Pacific region is set to emerge as the fastest-growing market, propelled by rising mental-health awareness, increasing NCD burdens, and expanding support for telehealth ecosystems.

Segment Insights:

- By 2035, the drug therapy segment is forecasted to account for a 45.5% share in the Clinical Disorder Treatment Market, supported by scalable first-line use and reimbursement-enabled uptake.

- By 2035, the hospitals & specialty psychiatric centers segment is projected to secure a 40.8% share, reinforced by comprehensive care infrastructure and broad insurance-linked inpatient management.

Key Growth Trends:

- Treatment advances

- Increasing healthcare expenditures

Major Challenges:

- High research & development expenses

- Regulatory approval delays

Key Players: Johnson & Johnson (Janssen), Eli Lilly & Company, Pfizer Inc., GlaxoSmithKline (GSK), Novartis AG, AstraZeneca plc, Takeda Pharmaceutical, Otsuka Holdings, Lundbeck A/S, Boehringer Ingelheim, Sanofi S.A., Merck & Co., Sun Pharmaceutical Industries, Cipla Ltd., Dr. Reddy’s Laboratories, Lupin Pharmaceuticals, Aurobindo Pharma, Astellas Pharma, Teva Pharmaceutical Industries.

Global Clinical Disorder Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 890.5 million

- 2026 Market Size: USD 934.4 million

- Projected Market Size: USD 1,520.9 million by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Australia, Canada

Last updated on : 6 October, 2025

Clinical Disorder Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Treatment advances: The innovations in terms of treatment approaches, including the development of personalized medicine, digital therapeutics, and new pharmacological drugs, are readily driving business in the clinical disorder treatment market. In September 2024, Bristol Myers Squibb announced that its COBENFY (xanomeline and trospium chloride) had been accepted by the U.S. FDA as a first-in-class oral treatment for schizophrenia in adults, which offers a novel mechanism targeting M1 and M4 receptors without blocking D2 receptors.

- Increasing healthcare expenditures: Both the government and private entities are readily making investments in the mental health infrastructure, research, and service delivery. Also, the policy initiatives aimed at integrating mental health into primary care support market expansion. Testifying to this, the NIH in August 2022 stated that the median proportion of government health expenditure allocated to mental health services across 78 countries was 2.7%, with significant variation ranging from as low as 0.1% in Zimbabwe to 12.9% in France, hence suitable for standard market growth.

- Emergence of telemedicine & remote care: The ever-increasing adoption of telemedicine and remote care has evidently reshaped the foundation of clinical disorder treatments market in recent years. This can be testified from a WHO article published in March 2025 stating it had launched a 13-part webinar series called Telemedicine in Action, in collaboration with Intelehealth, thereby promoting equitable healthcare access through telemedicine in developing countries, thereby positively influencing market growth.

Historic Trends in Global Prevalence and Impact of Common Mental Disorders 2019

|

Mental Disorder / Topic |

Key Statistics / Details |

|

Global Prevalence |

1 in every 8 people (approx. 970 million) live with a mental disorder |

|

Anxiety Disorders |

301 million affected (including 58 million children and adolescents) |

|

Depression |

280 million affected (including 23 million children and adolescents) |

|

Bipolar Disorder |

40 million affected |

|

Schizophrenia |

24 million affected (approx. 1 in 300 people); 10-20 years lower life expectancy |

|

Eating Disorders |

14 million affected (including 3 million children and adolescents) |

|

Disruptive & Dissocial Disorders |

40 million affected (including children and adolescents) |

Source: WHO

International Comparison of Health Expenditure, 2023

|

Country |

Health Spending (% of GDP, 2023) |

|

U.S. |

~16.6% |

|

Switzerland |

~11.6% |

|

New Zealand |

~10.9% |

|

Japan |

~10.7% |

|

Australia |

~9.8% |

Source: OECD

Key Advances in Clinical Disorder Treatment Market: Anxiety and Schizophrenia (2023-2025)

|

Year |

Company/Entity |

Product/Study |

Key Info |

|

2025 |

Newron Pharmaceuticals |

Evenamide for schizophrenia |

Presenting data at 2025 WCBP; add-on therapy modulating glutamate for treatment-resistant schizophrenia; well-tolerated; landmark ENIGMA-TRS 1 study ongoing |

|

2024 |

MindMed |

MM120 (LSD) for Generalized Anxiety Disorder (GAD) |

Phase 3 Voyage study started; 12-week primary endpoint (HAM-A); builds on positive Phase 2b results; ~200 US patients |

|

2024 |

Laboratorios Farmacéuticos Rovi |

Risperidone ISM (injectable antipsychotic) |

FDA approved for schizophrenia; monthly injection with no oral supplementation; rapid and sustained efficacy |

|

2023 |

TVM |

Sileo (anxiety medication for dogs) |

New UK distributor; dexmedetomidine-based; rapid onset for noise anxiety in dogs; practical dial-to-dose syringe with instructional QR code |

Source: Company Official Press Releases

Challenges

- High research & development expenses: The costs associated with research and development in the clinical disorder treatment market are relatively higher, making it challenging for niche manufacturers. Also, the development of new treatments for clinical disorders, especially rare or complex conditions, requires a huge investment in research and clinical trials. Therefore, this process can be extremely time-consuming and often faces high failure rates, making it costly and risky for firms.

- Regulatory approval delays: This is yet another factor negatively influencing the growth of the clinical disorder treatment market across most nations. The market is heavily regulated to ensure safety and efficacy, navigating through which can be complicated and time-consuming as well. Hence, these strict requirements and varying standards across countries can delay product launches and sometimes limit patient access to efficacious treatments.

Clinical Disorder Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 890.5 million |

|

Forecast Year Market Size (2035) |

USD 1,520.9 million |

|

Regional Scope |

|

Clinical Disorder Treatment Market Segmentation:

Treatment Type Segment Analysis

Based on treatment type, the drug therapy segment is expected to garner the largest revenue share of 45.5% in the clinical disorder treatment market during the forecast period. The subtype remains the first line, easy to scale, wherein reimbursement systems are driving higher adoption. In September 2025, Ionis Pharmaceuticals announced positive results for zilganersen, which is an investigational treatment for Alexander disease, showing significant stabilization in gait speed and consistent benefits across key secondary endpoints, marking a first potential disease-modifying therapy for this rare and often fatal neurological disorder.

End user Segment Analysis

Based on end user hospitals & specialty psychiatric centers segment, it is likely to attain a share of 40.8% in the clinical disorder treatment market during the assessed timeframe. The presence of necessary infrastructure, trained staff, diagnostic support, and extensive care to manage several severe clinical disorders positions the segment at the forefront of revenue generation in this field. Further, the existence of huge insurance coverage and integration with prescribing and monitoring inpatient stays propel growth in the segment.

Disorder Type Segment Analysis

In terms of disorder type, the depression segment is anticipated to gain a considerable share of 30.3% in the clinical disorder treatment market by the end of 2035. The growth in the segment is highly subject to the increasing burden of depression among the global population and awareness about the same. Testifying to this, the WHO in August 2025 revealed that globally, about 5.7% of adults suffer from depression, wherein women experience it at a higher rate, 6.9% when compared to men, 4.6%. It also stated that around 332 million people worldwide live with depression, including 5.9% of adults aged 70 and above.

Our in-depth analysis of the clinical disorder treatment market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Type |

|

|

End user |

|

|

Disorder Type |

|

|

Drug Class |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Clinical Disorder Treatment Market - Regional Analysis

North America Market Insights

North America is anticipated to hold a significant position in the global clinical disorder treatment market by capturing the largest revenue share of 40.7% by the end of 2035. The region’s growth in this sector is effectively attributable to the increasing funding grants and the presence of advanced healthcare infrastructure. The Biden-Harris administration in September 2024 announced a major investment of USD 68.5 million to address the U.S. mental health crisis, with a prime focus on expanding the workforce and improving care for underserved communities. Besides, USD 2 million was allocated through the LEAP in Health IT program to enhance interoperable medical systems that improve patient data access and care coordination.

The U.S. is the key contributor to growth in the clinical disorder treatment market, effectively propelled by the presence of payers, manufacturers, and policymakers who increasingly prioritize mental health and neurological care. In January 2025, Johnson & Johnson reported that the U.S. FDA had accepted its SPRAVATO (esketamine) nasal spray, which is the first and only monotherapy for adults with treatment-resistant depression who have not responded to at least two oral antidepressants, hence denoting a positive market outlook.

In Canada, the market is expected to garner humongous growth due to significant investment from the provincial and federal governments. In September 2025, the Government of Canada reported that it is investing over USD 30 million over four years to expand the Integrated Youth Services Network to improve mental health services for youth aged 12 to 25. The initiative was successfully led by CIHR and Indigenous Services Canada, supports 12 regional networks and an Indigenous network to enhance research and data systems, and is hence suitable for standard market growth.

Key Financial Burdens Across Mental and Neurological Disorders

|

Disorder / Area |

Estimated Cost Impact |

|

Alzheimer’s Disease |

USD 360 billion (2024); projected USD 1 trillion by 2050 |

|

Epilepsy |

USD 13.4 billion total (2019); USD 5.4 billion directly attributable |

|

Schizophrenia |

USD 30,000-USD 60,000 per patient annually (estimates from external sources) |

|

Depression |

Patients incur 2.5× higher healthcare costs (indirect estimate) |

Source: CDC

APAC Market Insights

Asia Pacific is identified as the fastest-growing region in the clinical disorder treatment market over the analyzed timeframe. The region’s progress in this field is highly subject to the rising recognition of mental health challenges alongside growing non-communicable disease burdens. On the other hand, the increasing urbanization, shifting lifestyles, and other social factors have created a huge demand for depression, anxiety, and mood disorder therapies. Furthermore, the governments across the region are extensively supporting telehealth and digital health platforms and improving regulatory pathways for psychiatric drugs.

China has a strong potential in the regional clinical disorder treatment market backed by policy reforms, increased public awareness, and technological adoption. The country also benefits from expanding outpatient services and regional mental health specialty centers that effectively help manage these conditions. For instance, in June 2023, Brii Biosciences reported the dosing of the first subject in a Phase 1 clinical trial of BRII-297, which is a novel long-acting injectable designed for the treatment of anxiety and depressive disorders. Moreover, BRII-297 is a GABAA receptor positive allosteric modulator and represents a first-of-its-kind approach.

India in the clinical disorder treatment market is portraying steady growth owing to the heightened demand for treatments for depression, anxiety, PTSD, and autism, supported by growing public and private investments. The Ministry of Finance in July 2024 reported that, through the Economic Survey 2023 - 2024, it found that 10.6% of adults in the country suffer from mental disorders, wherein treatment gaps range from 70% to 92%. The Survey also noted that over 8.07 lakh calls had been handled under the Tele MANAS programme, which is supported by 53 cells across 34 States/UTs.

Europe Market Insights

The clinical disorder treatment market in Europe is predicted to register a considerable growth rate during 2026-2035, fueled by a surge in novel product introductions and a rising aging population in the region. In August 2025, Eisai Co., Ltd. and Biogen Inc. announced that they had officially launched LEQEMBI in Austria, with a subsequent launch scheduled for Germany. The product is approved by the European Commission and is the first treatment in the region targeting the underlying cause of Alzheimer’s disease, specifically indicated for patients with early AD who are ApoE ε4 non-carriers or heterozygotes with confirmed amyloid pathology.

In Germany, the clinical disorder treatment market is experiencing significant growth on the back of the introduction of policy reforms and digital integration. In March 2024, Boehringer Ingelheim reported that it joined forces with Sosei Heptares to develop GPR52 agonists for the treatment of schizophrenia. Further, the prime focus of this collaboration revolves around HTL0048149, which is a first-in-class GPR52 agonist currently in Phase 1 trials, and has the potential to become a precision medicine targeting the brain regions involved in schizophrenia.

The U.K. is also maintaining a strong position in the clinical disorder treatment market since the public health innovations are prioritizing digital and therapeutic tools, integrating virtual reality and telehealth to reach people more efficiently. For instance, BDD Pharma in April 2025 announced that its OralogiK oral delivery technology is driving the development of CTx‑2103, which is a once-daily formulation of buspirone aimed at treating anxiety disorders. Hence, this highlights the growing role of advanced formulation platforms in making psychiatric therapies extremely convenient.

Key Clinical Disorder Treatment Market Players:

- Johnson & Johnson (Janssen)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eli Lilly & Company

- Pfizer Inc.

- GlaxoSmithKline (GSK)

- Novartis AG

- AstraZeneca plc

- Takeda Pharmaceutical

- Otsuka Holdings

- Lundbeck A/S

- Boehringer Ingelheim

- Sanofi S.A.

- Merck & Co.

- Sun Pharmaceutical Industries

- Cipla Ltd.

- Dr. Reddy’s Laboratories

- Lupin Pharmaceuticals

- Aurobindo Pharma

- Takeda (Japan)

- Astellas Pharma

- Teva Pharmaceutical Industries

The competitive landscape of the clinical disorder treatment market is rapidly evolving as established key players, healthcare giants, and new entrants are investing in novel medicines. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In September 2025, Crinetics Pharmaceuticals announced that the U.S. FDA had accepted its FDA PALSONIFY (paltusotine), the first once-daily oral treatment for adults with acromegaly who have an inadequate response to surgery or cannot undergo surgery.

- In August 2024, Otsuka Precision Health, along with Click Therapeutics, launched Rejoyn, which is the first U.S. FDA-cleared prescription digital therapeutic app for treating major depressive disorder symptoms as an adjunct to outpatient care.

- Report ID: 3749

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Clinical Disorder Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.