Civil Helicopter Market Outlook:

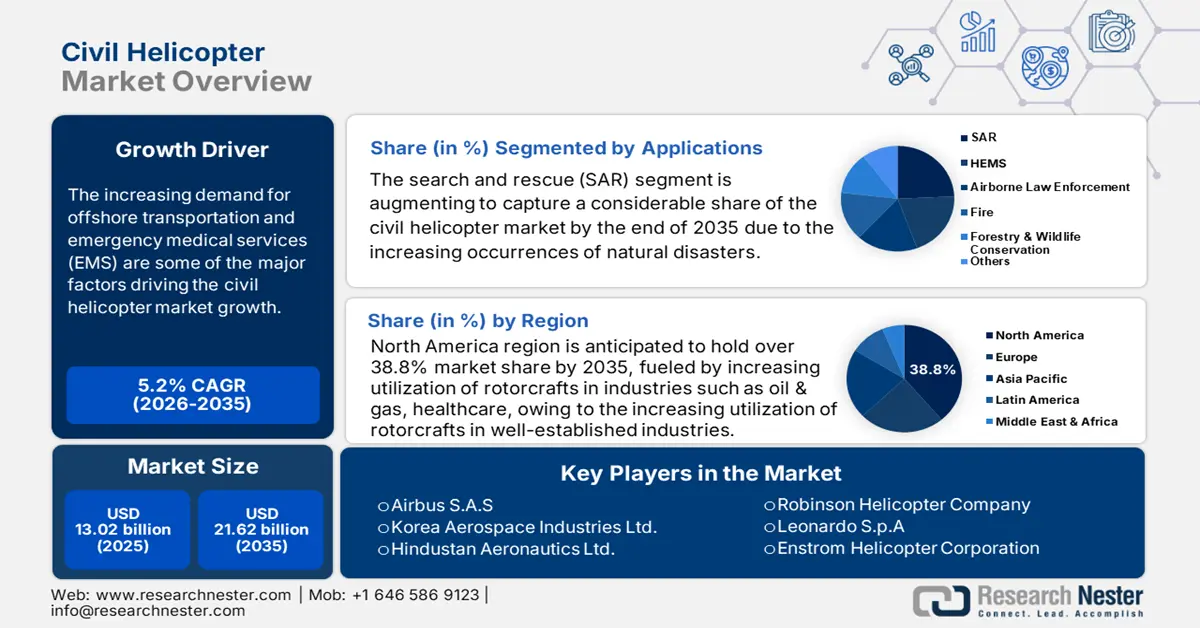

Civil Helicopter Market size was over USD 13.02 billion in 2025 and is anticipated to cross USD 21.62 billion by 2035, growing at more than 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of civil helicopter is estimated at USD 13.63 billion.

The increasing demand for offshore transportation and emergency medical services (EMS) are some of the major factors driving the civil helicopter market growth. With the worldwide surge for infrastructural development and explorations in the energy industry, the need for dedicated aircraft to transport oil and gas, inspect powerlines, and maintain utility is heightening. In addition, the inflating mortality due to health emergencies, such as severe accidental injuries, stroke, and others, is pushing global authorities to accommodate immediate response systems, including helicopter emergency medical services (HEMS). On this note, a 2021 NLM article reported that up to 28.0 million people with conditions requiring emergency care worldwide die every year, contributing to 51.0% of the global mortality burden.

Furthermore, the rising popularity of luxury tourism and business travel is opening new business pathways for the civil helicopter market. Being a suitable companion in sightseeing, charters, and executive transport, these rotorcrafts are now highly desired across tourism-prone regions such as tropical countries and emerging economies. Testifying for this opportunity, in May 2024, Leonardo shared its progress in solidifying its leadership in the VIP-corporate helicopter industry across Europe and Asia at EBACE 2024. Following the success in Europe, the company reinforced its new asset, the AW09 single engine, by strengthening its distribution partnership with Léman Aviation and Sloane. On the other hand, its partner in India, Universal Vulkaan Aviation, secured 5 orders for this model and 3 for helicopters (AW109, AW169, and AW139).

Key Civil Helicopter Market Insights Summary:

Regional Highlights:

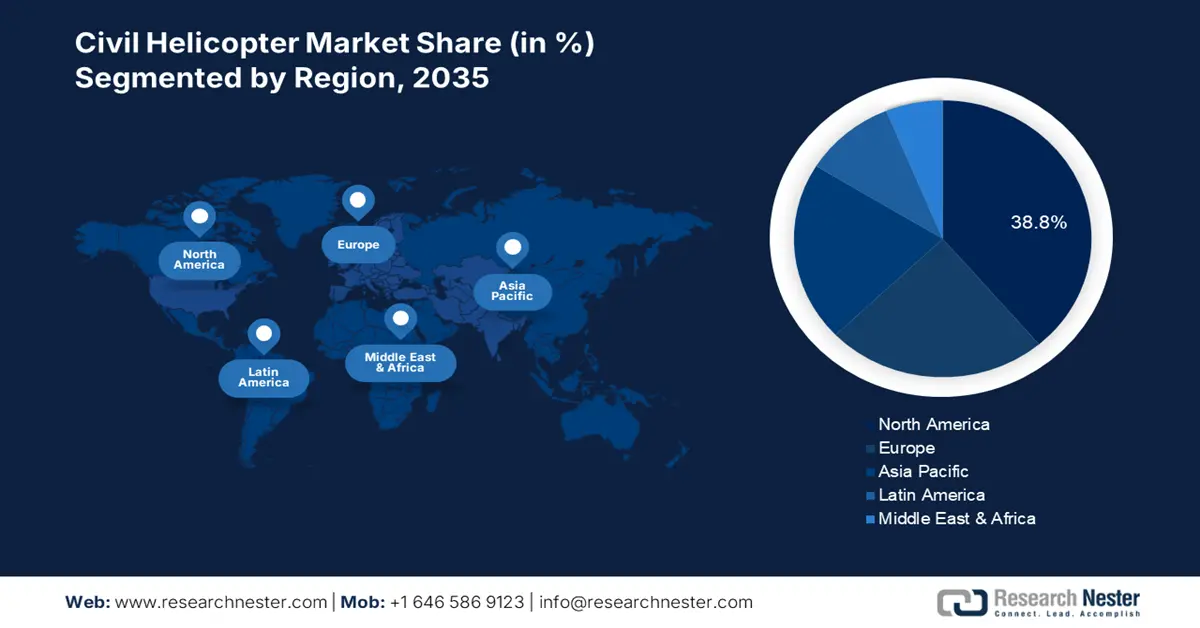

- North America civil helicopter market will dominate over 38.8% share by 2035, driven by increasing utilization of rotorcrafts in industries such as oil & gas, healthcare, and corporate sectors.

- Asia Pacific market will register moderate growth during the forecast timeline, driven by government spending, disaster response needs, and investments from global helicopter manufacturers.

Segment Insights:

- The search and rescue (sar) segment in the civil helicopter market is expected to gain considerable share by 2035, influenced by the increasing frequency of disasters and need for rapid aid and evacuation.

- The twin engine segment in the civil helicopter market is expected to show significant growth over 2026-2035, driven by the superior safety, reliability, and performance of twin-engine helicopters.

Key Growth Trends:

- Continuous upgrades in technology and assets

- Government initiatives and investments

Major Challenges:

- High associated expenses and sustainability concerns

Key Players: Bell Helicopter Textron Inc, AVIC Helicopter Company, Airbus S.A.S, Leonardo S.p.A, MD Helicopters Inc., Korea Aerospace Industries Ltd., Hindustan Aeronautics Ltd., Enstrom Helicopter Corporation, Lockheed Martin Corporation, Russian Helicopters JSC, Robinson Helicopter Company.

Global Civil Helicopter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.02 billion

- 2026 Market Size: USD 13.63 billion

- Projected Market Size: USD 21.62 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, France, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Civil Helicopter Market Growth Drivers and Challenges:

Growth Drivers

- Continuous upgrades in technology and assets: In search of compliance with current safety, efficiency, and cost-effectiveness standards, commercial fleets are increasingly modernizing their infrastructure, feeding financial growth in the civil helicopter market. To cope with the increasing demand for newer models, leading manufacturers are now offering hybrid and sustainable options, widening the product pipeline of this sector. For instance, in March 2025, magniX launched a new range of lightweight and high-speed engines, HeliStorm, for electric rotorcrafts. Its key features include: 6,000-7,000 RPM operating speed, 330kW peak power at just 75 kg, unmatched fault handling, and compatibility with both single & twin models.

- Government initiatives and investments: The worldwide urge for enhancing national surveillance, law enforcement, and rural connectivity is fueling the civil helicopter market significantly. The efforts of governing bodies and dedicated authorities to improve the quality and response time in the public service segment consist of air-transport accommodation. On this note, in March 2024, the Ministry of Civil Aviation (MoCA) in India launched HEMS to transform medical care and outreach. According to the pilot phase of this project, 1 fully-equipped helicopter is allocated to the helipad at AIIMS Rishikesh for a 1-year-term and is calling out other keen states such as Odisha and Madhya Pradesh.

Challenges

- High associated expenses and sustainability concerns: Being an expensive tool for transportation, these aircraft are often avoided by the majority population from price-sensitive regions. The maintenance and operational expenditures are also a few of the primary hurdles in the civil helicopter market, particularly in economic downturns. In addition, the sector has recently witnessed crashes of prototype models over a few under-development programs, adding to the risk of heavy financial loss. These may accumulatively discourage budget-constrained fleets from investing in this sector. Moreover, the growing environmental concerns about energy consumption and carbon emissions are also hindering globalization in this category.

Civil Helicopter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 13.02 billion |

|

Forecast Year Market Size (2035) |

USD 21.62 billion |

|

Regional Scope |

|

Civil Helicopter Market Segmentation:

Applications Segment Analysis

Based on applications, the search and rescue (SAR) segment is augmenting to capture a considerable share of the civil helicopter market by the end of 2035. According to a 2024 report from Our World in Data revealed that annually over 50,000 people across the world lose their lives due to disasters such as earthquakes, storms, floods, and droughts. Simultaneously, the Centre for Research on the Epidemiology of Disasters (CRED) claimed that the annual occurrence of such disasters has increased by 200 events in the past 20 years from 2023, in comparison to 100 in 1970. Thus, the ability of commodities availed by this merchandise to access remote, high-altitude, and natural disaster-afflicted areas has necessitated their incorporation into the majority of evacuation, humanitarian aid delivery, and situation surveillance missions.

Engine Type Segment Analysis

In terms of engine type, the twin segment is expected to gain significant traction in the civil helicopter market throughout the forecasted timeframe. The superiority of this type in delivering safety, reliability, performance, and capacity over others is the primary reason behind the rising customer interest in this segment. As a result, global leaders are also prioritizing and investing in developing these next-generation choppers. For instance, in March 2025, Airbus secured an order for 15 H140 helicopters from the Global Medical Response (GMR) right on the day of its first launch at VERTICON. This commercial accomplishment consolidated the company’s product penetration in the North America emergency medical services (EMS) industry. Such events indicate promising progress in this segment in the upcoming years.

Our in-depth analysis of the global civil helicopter market includes the following segments:

|

Application |

|

|

Engine Type |

|

|

Takeoff Weight |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Civil Helicopter Market Regional Analysis:

North American Market Insights

North America region is anticipated to hold over 38.8% market share by 2035. The region’s robust propagation is on account of the increasing utilization of rotorcrafts in well-established industries such as oil & gas, healthcare, and corporate. Thus, the domestic cohort of technological advances across this landscape is progressing with the influence of the latest industrial trends and requirements. For instance, in December 2023, Pratt & Whitney Canada, in collaboration with Leonardo, successfully completed the first 75-minute flight of the AW139 helicopter. This achievement attaining the goal of enabling 100% sustainable aviation fuel in this sector was powered by the PT6C-67C engine while delivering similar performance and power as Jet A1 fuel.

The U.S. is presenting a wider scope of business in the civil helicopter market with the strong presence of several giant SAR service providers. According to a study published by ScienceDirect, the count of disastrous events in this country was the 2nd highest in the world, accounting for 694 among 11,360 global events from 1995 to 2022. Considering the frequent occurrence of natural disasters in this country, many associated companies are exploring their potential to generate lucrative revenue from helicopter-based rescue operations. On this note, Bristow, a U.S.-based SAR company, highlighted that it participated in over 30,000 similar missions and saved 19,000 people from 1971 to 2025. These figures signify the continuous nationwide surge for gyroplanes.

APAC Market Insights

The Asia Pacific civil helicopter market is estimated to witness moderate growth over the assessed tenure. Developing countries in this region, such as China, Japan, and India, have a huge potential, backed by their government spending and highly disastrous events. For instance, Asia witnessed the maximum number of natural disasters from 1995 to 2022, accounting for 38.6% of the global occurrences (ScienceDirect). This scenario is further attracting both domestic and global pioneers to invest in this field. On this note, in October 2022, Airbus and Korea Aerospace Industries collaboratively delivered a light civil helicopter (LCH) to Gloria Aviation to support critical life-saving missions in Jeju Island, South Korea. Moreover, the government's efforts to improve medical response and outreach are also fueling the region’s progress.

The augmentation of India in the civil helicopter market is driven by several factors such as international collaborations, public investments, and medical & disastrous emergencies. The increased procurement of rotorcrafts by governing bodies to serve medical and law enforcement purposes is making this nation an emerging landscape for global leaders. For instance, in May 2023, the Ministry of Civil Aviation (MoCA) commenced the UDAN 5.1 phase of its helicopter service initiative, the Regional Connectivity Scheme (RCS). This was intended to broaden the scope for operators, expand viability gap funding (VGF), and reduce airfare caps to improve public access.

Civil Helicopter Market Players:

- Bell Helicopter Textron Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AVIC Helicopter Company

- Airbus S.A.S

- Leonardo S.p.A

- MD Helicopters Inc.

- Korea Aerospace Industries Ltd.

- Hindustan Aeronautics Ltd.

- Enstrom Helicopter Corporation

- Lockheed Martin Corporation

- Russian Helicopters JSC

- Robinson Helicopter Company

The civil helicopter market is evolving with continuous R&D, empowered by stable capital influx and strategic collaborations from key players. Their efforts to enhance product capability in a wide range of applications are encouraging more individuals and business fleets to invest in this sector. For instance, in July 2024, Tata Advanced Systems partnered with Airbus to construct a H125 Final Assembly Line (FAL) in India. This facility was crafted to establish a strong production chain and supply network for H125 helicopters in India and its neighboring countries. Such innovations are further inspiring other companies to engage in more development projects and expand commercial territory. This cohort of pioneers include:

Recent Developments

- In March 2025, Airbus unveiled its new multi-mission light twin helicopter, H140, at the vertical lift industry show VERTICON in Dallas, Texas. It is a 3-tonne class rotorcraft that is engineered to deliver remarkable performance, cost-effectiveness, and passenger & crew comfort.

- In March 2025, Robinson Helicopter Company redesigned its website, www.robinsonheli.com, to provide public access to the latest helicopter configurator, publications, flight training, and maintenance courses. Its modern design and intuitive navigation are crafted to improve buyers’ customizations and visualization experience.

- Report ID: 1443

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Civil Helicopter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.