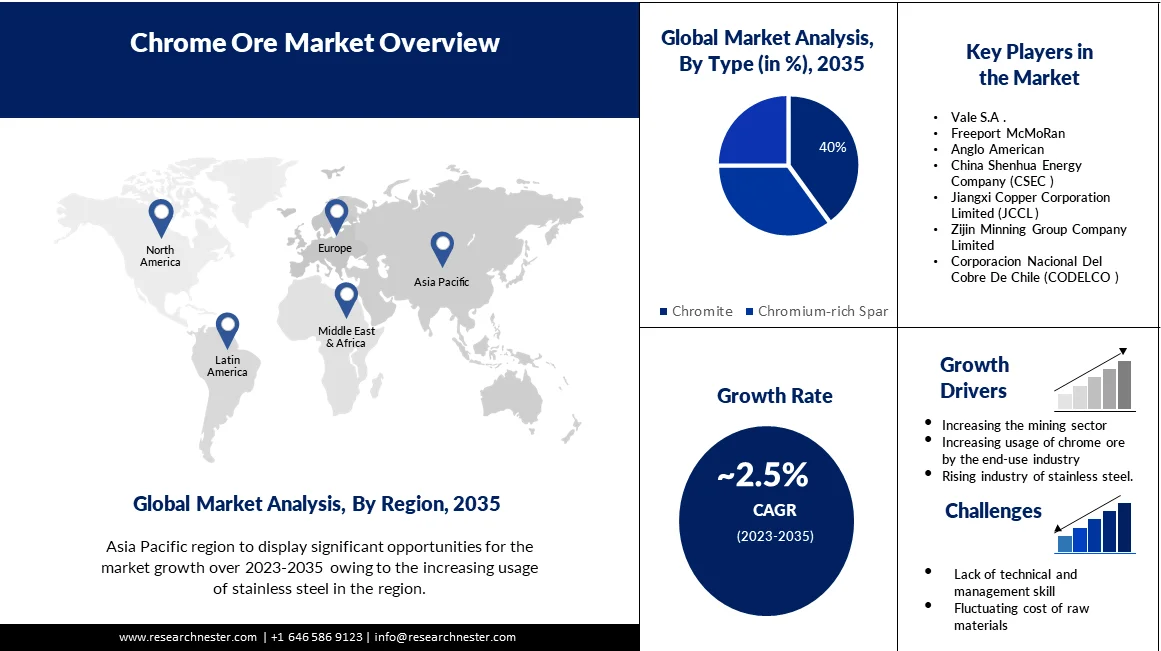

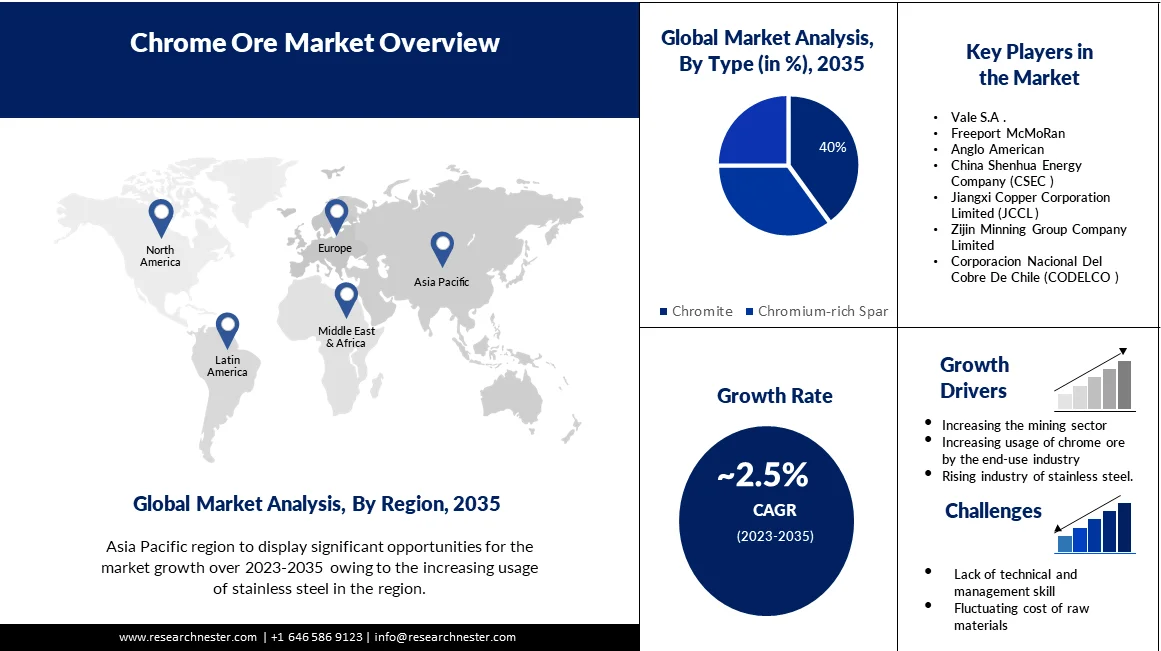

Chrome Ore Market size is expected to cross USD 6.58 Billion by the end of 2035, expanding at a CAGR of 2.5% during the forecast period, i.e., 2023 – 2035. In the year 2022, the industry size of chrome ore was around USD 4.9 Billion. The demand for stainless steel in areas such as construction is driving the growth of the market. According to the American Institute of Architects, non-residential building construction in the United States is expected to boost by 3.1 % by 2022. Hotel construction is expected to increase by 8.5% in 2022, while office space construction by 0.2%.

Governments in many regions have implemented policies to promote chrome ore mining. Such efforts are increasing the chrome ore market growth. In 2021, Chromium Ore was the world's 696th most traded product, with a total trade of $2.63B. Between 2020 and 2021 the exports of Chromium Ore grew by 28.3%, from $2.05B to $2.63B. Trade in Chromium Ore represents 0.012% of total world trade.

Growth Drivers

Challenges

|

Base Year |

2022 |

|

Forecast Year |

2023-2035 |

|

CAGR |

~ 2.5% |

|

Base Year Market Size (2022) |

~ USD 4.9 Billion |

|

Forecast Year Market Size (2035) |

~ USD 6.58 Billion |

|

Regional Scope |

|

Type (Chromite, Chromium-rich Spar, Hard Chrome Spinel)

The chromite segment accounts for the largest revenue and has a 40% share of the chrome ore market. Chromite is an essential element that is used in the manufacture of stainless steel, to harden steel and to form iron-free high-temperature alloy. They are also used for chromium plating for surface protection. The chemical industry uses it in the production of chromium compounds for the tanning of leather.

Application (Stainless Steel, Metallurgical, Chemical & Foundry, Refractory)

Stainless steel dominates the segment and accounts for approximately 75% share of the chrome ore market whereas, 25% is being used for manufacturing chemicals, pigments, and refractories. Chromite is a primary component in the production of stainless steel. The chrome ore market is growing at a rapid pace due to its demand in the chemical, refractory, and pigment industries.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

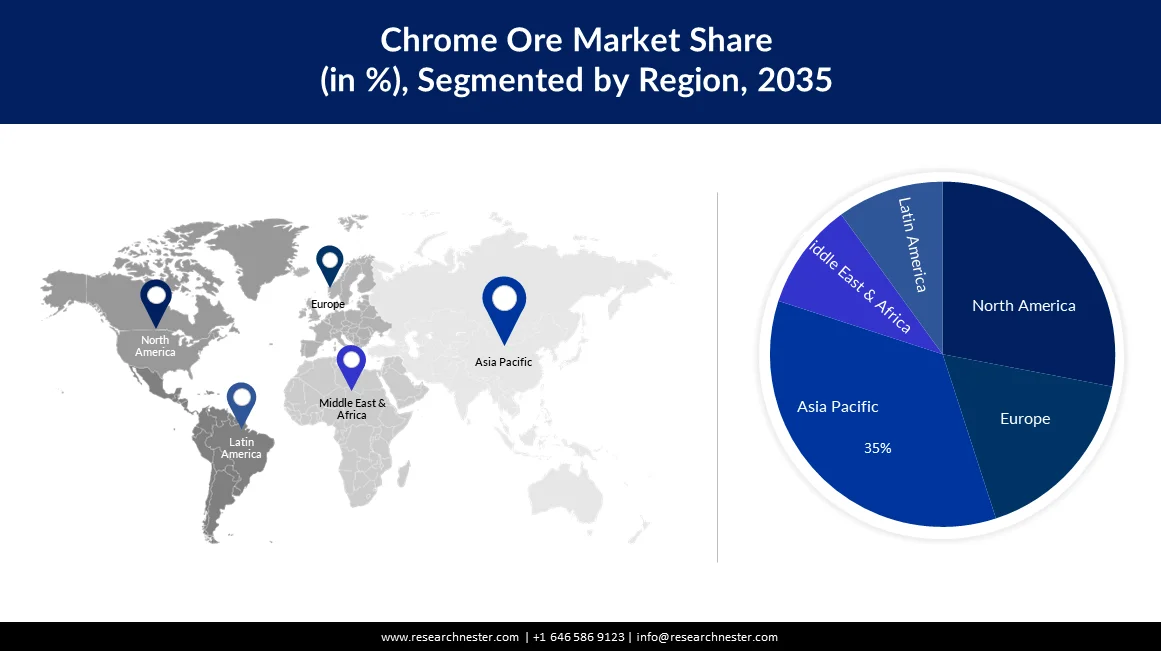

APAC Market Forecast

On the basis of region, Asia Pacific is the key region of the chrome ore market with a 35% revenue share and will be most dominating during the forecast period. The growth of the market in the region is due to the growth in the stainless-steel industry, and fewer restrictions imposed on the mining and exporting of ores for its wider application. For instance, Australia has the largest mining sites and rich rock formations for mineral extraction by end users can also drive the growth of the market during the predicted year. South Africa, India, Finland, Turkey, and Kazakhstan are the leading producers of chrome ore. In the forecast period of 2022 to 2029, the global market for refractories is estimated to grow from $33.01 billion in 2022, rising to $44.82 billion and reaching a compound annual growth rate of 4.5%.

Middle East and Africa Market Statistics

The Middle East and Africa chrome ore market is expected to showcase significant CAGR during the predicted year with a 28% market share. South Africa being one of the leading producers is a major supplier of chromite ore and ferrochromium to European Countries. Development in technology has also played a crucial role in increasing the growth of the market in the region as automatic machines and robots have made the mining process safe. 88% of companies plan to invest in adding automotive robotics to their organizations. In the world, over 3 million production robots are in use. Rise in the mining and exploration activities has also contributed to the growth of the market.

Author Credits: Richa Gupta, Harshita Srivastava

FREE Sample Copy includes market overview, growth trends, statistical charts & tables, forecast estimates, and much more.

Have questions before ordering this report?