Cholesterol API Market Outlook:

Cholesterol API Market size was valued at USD 337.2 million in 2025 and is projected to reach USD 523.5 million by the end of 2035, rising at a CAGR of 4.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cholesterol API is assessed at USD 352.37 million.

The global market is influenced by a large patient base, focused supply chains, and strategic trade dependencies, and India and the EU provide powerful production bases. The patient base in need of cholesterol-lowering treatments continues to be large and strong, propelling steady API demand. In the U.S., the Centers for Disease Control and Prevention (CDC) in October 2024 reported that almost 25 million adults have high cholesterol, i.e., 240 mg/dL, which is a main modifiable risk factor for cardiovascular disease. This provides a steady, large-scale ground for the Active Pharmaceutical Ingredient (API) market. A major quantity of generic statin APIs is produced from manufacturing centers in Asia, notably India and China.

Strategic investments are increasingly focused on securing supply chain resilience and driving next-generation manufacturing. Initiatives of the U.S. government, like the FDA's program to develop a more resilient medical product supply chain, are focused on avoiding over-reliance on single geographic sources of APIs. According to the Health Affairs report in June 2025, the national healthcare spending in 2024 was 8.2%, hence increasing the access to medical care and preventive treatment, which is likely to drive demand for cholesterol drugs and, in turn, the market for the cholesterol API.

Key Cholesterol API Market Insights Summary:

Regional Highlights:

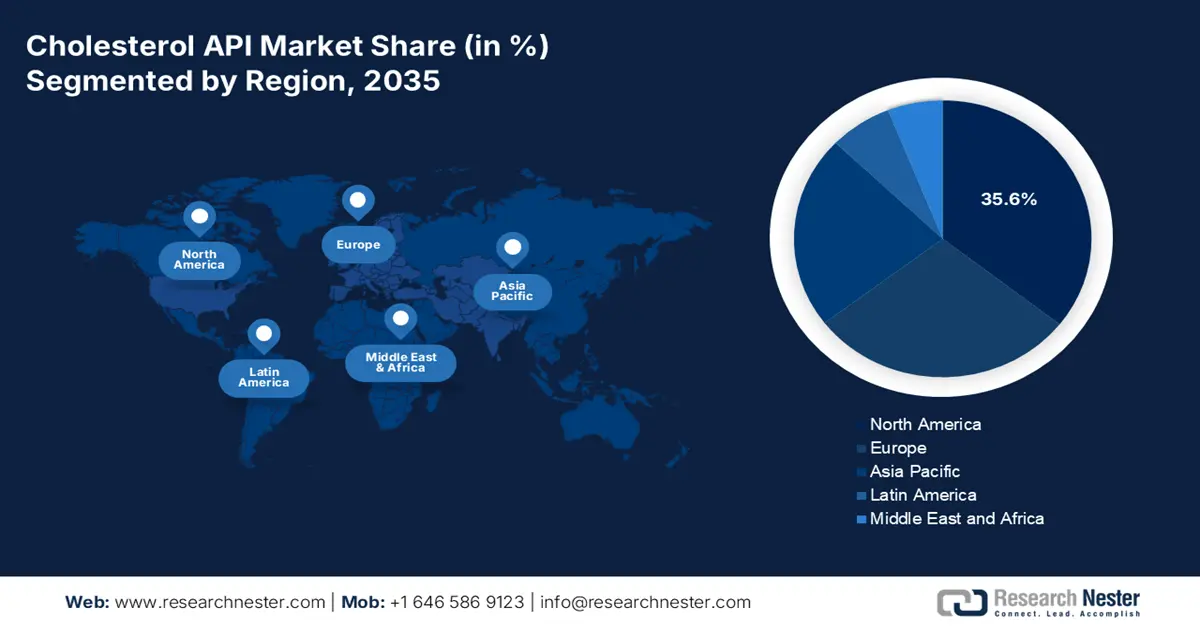

- North America is projected to command a 35.6% share by 2035 in the Cholesterol API Market, supported by the substantial cardiovascular disease burden and a strong generic pharmaceutical ecosystem.

- Asia Pacific is anticipated to expand at a 6.8% CAGR during 2026–2035, propelled by its rising cardiovascular patient pool and broadened healthcare access.

Segment Insights:

- Synthetic APIs are poised to capture a 95.5% share by 2035 in the Cholesterol API Market, reinforced by their cost-efficient chemical synthesis protocols.

- The generic drugs segment is expected to secure a sizable market share by 2035, encouraged by escalating cost-containment measures and accelerated generic substitution after major statin patent expirations.

Key Growth Trends:

- High and rising global prevalence of hypercholesterolemia

- Global aging demographics

Major Challenges:

- Regulatory hurdles and compliance costs

- Intense price pressure from genericization

Key Players: Zhejiang Garden Biochemical (China), NK Pharmaceuticals (India), Dishman Group (India), Zhejiang Biosynergy (China), Jiangxi Yichang (China), Anhui Chem-Bright (China), Ningbo Traditional Chinese Chemical (China), Zhejiang Langbo (China), Stason Pharmaceuticals (USA), Pfizer CentreOne (USA), BASF (Germany), Covis Pharma (Switzerland), S.A. Ajinomoto OmniChem (Belgium), Merck KGaA (Germany), Teva Pharmaceutical Industries (Israel), Sawai Pharmaceutical (Japan), Mylan N.V. (now part of Viatris) (USA), Hovione (Portugal), Fareva (France), ScinoPharm (Taiwan).

Global Cholesterol API Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 337.2 million

- 2026 Market Size: USD 352.37 million

- Projected Market Size: USD 523.5 million by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: Vietnam, Indonesia, Brazil, Mexico, Turkey

Last updated on : 22 October, 2025

Cholesterol API Market - Growth Drivers and Challenges

Growth Drivers

- High and rising global prevalence of hypercholesterolemia: The main driver is the rising patient population having high LDL cholesterol, which is a major risk factor for cardiovascular disease. The WHO report in July 2025 depicts that 19.8 million individuals globally died from CVDs in 2022. This creates a sustained demand for lipid-lowering therapies. National health surveys, such as the CDC, show a high prevalence of dyslipidemia in adult populations, ensuring a stable base for generic statin API consumption. This burden forces for continuous API production to address the formulary needs in private and public healthcare systems.

- Global aging demographics: Aging population in various regions such as Europe, North America and APAC are the key driver for the market. According to the PRB report in January 2024, 58 million people are aged above 65 and this number is set to rise. As the prevalence of high cholesterol and CVD rises with age, this demographic shift offers a growing addressable market for cholesterol-lowering drugs, hence sustaining the demand for API. This trend provides a predictable, long-term demand forecast for API manufacturers, supporting investment in production capacity.

- Patent expirations and growth of generic drug markets: Patent expirations of leading branded statins such as atorvastatin and rosuvastatin have unlocked the market for mass generic production, which is the biggest consumer of APIs. The U.S. FDA's Orange Book has hundreds of approved abbreviated new drug applications for generic statins, which shows an extremely competitive and volume-driven market. This transition enormously raises the need for inexpensive generic APIs from various manufacturers.

Percentage of Population with Hypercholesterolemia

|

Year |

Percentage |

|

2001-2004 |

26.3 |

|

2005-2008 |

27.5 |

|

2009-2012 |

27.8 |

|

2013-2016 |

27.1 |

|

2017-3/2020 |

25.4 |

Source: CDC October 2025

Challenges

- Regulatory hurdles and compliance costs: The major financial and operational barrier is the shift of stringent requirements of Good Manufacturing Practice of agencies such as the U.S. FDA and EMA. The cost of constructing the compliant facility is high, with ongoing quality control and audit expenses. The main failure results in import alerts and halting market entry. For instance, in 2023, the FDA has provided a warning letter to a major API plant for issues related to data integrity. This effectively blocks its U.S. shipments and showcasing the severe consequences of non-compliance.

- Intense price pressure from genericization: The market is extremely commoditized with patent expiries of major statins. The market is subject to severe competition, particularly from Asian players, lowering prices every year. Government programs such as the U.S. Medicare Part D program utilize generic competition to reduce expenditures, compelling API manufacturers to become ultra-cost-efficient in order to sustain margins. This renders profitability extremely difficult for new players lacking scale.

Cholesterol API Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 337.2 million |

|

Forecast Year Market Size (2035) |

USD 523.5 million |

|

Regional Scope |

|

Cholesterol API Market Segmentation:

Synthesis Type Segment Analysis

Synthetic APIs are dominating the segment and is poised to hold the share of 95.5% by 2035. As all the cholesterol-lowering drugs, including statins, are manufactured via chemical synthesis, demand the segment. This method provides a cost-effective and well-established manufacturing protocol while comparing with biotechnology routes. The World Health Organization (WHO) prequalifies many synthetic statin APIs, ensuring their quality and efficacy for global use and reinforcing the segment's near-total market penetration over biological alternatives.

Drug Type Segment Analysis

The generic drugs segment is expected to hold a significant percentage of the market in 2035. The segment is fueled by significant cost pressures from healthcare systems and the patent expiry of all major branded statins. Governments and insurers actively promote generic substitution to minimize the costs. The Association of Accessible Medicine 2025 report depicts that nearly 90% of all U.S. prescriptions are filled with generics drugs, highlighting the demand for affordable generic solutions.

Manufacturer Type Segment Analysis

Under the manufacturing type, the merchant API is leading the segment and is poised to hold a considerable share by 2035. This dominance is driven due to the strategic shift by various pharmaceutical companies from captive API production to outsourcing to specialized merchant manufacturers. This allows drug formulators to minimize the capital expenditure and use the expertise and cost competitiveness of dedicated API producers and build more resilient and flexible supply chains. Further, U.S. FDA include vast number of merchant API facilities, highlighting the vital role in supply of essential medicines such as statins.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Synthesis Type |

|

|

Drug Type |

|

|

Distribution Channel |

|

|

Manufacturer Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cholesterol API Market - Regional Analysis

North America Market Insights

North America is dominating the cholesterol API market and is poised to hold the share of 35.6% by 2035. The market is driven by a high burden of cardiovascular disease and a robust generic pharmaceutical industry. As per the CDC report in January 2025, 6.9% of the people visit physicians for a cholesterol test being ordered or performed. Rising awareness of cholesterol management and preventive healthcare measures is also contributing to increased demand for cholesterol-lowering medications and their APIs in the region.

The U.S. market for cholesterol is spearheading the region and is driven by a high incidence rate of cardiovascular disease and strong generic pharmaceutical production. A major trend is the shift towards local API manufacturing and procurement from reputed partners to minimize supply chain weaknesses, which is a priority highlighted by the FDA's initiatives to strengthen the medical supply chain. According to the Centers for Disease Control and Prevention (CDC) report in October 2024, nearly 86 million U.S. adults older than 20 have a total cholesterol level of more than 200 mg/dL, creating an ongoing demand for lipid-lowering drugs.

The cholesterol API market in Canada is defined by the reliance on imports and strong government pricing controls. Further, the rising pressure on API and drug costs which are driven by the regulatory bodies that directly impact the market dynamics. According to the report from the Heart and Stroke Foundation of Canada, cardiovascular disease is the leading cause of death, with high cholesterol is the major risk factor. Aligning with this, the government of Canada's report in July 2022 depicts that 1 in 12 people live with heart disease. This growing prevalence of heart disease is expected to sustain steady demand for cholesterol-lowering APIs and related pharmaceutical products in Canada.

Prevalence of High Cholesterol by Age and Gender

|

Age Group (years) |

Overall Prevalence (%) |

Men (%) |

Women (%) |

|

20-39 |

6.0 |

7.4 |

4.7 |

|

40-59 |

16.7 |

18.3 |

15.2 |

|

60+ |

11.3 |

5.6 |

16.4 |

Source: CDC November 2024

APAC Market Insights

Asia Pacific is the fastest-growing region in the cholesterol API market and is expected to grow at a CAGR of 6.8% during the forecast period 2026 to 2035. The region is fueled by the rising cardiovascular disease and expanding healthcare access. According to the NIH study in July 2024, nearly 60% of the cardiac patients globally live in Asia, hence underpinning the market demand. The market is further evolving with stringent regulatory harmonization and a focus on developing high-potency, next-generation statins.

Japan's API market for cholesterol is dominated by a high-value, advanced pharmaceutical industry and a fast-growing elderly population that guarantees steady demand. The National Health Insurance (NHI) system of the government imposes high cost pressures, promoting generic medicines and driving the procurement costs of APIs. One of the trends is the collaborative agreement between local and foreign API producers to guarantee a secure supply of high-quality materials. Further, the country is the leading importer of APIs, with high regulatory standards from the PMDA guaranteeing quality.

China is the global leader in the production and export of cholesterol APIs, with a gigantic domestic market boosted by increasing CVD incidence. The government's Made in China 2025 policy focuses on pharmaceutical development and the indigenous production of high-quality APIs. As per the OEC 2023 report, China exports USD 25 million of pharmaceutical goods, including cholesterol API, globally. Further, China holds a dominant position in the global statin API value chain. Rising domestic hypercholesterolemia cases further boosts the internal demand.

Trade Flow of Pharmaceutical Products in 2023, Including Cholesterol API

|

Country |

Trade Flow |

Value (USD) |

|

China |

Import |

12.1 million |

|

India |

Export |

8.5 million |

|

Malaysia |

Export |

5.54 million |

|

Japan |

Import |

3.05 million |

Source: OEC 2023

Europe Market Insights

Europe is the second-largest cholesterol API market and is defined by robust regulatory oversight from EMA and a high prevalence of cardiovascular disease. The region is further driven by the rising aging population, high penetration of generic statins, and a continuous demand for cost-effective treatments. The World Heart Federation report in May 2023 depicts that nearly 239.9 deaths per 100,000 people occurred in the region due to cardiovascular disease, highlighting the market demand.Leading producers who adhere to strict Good Manufacturing Practice (GMP) guidelines and environmental laws further consolidate the market.

Germany is expected to have the highest share in Europe's cholesterol API market by 2035. Its leadership is driven by the position as Europe's biggest pharmaceutical market and a center for advanced API production. The High-Tech Strategy of the German government has facilitated innovation in pharmaceutical manufacturing, such as active ingredients. The trend in the market is heading towards sustainability of the environment in API manufacturing and continuous manufacturing, with support from the German Federal Ministry for Economic Affairs and Climate Action.

The UK’s cholesterol API market is driven by the huge cardiovascular cases and the rising elderly population. The British Heart Foundation report in 2025 states that around 7.6 million people in the nation are living with heart or circulatory diseases. The National Health Service exerts significant cost pressure, spending billions annually on statins, which is heavily influenced in generic API procurement costs. While the NHS budget is not broken down by API spend, its main focus is on cost-effective generics demanding market dynamics.

Key Cholesterol API Market Players:

- Zhejiang Garden Biochemical (China)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NK Pharmaceuticals (India)

- Dishman Group (India)

- Zhejiang Biosynergy (China)

- Jiangxi Yichang (China)

- Anhui Chem-Bright (China)

- Ningbo Traditional Chinese Chemical (China)

- Zhejiang Langbo (China)

- Stason Pharmaceuticals (USA)

- Pfizer CentreOne (USA)

- BASF (Germany)

- Covis Pharma (Switzerland)

- S.A. Ajinomoto OmniChem (Belgium)

- Merck KGaA (Germany)

- Teva Pharmaceutical Industries (Israel)

- Sawai Pharmaceutical (Japan)

- Mylan N.V. (now part of Viatris) (USA)

- Hovione (Portugal)

- Fareva (France)

- ScinoPharm (Taiwan)

- Zhejiang Garden Biochemical is the leading company in the market. The company focuses on securing a dominant supply chain position, producing cholesterol that meets the stringent international pharmacopoeia standards for use in lipid-based drug delivery systems, liposomes, and more. The company’s strategic initiative involves scaling the production capacity and advancing purification technologies to grow the demand from the pharmaceutical and nutraceutical industries

- NK Pharmaceuticals is a significant player from India specializing in the manufacturing of hormone intermediates and steroids with a focus on cholesterol API, with total income of the company in 2024 reaching Rs. 40.36 lakhs. The company produces high-quality cholesterol used in many applications, such as pharmaceutical formulations and other active ingredients. Further, it strengthens its position by optimizing its purification and synthetic process to enhance the yield and position as a reliable, quality-focused supplier in the global cholesterol API supply chain.

- Dishman Group is a contract research and manufacturing services provider with a high presence in the cholesterol API segment. The company provides high-purity, pharmaceutical-grade cholesterol that is produced under cGMP standards. These products are primarily for use in complex formulations for oncology and other injectables. Dishman’s strategic focus is on providing an integrated service from development to commercial manufacturing.

- Zhejiang Biosynergy is a key manufacturer in China focused on specialty biochemicals, including a robust portfolio in cholesterol APIs and their derivatives. Further, the company's main focus is on innovation and quality that meets the requirements for advanced drug delivery systems. On the other hand, it has made significant investments in research and development to create new cholesterol derivatives with enhanced functionality and to improve its purification methods for increased bioavailability as part of its strategic ambitions.

- Jiangxi Yichang is a major supplier in the global cholesterol market, with a strong foundation in the production and export of pharmaceutical-grade cholesterol. The company's total revenue earned in 2024 is 520,928,245,943 yuan, and it focuses on leveraging China's raw material advantage to provide cost-competitive and high-quality cholesterol APIs for a wide range of global customers. Its strategic initiatives are centered on scaling its manufacturing output and enhancing its global distribution network to ensure a steady supply.

Below is the list of some prominent players operating in the global market:

The global market is very competitive and is dominated by both India and China manufacturers who focus on cost-effective production and vertical integration from raw wool grease. Some key players, such as Zhejiang Garden Biochemical and Dishman Group, are leading the market. The competitive landscape is driving the strategic initiatives focused on backward integration to secure raw material supply and ensure consistent quality. For example, in May 2022, Cadila Pharma, one of the leading pharmaceutical companies, launches Belmore, which is used to treat uncontrolled LDL-cholesterol. This growing innovation is surging the market growth.

Corporate Landscape of the Cholesterol API Market:

Recent Developments

- In April 2025, Zydus Lifesciences received U.S. FDA approval to launch Niacin, which is an extended-release tablet available in 500 mg, 750 mg, and 1,000 mg doses. The tablet targets a USD 5.5 million market share in the U.S. market.

- In September 2024, Tiefenbacher Pharmaceuticals has prepared the launch of the generic version of Ezetimibe or Atorvastatin across the EU. This combination therapy is used to reduce the production of cholesterol in the liver.

- Report ID: 4243

- Published Date: Oct 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cholesterol API Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.