Childhood Absence Epilepsy Treatment Market Outlook:

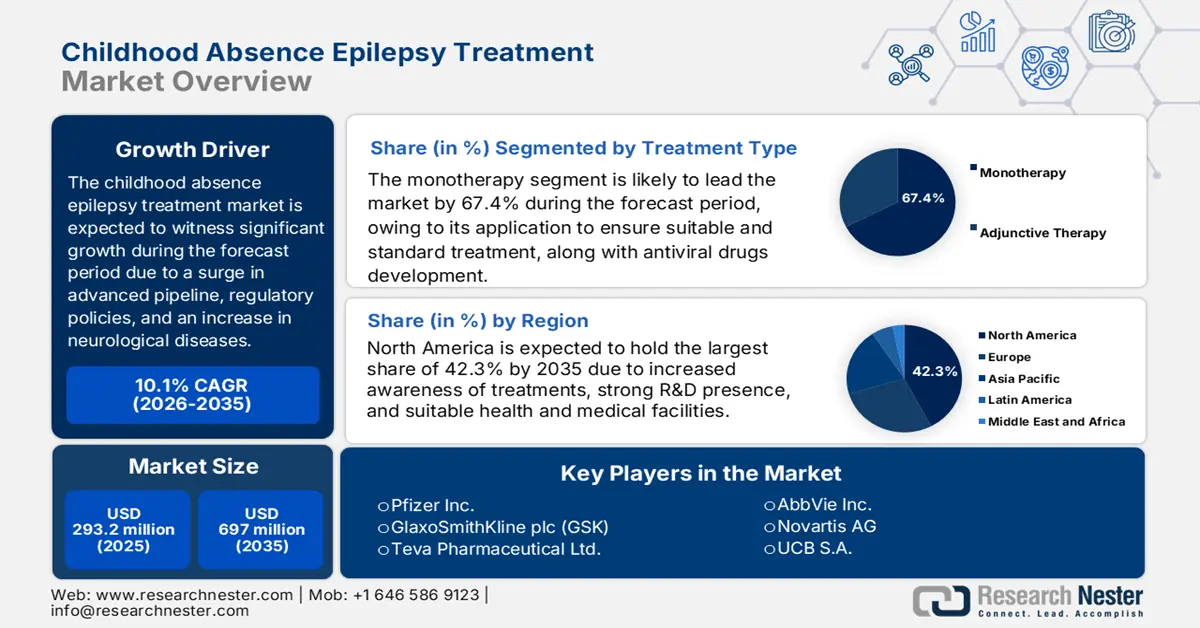

Childhood Absence Epilepsy Treatment Market size was USD 293.2 million in 2025 and is anticipated to reach USD 697 million by the end of 2035, increasing at a CAGR of 10.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of childhood absence epilepsy treatment is estimated at USD 322.8 million.

The market is witnessing sustained growth, which is readily driven by a combination of economic, regulatory, and scientific factors that develop a suitable environment for commercial and innovative expansion. These include an in-depth understanding of pathophysiology, a strong and advanced pipeline, regulatory frameworks for pediatric incentives and orphan drugs, and expedited approval pathways. Besides, there are different types of seizures that are effectively uplifting the market. As per an article published by NIH in April 2025, an estimated 60% of people with epilepsy suffer from foal seizures, thereby enhancing the market’s exposure internationally.

Moreover, an increase in optimized diagnostic capabilities, focus on rare diseases, a surge in unmet medical demand, and premium pricing of advanced therapeutics are also positively impacting the market across different nations. According to an article published by the NIH in January 2025, approximately 25 to 30 million people in America are affected by rare diseases. In addition, the UDP has achieved almost 10,000 inquiries, reviewed over 3,000 applications, and admitted more than 900 patients. Therefore, all these aspects play a crucial role in uplifting the overall market worldwide.

Key Childhood Absence Epilepsy Treatment Market Insights Summary:

Regional Insights:

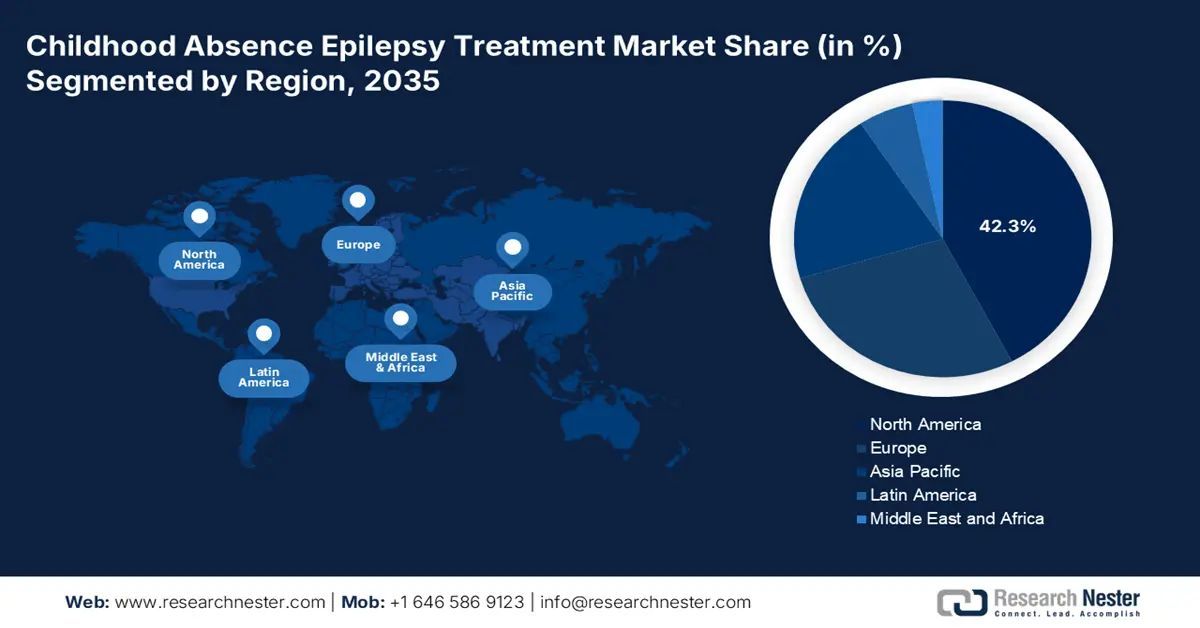

- North America in the Childhood Absence Epilepsy Treatment Market is anticipated to command a substantial 42.3% share by 2035, owing to advanced healthcare infrastructure, strong pharmaceutical R&D, and expanding adoption of digital health tools and telemedicine.

- Asia Pacific is expected to register the fastest growth through 2026–2035, fueled by rapid pediatric population expansion, rising healthcare expenditure, and intensified neurological research collaborations.

Segment Insights:

- The monotherapy segment in the Childhood Absence Epilepsy Treatment Market is projected to capture a dominant 67.4% share by 2035, propelled by its effectiveness in addressing various disease forms and the widespread utilization of antiviral drugs in diverse treatment protocols.

- The 6–10 years segment is anticipated to secure the second-largest share by 2035, spurred by the peak onset of CAE cases within this age range and the resulting emphasis on early diagnosis and consistent therapeutic adherence.

Key Growth Trends:

- Focus on precision medicine and targeted therapies:

- Increase in orphan drug integration

Major Challenges:

- Budget limitations in public health systems

- Reference pricing and generic competition

Key Players: Pfizer Inc., GlaxoSmithKline plc (GSK), Teva Pharmaceutical Ltd., AbbVie Inc., Novartis AG, UCB S.A., Sanofi S.A., Bausch Health Companies, Johnson & Johnson, Abbott Laboratories, Biocon, Cadila Pharmaceuticals, Albany Molecular Research, GW Pharmaceuticals, Sunovion Pharmaceuticals.

Global Childhood Absence Epilepsy Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 293.2 million

- 2026 Market Size: USD 322.8 million

- Projected Market Size: USD 697 million by 2035

- Growth Forecasts: 10.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Australi

Last updated on : 1 October, 2025

Childhood Absence Epilepsy Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Focus on precision medicine and targeted therapies: These are essential for uplifting the childhood absence epilepsy treatment market way beyond the one-size-fits-all approach. This is possible by adopting suitable treatment and disease prevention to personal variability in lifestyle, environment, and genes. According to an article published by NLM in December 2023, the successful establishment of particular clinical protocols by incorporating a precision medicine approach caters to at least 85% of patients receiving standard treatment options, thereby suitable for bolstering the overall market globally.

- Increase in orphan drug integration: Orphan drugs are crucial since they provide suitable treatment options for patients suffering from rare diseases, which denotes an optimistic outlook for the market’s exposure. As per the June 2023 NLM article, here has been an increase in orphan approvals, including formulation, indication, and molecule formulations from 14 to 77. In addition, as of 2022, drugs that effectively aided rare diseases represented almost half, which is 49% of overall novel drugs, along with biologics, that are readily cleared from the FDA.

- Accuracy in improved diagnosis: This service is essential for the childhood absence epilepsy treatment market, since it provides earlier and more accurate disorder identification. This, in turn, leads to appropriate and timely treatment, which optimizes patient outcomes, diminishes healthcare expenses by overcoming advanced disease and hospitalization, and enhances the efficacy of the overall healthcare system. As per an article published by OECD in September 2024, almost 80%of harm caused by misdiagnosis or delay can be preventable, thus denoting the increasing importance of diagnostics which are essential for boosting the market.

CT, MRI, and PET Scans (2022) Uplifting the Market

|

Countries |

Total Number of Scans |

|

Korea |

397 |

|

Austria |

381 |

|

France |

379 |

|

Germany |

299 |

|

Canada |

225 |

|

Cosa Rica |

65 |

Source: OECD

Challenges

- Budget limitations in public health systems: In low- and middle-income nations, public health budgets are critically constrained and readily prioritized against infectious disorders, as well as primary care, which is causing a hindrance in the childhood absence epilepsy treatment market. Besides, expensive neurological treatments for chronic conditions, such as CAE, are frequently deemed poor cost-effectiveness. In addition, the WHO has readily denoted a treatment-based gap, which has exceeded across different regions, owing to a lack of medicines and resources. This has resulted in making the market entry unviable without radical pricing approaches.

- Reference pricing and generic competition: The childhood absence epilepsy treatment market is effectively anchored by effective and low-cost generics, including ethosuximide, which has set a very low reference price. It is essential that the newly introduced drug demonstrate dramatic superiority to successfully justify a price that might comprise a higher magnitude. This is almost an economic and insurmountable clinical hurdle negatively impacting the overall market globally. Besides, payers have benchmarked all new therapies against this generic price aspect, thus pressuring manufacturers into impossible negotiations.

Childhood Absence Epilepsy Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.1% |

|

Base Year Market Size (2025) |

USD 293.2 million |

|

Forecast Year Market Size (2035) |

USD 697 million |

|

Regional Scope |

|

Childhood Absence Epilepsy Treatment Market Segmentation:

Treatment Type Segment Analysis

Based on the treatment type, the monotherapy segment in the childhood absence epilepsy treatment market is projected to account for the highest share of 67.4% by the end of 2035. The segment’s growth is highly driven by its capability to aid any disease, and in this process different antiviral drugs are developed and are readily utilized in numerous treatment procedures. According to a clinical study published by the Ash Publications Organization in August 2023, 88 patients were readily enrolled to evaluate this particular therapy. This resulted in a controlled CR rate of 205, and the overall CR and response rates were 23.9% and 42.0%, thus suitable for uplifting the overall segment.

Age Group Segment Analysis

Based on the age group, the 6-10 years segment in the childhood absence epilepsy treatment market is projected to cater to the second-highest share during the forecast timeline. The segment’s upliftment is highly fueled by the peak CAE onset occurrence within this particular range, which directly drives the initial treatment and diagnostic demand. This cohort is the ultimate focus of clinical guidelines, which suggest rapid intervention upon diagnosis to combat long-lasting educational and cognitive impacts. Besides, the aspect of treatment adherence is closely observed by caregivers and pediatric neurologists, thus ensuring continuous prescription volumes.

Distribution Channel Segment Analysis

Based on the distribution channel, the hospital pharmacies segment in the childhood absence epilepsy treatment market is predicted to cater to the third-highest share by the end of the projected duration. The segment’s development is highly driven by being the ultimate point of care for the original diagnosis and complicated case management by pediatric neurologists. The commencement of therapy, particularly with intravenous or specialized formulations, usually occurs in a hospital setting to permit for close observation of potential and efficacy adverse effects. Besides, various innovative second-generation anti-seizure drugs and overall pipeline biologics are considered specialized medications, thus suitable for the segment’s upliftment.

Our in-depth analysis of the childhood absence epilepsy treatment market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Type |

|

|

Age Group |

|

|

Distribution Channel |

|

|

Drug Class |

|

|

Disease Type |

|

|

End users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Childhood Absence Epilepsy Treatment Market - Regional Analysis

North America Market Insights

North America in the childhood absence epilepsy treatment market is anticipated to garner the largest share of 42.3% by the end of 2035. The market’s growth in the region is highly attributed to advanced healthcare infrastructure, increased awareness about treatments, robust pharmaceutical R&D presence, a surge in pediatric epilepsy presence, personalized medicine incorporation, growing investments in digital health tools and telemedicine, and the presence of government policies. According to an article published by NLM in July 2024, the reported prevalence of epilepsy among children ranged from 2.5 to 5.5 per 1,000 children, especially in Canada, and from 4.7 to 7.3 per 1,000 children in the U.S., thus suitable for the market’s demand.

The childhood absence epilepsy treatment market in the U.S. is significantly growing, owing to the presence of a strict FDA-based regulatory framework to promote rapid approval for the latest anti-epileptic medications, a generous federal budget for research, an expansion in Medicare and Medicaid reimbursement policies, and an upsurge in wearable devices, along with digital health solutions. As per the September 2023 NLM article, a physician computer order entry system has the ability to diminish 55% of non-intercepted critical health errors in hospitals within the country, denoting an optimistic outlook for the market.

The childhood absence epilepsy treatment market in Canada is also growing due to the existence of provincial and federal government healthcare expenditure, increased investments in personalized pediatric epilepsy care services, administrative approval for research, partnerships between biopharma organizations and regional healthcare associations, and growing influence on telehealth services. According to the May 2024 Government of Canada report, an estimated 1 in 100 people in the country has epilepsy, thus denoting an increased exposure of the market in the country.

Healthcare Expenditure in North America (2023)

|

U.S. |

Canada |

||

|

Components |

Amount/Rate |

Components |

Amount/Rate |

|

Hospital care |

USD 1,519 (31.2%) |

Overall health spending |

USD 344 billion |

|

Other personal healthcare |

USD 800.8 (16.5%) |

Per person expenditure |

USD 8,740 |

|

Physician services |

USD 721.7 (14.8%) |

GDP |

12.1% |

|

Prescription drugs |

USD 449.7 (9.2%) |

Hospital, drugs, and physicians |

26%, 14%, and 14% |

|

Net cost of health insurance |

USD 302.9 (6.2%) |

MRI machine expense |

USD 3 million |

|

Clinical services |

USD 256.3 (5.3%) |

Public funding for healthcare expenses |

70% |

|

Investment |

USD 238.8 (4.9%) |

Canada Health Transfer |

21.5% |

Sources: AMA, April 2025; CMA 2025

APAC Market Insights

Asia Pacific in the childhood epilepsy treatment market is expected to emerge as the fastest-growing region during the projected duration. The market’s development in the region is highly subject to a rapid increase in the pediatric population, an expansion in health and medical spending, enhanced private and public investments in pediatric neurology and neurological research, and collaboration in research and development. As per the 2025 UNICEF data report, almost 659 million children are under 18 years of age, accounting for 36% of the overall population in the region, denoting a high epilepsy prevalence.

The childhood epilepsy treatment market in China is gaining increased traction, owing to an upsurge in government spending for increased epilepsy treatment services, the presence of strong administrative frameworks by the National Medical Products Administration (NMPA), extension in healthcare coverage, as well as outreach programs, growth in the domestic pharma sector, and an increase in innovative diagnostic technology integration. According to the October 2023 NLM article, the country comprises 4 billion, which is 50% of the global population, of which 23 million people suffer from epilepsy. Besides, 90% of patients in the region are devoid of standard treatment facilities, due to which the market is poised to gain more importance in the country.

The childhood epilepsy treatment market in India is also developing due to a steady increase in the healthcare budget allocation, increased patient pool, ongoing investments across pediatric neurology centers, government strategies to promote epilepsy awareness, and telehealth service integration, and healthcare quality maintenance. As per the May 2024 NLM article, the country comprised 160,891 health and wellness centers, out of which 15% were designated to community and public centers as of 2023. In addition, medical and health services are provided through a mid-level Health worker, along with 3 staff members offering referral and outreach services, thus suitable for the childhood absence epilepsy treatment market’s upliftment.

Epilepsy Prevalence and Incidence in Asia (2023)

|

Countries |

Prevalence (per 1,000) |

Incidence (per 100,000) |

|

China |

4.6 to 7 |

28.8 to 30 |

|

Japan |

2.7 to 4 |

24 to 53 |

|

India |

3 to 11.9 |

38 to 60 |

|

South Korea |

4.8 |

35.4 |

|

Indonesia |

5.6 |

50 |

|

Saudi Arabia |

6.5 |

- |

Source: NLM

Europe Market Insights

Europe in the childhood absence epilepsy treatment market is predicted to steadily grow by the end of the projected timeline. The segment’s upliftment is highly fueled by strong government strategies, an increase in funding for neurological disorder research, well-established healthcare facilities, collaborative regional policies uplifting cross-border innovation and research, an upsurge in childhood epilepsy, and personalized medicine and therapy approaches. As per an article published by NLM in December 2023, the overall expenses of brain disorders in the region are approximately EUR 798 billion, of which 37% caters to direct health expenses and 23% caters to direct nonmedical expenses, while 40% of indirect costs are readily associated with production losses.

The childhood absence epilepsy treatment market in Germany is gaining increased exposure, owing to suitable government expenditure, robust administrative environment for promoting advanced treatment development and early drug approvals, the presence of strong specialty clinics and hospital networks, increased implementation of neurostimulation devices, and deliberate involvement of medical associations. As per the December 2024 NIH article, 10% of the regional population earlier comprised insurance, and at present 100% of population undertake insurance services, thus denoting free medical treatment and medication facilities.

The childhood absence epilepsy treatment market in the UK is also growing due to an increase in the NHS budget, effective integration of telemedicine and digital health solutions, focus on public health strategies, government support for clinical studies, suitable emphasis on personalized treatment regimens, along with multidisciplinary care teams, and an extension in specialized pediatric neurology hubs. As stated in the March 2025 Informatics and Health article, an estimated 18% of the population in England are required to travel at least 20 minutes to reach the nearest general practitioner, thus denoting a huge opportunity for ensuring home healthcare service for epilepsy.

Key Childhood Absence Epilepsy Treatment Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GlaxoSmithKline plc (GSK)

- Teva Pharmaceutical Ltd.

- AbbVie Inc.

- Novartis AG

- UCB S.A.

- Sanofi S.A.

- Bausch Health Companies

- Johnson & Johnson

- Abbott Laboratories

- Biocon

- Cadila Pharmaceuticals

- Albany Molecular Research

- GW Pharmaceuticals

- Sunovion Pharmaceuticals

The global childhood absence epilepsy treatment market is extremely characterized by increased competition with international organizations grabbing substantial market shares, usually from Europe and the U.S., while Japan has maintained a robust regional presence. Notable organizations tend to focus on advancements in drug formulations and delivery, along with tactical partnerships and mergers, with the intention to extend their geographic reach and portfolios. Besides, the market growth is effectively propelled by a rise in awareness, progressions in personalized medicine, and enhanced pediatric epilepsy diagnosis, thus driving the overall childhood absence epilepsy treatment market across different nations.

Here is a list of key players operating in the global market:

Recent Developments

- In July 2025, Biocodex, along with Taiba Middle East FZ LLC, collectively signed an outstanding deal for Oman and Qatar, Kuwait, Bahrain, the United Arab Emirates, and Saudi Arabia markets for commercializing Diacomit, which is an antiepileptic drug for aiding Dravet syndrome.

- In July 2024, Marinus Pharmaceuticals, Inc. notified that China’s National Medical Products Administration (NMPA) has readily cleared ganaxolone oral suspension for the treatment of epileptic seizures in patients two years of age and older with CDKL5 deficiency disorder (CDD).

- In May 2024, Eisai Co., Ltd. declared that it has successfully achieved the approval for the additional indication of its in-house discovered antiepileptic drug (AED) Fycompa, suitable for aiding primary generalized tonic-clonic seizures in patients with epilepsy aged more than 12 years.

- Report ID: 8147

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Childhood Absence Epilepsy Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.