Chikungunya Treatment Market Outlook:

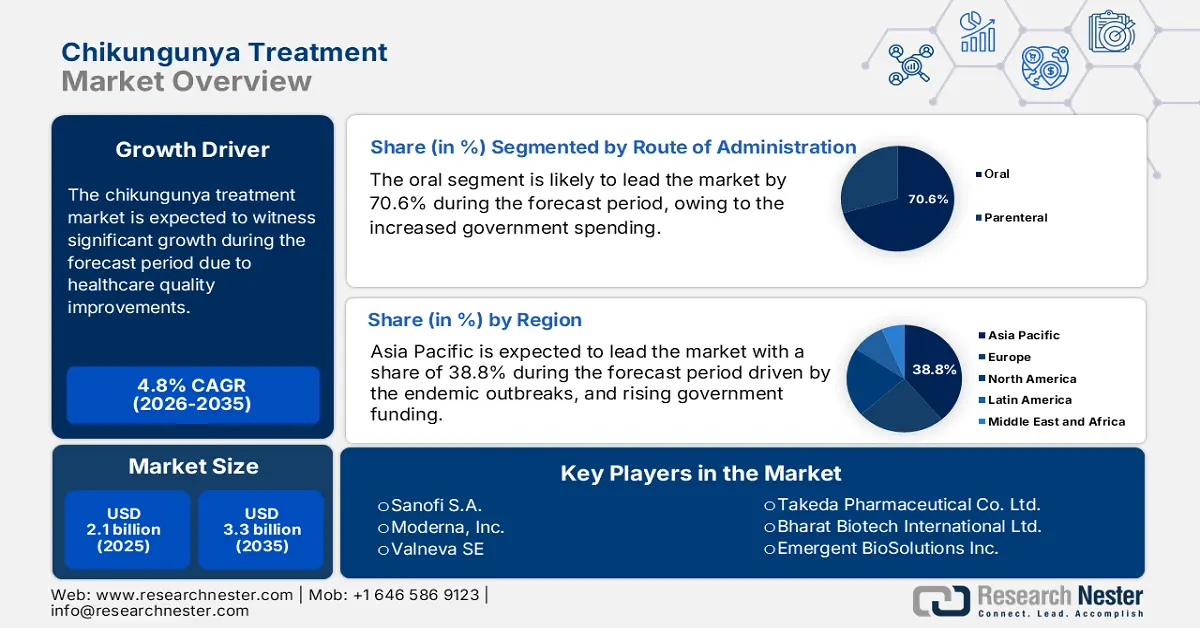

Chikungunya Treatment Market size was valued at USD 2.1 billion in 2025 and is projected to reach USD 3.3 billion by the end of 2035, rising at a CAGR of 4.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of chikungunya treatment is assessed at USD 2.2 billion.

The global chikungunya treatment market is driven by rising government investment in vector-borne disease control, demand for symptomatic relief treatment, including antivirals and NSAIDs, and an increase in incidence rates in endemic regions. The patient pool has a strong growth in tropical and sub-tropical regions. As per the Centers for Disease Control and Prevention, chikungunya virus cases have been reported over 103 countries and mostly confirmed in south and Southeast Asia, parts of the U.S., and Central America. Over 500,000 cases were registered globally in 2023, with 400 deaths reported, as per the European Centre for Disease Prevention and Control report in December 2023. This outbreak is creating a sustained demand for pharmaceutical interventions.

On the supply chain side treatment for chikungunya is mainly for generic NSAIDs, limited antiviral compounds, and supportive therapies including corticosteroids and fluids. API are mostly imported from India and China. As per the Rubicon Research report released in July 2024, the export of pharmaceuticals by India reached USD 24.0 billion, including 500 APIs. South Asia continues to be the hub for raw material acquisition and formulation. The device components in the healthcare sector, such as infusion kits and hospital syringes, are also imported to meet the demands. Strategic public procurement initiatives, such as Brazil’s Unified Health System (SUS), are helping local pharmaceutical manufacturers to scale up with chikungunya-related production via government tenders and subsidized raw material access.