Cellular M2M Market Outlook:

Cellular M2M Market size was valued at approximately USD 21 billion in 2025 and is projected to reach around USD 114.2 billion by the end of 2035, rising at a CAGR of approximately 19.1% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of cellular M2M is assessed at USD 25 billion.

The research and development in the market is mainly focused on increasing the connectivity and lowering the latency. Various prominent vendors are investing significantly in modern modules that are compatible with the NB-IoT and 5G standards to ensure cost-efficient communication. Extensive research and development have also been made in making embedded chipsets and cloud integration, fostering swift decision-making and real-time transfer of data. Additionally, alliances between semiconductor manufacturers, telecom companies, and IoT solution providers are speeding up the monetization of secure and interoperable avenues.

The market growth of the market is associated with the resilience of the global supply chain. The production of chipsets and various connectivity hardware depends on the well-timed availability of the semiconductors. Any type of disruption in the supply chain slows down the inclusion of the M2M solutions by restricting the availability of the device. On the other hand, an agile and robust supply chain increases scalability by fostering manufacturers to meet the burgeoning demand across a myriad of industries.

Key Cellular M2M Market Insights Summary:

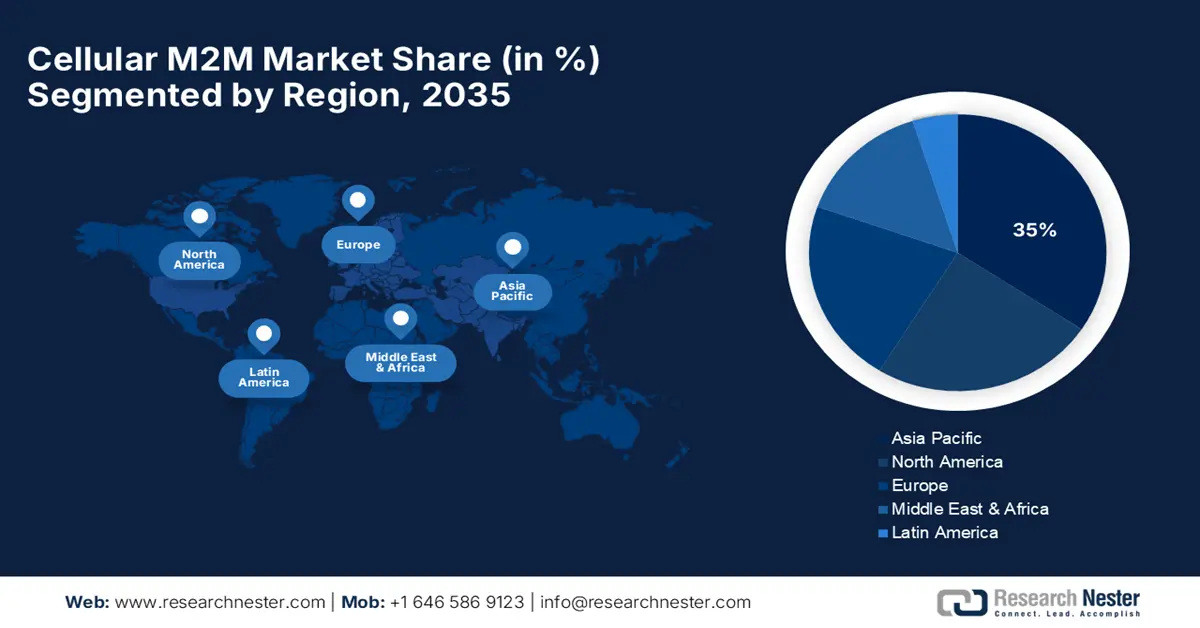

Regional Insights:

- The Asia Pacific Cellular M2M Market is projected to secure a dominant 35% share by 2035, impelled by government-led initiatives and the accelerating digitalization across key economies.

- North America is anticipated to register a CAGR of 14% from 2026 to 2035, fueled by rapid 5G deployment and a robust innovation ecosystem across diverse industrial applications.

Segment Insights:

- The connectivity services segment in the Cellular M2M Market is anticipated to retain a commanding 66% share by 2035, propelled by the rising demand for secure and dependable data transmission supporting large-scale M2M applications.

- By 2035, the asset monitoring and tracking segment is expected to account for 35% of the market share, owing to the surging requirement for cost-efficient asset supervision and compliance with stringent regulatory mandates across industries.

Key Growth Trends:

- Adoption of 5G and next-generation networks

- Increase in usage of the IoT and smart manufacturing

Major Challenges:

- Offering ubiquitous network coverage and reliability

- Rapid technological evolution

Key Players: Sierra Wireless, Telit, Thales Group (Gemalto), Huawei, Quectel, u-blox, SIMCom, Samsung SDS, ORBCOMM, Verizon, Ericsson, Telstra, Tata Communications, Maxis.

Global Cellular M2M Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21 billion

- 2026 Market Size: USD 2.93 billion

- Projected Market Size: USD 114.2 billion by 2035

- Growth Forecasts: 19.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: China

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, United Kingdom, Brazil, Australia, Singapore

Last updated on : 7 October, 2025

Cellular M2M Market - Growth Drivers and Challenges

Growth Drivers

- Adoption of 5G and next-generation networks: The mushrooming rollout of 5G networks is acting as a prominent catalyst for the growth of the market, enabling capabilities that conventional networks can not match. According to data published by the World Economic Forum, the 5G technology is projected to create more than USD 12 trillion in the worldwide economic value by 2035. The characteristics of the 5G networks, such as ultra-low latency, network slicing, and the capability to connect a mammoth number of devices per square kilometer, are pivotal for IoT use cases.

- Increase in usage of the IoT and smart manufacturing: The expeditious adoption of the IoT and the rising expansion of smart manufacturing are significant growth propelling factors for the market. Manufacturing industries are incorporating AI-powered control systems and robots for conducting seamless automation and predictive maintenance. According to the International Federation of Robotics, almost 276,288 industrial robots were installed globally in 2023 in factories. The initiatives for Industry 4.0, amalgamated with the government support for promoting smart factories, are speeding up the inclusion of cellular M2M. These factors are not only widespread on the scale of the deployment but also foster innovation, further fueling the significant market growth.

- Automotive sector’s drive for connectivity: The automotive industry has sprung up as one of the significant engines for fueling the growth of the market. The growth can be attributed to the burgeoning demand for the intelligent transport system and connected vehicles. Almost all the trailblazing automakers are embedding cellular M2M modules to enable ultra-modern features such as fleet management and vehicle tracking. As a result, the automotive sector’s push for advanced connectivity is not only expanding the scale of deployments but also raising the value of each connection, making it a key contributor to the sustained growth of the Cellular M2M market.

Challenges

- Offering ubiquitous network coverage and reliability: One major challenge lies in providing robust and consistent cellular connectivity to M2M devices, particularly in rural, remote, or far-flung locations where ground-based networks are often weak or nonexistent. Governments are taking initiatives toward ubiquitous coverage required for numerous life-critical M2M applications, such as agriculture and remote asset tracking.

- Rapid technological evolution: Leveraging the modern capabilities requires continuous updates in the devices and overall network infrastructure. These factors increase research and development investment costs for the providers. These factors increase the technical complexity in making multiple network generations compatible.

Cellular M2M Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

19.1% |

|

Base Year Market Size (2025) |

USD 21 billion |

|

Forecast Year Market Size (2035) |

USD 114.2 billion |

|

Regional Scope |

|

Cellular M2M Market Segmentation:

Services Segment Analysis

The connectivity services segment is projected to maintain its dominant 66% market share during the forecast period, as it serves as the foundational layer for all M2M applications. The tremendous growth in the number of connected devices is necessarily translating into a growing need for trusted and secure data transmission services. As organizations increasingly rely on data-driven decision-making, the services segment remains central to the deployment, management, and optimization of large-scale M2M networks.

Application Segment Analysis

By 2035, the asset monitoring and tracking segment is predicted to garner 35% of the share, driven by the burgeoning need across a myriad of industries. The technology renders a cost-efficient pathway to supervise the assets and optimize the utilization. The inclusion of connected sensors and cloud platforms enables companies to locate the asset and extract significant insights for making accurate decisions. Moreover, the stringent regulatory policy in prominent sectors such as food safety and pharmaceuticals is encouraging the adoption of precise tracking systems.

End-user Segment Analysis

The logistics and transportation segment is predicted to maintain a 29% share of the market until 2035. The growth of the market can be attributed to the significant characteristics of the cellular M2M technology for advanced fleet management and increasing transparency in the supply chain management. Additionally, according to the International Trade Administration, by 2027, the global B2C ecommerce revenue is anticipated to reach USD 5.5 trillion of growth. With the mushrooming growth of e-commerce and worldwide trade, logistics service providers are prioritizing interconnected technologies to ensure transparency and timely shipments of products.

Our in-depth analysis of the cellular M2M market includes the following segments:

|

Segment |

Subsegments |

|

Services |

|

|

Application |

|

|

End user |

|

|

Organization Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cellular M2M Market - Regional Analysis

APAC Market Insights

Asia Pacific cellular M2M market is likely to maintain a dominant 35% market share during the forecast period. The growth of the market can be attributed to the government-led initiatives and the rapid pace of digitalization across various countries. The burgeoning e-commerce sector in the region is speeding up demand for the real-time tracking of assets and fleet management. Moreover, China is representing fastest growing market globally, fueled by robust government support and increased IoT adoption. Backed by its large-scale manufacturing ecosystem, strong policy framework, and growing number of IoT device connections, China is positioned as a dominant force in the Cellular M2M market.

The market in India is expanding significantly, propelled by a surge in mobile penetration. Various programs, such as Smart Cities missions and Digital India, are encouraging widespread adoption of the connected infrastructure. According to the India Brand Equity Foundation, in 2025, the country garnered the Gross Merchandise Value of USD 14 billion, showcasing 12% of Y-o-Y growth. Also, the integration of IoT platforms in the country is increasing the precision and minimizing delays, making logistics a leading contributor to the growth of the market.

North America Market Insights

North America market is expected to record a CAGR of 14% from 2026 to 2035, owing to rapid uptake of 5G, a culture of excellent innovation, and a pervasive and diversified technology provider and end-user ecosystem. The region is a leader in the development and utilization of M2M solutions across several applications, such as connected automobiles and intelligent cities, industrial automation, and precision agriculture, with the help of a favorable regulatory environment and extensive investment.

The market in the U.S. is undergoing staggering growth, aided by robust enterprise adoption of IoT and the burgeoning growth of the 5G deployment. According to the National Cybersecurity Center of Excellence, there will be more than 75 billion IoT devices in use by the end of 2025. Moreover, the push for Industry 4.0 is creating innumerable opportunities for process automation with the use of M2M networks. The robust growth is also backed by strong research and development investments and the presence of state-of-the-art telecom infrastructure.

The market in Canada is also gaining traction through the swift adoption of IoT technologies. Moreover, the vast geography of the country and the robust logistics sector are propelling the demand for adequate asset management. Also, the supportive government policies for digital innovations, coupled with significant investment in smart city projects and industrial automation, are augmenting the market growth. Additionally, the healthcare industry is inculcating M2M-powered solutions for enabling connected ambulances and remote patient monitoring.

Europe Market Insights

The Europe market is flourishing steadily, propelled by the widespread adoption of the IoT and the extensive rollout of 5G networks. Moreover, the advanced automotive sector is instilling the need for vehicle telematics. The data published by the European Government in 2023 stated that the number of connected devices powered by IoT reached more than 40 million. Other than this, the market in the UK is witnessing significant growth, propelled by the presence of the advanced 5G infrastructure. Various government initiatives in the country are also fostering the adoption of cellular M2M technology.

Germany, being a significant hub for the smart industries, is a prominent driver for the market. The government is focusing on Industry 4.0 and aggressively including predictive maintenance. Various standards from the government for data security ensure that the providers focus on secure solutions, encouraging the overall expansion of the market in the country. Additionally, government initiatives supporting smart cities, energy efficiency, and intelligent transport systems encourage adoption of M2M solutions in urban infrastructure.

Key Cellular M2M Market Players:

- Sierra Wireless

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Telit

- Thales Group (Gemalto)

- Huawei

- Quectel

- u-blox

- SIMCom

- Samsung SDS

- ORBCOMM

- Verizon

- Ericsson

- Telstra

- Tata Communications

- Maxis

The cellular M2M market is competitive and sophisticated, with an extensive array of participants from module manufacturers, mobile network operators, platform businesses, and enterprise solution specialists. Key players such as Sierra Wireless, Telit Cinterion, Thales Group, Huawei, and Quectel are competing on the grounds of technological innovation, price, and the breadth of their product portfolios. The market is also driven by a trend towards strategic partnerships and the development of end-to-end, integrated solutions that decrease the complexity for customers' IoT deployments.

A notable trend reflecting competitive dynamics is Sierra Wireless' March 2023 release of a partnership with a leading cloud provider, offering a module-to-cloud solution. This move, which will reduce development time for new IoT applications by up to 40%, is indicative of the industry's shift towards providing more comprehensive and end-user-friendly solutions. With maturity in the market, having the ability to offer not just components but end-to-end, easy-to-deploy platforms will be a success differentiator.

Here are some leading companies in the cellular M2M market:

Recent Developments

- In March 2025, Sierra Wireless introduced advancements in IoT connectivity, highlighting the acceleration of 5G Standalone (SA) and network slicing adoption, along with the anticipated arrival of the SGP.32 eSIM standard.

- In September 2025, Samsung SDS launched 'REAL Summit 2025' at COEX, Seoul, unveiling its AI agent-based corporation innovation strategies and full-stack AI service strategies covering infrastructure, consulting, platform, and solutions for AI-based transformation.

- Report ID: 8174

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cellular M2M Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.