Cell Therapy Monitoring Kits Market Outlook:

Cell Therapy Monitoring Kits Market size was valued at USD 3.2 billion in 2025 and is expected to reach USD 5.36 billion by 2035, registering around 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cell therapy monitoring kits is evaluated at USD 3.35 billion.

The cell therapy monitoring kits market is growing immensely due to the surging number of cancer and autoimmune diseases, thus, it demands reliable and strong monitoring kits. For instance, the WHO revealed in February 2024 that, an estimated 9.7 million people died from cancer and 20 million new cases were reported in 2022. It was projected that 53.5 million people survived five years after receiving a cancer diagnosis. 1 in 5 people will get cancer at some point in their lives, and 1 in 9 men and 1 in 12 women will die from this disease. Moreover, a survey on UHC and cancer, only 39% of participating nations included the fundamentals of cancer management in their health benefit packages, and 28% of them provided coverage for palliative care, which includes pain management in general and not just for cancer patients.

In addition, increased applications of cell therapies in the clinical field and stringent regulatory guidelines drive the demand for quality and standardized monitoring kits. Improved cell analysis technologies, such as flow cytometry and PCR, usually incorporated into such kits, also drive market expansion through greater sensitivity and accuracy in cell characterization and quality assurance. For instance, in November 2023, Roche announced the launch of the LightCycler PRO System based on the proven gold standard technology of the LightCycler Systems. This new system bridges the gap between translational research and in vitro diagnostics, which includes solutions for researchers in the field of cancer, infectious diseases, and other public health challenges.

Key Cell Therapy Monitoring Kits Market Insights Summary:

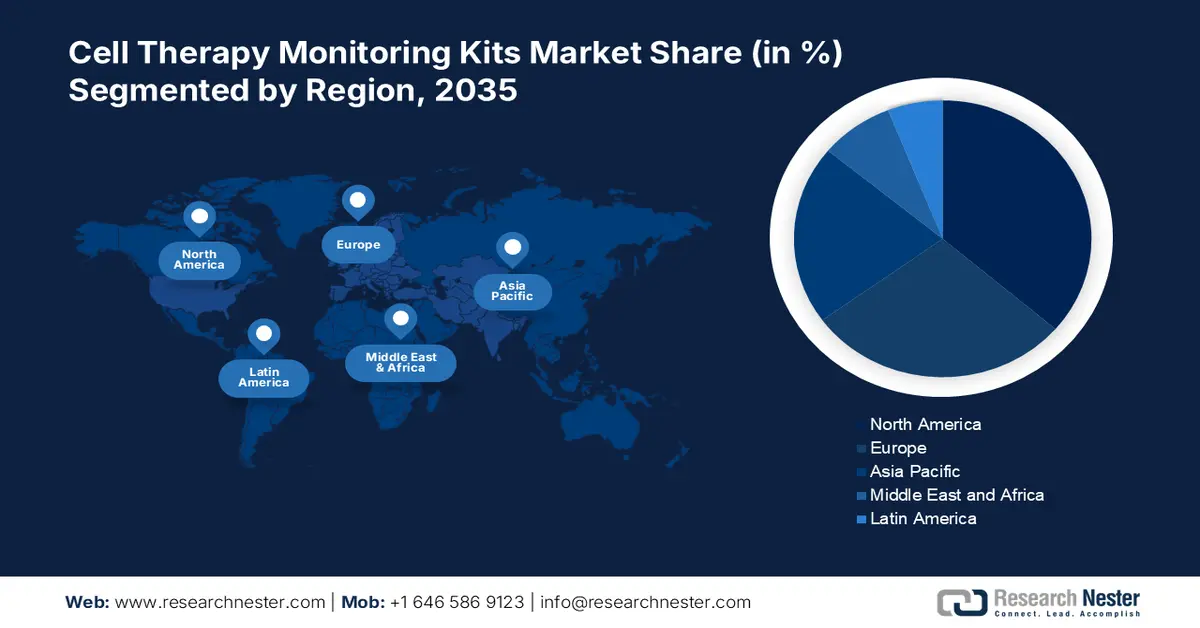

Regional Highlights:

- North America is expected to hold a 36.3% share by 2035, propelled by therapy effectiveness and ensured patient safety.

- Asia Pacific is likely to witness the fastest growth during 2025–2035, owing to accelerated access to cutting-edge treatments through regulatory frameworks.

Segment Insights:

- T-cell therapy segment is projected to account for 43% share by 2035, driven by strategic alliances and mergers expanding company portfolios.

- Oncology segment is anticipated to dominate the market by 2035, owing to rising global cancer incidence and the critical need for precise monitoring during cell therapies.

Key Growth Trends:

- Efficacy check through R&D activities and clinical trials

- Funding and grants

Major Challenges:

- Manufacturing and logistical complexities

- Potency assessment and product characterization

Key Players: STEMCELL Technologies Inc., Lonza Group, Thermo Fisher Scientific Inc., Merck KGaA (Sigma-Aldrich), BD Biosciences, Miltenyi Biotec, GE Healthcare, Sartorius AG, PerkinElmer Inc., Cell Biolabs Inc.

Global Cell Therapy Monitoring Kits Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.2 billion

- 2026 Market Size: USD 3.35 billion

- Projected Market Size: USD 5.36 billion by 2035

- Growth Forecasts: 5.3%

Key Regional Dynamics:

- Largest Region: North America (36.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, France, Japan

- Emerging Countries: China, India, South Korea, Brazil, Australia

Last updated on : 3 December, 2025

Cell Therapy Monitoring Kits Market - Growth Drivers and Challenges

Growth Drivers

-

Efficacy check through R&D activities and clinical trials: In the cell therapy monitoring kits market, research studies play a crucial role, aiming at targeted therapies, particularly in chimeric antigen receptor (CAR) T-cell therapies. Such advanced treatments, involving patients' T-cells that are genetically modified to target specific cancer antigens, need sophisticated monitoring technology to determine treatment efficacy. For instance, in April 2025, a research team examined the usage of T cell receptor (TCR)-engineered T cells in a phase 1 trial with 40 patients, discovered in the Nature Medicine magazine. It helped the T cells recognize tumor-specific proteins by using genetic engineering techniques to introduce a sort of target identification into the cells.

-

Funding and grants: The most potent growth stimulator in the cell therapy monitoring kits market is funds from private and public organizations. These funds spur the monitoring techniques, boost the sensitivity and specificity of kits continually, and encourage the development of new solutions for real-time cell therapy analysis. For instance, in October 2024, AvenCell Therapeutics, Inc. announced that it had secured USD 112 million in Series B funding. With this funding, AvenCell's patented, switchable universal CAR-T cell treatment platform continued to undergo clinical validation. This move helped the company expand its pipeline and introduce next-generation immunotherapies that can help with important unmet patient needs.

Challenges

-

Manufacturing and logistical complexities: Market navigation for cell therapy monitoring kits production is amongst the most challenging concerns in the cell therapy monitoring kits market. The kits, typically comprised of temperature-sensitive reagents and specially designed parts, necessitate rigorous quality control and accuracy of manufacture. In addition, the customized and time-sensitive nature of cell therapies demands robust and resilient logistic networks with the ability to deliver on schedule to treatment destinations globally, commonly under stringent temperature requirements and compliance with regulations.

- Potency assessment and product characterization: One of the biggest barriers in the cell therapy monitoring kits market is the complexity of product characterization and potency testing. It is challenging to validate the precision of such kits by employing stringent assays that are capable of measuring key functional properties of the cell therapy product accurately. Globally harmonized and standardized methodologies for potency measurement and overall product validation remain a threat due to the intrinsic heterogeneity of cell-based products and dynamic nature of key quality attributes.

Cell Therapy Monitoring Kits Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 3.2 billion |

|

Forecast Year Market Size (2035) |

USD 5.36 billion |

|

Regional Scope |

|

Cell Therapy Monitoring Kits Market Segmentation:

Type of Cell Therapy Segment Analysis

Based on the type of cell therapy, the T-cell therapy segment is expected to dominate in the cell therapy monitoring kits market with a lucrative share of 43%. This segment expansion is greatly aided by strategic alliances and commercial choices such as mergers and acquisitions between companies to expand their portfolios and hold the prime market position. For instance, in November 2024, Novartis and Vyriad, Inc. have partnered strategically to find and create in vivo CAR-T cell treatments. This collaboration involved Novartis's experience in developing innovative cell therapies and Vyriad's active targeting lentiviral vector platform to create direct-to-patient next-generation CAR-T cell therapy, which could eliminate the requirement for ex vivo T cell modification.

Application Segment Analysis

Based on application, the oncology segment is anticipated to dominate the cell therapy monitoring kits market throughout the projected timeframe, spurred by the increasing global cancer incidence and the critical necessity for precise monitoring during cell therapy therapies. For instance, in March 2024, the National Cancer Institute unveiled that Lifileucel (Amtagvi) had received FDA approval. It was the first cellular treatment to be authorized for a solid tumor, namely melanoma, a type of skin cancer. According to the agency's expedited approval, lifileucel was used for patients whose metastatic melanoma had worsened following treatment with specific immunotherapy medications or targeted therapies.

Our in-depth analysis of the global cell therapy monitoring kits market includes the following segments:

|

Type of Cell Therapy |

|

|

Application |

|

|

End use |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell Therapy Monitoring Kits Market - Regional Analysis

North America Market Insights

The cell therapy monitoring kits market in North America is expected to dominate during the forecast timeline, i.e., from 2026 to 2035, with a notable share of 36.3%. These kits are gaining traction in the region due to their therapy effectiveness and ensured patient safety. For instance, in May 2024, according to a statement released by CellFE Inc., it exhibited an abstract that highlighted the production of its resting T cells with high stemness and improved survivability using its non-viral platform. This presentation was given at the International Society of Gene & Cell Therapy (ISCT) 2024 Annual Meeting held in Vancouver, British Columbia.

The U.S. cell therapy monitoring kits market is likely to unveil lucrative growth opportunities during the projected timeframe, attributable to the shifting preference of manufacturers for enhanced patient care, and owning their innovations. For instance, in February 2025, the ground-breaking induced Allogeneic Cell Tolerance (iACT Stealth) U.S. Patent No. 12,178,835 was issued by Pluristyx, marking a major milestone. It is a genetic engineering package designed to stop the immune system of the receiver from identifying implanted tissues or cells as alien. To improve patient safety, iACT StealthTM is intended to be used in conjunction with our fully licensed FailSafe technology.

In Canada, the cell therapy monitoring kits market is exponentially increasing its footprint, owing to the innovative developments by the key players. For instance, in October 2024, OmniaBio Inc. announced the establishment of a new North American CGT manufacturing and artificial intelligence (AI) center of excellence, which will be the largest CGT-focused contract development and manufacturing organization (CDMO) facility in Canada. Located in Hamilton, Ontario, the facility is a ground-breaking development that will enhance the production of these revolutionary treatments, strengthening Canada's standing as an innovation powerhouse while also increasing availability and affordability.

Asia Pacific Market Insights

The cell therapy monitoring kits market in Asia Pacific is likely to witness the fastest growth during the stipulated timeframe. This is attributed to the access to cutting-edge treatments, which is being accelerated by regulatory frameworks, resulting in speedier approvals for novel medications, especially in crucial fields. For instance, in July 2024, Bioserve India announced the arrival of its cutting-edge stem cell products, REPROCELL solutions in India. With the help of these new solutions, the Indian market witnessed advances in regenerative medicine and therapeutic discoveries, as well as innovation in scientific research and drug development.

In India cell therapy monitoring kits market is likely to witness robust growth owing to the systematic regulation of variability of biological materials and placing a strong emphasis on safety, potency, and uniformity. For instance, in January 2025, a CD19-targeted chimeric antigen receptor (CAR) T-cell therapy called varnimcabtagene autoleucel (var-cel) was licensed by India's Central Drugs Standard Control Organization (CDSCO) to treat adult patients with relapsed or refractory B-cell non-Hodgkin lymphoma. Immuneel Therapeutics' Var-cel, branded as Qartemi, was approved based on results from the phase 2 IMAGINE trial, which was conducted in hospitals across India and showed that patients who got the medication had an overall response rate of 83.3% at 90 days.

China cell therapy monitoring kits market is likely to flourish at a fast pace during the stipulated timeline, owing to the development of dependable technologies and tools for effective quality control and monitoring procedures. For instance, in November 2024, Sino-Biocan expanded its modular cell preparation platforms with the introduction of the WUKONG Automated, Closed, Integrated Cell Processing System, which it developed internally. This cutting-edge system can operate effectively and independently with meeting the demands of pharmaceutical R&D firms and Contract Development and Manufacturing Organizations (CDMOs).

Cell Therapy Monitoring Kits Market Players:

- STEMCELL Technologies Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lonza Group

- Thermo Fisher Scientific Inc.

- Merck KGaA (Sigma-Aldrich)

- BD Biosciences

- Miltenyi Biotec

- GE Healthcare

- Sartorius AG

- PerkinElmer Inc.

- Cell Biolabs Inc.

Several significant players are at the forefront of innovation and advancement in the ever-evolving cell therapy monitoring kits market. They provide a wide range of goods and services designed especially for cell therapy applications, greatly advancing the market's technological capabilities. For instance, in April 2025, the new specialized cell and gene business division of AGC Biologics was launched. The patented cell therapy and viral vector platforms from AGC Biologics, such as BravoAAV and ProntoLVV, allowed developers to accelerate their time to GMP stages while drastically reducing costs.

Here's the list of some key players in cell therapy monitoring kits market:

Recent Developments

- In March 2025, AstraZeneca finalized a deal to purchase EsoBiotec. Its engineered nanobody lentiviral (ENaBL) technology eliminates the necessity for immune cell depletion and allows cell treatments to be delivered with a straightforward intravenous injection.

- In September 2024, Kincell Bio announced that it had acquired a new customer through a multi-year collaboration to manufacture clinical-grade medicine in batches tailored to individual patients at its Gainesville, Florida, facility.

- Report ID: 7622

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell Therapy Monitoring Kits Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.