Cell Penetrating Peptide Market Outlook:

Cell Penetrating Peptide Market size was valued at USD 2.25 billion in 2025 and is expected to reach USD 7.18 billion by 2035, registering around 12.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cell penetrating peptide is evaluated at USD 2.5 billion.

The growth in the CPP industry is majorly due to the expanding demand for increasing applications in drug delivery & therapeutics fueled by the increasing prevalence of conditions such as cancer, neurological disorders, infectious diseases, cardiovascular diseases, etc. In September 2024, according to research published in The Lancet, antimicrobial resistance led to over 1 million deaths globally from 1990 to 2021. The rise of drug-resistant infections poses a significant threat to public health, driving the requirement for efficient therapeutic solutions.

Furthermore, with the population aged 70 and older increasing by more than 80%. This study also indicates that AMR (Antimicrobial Resistance) related deaths will rise by 70% i.e. 39 million deaths by 2050 which emphasizes the demand for effective CPPs in the global market. Consequently, the pharmaceutical firms are investing heavily in peptide-based therapeutics to combat the growing threat of chronic diseases.

Key Cell Penetrating Peptide Market Insights Summary:

Regional Highlights:

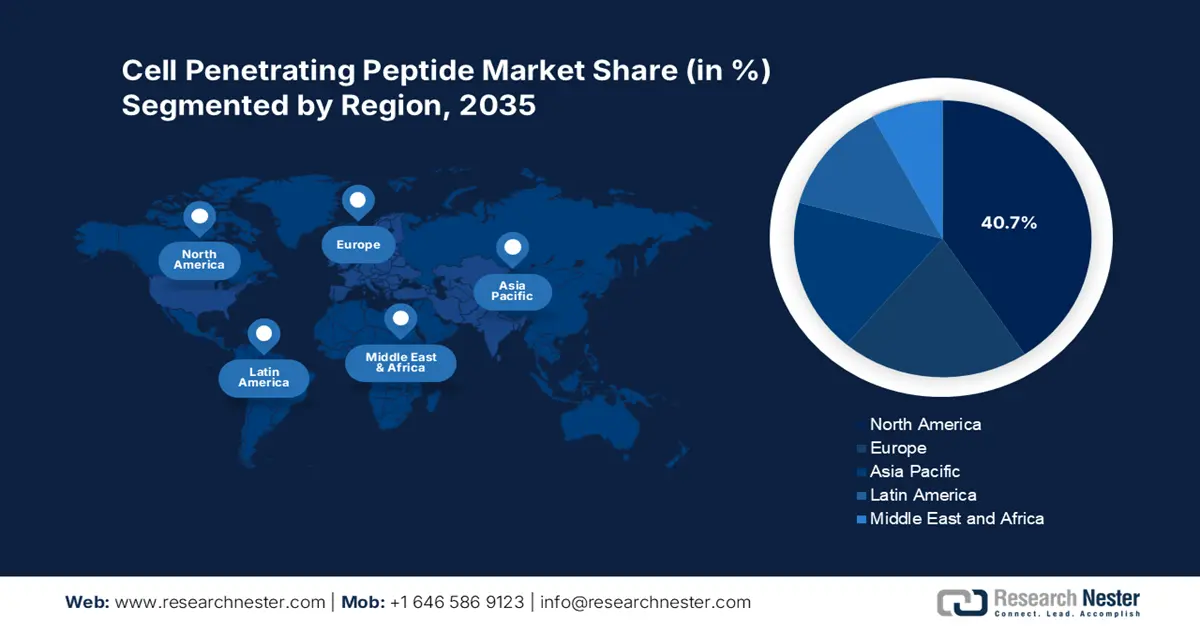

- North America dominates the Cell Penetrating Peptide Market with a 40.7% share, fueled by the rising prevalence of malignancies and chemotherapy side effects, driving growth through 2026–2035.

Segment Insights:

- Protein-based CPPs segment are anticipated to achieve a 60.2% share by 2035, propelled by their extensive use in drug delivery and molecular imaging applications.

Key Growth Trends:

- Increasing applications in drug delivery and therapeutics

- Rising research and development investments by biopharmaceuticals

Major Challenges:

- High manufacturing costs

- Low drug encapsulation efficiency

- Key Players: AltaBioscience, Pepscan, AnaSpec, ProImmune, Bachem, Cupid Peptides, Tocris Bioscience.

Global Cell Penetrating Peptide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.25 billion

- 2026 Market Size: USD 2.5 billion

- Projected Market Size: USD 7.18 billion by 2035

- Growth Forecasts: 12.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 12 August, 2025

Cell Penetrating Peptide Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing applications in drug delivery and therapeutics: The rising number of neurological disorders and infectious diseases is driving the cell penetrating peptide (CPP) market as it boosts the demand for drug deliveries, proteins, and nucleic acids into the cells, reducing cytotoxicity as side effects. For instance, in August 2023, the U.S. FDA approved Revance’s DAXXIFY injection to treat cervical dystonia, the first and only peptide-formulated, long-lasting neuromodulator. This condition affects approximately 60,000 of the population in the USA as highlighted by Revance. This underscores the requirement to accelerate the development of cell penetrating peptide therapeutics.

- Rising research and development investments by biopharmaceuticals: Due to the expanding market of cell-penetrating peptides, biotechnology, and pharmaceutical companies are investing and funding research to develop peptide-based drugs notably for rare diseases and gene therapies. For instance, in August 2021 PepGen announced a deal of USD 112.5 million for the advancement of CPP-based drug delivery particularly for neuromuscular and neurological concerns with investors being RA Capital Management, Oxford Sciences Innovation (OSI), and CureDuchenne Ventures, Viking Global Investors, Deerfield Management Company, Qatar Investment Authority and others. Such initiatives promote the drug requirement further boosting market expansion.

Challenges

-

High manufacturing costs: The production of cell-penetrating therapeutics requires complex multi–set up chemical processes involving costly solid-phase peptide synthesis methods making the process unaffordable. Screening for the optimal amino acid sequences, purification and validation studies further act as a financial restraint in the cost of production. Additionally, the need for specialized equipment and skilled experts further drives up costs, restricting market growth.

- Low drug encapsulation efficiency: These complications act as a major drawback of CPPs is their low efficacy in drug delivery within the target cells. Most of the therapeutic dose administered could break down in systemic circulation or be lost before reaching the desired target. This lowers the effectiveness of treatment as well as increases drug wastage, rendering the method less feasible, for clinical use. These factors act as a significant barrier to widespread adoption despite the growing demand for CPPs.

Cell Penetrating Peptide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.3% |

|

Base Year Market Size (2025) |

USD 2.25 billion |

|

Forecast Year Market Size (2035) |

USD 7.18 billion |

|

Regional Scope |

|

Cell Penetrating Peptide Market Segmentation:

Type (Protein-based CPPs, Peptide-based CPPs)

Protein-based CPPs segment is likely to dominate cell penetrating peptide (CPP) market share of over 60.2% by 2035. These protein-based CPPs are widely used in drug delivery, gene delivery, and molecular imaging, driving the segment’s growth. These are usually divided into three groups: TAT peptide, penetratin, and Antp. For instance, in March 2025, as per a study published in Nanoscale, the self-assembled complexes of CPP and ferrocifens proved to showcase enhanced drug delivery and anti-cancer effects in lung cancer treatment.

Application {Drug Delivery, Gene Delivery, Diagnostics, Molecular Imaging, Others (Vaccine development, Antimicrobial Therapy)}

Based on application, drug delivery is projected to expand at a considerable rate during the forecast period in the cell penetrating peptide market due to the growing demand for targeted and efficient therapeutic drug deliveries. The strong precision in drug delivery reduces systemic side effects by enhancing treatment efficacy, especially for carcinoma, ocular drug delivery, and neurological disorders. According to a report by NLM in April 2023, it's stated that ocular drug delivery has been challenging due to the structural complexity of the eye, limiting the drug’s ability to penetrate so these CPPs facilitate targeted delivery to the retina by reducing the frequency of invasive intravitreal injections essential for eye diseases. This reflects the expanding urge for CPPs to fuel the segment’s growth among a broad audience.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell Penetrating Peptide Market Regional Analysis:

North America Market Analysis

North America in CPP market is predicted to dominate over 40.7% revenue share by 2035. This region holds a significant consumer base due to the rising prevalence of malignancies and chemotherapy presenting severe side effects encouraging increased research for CPP-based drug delivery systems for a safer and targeted alternative. As per a report in January 2024 by the American Cancer Society, approximately 2,001,140 new cases were diagnosed with 5,480 diagnoses each day. This rising incidence, especially breast-related cases in total 313,510 with deaths estimated at 42,250, is a key factor in driving the demand for cell-penetrating peptides.

The U.S. market has been gaining traction due to the rising occurrence of cases as outlined above. For instance, in November 2022, according to an article published by Drug Discovery Today (DDT), the advancement in the market is contending triple-negative breast cancer, representing a solution for side effects of chemotherapy, which highlights the requirement for the authorized market to enhance its production. Additionally, in June 2022, Sarepta Therapeutics announced that its clinical trials are in progress for SRP-5051 to be employed for Duchenne muscular dystrophy.

Canada CPP market is growing steadily, supported by the government, and is predicted to witness an exceptional pace of expansion during the forecast period. In June 2024, UBC developed oral insulin drops incorporated with a combination of insulin along a unique cell penetrating peptide to offer relief to diabetes patients, as 11.7 million people in Canada are diagnosed with diabetes or pre-diabetes. Therefore, the Canada Government is committed to encouraging the development of CPPS for such diseases, positively driving the market within the country.

APAC Market Statistics

The CPP market in APAC is the fastest-growing region and is poised to witness lucrative growth due to the presence of huge biotechnology and pharmaceutical firms. The country’s vast population and healthcare needs make Asia-Pacific a major player in the industry. For instance, in March 2024, an article published in the Journal of Medicinal Chemistry highlighted the De Novo Discovery of a Noncovalent Cell-Penetrating Bicyclic Peptide Inhibitor Targeting SARS-CoV-2 Main Protease which demonstrates the potential for therapeutic applications.

India market is expecting substantial growth since there is ongoing research on medical developments associated with CPPs. In November 2023, Abbott launched New PediaSure with the nutri-pull system, the formulation is being incorporated with 37 nutrients and added casein phosphopeptides (CPPs) to promote growth and development in children. Additionally, its report highlights that 40.6 million children in India lack proper nutrition, resulting in stunted growth, which again establishes the growing requirement for CPPS in functional foods and nutritional supplements.

China cell penetrating peptide market is driven by the large patient base and government support with regulatory adjustments for faster approvals. Additionally, factors such as increased drug applications and molecular imaging are raising the market potential. Therefore, the country’s market is anticipated to witness considerable growth during the forecast period.

Key Cell Penetrating Peptide Market Players:

- AltaBioscience

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pepscan

- AnaSpec

- ProImmune

- Bachem

- Cupid Peptides

- Tocris Bioscience

- Bachem

- BioAlps

Companies dominating the market are gaining great exposure due to the integrations in delivering innovative healthcare solutions. For instance, in June 2023, IRBM, an innovative Contract Research Organization (CRO) extended its peptide therapeutics collaboration with Merck & Co. Inc. Rahway USA which displays the high objective to explore peptide-based therapies across multiple healthcare needs. Thus, it can be a positive outlook for the CPP industry to expand globally.

Some of the prominent players are:

Recent Developments

- In January 2025, JPT Peptide Technologies launched a new category of cell-penetrating peptides offering solutions for drug delivery, gene therapy, and molecular biology along with custom synthesis and conjugation services.

- In September 2020, Amytrx Therapeutics emerged from stealth to develop novel therapies with its lead program AMTX-100 in clinical development for dermatologic indications.

- Report ID: 7355

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell Penetrating Peptide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.