Carvedilol Drug Market Outlook:

Carvedilol Drug Market size was valued at USD 1.9 billion in 2025 and is projected to reach USD 3.7 billion by the end of 2035, rising at a CAGR of 7.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of carvedilol drug is assessed at USD 2 billion.

The amplifying cardiovascular disease (CVD)-afflicted population and generic drug adoption in emerging economies are the main driving factors in the carvedilol drug sector globally. The proven efficacy of this drug as a beta-blocker to treat heart failure and hypertension uplifts the sustained demand. Testifying to this substantial nature, the World Health Organization (WHO) states that CVDs account for over 17.9 million yearly deaths, where 4 out of 5 of them are caused by heart attacks and strokes. It also mentioned that 33.3% of these events occur prematurely in people under 70 years of age. This demonstrates the growing need to control CVD comorbidities before worsening.

The supply chain of the market involves a concentrated manufacturing landscape, primarily in China and India. This can be displayed through the 2025 findings from the US Pharmacopeia study, where 32% of API production for all drug products (excl. IV fluids) worldwide originated from India. As a result, the payers’ pricing of these beta-blockers witnesses a year-over-year increase, particularly in the U.S., due to its import dependence. However, better adherence to public affordability thresholds ensures consistency in uptake rates of carvedilol, where a 2022 comparative cost analysis calculated the incremental cost-effectiveness ratio (ICER) of this drug to range between USD 10,902 and USD 34,237 per life-year.

Key Carvedilol Drug Market Insights Summary:

Regional Highlights:

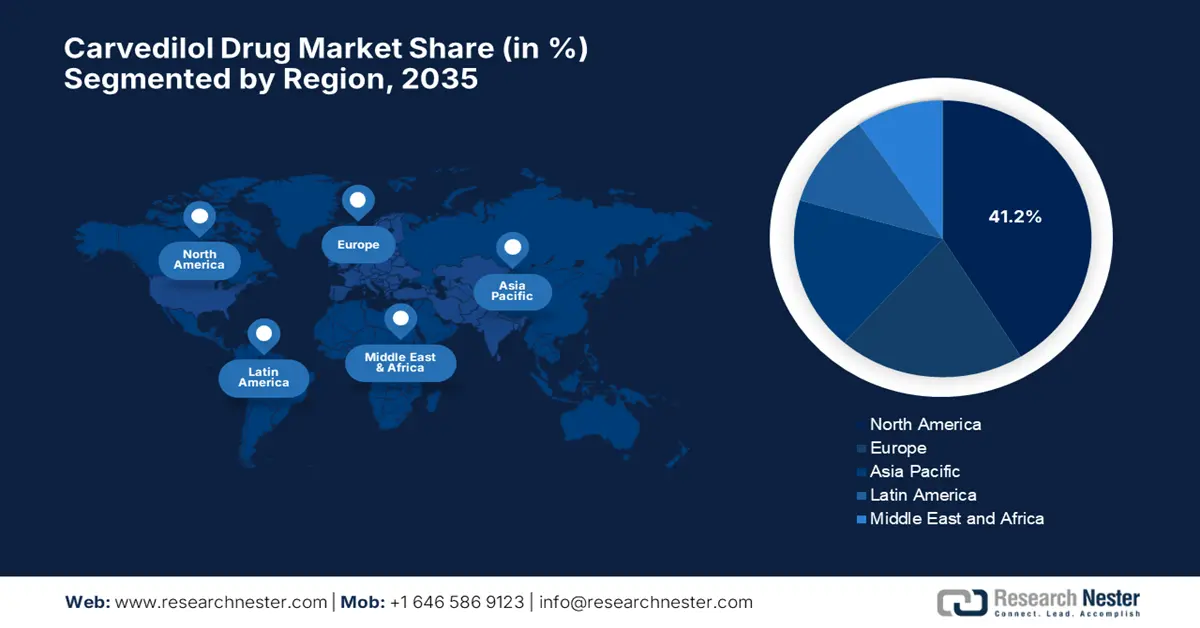

- North America is projected to secure the largest 41.2% share of the carvedilol drug market by 2035, impelled by the increasing patient pool with cardiovascular ailments and enhanced formulary coverage under healthcare programs.

- Asia Pacific is expected to experience the fastest growth through 2035, propelled by rising unmet medical needs, a growing middle-class population, and a strong generic drug manufacturing base.

Segment Insights:

- The generics segment is projected to command an 87.6% share of the carvedilol drug market by 2035, driven by robust regulatory support and cost-effective healthcare strategies enhancing accessibility.

- The heart failure (HF) segment is estimated to capture 48.4% share by 2035, bolstered by the rising global prevalence of cardiovascular diseases and the proven therapeutic efficacy of carvedilol in heart failure management.

Key Growth Trends:

- Increasing geriatric population worldwide

- Improvements in healthcare access and quality

Major Challenges:

- Growing concerns about side effects and safety

- Patent expirations and price erosion

Key Players: Viatris Inc., Teva Pharmaceutical, Sun Pharmaceutical, Aurobindo Pharma, Hikma Pharmaceuticals, Sandoz (Novartis), Zydus Cadila, Lupin Limited, Dr. Reddy's Laboratories, Apotex Inc., Accord Healthcare (Intas), Amneal Pharmaceuticals, STADA Arzneimittel AG, Krka, d.d., GlaxoSmithKline (GSK)

Global Carvedilol Drug Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.9 billion

- 2026 Market Size: USD 2 billion

- Projected Market Size: USD 3.7 billion by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 24 September, 2025

Carvedilol Drug Market - Growth Drivers and Challenges

Growth Drivers

- Increasing geriatric population worldwide: The rapidly aging individuals living across the globe are expanding the high-risk demography of CVD-related deaths and disabilities. These residents are highly susceptible to chronic heart conditions, such as hypertension, arrhythmias, and heart failure, which creates a sustainable demand for the market. Besides, the requirement for long-term management among these patients helps the sector maintain a steady cash inflow with a lifetime consumption cycle. Testifying to the same, a 2022 NLM study unveiled that the proportion of CVD deaths to total deaths increases with age, where people ≥70 years old account for over 40%.

- Improvements in healthcare access and quality: The carvedilol drug industry is becoming more efficient on account of its contribution to affordable interventions and healthcare quality improvements. The spreading awareness about the importance of early intervention to avoid exceptionally high CVD-related expenses is propelling the adoption rates in this sector. This is further complemented by the 2022 guidelines released by the AHA, Heart Failure Society of America, and American College of Cardiology, which indicate that prescribing carvedilol upon discharge is associated with a decrease in 60- to 90-day mortality and rehospitalization rates.

- Rising innovations and adoption rates: As the pioneering firms in the carvedilol drug industry are focusing on strategic approaches and product innovations, the volume of demand is substantially increasing. Specifically, the clinical and economic benefits of these therapeutics are making them a highly preferred option for both budget-constrained healthcare settings and a cost-sensitive consumer base. In this regard, a 2023 study from the American Heart Association (AHA) revealed that the most prescribed antihypertensive medications in India were beta blockers (BBs), which resulted in prescription rates of 30% and 27% among consultant physicians and general practitioners, respectively.

Historical Uptake Rates and Their Impact on Future Expansion of the Market

Overview of Prescription Rates of Beta Blockers as Antihypertensive Drugs

|

Country |

Study Period |

Beta Blocker Prescription Rate |

Notes |

|

U.S. |

2011-2020 |

~40% (plateaued, after earlier rise) |

Beta blockers are stably used, especially in comorbid heart failure and coronary heart disease |

|

China |

2016-2023 |

32.47% |

Prescription rate among first-line antihypertensive drugs: modest annual increase |

|

India |

2014-2022 |

32% |

The highest-prescribed anti-hypertensive drug among clinicians |

|

Europe (Italy, Poland) |

2023-2024 |

44% (Italy), 52% (Poland) |

Higher rates in patients with cardiovascular comorbidity |

Source: NLM and AHA

Cost Dynamics of the Market in Key Landscapes

Comparative Cost Analysis of Different Drugs for Heart Failure in the U.S.

(30-Day Supplies) (2024)

|

Drug |

Generic/Brand Name |

Average Medicare Cost (in USD) |

Average Out-of-Pocket Cost (in USD) |

|

Carvedilol |

Generic |

5 |

1 |

|

Lisinopril |

Generic |

3 |

1 |

|

Losartan |

Generic |

6 |

2 |

|

Spironolactone |

Generic |

6 |

2 |

|

Empagliflozin |

Brand |

544 |

37 |

|

Dapagliflozin |

Brand |

538 |

35 |

|

Sacubitril-Valsartan |

Brand |

566 |

46 |

|

Hydralazine |

Generic |

9 |

3 |

|

Isosorbide dinitrate |

Generic |

49 |

7 |

|

Vericiguat |

Brand |

589 |

34 |

|

Tafamidis |

Brand |

19,560 |

530 |

Source: NLM

Challenges

- Growing concerns about side effects and safety: Adverse reactions, including dizziness, fatigue, hypotension, and bradycardia, are becoming a major reason behind the sudden downfall of the carvedilol drug market. Such poor patient compliance ultimately results in discontinuation of therapy and rigorous post-market surveillance, reducing uptake rates and inflating the cost of compliance. These factors collectively impact the availability and profitability in this sector.

- Patent expirations and price erosion: The disputed and expired patents are evidently becoming a prominent issue in the long-term revenue generation for branded medicine suppliers in the market. This also leads to the rapid emergence of generic and more affordable alternatives, reducing the exclusivity of premium-priced therapeutic options. Moreover, this is making it hard to maintain brand loyalty among consumers in the presence of cheaper options in this category.

Carvedilol Drug Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 1.9 billion |

|

Forecast Year Market Size (2035) |

USD 3.7 billion |

|

Regional Scope |

|

Carvedilol Drug Market Segmentation:

Drug Type Segment Analysis

Based on drug type, the generics segment is expected to garner the highest share of 87.6% in the carvedilol drug market by the end of 2035. The dominance of the segment is attributed to the widespread affordable measures implemented by the healthcare systems and the regulatory support. Besides, favorable government access-enhancement strategies and initiatives, such as the Competitive Generic Therapy program by the FDA, intensify the user concentration in this category in comparison to branded alternatives. Furthermore, the seamless alignment of generic options with the benchmarks of upgraded payer policies also drives the segments' leadership in regions where affordability is a primary barrier.

Indication Segment Analysis

In terms of indication, the heart failure (HF) segment is poised to grow at a considerable rate, with a share of 48.4% in the carvedilol drug market during the assessed period. The growth in the segment is facilitated by the escalating instances of this CVD subtype. In this regard, a NLM report stated that the number of HF patients in the world crossed 64 million in 2023. Besides, the Heart Failure Society of America (HFSA) estimated this figure to surpass 8.7 million in 2030,10.3 million in 2040, and 11.4 million by 2050 among U.S.-based adults aged above 20. Thus, the clinical efficacy and economic advantages offered by the carvedilol drug make it a preferred choice among most consumers.

Distribution Channel Segment Analysis

Retail pharmacies are predicted to serve as a dominant distribution channel in the carvedilol drug market throughout the analyzed timeframe. With a crucial role in making the medication widely accessible to patients, these facilities are maintaining the solidification of their foundation in this sector. These distributors are also standing as the primary source of revenue generation for key manufacturers, with their ability to offer convenience and immediate availability of prescription medications. Moreover, the extensive presence of retail pharmacies across both urban and rural areas ensures maximum patient accessibility to treatment regimens available in this sector.

Our in-depth analysis of the global market includes the following segments:

| Segment | Subsegments |

|

Drug Type |

|

|

Indication |

|

|

Distribution Channel |

|

|

Dosage Form |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carvedilol Drug Market - Regional Analysis

North America Market Insights

North America carvedilol drug market is set to dominate globally by capturing the largest share of 41.2% over the discussed tenure. The landscape witnesses such leadership on account of the amplifying burden of associated ailment-affected patients and optimized formulary coverage. As evidence, the 2025 CDC report notes that over 119.9 million adults in the U.S. are affected by hypertension. Besides, there is an improved adoption of fixed-dose combinations in Medicare Part D, reflecting the amplified volume of adoption in this sector. Besides, the efforts to localize the supply chain aim to diminish import risks, creating a promising scope of expansion.

The U.S. is estimated to be the primary contributor to revenue generation in the North America market. The country benefits from an increasing patient base, where only 1 in 4 residents with high BP have their condition under control, as per the 2023 NLM article. Another NLM study predicted the occurrence of HF in the U.S. to increase by 46% from 2012 to 2030, with a corresponding increase in healthcare costs of about 127%. Besides, the HFSA revealed that the lifetime risk of HF rose to 24% nationwide in 2024, with 24-34% of the U.S. population being at the pre-HF stage. These figures indicate the presence of a sustainably growing consumer volume in this sector.

Asia Pacific Market Insights

The Asia Pacific carvedilol drug market is expected to grow at the fastest rate, grabbing a considerable share by the end of 2035. The landscape is largely fueled by the growing volume of unmet needs and the middle-class population. Besides, the rapid aging among residents across Japan, China, and Australia is also contributing to the demographic expansion in this sector. Moreover, the high CVD burden and a strong emphasis on generic production make the region an epitome of both a continuously enlarging source of cash inflow and innovation for the merchandise.

China is the major exporter in the market, which is attributed to its exceptional API manufacturing capacity and a large proportion of hypertension in total CVD-related deaths, accounting for 54.5%, as per the statistics published by the NLM in 2024. In response to this epidemic, the notable increase in government healthcare spending is securing a greater capital influx in this field. Further, the domestic manufacturers such as CSPC Pharmaceutical dominate the market with a predominant position in terms of APIs.

Feasible Opportunities Present in APAC Countries

|

Country |

Key Notes |

Timeline |

|

Australia |

More than USD 611 million of the net annual cost of hypertension belongs to pharmacy fees for dispensing and handling medications |

2021-2022 |

|

India |

The government launched the 75/25 initiative to screen and provide standard of care for 75 million individuals with hypertension and diabetes |

2023-2025 |

|

China |

Sets major targets to manage 110 million hypertension patients, aiming to achieve a standardized management rate of 70% |

2017-2025 |

Source: The George Institute for Global Health, PIB, and NLM

Europe Market Insights

In Europe, the carvedilol drug market is well-established, empowered by rapid aging and advances in formulations. The region also sets its significance in this sector as one of the largest suppliers of branded APIs for manufacturers. Currently, the emergence of generics is also gaining traction in this field due to stringent cost-containment policies and widespread reimbursement systems. Tablets remain the preferred dosage form in the Europe landscape in support of upgraded clinical guidelines and physician familiarity. Moreover, enhanced harmonization between regulatory frameworks across the region enables consistency in progress.

The ongoing innovation in medical sciences, particularly revolutionary discoveries in affordable CVD-related care, continues to shape the market in the UK. The country’s focus is currently concentrating on evidence-based prescribing and centralized procurement, which contributes to stable demand and comprehensive pricing. This environment is further backed by massive public funding, which can be exemplified by the USD 171.1 million allocation to cardiovascular disease and stroke research under the research programmes of the National Institute of Health and Care Research (NIHR) from 2020 to 2024.

Country-wise Prescription Rates of Carvedilol Drugs for Hypertensive Patients (2024)

|

Country |

Hypertension |

Hypertension with CVD Comorbidity |

Hypertension with Diabetes Comorbidity |

|

Itay |

16% |

18% |

16% |

|

Poland |

11% |

15% |

13% |

|

Tyrkey |

20% |

22% |

22% |

Source: NLM

Key Carvedilol Drug Market Players:

- Viatris Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teva Pharmaceutical

- Sun Pharmaceutical

- Aurobindo Pharma

- Hikma Pharmaceuticals

- Sandoz (Novartis)

- Zydus Cadila

- Lupin Limited

- Dr. Reddy's Laboratories

- Apotex Inc.

- Accord Healthcare (Intas)

- Amneal Pharmaceuticals

- STADA Arzneimittel AG

- Krka, d.d.

- GlaxoSmithKline (GSK)

The carvedilol drug market comprises a cohort of key players in the pharmaceutical industry. Many of them are now leveraging their generics portfolio to solidify their position in this field. Particularly, firms based in India, such as Sun Pharma and Dr. Reddy’s, are dominating this pricing competition, whereas players from established landscapes, such as Teva and Viatris, emphasize equitable distribution and product innovation. Furthermore, the commercial dynamics of this sector are being stimulated by the strategic roadmap for future progress.

Here is the list of some prominent players in the industry:

Recent Developments

- In May 2025, GSK attained reaffirmation for its COREG CR (carvedilol phosphate) extended-release capsules, 10 mg, 20 mg, 40 mg, and 80 mg, saving it from being withdrawn from the market. The company developed the drug in alliance with Flamel Technologies, which was further marketed by Waylis Therapeutics.

- In March 2025, RBL LLC was launched by Rice Biotech, which was intended to empower the development and commercialization of clinical innovations with lifesaving medical technologies introduced by the Launch Pad. The portfolio of demonstrated drugs included carvedilol (Coreg) for the treatment of congestive heart failure.

- Report ID: 4019

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carvedilol Drug Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.