Carrageenan Market Outlook:

Carrageenan Market size was valued at USD 1.02 billion in 2025 and is projected to reach USD 3.9 billion by the end of 2035, rising at a CAGR of 5.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of carrageenan is estimated at USD 1.08 billion.

The carrageenan market is primarily shaped by institutional demand from the food processing, pharmaceutical formulation, and regulated industrial applications, where the usage is influenced by the raw material availability, regulatory acceptance, and downstream production volumes rather than consumer-facing branding. The global supply is closely tied to red seaweed cultivation, with Southeast Asia dominating the harvest volumes. According to the NLM study in July 2022, the global seaweed and aquatic plants production reached 1,083,242 tonnes. Red seaweeds represent a material share due to their role in the hydrocolloid extraction, including carrageenan. Indonesia and the Philippines are expected to produce a high volume of seaweed output, making the supply chain highly concentrated and sensitive to climate variability, labor availability, and coastal aquaculture policy decisions.

Wild Seaweed and Aquatic Plants Production Worldwide

|

Country |

Brown Seaweed |

Red Seaweed |

Green Seaweed |

Seaweed Nei |

Aquatic Plants Nei |

Total |

|

Chile |

288,486.00 |

115,973.00 |

- |

- |

467.00 |

404,926.00 |

|

China |

- |

- |

- |

- |

174,450.00 |

174,450.00 |

|

Norway |

162,824.00 |

- |

128.00 |

- |

- |

162,952.00 |

|

Japan |

46,500.00 |

- |

- |

- |

20,300.00 |

66,800.00 |

|

France |

51,141.92 |

158.12 |

- |

0.01 |

- |

51,300.05 |

Source: NLM July 2022

Further, the carrageenan market is also driven by its role as a critical functional ingredient in the supply chain of processed food. Its primary application is as a gelling, thickening, and stabilizing agent, with the food and beverage industry accounting for the dominant share of consumption. The demand is closely tied to the production volumes of the key end-use products, such as the meat diary and plant-based alternatives. The global supply chain originates with the cultivation of the specific seaweed species, such as the Kappaphycus and Eucheuma, with the Philippines and Indonesia serving as the world’s primary production regions, with the Philippines being in the third position in the world’s seaweed production, based on the BFAR 2022 to 2026 data. This geographical concentration introduces considerations regarding supply security, environmental impact, and socio-economic factors for the farming communities.

Key Carrageenan Market Insights Summary:

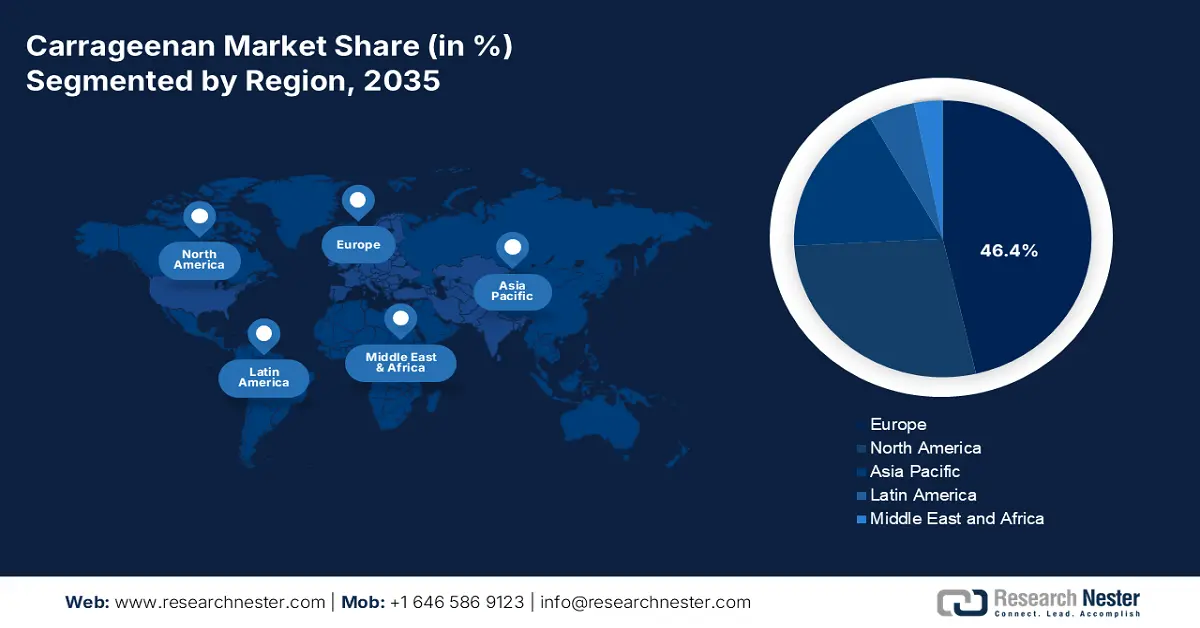

Regional Insights:

- Europe is projected to secure a 46.4% share by 2035 in the carrageenan market, underpinned by strong consumer and regulatory emphasis on natural plant-based ingredients in food and pharmaceutical applications.

- Asia Pacific is anticipated to register the fastest expansion through 2026–2035, advancing at a CAGR of 6.5% as a result of rapidly growing food processing industries and rising adoption of plant-based protein products.

Segment Insights:

- Under the sales channel, the B2B or direct sales segment is forecast to command a dominant 90.2% share by 2035 in the carrageenan market, supported by large-volume industrial procurement and close producer–manufacturer collaborations.

- The powder form segment is expected to lead during the 2026–2035 period with a significant share, strengthened by superior logistics efficiency and high formulation flexibility for large-scale food and beverage manufacturing.

Key Growth Trends:

- Government support for seaweed aquaculture expansion

- Government healthcare and pharmaceutical manufacturing expenditure

Major Challenges:

- Raw material supply volatility

- Stringent and evolving regulatory hurdles

Key Players: DuPont (U.S.), Ingredion (U.S.), Ashland (U.S.), Cargill (U.S.), MCPI Corporation (Philippines), Shemberg Biotech Corporation (Philippines), CEAMSA (Spain), Gelymar S.A. (Chile), Europa (China), Green Fresh (Fujian) Co., Ltd. (China), Karagen Indonesia (Indonesia), PT. Gumindo Perkasa Industri (Indonesia), AEP Colloids (U.S.), Marcel Carrageenan (Philippines), Soriano S.A. (Argentina), LAUTA (Germany), TBK Manufacturing Corporation (Philippines), W Hydrocolloids, Inc. (Philippines), Argeles Pty Ltd (Australia).

Global Carrageenan Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.02 billion

- 2026 Market Size: USD 1.08 billion

- Projected Market Size: USD 3.9 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (46.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, France, Japan

- Emerging Countries: India, Brazil, Indonesia, Vietnam, South Korea

Last updated on : 23 December, 2025

Carrageenan Market - Growth Drivers and Challenges

Growth Drivers

- Government support for seaweed aquaculture expansion: Public investment in seaweed aquaculture is a primary driver of the carrageenan market, availability, and downstream demand. The governments in Asia and Europe have increased the budgetary allocations to coastal aquaculture as part of food security, rural income, and blue economy programs. The FAO report in 2025 depicts that between 2013 and 2023, the seaweed farming in Latin America and the Caribbean increased by 66%, reaching 22,125 tonnes in 2023. Further, Indonesia’s Ministry of Marine Affairs and Fisheries prioritizes seaweed as a strategic export crop under the national aquaculture roadmaps, supporting the hatchery farmer cooperatives and processing clusters. As governments link seaweed cultivation with climate mitigation and coastal employment, institutional support continues to stabilize carrageenan supply chains and sustain B2B demand growth.

- Government healthcare and pharmaceutical manufacturing expenditure: The public healthcare spending indirectly drives the demand for the carrageenan market via pharmaceutical excipient usage. The report from the CMS report in December 2023 states that the U.S. health care spending increased by 4.1% and reached USD 4.5 trillion in 2023, with continued growth projections through 2025. The government-funded drug manufacturing and procurement programs emphasize formulation stability, shelf life, and scalable excipient sourcing. The Carrageenan is listed in the pharmacopeial references supporting its use in specific oral and topical formulations. In the U.S., the federal pharmaceutical purchasing via Medicare and Medicaid also increased, reinforcing the demand for the carrageenan market for compliant excipient supply chains.

- Trade and export promotion policies for the seaweed-based products: Several governments classify seaweed and hydrocolloids as strategic export commodities. Indonesia’s national export statistics list seaweed and derived products among the priority agricultural marine products. The Philippines Department of Agriculture supports seaweed export competitiveness via logistics and quality programs. The export incentives improve the processing capacity utilization, increasing the carrageenan production volumes for the global B2B buyers. As export-oriented policies expand, the manufacturers secure scale efficiencies supporting competitive pricing and broader institutional adoption. FAO trade data shows seaweed exports strengthen foreign exchange and industrial supply security.

Challenges

- Raw material supply volatility: The carrageenan market is dependent on cultivated seaweed, mainly Kappaphycus and Eucheuma, whose supply is highly volatile due to climate change and geopolitical issues in the key regions such as the Philippines and Indonesia. The price and availability fluctuations directly impact the cost stability. Leading companies reduce this via vertical integration and long-term contracts with the seaweed farmers to secure the supply, but this requires significant upfront capital and local expertise, creating a high barrier for new entrants.

- Stringent and evolving regulatory hurdles: Carrageenan faces ongoing regulatory scrutiny, mainly in the EU and among organic certifiers, concerning its use in food. For example, the top players of the carrageenan market invest heavily in regulatory affairs and safety research to maintain compliance and defend their products. A new entrant must budget for a lengthy approval process and potential regulations if regulations change, creating significant R&Dand time to market challenges.

Carrageenan Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 1.02 billion |

|

Forecast Year Market Size (2035) |

USD 3.9 billion |

|

Regional Scope |

|

Carrageenan Market Segmentation:

Sales Channel Segment Analysis

Under the sales channel, the B2B or direct sales are dominating the segment and are expected to hold the share value of 90.2% by 2035. The segment’s dominance is due to the nature of the carrageenan as a specialized industrial hydrocolloid purchased in large, consistent volumes by major food, pharmaceutical, and cosmetic manufacturers. Direct relationships among the producers, such as the CP Kelco and Cargill and their multinational clients, are vital for ensuring the supply chain security, facilitating the co-development of the custom formulations, and providing dedicated technical support. For instance, the closely related food ingredient sector the showing the merchant wholesale sales of other chemical and allied products, accounted for hundred and millions of dollars, underscoring the massive industrial scale transaction that defines this channel.

Form Segment Analysis

Powder form is the leading subsegment in the carrageenan market and is commanding a significant share value during the forecast period, 2026 to 2035. The segment is led by its attributes to the superior logistical advantages, including the lower shipping costs, extended shelf life, and reduced risk of microbial spoilage, combined with the greater formulation flexibility for industrial users. Manufacturers can precisely meter and blend dry powder into the complex production processes, a critical requirement in large-scale food and beverage manufacturing. The economic importance of such processed ingredients is reflected in the broader trade data. Moreover, the NLM June 2025 report depicts that carrageenan is a sulfated polygalactan containing 15% to 40% of ester-sulfate, making it an anionic polysaccharide. It is used in the food sector as a gelling, stabilizing, and thickening agent, also a fat substitute, mainly in dairy products.

Grade Segment Analysis

The food grade is the leading segment in the carrageenan market. This is a direct function of its vast application across the processed food industry, where it acts as a critical thickener, gelling agent, and stabilizer in products ranging from dairy and meat to plant-based alternatives and beverages. Its use is strictly regulated for purity. The scale of this end market is immense. The report from the USDA September 2024 depicts that the U.S. consumer spending on processed food for at-home consumption reached USD 1.04 trillion in 2023, a market that fundamentally depends on functional ingredients such as the food-grade carrageenan to ensure the product quality and the stability and texture that meet the consumer expectations.

Our in-depth analysis of the carrageenan market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Grade |

|

|

Application |

|

|

Function |

|

|

Form |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carrageenan Market - Regional Analysis

Europe Market Insights

Europe is dominating the carrageenan market and is expected to hold the market share of 46.4% by 2035. The market operates within one of the world’s most stringent regulatory frameworks governed by the European Food Safety Authority for food use and the European Medicines Agency for pharmaceutical applications. The primary driver of the carrageenan market in Europe is the strong consumer and regulatory push for natural plant-based ingredients, positioning carrageenan as a key texturizer in the growing plant-based food sector. However, this growth is tempered by the ongoing scientific reevaluations of its safety that can influence the market perception and regulatory status. The trend towards the clean label products presents both an opportunity, as carrageenan is a natural extract, and a challenge, as some consumer groups advocate for its removal.

Germany’s carrageenan market is the largest in Europe and is driven by its advanced food processing and pharmaceutical industries. The demand is concentrated in the meat processing, dairy products, and as an excipient in pharmaceutical gels and tablets. The key driver is the Bioeconomy policy, which aims to replace the fossil-based products with sustainable, renewable materials such as seaweed-derived hydrocolloids. The ACT Health and Nutrition is the leading company in Germany and produces carrageenan under the category of Hydrocolloids with a stability greater than 120 degrees Celsius. Germany has exported seaweeds of 1,332 tonnes, based on the Government of Netherlands February 2022 report, highlighting the demand for the seaweed-derived inputs across European food, pharmaceutical, and industrial manufacturing supply chains.

France’s carrageenan market is defined by the high demand from its prestigious dairy, processed meat, and bakery sectors, alongside growing applications in organic and clean-label products. The consumers in the country and the retailers exert strong pressure for the natural, traceable ingredients, influencing the carrageenan sourcing. The government support is channeled via the France 2030 investment plan that targets agricultural and food innovation. The report from the Government of the Netherlands in February 2022 states that France has increased the seaweed imports by 5% from 2,869 tonnes to 3,034 tonnes. Further, the small volume import price is expected to be high, from USD 4.00/kg to USD 6.00/kg. This growth reflects the tight domestic supply and sustained industrial demand, mainly from the regulated food processors prioritizing consistent quality inputs.

APAC Market Insights

The Asia Pacific is the fastest growing carrageenan market and is expected to grow at a CAGR of 6.5% during the forecast period 2022 to 2035. The market is driven by the dominant raw material suppliers and the fastest-growing consumption hub. The primary growth drivers are the massively expanding food processing industries in China and India, driven by the rising disposable incomes, urbanization, and the proliferation of packaged and convenience foods. The key trend is the rapid rise of the plant-based protein sector, where carrageenan is essential in texturizing dairy and meat alternatives. The region benefits from the significant government investment in marine biotechnology and sustainable aquaculture, enhancing the supply chain security. However, the market faces price volatility of raw seaweed and competition from alternative hydrocolloids in cost-sensitive applications.

China’s carrageenan market is defined by its dual role as the world’s largest consumer and a leading processor of refined carrageenan. Domestic demand is driven by the massive modernizing food manufacturing sector, mainly in dairy, instant noodles, and processed meats. The key growth vector is the state-backed push for food security and technological self-sufficiency in ingredients. This is supported by the significant R&D funding. Further, the People’s Government of Fujian Province in April 2025 reported that in 2024, seaweed production exceeded 1.6 million metric tons. This scale ensures the cost-efficient upstream integration supporting large volume carrageenan refining and export competitiveness. The provincial investment incentives further encourage the processing automation and capacity expansion aligned with the national food security goals.

India’s carrageenan market is defined by the explosive growth potential driven by the rapid urbanization, a young population, and government policies incentivizing domestic food processing to reduce imports and create jobs. The key driver is the expansion of organized retail and demand for packaged foods diary products, and meat analogues. The PIB March 2025 report shows that the Ministry of Food Processing Industries has allocated ₹10,900 crore for the Production Linked Incentive Scheme for the Food Processing. This supports the creation of the global food manufacturing champions. This scheme fosters large-scale manufacturing that inherently increases the demand for the functional ingredient, such as carrageenan. The PIB March 2025 has reported that the total seaweed production in India reached 72,385 tonnes in 2023, highlighting the rise in demand for seaweed.

Seaweed-Focused Budgetary Allocations under PMMSY

|

Budget Component |

Approval / Allocation |

Central Share |

Coverage / Location |

Purpose |

|

Total PMMSY Outlay (Fisheries Sector) |

₹20,050 crore |

— |

National |

Overall fisheries development with seaweed as a priority activity |

|

Seaweed-Specific Projects (Approved) |

₹194.09 crore |

₹98.97 crore |

Multiple States & UTs |

Promotion of seaweed cultivation and ecosystem development |

|

Infrastructure Support to Beneficiaries |

Included in ₹194.09 crore |

Included |

Coastal States & UTs |

Installation of rafts, monolines, and tubenets |

Source: PIB March 2025

North America Market Insights

The North America carrageenan market is a mature and value-driven segment defined by the robust regulatory oversight and demand for the high purity functional ingredients. The growth is primarily driven by the robust processed food industry, increasing consumer adoption of plants based diary and meat alternatives, and clean label reformulation trends where carrageenan replaces the synthetic stabilizers. The region’s advanced R&D capabilities foster demand for the specialized pharmaceutical-grade carrageenan in drug delivery systems. The key challenges include price sensitivity and competition from the alternative hydrocolloids. However, the innovation in sustainable sourcing and application-specific blends from suppliers, such as CP Kelco and DuPont, supports steady demand. The U.S. dominates the regional share, with Canada representing a smaller but stable market influenced by similar health and wellness trends.

The U.S. carrageenan market is the leading one and is driven by the large-scale food processing and innovation in plant-based alternatives. The demand is concentrated in dairy substitutes, processed meats, and pharmaceutical applications, with the suppliers competing on technical service and sustainable sourcing. The U.S. FDA GRAS status governs its use. The growth is supported by the consumer trends toward the clean label and natural ingredients. A key demand is the government-backed research into alternative proteins. Carrageenan remains authorized for use under FDA regulation 21 CFR §172.620, allowing continued procurement by dairy, meat, and beverage manufacturers supplying national retail and institutional channels, based on the ECFR December 2025 report. Further, the USDA May 2025 report notes that the food and beverage sector is the largest and made sales of 26.2% in 2021, reflecting the production base that relies on the approved stabilizing and gelling inputs.

Canada’s carrageenan market is defined by the robust quality demands and alignment with the health-focused consumer trends within its robust dairy and functional food sectors. Health Canada regulates carrageenan as a food additive. The demand is stable for the applications in the dairy products, beverage stabilization, and nutraceutical gummies. The government programs supporting agricultural innovation are key drivers. For instance, the Agriculture and Agri-Food Canada’s report in November 2023 committed over USD 250 million to support the research, including the novel food ingredients and bioproducts, boosting an environment for the development and use of specialty ingredients such as carrageenan in value-added food products in Canada.

Key Carrageenan Market Players:

- CP Kelco (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DuPont (U.S.)

- Ingredion (U.S.)

- Ashland (U.S.)

- Cargill (U.S.)

- MCPI Corporation (Philippines)

- Shemberg Biotech Corporation (Philippines)

- CEAMSA (Spain)

- Gelymar S.A. (Chile)

- Europa (China)

- Green Fresh (Fujian) Co., Ltd. (China)

- Karagen Indonesia (Indonesia)

- PT. Gumindo Perkasa Industri (Indonesia)

- AEP Colloids (U.S.)

- Marcel Carrageenan (Philippines)

- Soriano S.A. (Argentina)

- LAUTA (Germany)

- TBK Manufacturing Corporation (Philippines)

- W Hydrocolloids, Inc. (Philippines)

- Argeles Pty Ltd (Australia)

- CP Kelco is a global leading player in the carrageenan market and is known for its high-purity, technically advanced product portfolio. Its strategic initiatives focus on deep R&D to develop specialized synergistic hydrocolloid blends that offer superior functionality in dairy, meat, and plant-based applications. By providing application-specific solutions and technical support to major multinational food companies, CP Kelco competes on innovation and performance rather than price, securing its position as a high-value market segment.

- DuPont leverages its formidable life sciences expertise to compete in the carrageenan market via its Nutrition & Biosciences division. Its strategy centers on creating integrated clean-label texture solutions where the carrageenan is a key component. DuPont invests heavily in consumer trend analysis and sustainability, developing carrageenan-based systems that meet the demand for the plant based alternatives and reduced fat or sugar content, thereby embedding its offerings into the next-gen food and beverage products.

- Ingredion has strategically entered the carrageenan market via partnerships and investments such as its joint venture with the carrageenan producer CEAMSA. This move is a part of a broader initiatives too expand its specialty ingredient portfolio beyond starches. Ingredion's strategy focuses on offering comprehensive texture solutions by combining carrageenan with its native and modified starches, providing customers with a streamlined supply chain and integrated formulation expertise for diverse food and industrial applications.

- Ashland operates in the carrageenan market via its pharmaceutical and specialty ingredients segments. Its strategic approach emphasizes the high purity and functional consistency of its carrageenan products, mainly for pharmaceutical gelling and controlled release applications. Ashland focuses on robust quality control and regulatory support, targeting demanding industries where performance and compliance are critical, thus carving out a strong niche in the pharmaceutical and premium food stabilization. The company has achieved an organic sale of USD 2.1 billion in 2024.

- Cargill is leading with its massive global scale and supply chain mastery in the carrageenan market. The company's strategy focused on vertical integration and sourcing reliability, ensuring a consistent supply for its global customer base. Cargill focuses on making the carrageenan accessible for the large-scale cost-sensitive food production while also investing in R&D for sustainable sourcing and clean label systems, balancing commodity strength with innovation to service a wide spectrum of the market. The company has made an annual revenue of USD 160 billion in 2024.

Here is a list of key players operating in the global market:

The global carrageenan market features a competitive landscape divided between the integrated multinational ingredient giants and specialized regional producers in Southeast Asia and Latin America. The key players compete on the quality, consistency, supply chain security, and application-specific solutions. The strategic initiatives are pivotal, including the multinational securing raw materials supply via acquisitions and partnerships in seaweed farming regions such as the Philippines and Indonesia. For example, in February 2024, Univar Solutions and Gelymar announced a distribution agreement for carrageenan in beauty and personal care. Further, the producers are investing heavily in R&D for value-added customized carrageenan blends and clean-label products to meet the evolving food texture and stabilization demands. The sustainability certification and vertical integration from the seaweed to finished product are also vital strategies to ensure the cost leadership and market resilience.

Corporate Landscape of the Carrageenan Market:

Recent Developments

- In November 2024, Marinomed Biotech AG has signed an agreement on the sale of its Carragelose business to the French CDMO Unither Pharmaceuticals. The contract provides for upfront and milestone payments in total of up to EUR 20 million, including an upfront payment of up to EUR 5 million.

- In May 2024, Roquette, a global leader in plant-based ingredients and a leading provider of pharmaceutical and nutraceutical excipients, has announced the launch of its new LYCAGEL Flex hydroxypropyl pea starch and carrageenan foundation as the original LYCAGEL VS 720 Premix.

- In February 2024, Ingredion Incorporated, has announced the launch of NOVATION Indulge 2940 starch, expanding their line of clean label texturizers with the first non-GMO functional native corn starch that provides a unique texture for gelling and co-texturizing for popular dairy and alternative dairy products and desserts.

- Report ID: 2870

- Published Date: Dec 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carrageenan Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.