Cardiovascular Prosthetic Devices Market Outlook:

Cardiovascular Prosthetic Devices Market size was valued at USD 8.6 billion in 2024 and is projected to reach USD 19.9 billion by the end of 2037, rising at a CAGR of 7.7% during the forecast period, i.e., 2025-2037. In 2025, the industry size of cardiovascular prosthetic devices is evaluated at USD 9.1 billion.

The global market caters to a significant patient pool readily affected by valvular heart disease and coronary artery disease. A CDC report in 2024 states that over 2.6% of the population in the U.S. are diagnosed with valvular heart disease, and coronary artery disease is causing 18.1 million deaths yearly across all nations. Besides, the National Institute of Health reports that in the well-established markets, nearly 210,000 valve replacement procedures are being performed annually, thus enhancing worldwide demand for prosthetic devices. Meanwhile, the presence of aging demographics also expands the business demand owing to the growing burden of CVD.

Supply chain is yet another factor positively influencing the cardiovascular prosthetic devices market, as it majorly relies on specialized materials such as titanium alloys, with 42% of mechanical valve components. These components are critically sourced from the U.S. and Germany, simultaneously, bovine or pericardial tissue, 75% of biological valves, are critically imported from Australia and New Zealand, as of the USDA 2024 data. Furthermore, the DGFT report in 2024 denoted that the U.S. prosthetic valves exports reached USD 2.1 billion in 2023, out of which 65% were dedicated towards the EU and Asia markets, whereas India imports 80% of its high-end cardiac devices, thus creating a prolific market opportunity.

Cardiovascular Prosthetic Devices Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements: The aspect of technological aspects and innovations have made a pivotal turning point in the upliftment of the cardiovascular prosthetic devices market. This effectively enhances the device performance and patient outcomes. Besides, Medtronic launched the Micra AV transcatheter Pacing system in 2022, hence representing a remarkable milestone in pacing technology. Further, these transcatheter heart valves and next-generation pacemakers appreciably improve durability and biocompatibility.

- Improvements in healthcare quality: The presence of vast healthcare facilities and patient base in the market has resulted in extreme improvements in healthcare quality. Based on this factor, a study found that intervention with advanced prosthetic devices reduced hospitalizations by an estimated 17.4%, resulting in USD 510.2 million savings within two years. Therefore, these protocols implemented improve the patient outcomes, thereby preemptively reducing hospital readmissions thus suitable for market development.

Historical Growth of Cardiovascular Prosthetic Device Patients and Its Impact on Market Expansion

The cardiovascular prosthetic devices market has been fundamentally reshaped by the expanding patient pool over the last decade, effectively attributed to the presence of aging demographics, cardiovascular disease prevalence, and advancements in medical technology. Besides, in the U.S. and Europe, the consumer base expanded owing to the enhanced healthcare infrastructure and reimbursement policies. Simultaneously, in the Asia Pacific, there was an accelerated adoption due to rising disposable income and medical tourism. Therefore, this has set the stage for heightened adoption, creating a revenue potential for worldwide markets.

Historical Patient Growth (2010–2020) – Cardiovascular Prosthetic Device Users (in millions)

|

Country |

2010 Patients |

2020 Patients |

Growth Rate (%) |

|

U.S. |

2.3 |

3.9 |

82.2% |

|

Germany |

1.2 |

1.8 |

79.5% |

|

France |

0.9 |

1.5 |

87.3% |

|

Spain |

0.7 |

1.3 |

102.3% |

|

Australia |

0.5 |

0.8 |

102.4% |

|

Japan |

1.4 |

2.3 |

76.2% |

|

India |

0.9 |

2.7 |

214.2% |

|

China |

1.6 |

4.3 |

18.6% |

Feasible Expansion Models Shaping the Future of Cardiovascular Prosthetic Devices

The global market comprises notable manufacturers, allowing the market to undergo evolutionary changes through domestic partnerships, innovations in terms of technological devices, and policy-backed expansions. For instance, in emerging markets, the suppliers are collaborating with public healthcare systems such as Ayushman Bharat to boost affordability, whereas developed markets focus on AI-based implants and strategic pricing. In this regard, in Germany, the adoption of LoT-enabled CPDs witnessed a steep revenue growth of 10.5%, thus creating an optimistic opportunity for the market growth.

Feasibility Models for CPD Market Expansion

|

Model |

Region |

Outcome (2020-2024) |

|

Public-Private Partnerships |

India |

12.4% revenue growth |

|

Localized Manufacturing |

China |

19.5% cost reduction |

|

Premium Innovations |

U.S. |

$2.2B market expansion |

|

Medical Tourism Boost |

Spain |

16.5% demand increase |

Challenges

- Delayed regulatory activities: The governing bodies create a remarkable hurdle in the cardiovascular prosthetic devices market, resulting in delayed product entry. Based on this factor, in Japan, PMDA takes 6 months to 12 months longer than the U.S. FDA, thereby delaying launches. However, to address this, Edwards Lifesciences made a significant investment towards clinical trials, cutting the approval timeline by 32% for its Sapien XT valve.

- Competition from generics: There has been a significant demand for prosthetic devices, despite which, the competition from generics hinders growth in the cardiovascular prosthetic devices market. WHO in 2023 reported that Turkey and Egypt adopted affordable biosimilar heart valves, diminishing the opportunity for manufacturers. Besides. Abbott launched trade-in programs facilitating upgrades to branded devices at a 52% discount.

Cardiovascular Prosthetic Devices Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

7.7% |

|

Base Year Market Size (2024) |

USD 8.6 billion |

|

Forecast Year Market Size (2037) |

USD 19.9 billion |

|

Regional Scope |

|

Cardiovascular Prosthetic Devices Market Segmentation:

Procedure Segment Analysis

Based on the procedure, the minimally invasive segment is expected to garner the highest share of 52.5% in the cardiovascular prosthetic devices market by the end of 2037. The dominance of the segment originates from the lower mortality rates when compared to open heart surgery and affordability. Testifying to the National Institute of Health denotes that it offers a 30-day survival over 95%, reflecting the high efficacy. Besides, transcatheter aortic valve replacement (TAVR) saves USD 10,000 per patient when compared to traditional surgery, thus positively impacting the segment’s dominance.

Product Type Segment Analysis

Based on the product type, the transcatheter heart valves segment is projected to grow at a considerable rate, with a share of 32.7% in the cardiovascular prosthetic devices market during the forecast period. The growth in this segment became possible with its expanded utilization among the geriatric population, which is 1.6 billion people aged above 60 2030 as of the WHO estimation. Besides, the U.S. FDA states that there is a 16.7% annual growth in minimally invasive procedures. On the other hand, Medicare is set to cover 82% of U.S. TAVR procedures by the end of the assessed timeframe.

Our in-depth analysis of the global market includes the following segments:

|

Procedure |

|

|

Product Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

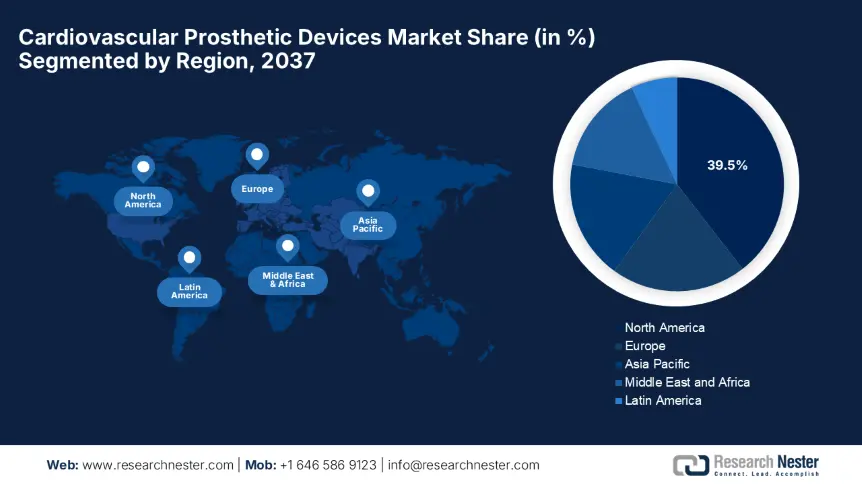

Cardiovascular Prosthetic Devices Market Regional Analysis:

North America Market Insights

The North America cardiovascular prosthetic devices market is projected to account for the highest share of 39.5%, along with a growth rate of 6.9% by the end of 2037. The growth in the region is effectively attributed to the advanced healthcare infrastructure and a prominent adoption of premium-priced innovations. Besides, the region benefits from Medicare's expanded coverage of TAVR, which offers reimbursement for 92% of procedures, and the U.S. FDA's extended approvals for next-generation devices such as robotic-assisted valves. Further U.S. and Canada import 30% of raw materials from Europe and Asia, creating an optimistic opportunity for foreign players.

The U.S. is the dominating player in the cardiovascular prosthetic devices market, which is remarkably fueled by the Medicare expansion and accelerating approvals. The country holds a substantial number of key players implementing tactical strategies to secure their global positions. Besides, the federal funding for CVD treatments reached USD 5.5 billion in 2023, whereas Medicaid grants of USD 1.3 billion facilitated access to patients with constrained income. Private sector investments such as Edward Lifescience, granting USD 510 million for AI-based valves, further propel growth in the U.S.

Canada is steadily consolidating its position in the cardiovascular prosthetic devices market, fueled by public healthcare expenditures. Based on this factor, Health Canada notes that in terms of provincial healthcare investments, Ontario allocated USD 3.3 billion in 2023 to cater to the cardiovascular prosthetic devices demand. Besides, the Canada Institute for Health Information (CIHI) notes that the publicly funded TAVR programs significantly reduced wait time by 32.6%. On the other hand, domestic manufacturing reduces reliance on imports by 42%, hence an ultimate opportunity for market progression.

Asia Pacific Market Insights

The Asia Pacific cardiovascular prosthetic devices market is poised to witness the fastest growth, rising at a CAGR of 8.4% with a considerable share of 26.4%. The growth in the region is effectively facilitated by the rising burden of cardiovascular diseases, expanding medical tourism, and government-backed healthcare modernization. Besides the presence of government subsidies, domestic manufacturing units and exclusive innovations readily drive business in this sector. Also, there is an amplified adoption of robotic surgery and affordable cardiovascular prosthetic devices, leading the way to utmost success.

China is the global leader in the cardiovascular prosthetic devices market, grabbing a share of 46.4% in the regional market during the assessed timeframe. The country is readily expanding with the presence of a USD 1.3 billion national subsidy program for cardiac devices. Besides, domestic manufacturing capacity currently meets over 70% of the country’s demand, with TAVR growing at a 19% CAGR owing to rising instances of cardiovascular diseases. Further, the price caps on imported devices encouraged international firms such as MicroPort to invest USD 310.5 million in Shanghai-based production.

The cardiovascular prosthetic devices market in India is vigorously growing, capturing a remarkable share of 19.4% in the Asia Pacific. The country benefits from the presence of government-backed initiatives and domestic manufacturing capabilities. In this context, Ayushman Bharat offers coverage for 510 million beneficiaries for cardiac surgeries. Costs of TAVR have reduced by 40% since 2022, owing to domestic manufacturing, with players such as Meril Life Sciences holding 62% of the share. Further 2023 National Interventional Council guidelines standardize CPD use across 1,500 centers, thus creating an optimistic market outlook.

Key Cardiovascular Prosthetic Devices Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The worldwide market comprises notable U.S. giants such as Medtronic, Edwards, and Abbott, strengthening their positions through R&D and acquisitions. Besides, the Europe-based firms such as Siemens, Getinge, and LivaNova are leading the market with surgical systems. The tactical trends implemented by the players include transcatheter aortic valve replacement expansion, bioresorbable stents, and AI-based diagnostics. Further, the regulatory approvals, collaborations with healthcare facilities, and digital health integration provide an encouraging opportunity for the market to expand more.

Here is the list of some prominent players in the industry:

|

Company Name |

Country |

Market Share |

Industry Focus |

|

Medtronic |

U.S. |

26.3% |

Leader in artificial heart valves, pacemakers, and stent technologies. |

|

Edwards Lifesciences |

U.S. |

19.4% |

Specializes in transcatheter heart valves (TAVR) and surgical heart valves. |

|

Abbott Laboratories |

U.S. |

13.5% |

Key player in coronary stents and structural heart devices. |

|

Boston Scientific |

U.S. |

11.2% |

Focuses on minimally invasive cardiovascular devices (stents, ablation systems). |

|

Johnson & Johnson |

U.S. |

9.8% |

Known for Biosense Webster electrophysiology products. |

|

Siemens Healthineers |

Germany |

xx% |

Advanced imaging and diagnostics for cardiovascular interventions. |

|

Getinge |

Sweden |

xx% |

Heart-lung machines and extracorporeal circulation systems. |

|

LivaNova |

UK |

xx% |

Specializes in advanced circulatory support and heart-lung technologies. |

|

MicroPort Scientific |

China |

xx% |

Emerging leader in coronary stents and transcatheter valves. |

|

B. Braun |

Germany |

xx% |

Vascular intervention devices and surgical solutions. |

|

Fresenius Medical Care |

Germany |

xx% |

Cardiovascular dialysis and support systems. |

|

Biotronik |

Germany |

xx% |

Pacemakers and implantable cardioverter-defibrillators (ICDs). |

|

Lepu Medical |

China |

xx% |

Drug-eluting stents and structural heart devices. |

|

Meril Life Sciences |

India |

xx% |

Affordable prosthetic heart valves and stents. |

|

Osypka AG |

Germany |

xx% |

Cardiac rhythm management devices. |

Below are the areas covered for each company under the top global manufacturers:

Recent Developments

- In April 2024, Boston Scientific announced the launch and U.S. FDA approval of 3D-Printed Grafts Transform Pediatric Care vascular grafts, offering bespoke solutions for congenital heart defects.

- In March 2024, Medtronic launched Next-Gen TAVR, expanding its dominance in transcatheter aortic valve replacement (TAVR) with the U.S. launch of its Evolut FX+ system, now approved for low-risk patients.

- Report ID: 7766

- Published Date: Jun 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert