Carbon Credit Market Outlook:

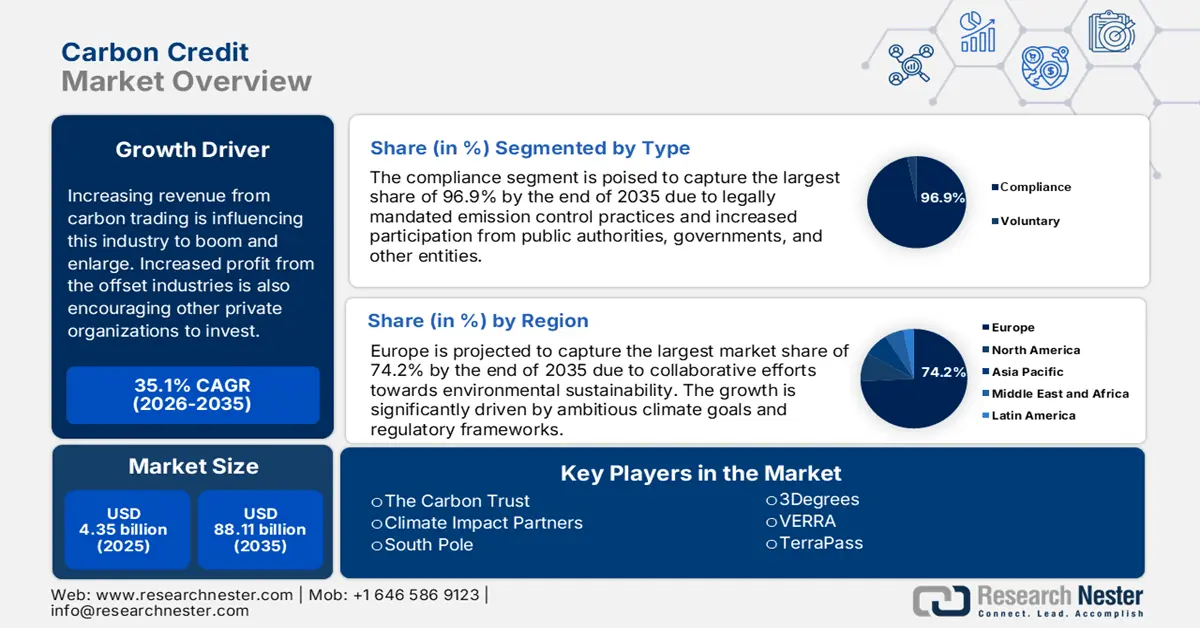

Carbon Credit Market size was valued at USD 4.35 billion in 2025 and is likely to cross USD 88.11 billion by 2035, expanding at more than 35.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of carbon credit is estimated at USD 5.72 billion.

Increasing revenue from carbon trading is influencing this industry to boom and enlarge. According to the World Bank, the carbon pricing revenue reached over USD 104 billion by 2023. This further encourages to establishment of more crediting frameworks. Increased profit from these offset industries is also encouraging other private organizations to invest.

Sustainability goals set by corporations and other financial institutions have driven the inflating number of credit purchases. Many corporate and financial institutions are investing in the carbon credit market, considering it to be an asset. This further enables easier access for participants by creating new investment fields. They are also showing interest in crediting as a part of their ESG Strategies while meeting emission targets. For instance, in October 2024, CFC partnered with BACX and Lockton to launch the first exchange crediting trade in Latin America. The leading insurance provider sees this collaboration as an investment to ensure transaction security with voluntary carbon credits.