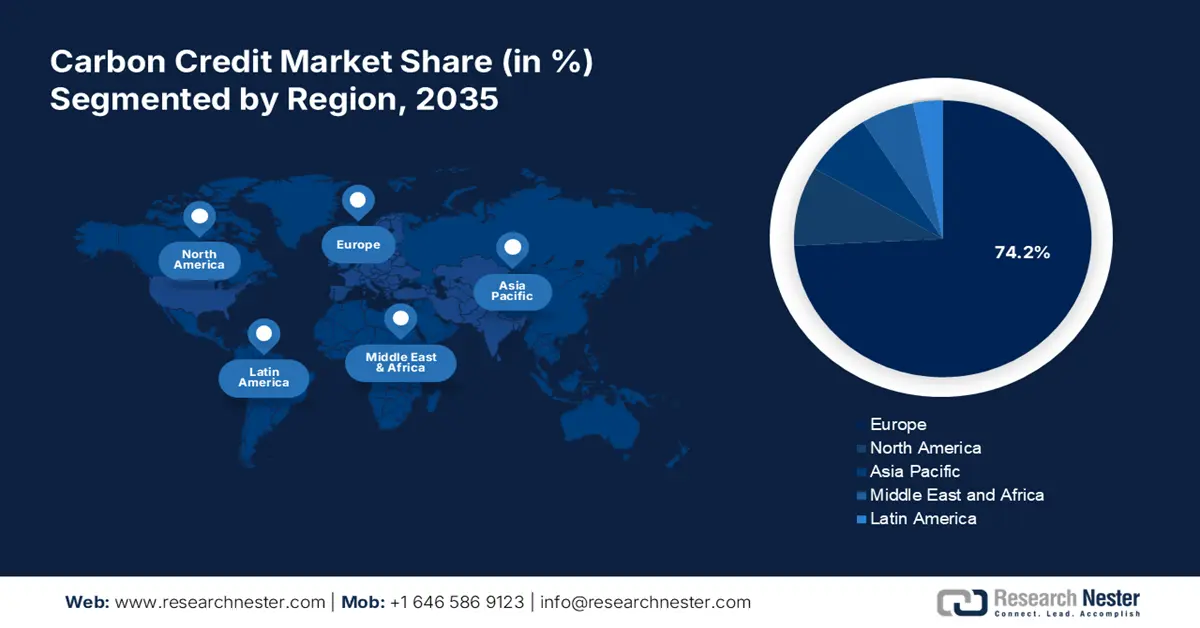

Carbon Credit Market Regional Analysis:

Europe Market Statistics

Europe industry is predicted to account for largest revenue share of 74.2% by 2035 due to collaborative efforts towards environmental sustainability. The growth is significantly driven by ambitious climate goals and regulatory frameworks. The region is home to one of the largest carbon markets EU ETS, influencing companies to lead the landscape. The region is issuing verifying systems to detect legitimate credits to reduce greenwashing threats. According to an IISD report published in December 2023, the European Union released a carbon removal certification framework to detect liability of all carbon credit claims. This further leads to the prevention of misleading claims and preserves market reputation.

The U.K. has established a prominent position in the carbon credit market through its advanced pricing mechanism. The country is now investing to escalate its credit generation to consolidate its global presence. Leading companies are also contributing to achieving the neutrality target by 2050. For instance, in July 2024, Changeblock acquired JustCarbon to magnify its carbon-capturing and removal technology by accessing high-integrity projects of JustCarbon. This acquisition will scale its operational activities to increase its value from USD 6.2 million to USD 350 million. Such strategic plans are further accelerating the trading ecosystem of the UK.

Italy is also leveraging its progress in the carbon credit market with its innovative biodiversity, restoration, and agroforestry projects. Many private companies are collaborating and investing to create their domestic trading funds for international participation. For instance, in October 2024, Respira partnered with Palladium to launch new nature-based carbon credit funds for corporates to secure offset emissions. The two new funds, Respira Carbon 2 and Vivair will help to raise supporting investments from around the world. The country’s net-zero target is further inducing unique credit-generating methods to create a new source of income for low-income populations including farmers.

North America Market Analysis

North America is expected to generate notable revenue from the carbon credit market through its advanced technology, improving trading infrastructure. The region is qualifying to be one of the largest suppliers through its success in both compliance and voluntary segments. Regional GHG capturing and reducing initiatives are creating a profitable way of generating additional revenue for various businesses. The supportive regulatory framework is also contributing to this process by issuing supportive policies, programs, and schemes. The emission allowances further encourage companies to participate in the trading system. In addition, the popularity of certification and standards has increased the scalability of credits to reduce emissions.

The U.S. is witnessing great progress in achieving neutrality through engaging in the carbon credit market. The cooperative effort of several states across the country has enlarged the sector. Technologically advanced trading companies are introducing innovative solutions to connect sellers and buyers. For instance, in September 2024, VERRA collaborated with EPİAŞ to avail certified exchange-based credits through a platform. This credit trading platform will provide transparency and regulatory compliance while facilitating trade through an exchange.

Canada is also following the regional growth to be one of the leading countries in compliance carbon credit market. The federal government has set the carbon price floor to stabilize the trading for provinces without a system. Authorities such as in British Columbia and Quebec have already created their cap-and-trade program to cover industries including energy production and transportation. The country further plans to release updated regulations to standardize the trading process for supplying verified carbon allowances.