CAR T-Cell Therapy Market Outlook:

CAR T-Cell Therapy Market size was valued at USD 6 billion in 2025 and is projected to reach USD 45.6 billion by the end of 2035, rising at a CAGR of 22.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of CAR T-cell therapy is assessed at USD 7.35.

The market is driven by the rising number of patients affected by chronic diseases, and the demand for targeted treatment also rises, creating a sustainable consumer base for the market. According to the NLM study published in May 2025, nearly 1,580 CAR T clinical trials were registered at ClinicalTrials.gov as of April 2024. Public funders and nonprofits remain large sponsors of trials and translational studies; NIH and disease foundations provide core grant funding and trial support that underpin clinical growth and broaden the addressable pool. This demographic trend represents a landscape of biopharmaceutical advances, benefiting this sector.

CAR T cells are mostly used to modify the genetic cytotoxic immune T cells to approach tumor-specific antigens and support durable remissions of relapsed or refractory B-Cell Lymphoma. B-Cell lymphoma is the most prevalent form of malignant lymphoma, and relapsed or refractory lymphoma has been demonstrated to be a greater cause of treatment failure. For example, according to Cancer Network, June 2022, diffuse large B-cell lymphoma (DLBCL) maintains a considerable presence under the category of Non-Hodgkin Lymphoma, and about 30-40% of the patients develop relapsed/refractory DLBCL in the first 2 years. Moreover, different product launches and approvals impart substantial momentum to the industry players. Various shortages and volatilities in manufacturing plants and API production are recognized as the key drivers of this upstream price flow.

Key CAR T-Cell Therapy Market Insights Summary:

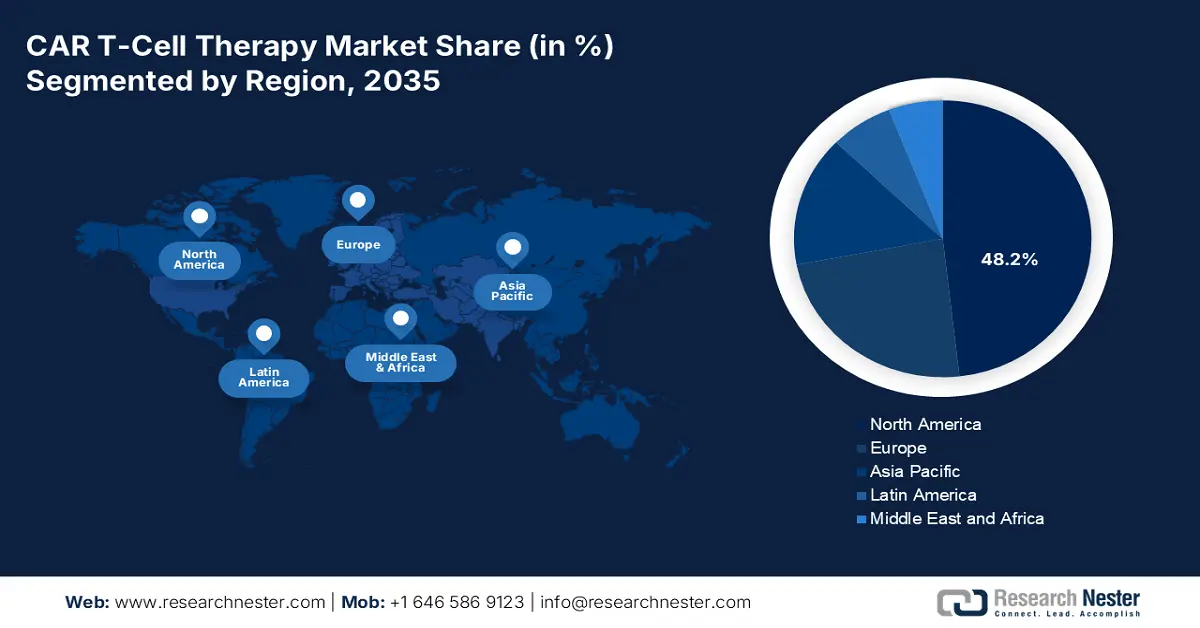

Regional Insights:

- North America is anticipated to capture a 48.2% share by 2037 in the CAR T-Cell Therapy Market, supported by its expanding patient pool and robust oncology care ecosystem.

- Asia Pacific is poised for the fastest growth by 2037, underpinned by extensive clinical trial activity and rising incidence of chronic diseases.

Segment Insights:

- By 2035, the Hospitals segment is projected to command an 87.6% share in the CAR T-Cell Therapy Market, bolstered by their advanced infrastructure and multidisciplinary capacity to deliver complex treatment regimens.

- The CAR T cell therapy type segment is anticipated to secure a substantial share by 2035, supported by its transformative clinical success in hematologic cancers where conventional treatments fall short.

Key Growth Trends:

- Rising patient pool and disease prevalence

- Manufacturers' innovation and strategies

Major Challenges:

- Limiting scopes of profitability

Key Players: Novartis,Gilead/Kite Pharma,Bristol Myers Squibb,Janssen (Johnson & Johnson),Legend Biotech,CARsgen,Bluebird Bio,Autolus Therapeutics,Celyad Oncology,Poseida Therapeutics,JW Therapeutics,Gracell Biotechnologies,Immuneel Therapeutics,LG Chem,Cartesian Therapeutics,Mustang Bio,CellVec,Kazia Therapeutics,Takeda,Daiichi Sankyo

Global CAR T-Cell Therapy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6 billion

- 2026 Market Size: USD 7.35 billion

- Projected Market Size: USD 45.6 billion by 2035

- Growth Forecasts: 22.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region:North America (48.2% Share by 2037)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: South Korea, Singapore, India, Australia, Italy

Last updated on : 10 September, 2025

CAR T-Cell Therapy Market - Growth Drivers and Challenges

Growth Drivers

- Rising patient pool and disease prevalence: The CAR T cell market is sustained by an increasing global burden of cancer. The U.S. accounted for nearly 80,000 new non-Hodgkin lymphoma cases, according to an NLM report published in June 2025. Relapse and refractory rates across the hematologic malignancies provide a large patient pool suitable for advanced therapies annually. In Europe and other parts of the world, the steady incidence of lymphoma and other cancers further increases the base for treatment. With increasing research expanding CAR T uses to numerous myeloma and certain solid tumors, the target market is likely to expand tremendously, making CAR T a vital component of cancer treatment.

- Manufacturers' innovation and strategies: Industry leaders are scaling up adoption through pipeline expansion, automation, and global access initiatives. Novartis, the dominant player in December 2021, introduced T-Charge, which is a next-gen CAR T platform with improved vein-to-vein times and that reduces the challenges in manufacturing. Further, Novartis received FDA approval in May 2022 for label expansions of Kymriah, expanding its indication in earlier lines of treatment. Collaboration with academic centers and local manufacturing hubs has enhanced global coverage. Such approaches not only increase clinical availability but also speed up patient throughput, making CAR T more scalable.

- Gene transfer strategies: They are the central drivers of the CAR T cell therapy, facilitating a limited and targeted alteration of the patient's T cells to recognize and eliminate the cancer cells. 2,042 gene therapies, including genetically engineered cell therapies like CAR-T cell therapies, are being developed according to the 2024 American Society of Gene + Cell Therapy report, representing 49% of gene, cell, and RNA therapies. These technologies reduce manufacturing difficulties and lower costs tso make the therapy more affordable.

Challenges

- Limiting scopes of profitability: The heightened R&D and manufacturing costs are shrinking the opportunities for securing a lucrative profit margin in the market. Additionally, governments in budget-constrained regions are refraining from premium pricing, which tends to a notable decrease in brand values. For instance, in 2023, the commencement of G-BA in Germany imposed price cuts for related treatments, creating hesitation among manufacturers regarding the full-fledged supply. This ultimately results in dose shortage and lower accessibility in this sector. In response, leaders are linking their pricing structure with the thresholds of local insurer policies to attain maximum financial backing.

CAR T-Cell Therapy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

22.5% |

|

Base Year Market Size (2025) |

USD 6 billion |

|

Forecast Year Market Size (2035) |

USD 45.6 billion |

|

Regional Scope |

|

CAR T-Cell Therapy Market Segmentation:

End use Segment Analysis

Hospitals dominate the end use segment and are set to hold a share value of 87.6% in 2035. The segment is driven by its strong infrastructure and multidisciplinary staff to take on complex treatments and effects. Hospitals offer specialized facilities, including dedicated operating theatres and an ICU, that is necessary for administering CAR T-cell therapies. In addition, the July 2022 Science Direct report illustrates that the CAR T cell infusions for the majority of patients are 88% to 98% in hospitals. The hospitals also provide ongoing monitoring of treatment to make therapy safer and more effective.

Type Segment Analysis

In the type category, CAR T cell therapy dominates the segment and is expected to hold a significant share in 2035. The segment is driven by its revolutionary outcomes in hematologic cancers, mainly in B-cell lymphomas and leukemias, where traditional therapies are ineffective. With the support of FDA approvals and strong clinical trial pipelines, CAR T-cell treatments have shown high remission rates and durability compared to other treatments. The growth of the therapy is also driven by strategic partnerships with academia, biotech, and regulatory agencies for the efficient launch of next-generation products, assuring long-term leadership in the market.

Target Antigen Segment Analysis

Based on the target antigen, the CD19 segment is predicted to capture the largest share in the market over the assessed period. The clinical validation and regulatory recognition are the drivers dominating this segment. For instance, in 2024 alone, the FDA and EMA gave clearance for six different CD19-targeted therapies. On the other hand, the NLM study published in December 2023 depicts that CAR T-cell therapy for refractory or relapsed diffuse large B-cell lymphoma (DLBCL) reports objective responses in about 70% of patients, with a specific phase II ZUMA-1 trial reporting an overall response rate (ORR) of 82% and a complete response (CR) rate of 54%, highlighting the response rate from using this technology. Moreover, its proven efficacy in treating hematologic malignancies is solidifying its dominance over other types.

Our in-depth analysis of the CAR T-cell therapy market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Target Antigen |

|

|

Indication |

|

|

Product |

|

|

Manufacturing Process |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

CAR T-Cell Therapy Market - Regional Analysis

North America Market Insights

North America is expected to dominate the global market with a share of 48.2% by the end of 2037. The region has a rising patient pool, which is the primary growth driver in the region. Regarding the same, the NLM article published in June 2025 states that patients aged 60+ received axicabtagene ciloleucel (Yescarta) with effective responses and manageable side effects. Further, the established network of advanced cancer care centers across developed countries, such as the U.S. and Canada, also contributes to a greater rate of adoption in this sector.

The U.S. is augmenting the regional market with dominance on account of strong insurer backing and substantial Federal investments. The CDC report released in June 2025 declares that in 2022, nearly 1,851,238 new cancer cases were reported, urging for CAR T cell therapy in the U.S. On the other hand, the government is increasing the funds for cancer research, including CAR T therapies. Medicare and Medicaid have expanded reimbursement policies to cover the patient population and enhance therapy accessibility. Clinical trials, patient access, and manufacturing capacity also drive the market growth.

Cancer Burden Statistics in U.S. and Canada

|

Country |

Year |

New Cases |

Deaths |

|

U.S. |

2023 |

1,958,310 |

609,820 |

|

Canada |

2023 |

239,100 |

86,700 |

|

U.S. |

2024 |

2,001,140 |

611,720 |

|

Canada |

2024 |

247,100 |

88,100 |

Source: Cancer Progress Report, Canadian Cancer Statistics, Canadian Cancer Society

APAC Market Insights

Asia Pacific is poised to register the fastest pace of growth in the global CAR T-cell therapy market by the end of 2037. Countries like China, Japan, Korea, and Singapore have performed various CAR T-cell clinical trials, supported by government and philanthropic funding. For example, China initiated over 342 clinical trials by 2021, as reported in NLM study in December 2023. In addition, the increasing occurrence and mortality of chronic disorders, such as cancers, cardiovascular disease, and diabetes, are presenting a broad range of applications for this merchandise. As a result, both domestic and foreign companies are becoming keener to invest and participate in this landscape to captivate a greater proportion of profit margins.

The emergence of India as a key biopharmaceutical therapeutic developer is solidifying its lucrative augmentation in the CAR T-cell therapy market. India's first homegrown CAR-T cell therapy, NexCAR19, shows a 73% success rate against cancer, according to the India Today article published in March 2025. Further, the NexCAR19 is expected to cost $50,000 and is projected to treat 1,200 patients in a year, based on the National Cancer Institute report in February 2024. The government supports its integration into healthcare via policy initiatives and infrastructure development, making India a growing hub for advanced cancer immunotherapy.

Europe Market Insights

The CAR T-cell therapy market in Europe is estimated to hold a notable share by 2035. This is accomplished through comprehensive pricing, accelerated EMA compliance, and increasing hematologic cancer cases. Over 30% of approved advanced therapy medicinal products in the UK/EU are CAR-T therapies; 63% target blood cancers, 37% solid tumors, mainly gastrointestinal, breast, and nervous system, based on the Science Direct report released in November 2024. On the other hand, the strengthening emphasis on cost-effective innovation and standardized access is making this region a major consumer base and policy leader in advanced CAR-T cell therapies globally.

The UK dominates the regional CAR T-cell therapy market with provincial government funding and the presence of international biotechnological pioneers. The nation is propelled by increasing hematologic cancer incidences, growing R&D spending, and favorable regulatory environments. According to the Macmillon Cancer Support article posted in January 2021, in the UK, CAR-T therapy treats selected B-cell leukemias and lymphomas, reaching around 200 patients each year. NHS programs and government funds are also driving market growth, whereas partnerships among industry and academia increase innovation and clinical trial activity, making the nation a leader in CAR T-cell therapy in Europe.

Key CAR T-Cell Therapy Market Players:

- Novartis

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Gilead/Kite Pharma

- Bristol Myers Squibb

- Janssen (Johnson & Johnson)

- Legend Biotech

- CARsgen

- Bluebird Bio

- Autolus Therapeutics

- Celyad Oncology

- Poseida Therapeutics

- JW Therapeutics

- Gracell Biotechnologies

- Immuneel Therapeutics

- LG Chem

- Cartesian Therapeutics

- Mustang Bio

- CellVec

- Kazia Therapeutics

- Takeda

- Daiichi Sankyo

The market commercial leadership is followed by the clinical and financial achievements of market leaders such as Novartis, Gilead, and Bristol Myers Squibb. Their commercialization strategy for FDA/EMA-approved treatments, effective pricing structure, and product development are collectively driving this market toward healthy competitiveness. Additionally, innovators like Poseida Therapeutics are leading the way in allogeneic off-the-shelf platforms that reduce vein-to-vein time from weeks to days, which is extending the industry's reach, even to underserved areas.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In June 2025, Bristol Myers Squibb announced the FDA approval for both of its CAR T cell therapies, Breyanzi in treating large B cell lymphoma and other lymphomas, and Abecma for the treatment of multiple myeloma.

- In January 2025, Immuneel launches Qartemi, India’s first global CAR T-cell therapy for non-Hodgkin’s lymphoma. The therapy is personalized for adult patients with relapsed or refractory B-NHL.

- Report ID: 2441

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

CAR T-Cell Therapy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.