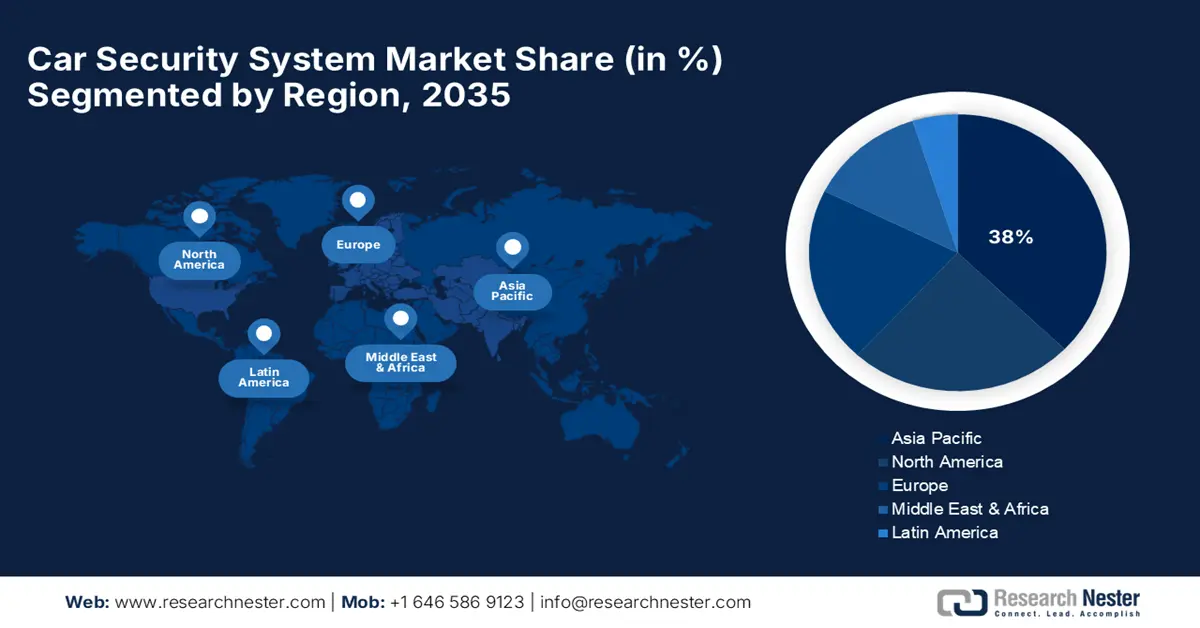

Car Security System Market - Regional Analysis

APAC Market Insights

Asia Pacific is projected to dominate the industry and capture a 38% market share during the forecast period. This dominance is driven by the region's rapidly growing automotive markets, accelerated urbanization, and gigantic government investments in smart city infrastructure and connectivity. As several new, connected vehicles are sold across APAC, demand for robust, integrated security solutions to protect vehicles from cyberattack and theft is increasing at an unprecedented rate, and it is a high-priority market for global security providers.

China is becoming a leader in the auto industry by embracing one of the most ambitious and strict mandatory cybersecurity regulation regimes. The government's top-down approach and push for technological sovereignty are accelerating the rollout of advanced security features on all cars sold in the country. An example of this occurred in September 2024, when China's GB 44495 cybersecurity regulation was made compulsory to roll out on all new vehicle models. The initial rollout phase requires all networked vehicles to comply with robust conditions, setting a new global standard for automotive cybersecurity enforcement.

India car security system market is rising, driven by the government's push towards vehicle modernization and the forthcoming release of comprehensive national cybersecurity regulations. With a massive and growing vehicle parc, the nation offers a huge long-term opportunity to security system suppliers. India went public with the forthcoming compulsory introduction of Automotive Industry Standard (AIS) 189 in November 2023. The regulation, which must become compulsory by 2027, will be aligned to global standards like UN R155 and will require OEMs to demonstrate end-to-end cybersecurity compliance at homologation, effectively revolutionizing the India automobile industry.

North America Market Insights

North America car security system market is estimated to experience a projected CAGR of 8% from 2026 to 2035, driven by technological synergies, intensive private investment, and increasing regulatory scrutiny. The region hosts many of the world's leading technology firms and automotive innovators, creating a highly competitive and dynamic environment. This is pushing the rapid development and deployment of advanced cybersecurity technology designed to protect the next generation of connected and autonomous vehicles, from the simple passenger automobile to massive commercial fleets.

The U.S. is a focal point for the market for automobile security, with a lucrative ecosystem of cybersecurity vendors and the move toward market consolidation to deliver end-to-end security platforms. This market expansion is driven by the need to consolidate fragmented security tools into more effective end-to-end solutions that can handle sophisticated threats. The example was seen in December 2024, when Arctic Wolf announced that it had acquired BlackBerry's endpoint security assets from Cylance. The action is a significant consolidation that brings AI-powered protection deployed by thousands of organizations worldwide, including the automotive space.

Canada is taking a thoughtful and direction-guided approach to automotive cybersecurity, with an emphasis on establishing flexible, technology-neutral frameworks that facilitate innovation without trading off safety. Transport Canada is working closely with industry stakeholders to establish principles and best practices for rollout throughout the entire vehicle life cycle, from design through manufacturing, deployment, and post-deployment. In March 2023, Transport Canada released its Vehicle Cyber Security Guidance document. This non-prescriptive approach encourages a risk-based management, protection, detection, and recovery strategy, providing a robust national standard for the creation of secure connected vehicles.

Europe Market Insights

Europe is projected to witness substantial growth in the car security system market by 2035 as a leading world power in motor regulation and sustainability. The region's rigorous regulatory environments, particularly for cybersecurity and data protection, are compelling car makers to introduce the highest vehicle protection standards. This regulation-driven demand, coupled with the continent's ambitious green and smart city initiatives, offers a rich terrain for cutting-edge, comprehensive car security systems that align with Europe's imagination of a secure, safe, and sustainable mobility future.

Germany, one of the lucrative hubs of the Europe auto industry, is a driving force in encouraging the adoption of state-of-the-art car security systems. Germany's giant OEMs and Tier 1 players lead in the use of innovative technology in their vehicles to meet global requirements and guard their edge in technology and quality. This focus on premium engineering was witnessed in May 2024, when BorgWarner went public with its delivery of the eTVD system to Polestar and other major European OEMs. This technology intelligently manages torque to improve vehicle stability, performance, and overall electronic system safeguard.

The UK is among the leading markets for self-driving car technology, backed by one of the world's most comprehensive sets of self-driving car legislation. Government leadership in innovation and safety provides clear regulatory authority and legal guarantees. This reassures investors and operators, encouraging the introduction of new mobility solutions. In June 2024, the UK passed the Automated Vehicles Act 2024. This revolutionary piece of legislation created an over-riding safety and security framework uniquely designed to propel innovation to the maximum while making the vehicle safe to operate without human input. APAC Car Security System Market Insights