Candidiasis Drugs Market Outlook:

Candidiasis Drugs Market size was valued at USD 2.6 billion in 2025 and is projected to reach USD 4.9 billion by the end of 2035, rising at a CAGR of 7.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of the candidiasis drugs market is estimated at USD 2.8 billion.

The increasing occurrence rate of bloodstream infections, fungal infections, particularly among immunocompromised populations around the world, is the primary driver behind the robust growth in the candidiasis drugs market. Also, there has been a shift towards outpatient care and the growing prevalence of hospital-acquired infections, which is remarkably expanding the demand for effective antifungal treatments. NIH in May 2023 revealed that in the U.S., approximately 37% of newborns may develop oral thrush within the first few months of life, wherein children using inhaled corticosteroids also exhibit a higher incidence of oral candidiasis.

Furthermore, IJID Regions in September 2025 stated that recurrent vulvovaginal candidiasis affects around 6% to 9% of women across all nations and imposes a huge burden on Uganda’s healthcare system. Besides, the annual economic cost was valued at USD 75.7 million, which is equal to 11.22% of national health spending. It further stated that the direct medical costs made up 71.5% of the total, while the average cost per patient was USD 70.29, about 7% of per-capita GDP, wherein the key risk factors are HIV, hormonal contraceptives, and antibiotic use.

Key Candidiasis Drugs Market Insights Summary:

Regional Insights:

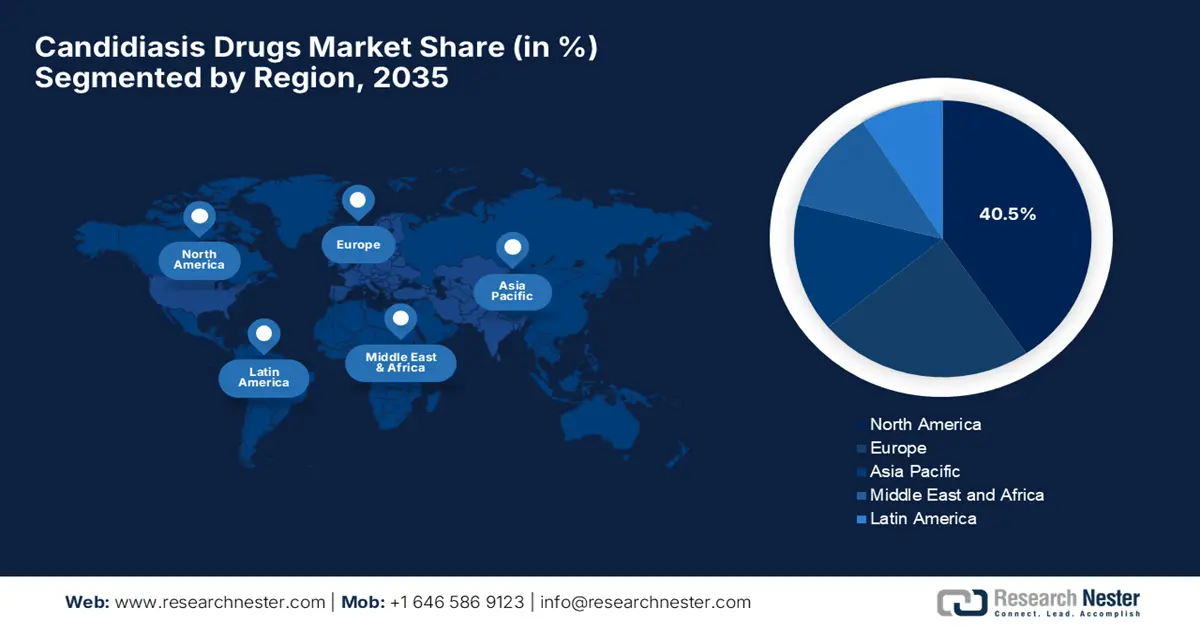

- By 2035, North America is anticipated to command a 40.5% share in the Candidiasis Drugs Market, attributable to advanced healthcare infrastructure and continual formulation upgrades.

- Asia Pacific is projected to expand at the fastest pace between 2026 and 2035, supported by rising fungal infection incidence, growing diabetic and immunocompromised populations, and heightened antibiotic overuse.

Segment Insights:

- By 2035, the oral segment is poised to secure a 52.8% share in the Candidiasis Drugs Market, underpinned by higher prescription rates for systemic and recurrent vulvovaginal infections.

- The azole segment is forecast to capture a 49.3% share by 2035, spurred by its broad-spectrum efficacy, established treatment-guideline positioning, and availability across multiple formulations.

Key Growth Trends:

- Rise in invasive procedures and hospitalizations

- Drug development advancements

Major Challenges:

- Limitations in infrastructure and supply chain

- Rising antifungal resistance

Key Players: Pfizer Inc.,Merck & Co., Inc.,Astellas Pharma Inc.,Novartis AG,Bayer AG,GlaxoSmithKline (GSK) plc,Cidara Therapeutics, Inc.,SCYNEXIS, Inc.,Melinta Therapeutics, LLC,Basilea Pharmaceutica Ltd.,Mylan N.V. (now part of Viatris Inc.),Teva Pharmaceutical Industries Ltd.,Sun Pharmaceutical Industries Ltd.,Astellas Pharma US (Sub. of Astellas),Pacgen Life Science Corporation,Lupin Limited,Cipla Limited,Alkem Laboratories,Hikma Pharmaceuticals PLC,Bausch Health Companies Inc.

Global Candidiasis Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.6 billion

- 2026 Market Size: USD 2.8 billion

- Projected Market Size: USD 4.9 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Mexico, Italy

Last updated on : 6 October, 2025

Candidiasis Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Growing immunocompromised and geriatric populations: The aging demographics are highly susceptible to conditions such as diabetes, cancer, and frequent hospital/ICU exposure. DMID in April 2022 analyzed 4,497 fungal isolates from elderly patients above 65 years and nonelderly (18 to 64 years) patients collected globally between 2 years through the SENTRY Antifungal Surveillance Program. Candida species accounted for the majority of isolates, with C. albicans and C. glabrata being more frequent in the elderly. The study also found that antifungal resistance to triazoles and echinocandins was significantly higher in the younger population when compared to the elderly.

- Rise in invasive procedures and hospitalizations: The readily escalating surgical procedures and the utilization of central venous lines, ventilators, catheters, etc., lead to more candidemia and invasive candidiasis. In April 2024, the CDC in April 2024 revealed that the growing occurrence of candidiasis is associated with injection drug use. It also stated that in a span of 4 years, about 10% of prevalence was witnessed in patients with a history of injection drug use, mostly in younger adults, hence denoting a wider market scope.

- Drug development advancements: The continued innovations in drug development & better formulations, such as new echinocandins, agents effective against resistant species, are improving patient compliance in this field. For instance, in June 2024, Biocon Limited reported that it had received approval from the U.S. Food and Drug Administration for its vertically integrated, complex injectable drug product called Micafungin (50mg and 100mg vials), an antifungal medication used to treat fungal or yeast infections, allowing a steady business influx in this field.

Burden of Invasive Candidiasis: Global Statistics (2019-2021)

|

Parameter |

Statistic |

|

Annual incidence |

1,565,000 cases |

|

Annual crude mortality |

995,000 deaths |

|

Crude mortality rate |

63.6% |

|

Attributed mortality |

~68% of crude deaths |

|

Primary conditions/populations |

ICU patients, immunocompromised, and patients without positive blood cultures |

Source: The Lancet Infectious Diseases

Global Developments in Candidiasis Treatment Research and Innovation

|

Year |

Company |

Drug (or Tech) |

Phase/Status |

Key Highlights |

|

2025 |

SCYNEXIS, Inc. |

SCY-247 |

Preclinical / Phase 1 |

Second-gen IV/oral fungerp; active against drug-resistant Candida spp. |

|

2025 |

Zero Candida Tech |

Anti-Candida Device |

Preclinical |

Preparing FDA submission; device targeting women’s health |

|

2024 |

Basilea Pharma |

Fosmanogepix |

Phase 3 (FAST-IC) |

First-in-class antifungal; targets candidemia & invasive candidiasis |

Source: Company Official Press Releases

Challenges

- Limitations in infrastructure and supply chain: The absence of adequate production facilities and distribution channels in underserved regions often makes products in the candidiasis drugs market expensive. This has the potential to limit the rate of adoption and global-scale expansion of this sector. On the other hand, key manufacturers from developed landscapes, such as the U.S. and Europe, face volatilities in the supply of essential raw materials due to sole reliance on outsourcing, which ultimately raises product pricing.

- Rising antifungal resistance: This is yet another factor negatively impacting the growth trajectory of the candidiasis drugs market. The growing resistance of Candida species to existing antifungal medications due to the over time, and sometimes inappropriate use of antifungal drugs has enabled certain strains of Candida to develop mechanisms that reduce drug effectiveness. Therefore, this resistance not only complicates treatment but also leads to longer treatment duration, higher healthcare costs, and increased risk of severe infections.

Candidiasis Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 2.6 billion |

|

Forecast Year Market Size (2035) |

USD 4.9 billion |

|

Regional Scope |

|

Candidiasis Drugs Market Segmentation:

Formulation Segment Analysis

Based on formulation, the oral segment is projected to garner the largest revenue share of 52.8% in the candidiasis drugs market during the forecast tenure. The higher prescription rates for systemic infections and recurrent vulvovaginal candidiasis are the key factors behind the subtype’s leadership. Besides the efficacy and patient compliance advantages of oral drugs, especially fluconazole, the asset of this landscape is fostering a favourable business environment. Furthermore, the expanding availability of generic formulations and extended-release oral antifungals is expected to further boost the segment’s dominance in the years ahead.

Drug Class Segment Analysis

In terms of drug class, the azole segment is predicted to attain a significant share of 49.3% in the candidiasis drugs market by the end of 2035. The growth in the segment is highly subject to their broad-spectrum efficacy available both in oral and topical formulations, and their established position in treatment guidelines. The June 2025 NIH article stated that azole antifungals, particularly fluconazole, are highly essential in the management of vulvovaginal candidiasis in women, including those with type 2 diabetes mellitus. It states that fluconazole is most commonly prescribed owing to its oral availability, efficacy, and suitability with guidelines from the CDC and IMSS.

Application Segment Analysis

Based on the application, the vulvovaginal candidiasis segment is anticipated to capture a share of 42.4% in the candidiasis drugs market during the analyzed timeframe. The growing prevalence and occurrences are creating a sustained demand for these therapeutics. Testifying this, the IJOGR in August 2022 revealed that Vulvovaginal candidiasis affects around 70% to 75% of women at least once in their lifetime, wherein 8% to 9% are experiencing recurrent VVC with more than three episodes per year. Furthermore, in terms of global perspective, the US and UK reported VVC prevalence between 29% to 49%, with a 25% lifetime recurrence risk by age 50.

Our in-depth analysis of the candidiasis drugs market includes the following segments:

|

Segment |

Subsegments |

|

Formulation |

|

|

Drug Class |

|

|

Application |

|

|

Distribution Channel |

|

|

Type |

|

|

End user |

|

|

Patient Demographics |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Candidiasis Drugs Market - Regional Analysis

North America Market Insights

North America is expected to capture the largest share of 40.5% in the candidiasis drugs market by the end of the analyzed timeline. This leadership is pledged to its advanced healthcare infrastructure and upgradation in product formulations. In March 2023, GSK and SCYNEXIS together reported that they have entered an alliance to commercialize and further develop Brexafemme (ibrexafungerp), which is the first U.S. FDA-approved oral antifungal for vulvovaginal candidiasis and recurrent VVC. The company also stated that SCYNEXIS will gain USD 90 million upfront, while retaining rights to other enfumafungin-derived assets.

The U.S. is augmenting its dominance over the regional candidiasis drugs market, backed by substantial federal investments and healthcare escalations. Besides, the implementation of AI diagnostics reduced hospitalization due to related infections, fueling a surge in non-invasive treatment options. As evidence, NIH in July 2025 revealed that an estimated 133,555 fungal disease-related hospitalizations and 13.37 million outpatient visits occur on a yearly basis in the U.S., leading to USD 13.4 billion in direct medical costs. Out of these, invasive candidiasis caused the most hospitalizations, i.e., 61,120, and USD 3.3 billion in costs.

The Canada candidiasis drugs market is also experiencing significant growth on account of strong and ambitious government commitments toward healthcare advancements. For instance, in January 2024, Medexus Pharmaceuticals stated that its new drug submission for a topical terbinafine hydrochloride nail lacquer, for treating fungal nail infections, has been accepted for review by Health Canada, which marks a major milestone towards the treatment of fungal infections in the country.

Direct Medical Costs of Candidiasis in the U.S. by Payer Type (2024 USD)

|

Type |

Medicaid |

Medicare |

Private Insurance |

Other |

Total |

|

Hospitalization -Invasive |

421,712,709 |

1,707,767,031 |

1,904,536,553 |

199,631,338 |

4,233,647,630 |

|

Hospitalization Non-invasive/Unspecified |

12,375,103 |

44,612,841 |

54,613,536 |

4,509,375 |

116,110,854 |

|

Outpatient - Invasive |

14,730,787 |

14,460,998 |

57,736,515 |

8,475,085 |

95,403,384 |

|

Outpatient - Non-invasive/Unspecified |

69,147,577 |

260,790,328 |

490,590,734 |

72,013,319 |

892,541,958 |

|

Total Candidiasis (All Types) |

517,966,176 |

2,027,631,198 |

2,507,477,338 |

284,629,117 |

5,337,703,829 |

Source: NIH

APAC Market Insights

Asia Pacific is predicted to register the highest pace of growth in the global candidiasis drugs market between 2026 and 2035. This propagation is highly stimulated by the rising incidences of fungal infections, increasing populations of diabetes, HIV, and cancer, and widespread antibiotic overuse cases. China and India are taking leadership in this patient pool. Furthermore, the presence of technologically developed countries, such as Japan and South Korea, is focused on AI-based innovations through extensive R&D activities and investments.

China is marking its regional dominance over the candidiasis drugs market due to having a large patient pool and exceptional API production capacity. In February 2024, Mycovia Pharmaceuticals announced the launch of VIVJOA (oteseconazole) capsules by their partner Jiangsu Hengrui Pharmaceuticals in the country for treating severe vulvovaginal candidiasis. The company further stated that the innovative oral azole antifungal offers a 2-day treatment regimen, enabling a strong capital influx, benefiting this sector.

India is also following the accelerated progress of the Asia Pacific candidiasis drugs market, which is backed by its biologics production capacity, government efforts to bridge the access gap in rural hospitals, and an enlarging patient population. In December 2023, Aurobindo Pharma, also known as Eugia Pharma Specialities Limited, received final approval from the U.S. FDA for the manufacturing and marketing of Posaconazole Injection, a medication designed to help prevent invasive Aspergillus and Candida infections in immunocompromised patients.

Europe Market Insights

The candidiasis drugs market in Europe is portraying a steady growth facilitated by increasing awareness about fungal infections and the rising prevalence of immunocompromised patients. Besides advancements in antifungal therapies, along with improved diagnostic techniques, there are also providing greater opportunities for players to gain the interest of both service providers and consumers. In December 2023, Mundipharma announced that the European Commission had approved REZZAYO (rezafungin acetate) for the treatment of invasive candidiasis in adults and is the best alternative for seriously ill patients with high mortality rates.

Germany has a huge potential to capitalize on the candidiasis drugs market, effectively driven by a strong focus on research and development, supported by a robust healthcare system. The country’s market also benefits from a huge emphasis on early diagnosis and personalized treatment approaches, thereby driving demand for effective antifungal therapies. Furthermore, the country’s well-established pharmaceutical sector and amplifying collaborations between public and private entities are propelling greater progress in this field.

The U.K. also holds a strong position in the candidiasis drugs market due to the increasing instances of fungal infections and the pivotal role of the National Health Service (NHS) in ensuring access to antifungal medications. For example, in September 2025, researchers led by Professor Miraz Rahman at King’s College London received a £1.45 million (USD 1.7 million) grant to develop new antifungal drugs targeting drug-resistant Candida auris and other Candida species, thereby aiming to create efflux-resistant antifungal agents.

Key Candidiasis Drugs Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck & Co., Inc.

- Astellas Pharma Inc.

- Novartis AG

- Bayer AG

- GlaxoSmithKline (GSK) plc

- Cidara Therapeutics, Inc.

- SCYNEXIS, Inc.

- Melinta Therapeutics, LLC

- Basilea Pharmaceutica Ltd.

- Mylan N.V. (now part of Viatris Inc.)

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Astellas Pharma US (Sub. of Astellas)

- Pacgen Life Science Corporation

- Lupin Limited

- Cipla Limited

- Alkem Laboratories

- Hikma Pharmaceuticals PLC

- Bausch Health Companies Inc.

The candidiasis drugs market is representing intensifying competition among key players, including Pfizer, Bayer, Novartis, and Merck. They are currently solidifying their leadership for the upcoming years by advancing their bioidentical formulations and adopting AI-driven drug development to enhance treatment efficacy. On the other hand, Astellas Pharma and Takeda are concentrating on developing and marketing personalized antifungal therapies. Simultaneously, they are maintaining alignment with government initiatives to further accelerate the adoption and widespread use of their portfolio, along with an enhancement in drug accessibility.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In May 2025, SCYNEXIS reported that it had resumed patient dosing in its Phase 3 MARIO study, which investigates the efficacy of oral ibrexafungerp as a step-down therapy for invasive candidiasis followed by an IV echinocandin treatment.

- In March 2023, Cidara Therapeutics, Inc. and Melinta Therapeutics, LLC together notified that its REZZAYO (rezafungin for injection) has been approved by the U.S. FDA as the first new echinocandin treatment for candidemia and invasive candidiasis in over a decade.

- Report ID: 3650

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Candidiasis Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.