Cancer Biomarkers Market Outlook:

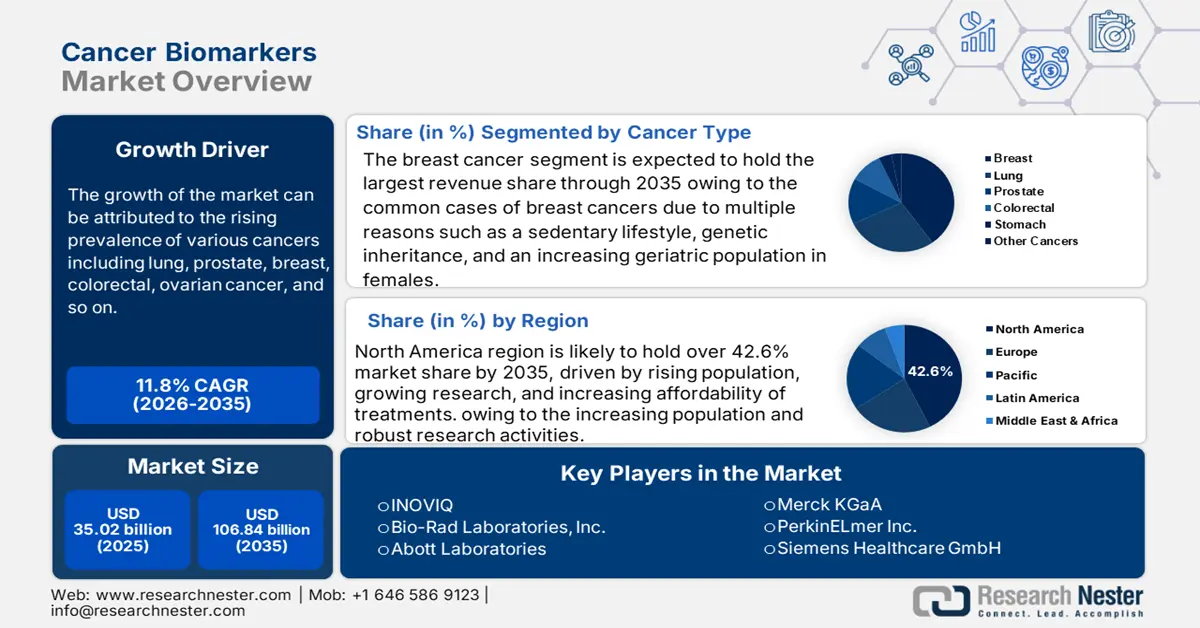

Cancer Biomarkers Market size was valued at USD 35.02 Billion in 2025 and is set to exceed USD 106.84 Billion by 2035, registering over 11.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cancer biomarkers is estimated at USD 38.74 Billion.

The growth of the market can be attributed to the growing patient base of various types of cancers comprising lung, prostate, breast, colorectal, ovarian cancer, and so on throughout the world. For instance, the number of new cancer cases in 2018 in the U.S. was 1,752,735 with the death of 599,589 people. Further, the rising consumer awareness regarding cancer biomarkers, coupled with the radically expanding use of cancer biomarkers for novel drug discovery, is estimated to hike the market growth during the coming years.

In addition to these, factors that are believed to fuel the market growth of cancer biomarkers include the worldwide rise in the geriatric population who are more vulnerable to fatal diseases such as cancer. Therefore, these individuals need the best possible care and prompt treatment for these conditions. According to the World Health Organization (WHO) estimations, the global population of individuals aged 60 and above is predicted to rise from 1 billion in 2020 to 1.4 billion by 2030. The world's population of individuals aged 60 and above is expected to double to 2.1 billion by 2050. Additionally, the growing proportion of research and development activities on cancer biomarkers, coupled with the increasing number of clinical research organizations across the world is expected to propel the growth of the cancer biomarkers market size during the forecast period. For instance, the number of clinical research organizations in 2022 across the world was nearly 3000 with a 0.3% rise from 2021.

Key Cancer Biomarkers Market Insights Summary:

Regional Highlights:

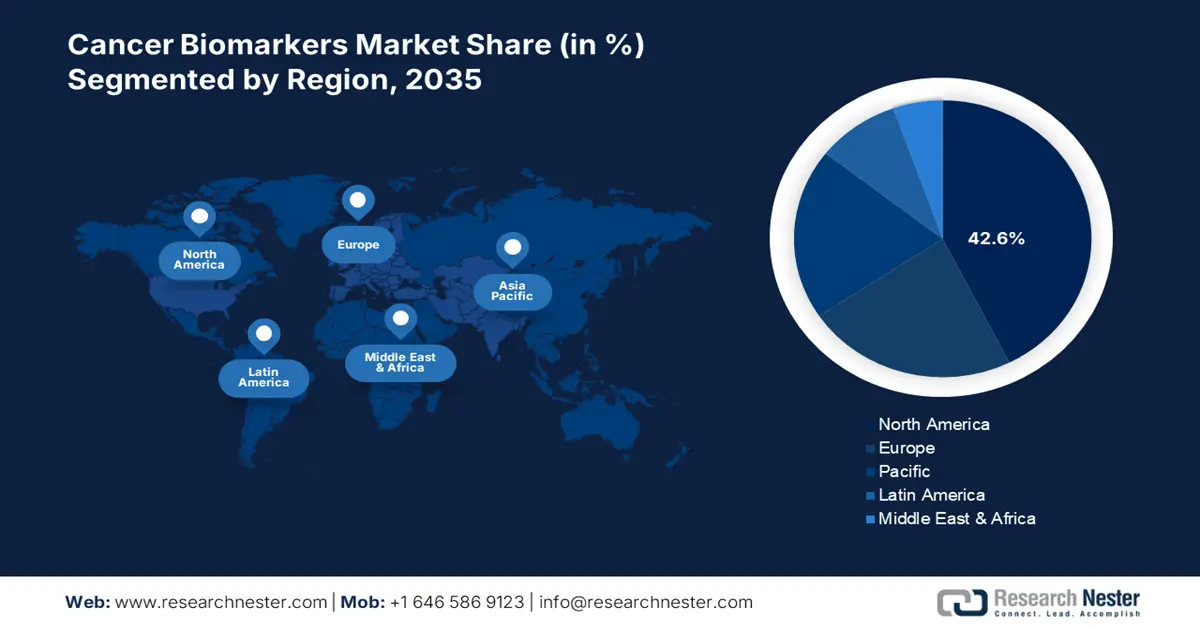

- North America cancer biomarkers market will hold over 42.6% share by 2035, driven by rising population, growing research, and increasing affordability of treatments.

Segment Insights:

- The omics technologies segment in the cancer biomarkers market is poised for significant share by 2035, driven by high efficiency in cancer diagnosis and advancements in profiling techniques.

- The breast cancer segment in the cancer biomarkers market is expected to achieve the largest share by 2035, fueled by rising breast cancer prevalence due to unhealthy lifestyles and an aging population.

Key Growth Trends:

- Growing Prevalence of Cancer

- Elevating R & D Activities and Investments

Major Challenges:

- The Dearth of Reimbursement Policies for Biomarker Testing

- Requirement of Hefty Capital Investment for Research and Development Activities

Key Players: INOVIQ, Bio-Rad Laboratories, Inc., Abbott Laboratories, Becton, Dickinson and Company, Merck KGaA, CENTOGENE GmbH, PerkinElmer Inc., Siemens Healthcare GmbH, F. Hoffmann-La Roche Ltd, Bristol Myers Squibb Company (BMS).

Global Cancer Biomarkers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 35.02 Billion

- 2026 Market Size: USD 38.74 Billion

- Projected Market Size: USD 106.84 Billion by 2035

- Growth Forecasts: 11.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Cancer Biomarkers Market Growth Drivers and Challenges:

Growth Drivers

- Growing Prevalence of Cancer – Cancer prevalence is defined by how often cancer occurs (incidence rate) and how long a person lives with it after diagnosis (survival rate). Thus, the most common cancer with the longest survival rate will have a high prevalence value. For instance, breast cancer in women and prostate cancer in men had high prevalence rates with 42% and 43% in 2019, as per estimations throughout the world.

- Elevating R & D Activities and Investments – For instance, the global cancer research and development activities continued to surge in 2021 with an increase of 50% more trail starts from 2021.

- Increasing Biotechnology and Pharmaceutical Companies – Between 2017 to 2018, about 46 new molecular entities and 59 biologic license applications were approved by the U.S Food and Drugs Administration, and in 2019, out of the 59 newly approved drugs, 19 were first-in-class drugs. Also, the contracts worth for biotech and pharmaceutical companies are estimated to reach USD 150 billion before the first quarter of 2019 in the U.S.

- Rising Use of Biomarkers in the Medical Sector – As per the observations, more than 50% of clinical trials used biomarkers in 2018, up from over 10% use in 2000 across the globe.

- Increasing New Drug Developments – Based on a drug development report, FDA-approved biomarkers such as activating mutations in epithelial growth factor receptors (EGFR) can predict the efficiency of EGFR inhibitors, such as gefitinib, a targeted cancer drug. The response rate for gefitinib was more than 60% in selected patients and about 25% in unselected patients.

Challenges

- The Dearth of Reimbursement Policies for Biomarker Testing - Even though there has been a surge in cancer incidences across the globe, and an escalating patient pool that needs a diagnostic test, and on the other hand, there is a deficit of reimbursement policies in numerous developed and developing countries, which is anticipated to hinder the growth of the cancer biomarkers during the forecast period of 2023-2033.

- Requirement of Hefty Capital Investment for Research and Development Activities

- Associated Issues in the Collection and Storage of Samples

Cancer Biomarkers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.8% |

|

Base Year Market Size (2025) |

USD 35.02 Billion |

|

Forecast Year Market Size (2035) |

USD 106.84 Billion |

|

Regional Scope |

|

Cancer Biomarkers Market Segmentation:

Cancer Type Segment Analysis

The global cancer biomarkers market is segmented and analyzed for demand and supply by cancer type into breast, lung, prostate, colorectal, stomach, and other Cancers. Out of these segments, the breast cancer segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the rising prevalence of breast cancer on account of unhealthy lifestyles, genetic inheritance, the rising female geriatric population, and exposure to hazardous radiation. As per the World Health Organization, in 2020, about 2.3 billion women are diagnosed with breast cancer, and 685,000 people died across the world.

Profiling Technology Segment Analysis

The global cancer biomarkers market is also segmented and analyzed for demand and supply by profiling technology into omics technologies, imaging technologies, and immunoassays. Amongst these three segments, the omics technologies segment is expected to garner a significant share. The growth of the segment can be attributed to the high efficiency of omics technologies in the diagnosis of cancer, along with the increasing development of profiling techniques for cancer biomarkers, that is anticipated to boost the market’s growth during the forecast period.

Our in-depth analysis of the global cancer biomarkers includes the following segments:

|

By profiling Technology |

|

|

By Biomolecule |

|

|

By Cancer Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cancer Biomarkers Market Regional Analysis:

North American Market Insights

North America region is likely to hold over 42.6% market share by 2035, driven by rising population, growing research, and increasing affordability of treatments. Furthermore, the rise in personal income and affordability of advanced treatments among people is estimated to fuel the market growth during the forecast period. As per the U.S Bureau of Economic Analysis, the personal income of people in the U.S. rose to USD 71.6 billion at the rate of 0.3% per month, and consumer spending rose to USD 67.5 billion at the rate of 0.4% in August 2022. Further, the rising adoption of cancer biomarkers, along with the proliferation of research and development of novel products to treat cancer are further factors that are estimated to spur market growth in the coming years. In addition, increasing adoption ratio of next-generation sequencing are also anticipated to boost the market growth during the forecast period.

APAC Market Insights

Furthermore, the Asia Pacific cancer biomarkers market is projected to display notable growth over the forecast period on the back of the accelerating prevalence of cancer in nations such as Japan, and China. For instance, more than 5 million new cancer cases were reported in China in 2020. With almost 850,000 new cases, lung cancer was the most prevalent type of cancer. Moreover, the surge in disposable income, growth in the geriatric population, and increasing investment in the research and development of biomarkers in the form of digital biomarker are some further factors that are projected to expand the global cancer biomarkers market size during the projected timeframe in the region.

Cancer Biomarkers Market Players:

- INOVIQ

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bio-Rad Laboratories, Inc.

- Abbott Laboratories

- Becton, Dickinson and Company

- Merck KGaA

- CENTOGENE GmbH

- PerkinElmer Inc.

- Siemens Healthcare GmbH

- F. Hoffmann-La Roche Ltd

- Bristol Myers Squibb Company (BMS)

Recent Developments

-

Bio-Rad Laboratories, Inc. launched Bio-Plex Pro Human Cytokine Screening Panel, the first validated high-performance multiplex assay. The panel can detect and calculate 48 different analytes associated with heart disease, allergy, cancer, autoimmunity, and others.

-

F. Hoffmann-La Roche Ltd’s VENTANA FOLR1 (FOLR1-2.1) RxDx Assay, has been approved by the FDA and is designed to help identify patients with epithelial ovarian cancer (EOC) who are suitable for treatment with ELAHERE (mirvetuximab soravtansine-gynx). The results of this test will allow clinicians to make better treatment decisions for patients with ovarian cancer.

- Report ID: 4552

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cancer Biomarkers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.