Calcium Bromide Market Outlook:

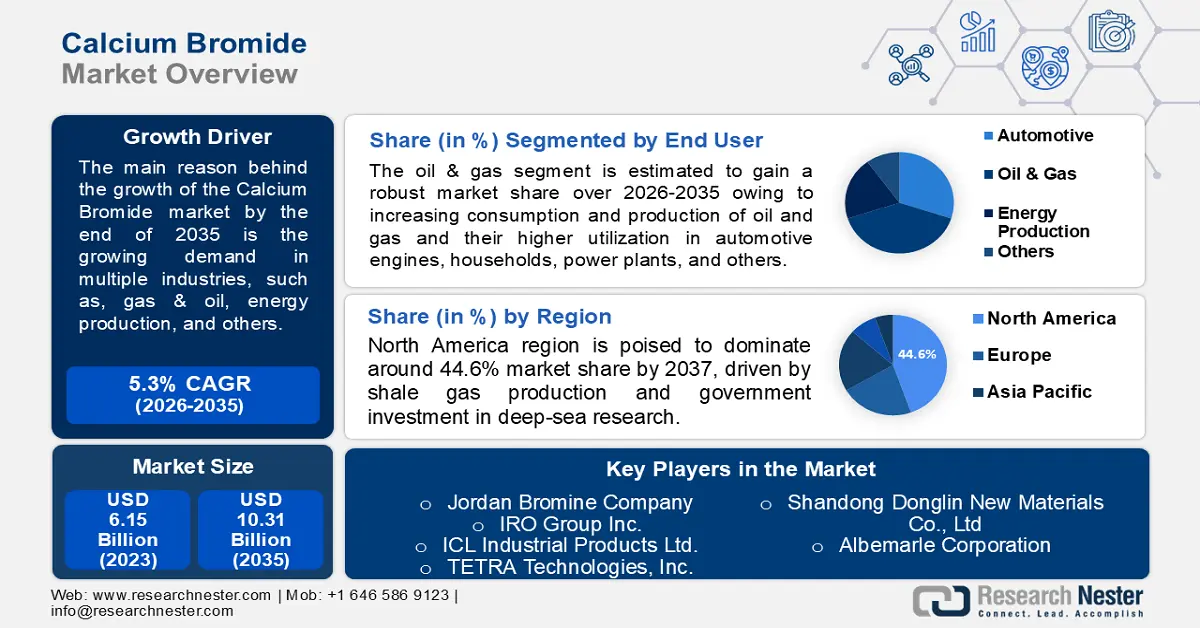

Calcium Bromide Market size was valued at USD 6.15 billion in 2025 and is set to exceed USD 10.31 billion by 2035, registering over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of calcium bromide is estimated at USD 6.44 billion.

The growth of the market can be attributed to the growing demand in multiple industries, such as, gas & oil, energy production, and others. Calcium bromide is used in the gas & oil industry since it can manage the pressure in upstream oil & gas operations. For instance, more than 4 billion metric tons of oil are produced globally. Meanwhile, the daily demand for oil in 2022 is estimated to be around 91 million barrels.

In addition to this, an up-surged demand for calcium bromide in the energy production industry is also anticipated to hike the growth of the market. As of 2020, global energy consumption was projected to be at almost 550 exajoules. Calcium bromide is used in various compounds that are utilized for high-density clear drilling and packing fluids to maintain the pressure of the wellbore. It is further utilized to decrease the emission of mercury from the coal-fired power plant. Calcium bromide is also utilized in the form of powder in freezing mixtures, photography, neuroses, fire retardants, and others. In 2019, the fire retardants industry was valued at over USD 5 billion globally. All these factors are anticipated to influence the growth of the market positively during the forecast period.

Key Calcium Bromide Market Insights Summary:

Regional Highlights:

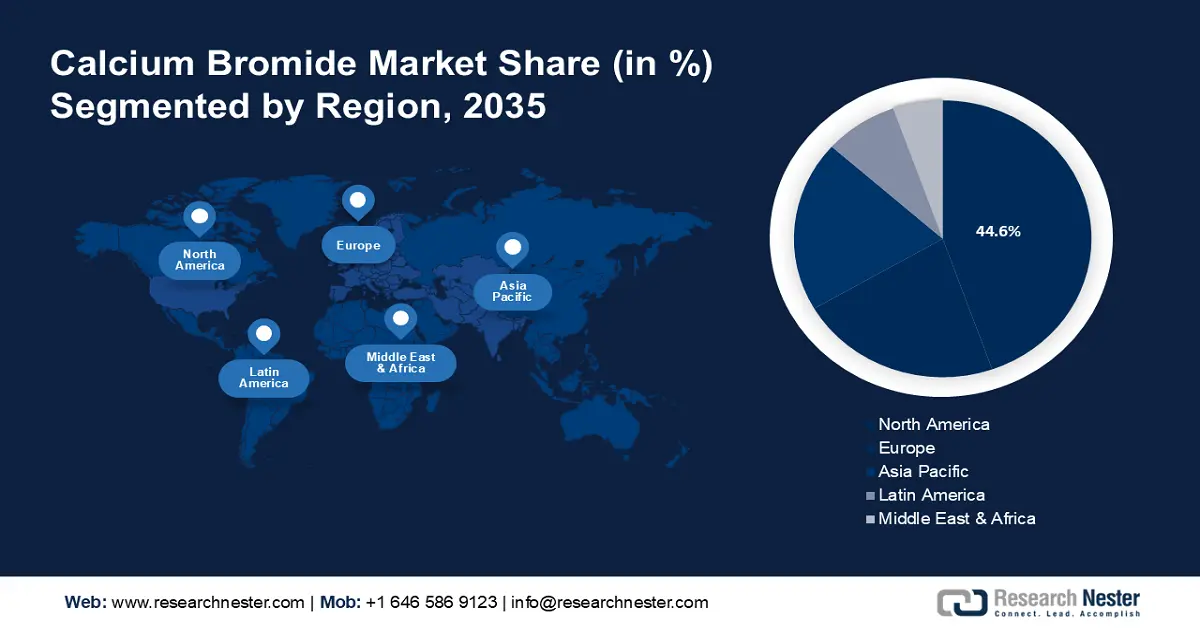

- North America calcium bromide market leads with a 44.6% share by 2035, driven by shale gas production and government investment in deep-sea research.

- Asia Pacific market will hold the second largest share by 2035, driven by rising deep-sea exploration investment by China and Korea.

Segment Insights:

- The oil & gas segment in the calcium bromide market is expected to maintain the largest share by 2035, fueled by high oil and gas production and consumption globally.

Key Growth Trends:

- Growing Activities in Coal Mining

- Rising Consumption and Production of Natural Gas

Major Challenges:

- Possibility of Side Effects of Calcium Bromide

- Availability of Alternative Chemicals in the Market

Key Players: Weifang Rixing Chemical Co., Ltd., TETRA Technologies, Inc., Shandong Donglin New Materials Co., Ltd, Albemarle Corporation, Shouguang Hon Hai Chemical Co., Ltd., Lanxess AG, Neogen Chemicals Ltd., Jordan Bromine Company, IRO Group Inc., ICL Industrial Products Ltd.

Global Calcium Bromide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.15 billion

- 2026 Market Size: USD 6.44 billion

- Projected Market Size: USD 10.31 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Calcium Bromide Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Activities in Coal Mining– For instance, in 2020 approximately 490 metric tons of coal were produced while in the United States, this amount was projected to hit around 480 metric tons. In the OECD region, 1400 metric tons of coal were estimated to be mined while in China alone, more than 3500 metric tons of coal were produced in 2020. Other countries such as India produced around 800 Metric, Indonesia 500 Mt, Russia 300 Mt, EU 300 Mt, and others in a similar year.

Calcium bromide is sprayed in coal mines to limit the emission of mercury. Coal combustion is observed to be the largest source to emit mercury into the air across the globe. Thus, mercury keeps accumulating in the water and food chain that be indigested by people and leave a harmful effect on the body. Thus, growing activities in coal mining is estimated to drive the growth of the market over the forecast period. -

Rising Consumption and Production of Natural Gas – for instance, in 2020, about 6 quadrillion cubic feet of natural gas reserves were found across the globe, out of which, more than 35 trillion cubic meters were estimated to be located in Russia which makes it the country with largest proved natural gas reserves in the world. Furthermore, in 2020, the United States produced approximately 900 billion cubic tons of natural gas while China accounted for the total production of 200 billion cubic tons.

-

Increasing Production and Consumption of Oil Worldwide – it was estimated that nearly 3,00,000 million barrels of oil are consumed every year while approximately 970 million barrels of oil are consumed per day worldwide. Additionally, in Russia, around 500 million metric tons of crude oil were produced in 2020 and more than 700 million metric tons of crude oil were produced in the United States.

-

Growing Demand for Calcium Bromide in Energy Production - as of 2021, about 35% of the electricity was produced using coal. In India alone, 1,000 billion units of electricity were generated in 2021. Furthermore, global electricity production was anticipated to be around more than 26 terawatts per hour in 2021.

Challenges

-

Possibility of Side Effects of Calcium Bromide - It is recommended safety goggles with side shields must be used when working with calcium bromide since it is observed to have a negative impact on the eyes. Furthermore, chemical protective gloves and boots should be used to protect arms and feet otherwise there can be a severe infection. Hence, this factor is projected to hamper the market growth over the forecast period.

-

Availability of Alternative Chemicals in the Market

-

Stringent Government Regulation regarding the Use of Calcium Bromide

Calcium Bromide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 6.15 billion |

|

Forecast Year Market Size (2035) |

USD 10.31 billion |

|

Regional Scope |

|

Calcium Bromide Market Segmentation:

End-user Segement Analysis

The global calcium bromide market is segmented and analyzed for demand and supply by the end-user industry into automotive, oil & gas, energy production, and others. Out of the segments, the oil & gas segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the increasing consumption and production of oil and gas and their higher utilization in automotive engines, households, power plants, and others. For instance, a typical engine of an automobile requires approximately 8 quarts of oil. Furthermore, more than 18 million barrels of petroleum were consumed in the United States in 2021. Similarly, a huge demand for gas can also be found across the globe which is further anticipated to boost the growth of the market over the forecast period.

Furthermore, the energy production segment is projected to hold the second-largest share during the forecast period. The growth of the segment can be accounted to the higher utilization of energy in almost every industry along with household facilities. The industrial use of energy is estimated to spike year over year owing to the rapid growth in the industrialization process worldwide. As of 2021, around 170 EJ of global final energy was consumed by the industrial sector, especially for coke ovens, blast furnaces, and feedstocks. Furthermore, as of 2021, around 10,000 kilowatt hours of energy were consumed by residential utilities in the United States. Therefore, such factors are estimated to influence segment growth positively over the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Application |

|

|

By End-User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Calcium Bromide Market Regional Analysis:

North American Market Insights

North America region is poised to dominate around 44.6% market share by 2035. The growth of the market can be attributed majorly to the increasing shale gas production in the region owing to higher demand. Calcium bromide is highly used in shale gas production in the form of fluid completion. It is observed that shale gas and tight oil production in the United States was 24 trillion cubic feet in 2021. Furthermore, calcium bromide is extensively used in deep-sea exploration which is also expected to expand the market size in the region over the forecast period. According to the data released by Oceanic and Atmospheric Research (OAR), in 2022, USD 4.42 billion of investment has been provided by the government of the region for deep-sea research and operations. Hence, on the back of growing initiatives by the government for deep-sea exploration, the global calcium bromide market is anticipated to grow during the forecast period. Moreover, the increased instances of horizontal drilling owing to reservoir complexities are also predicted to fuel the market growth in the region during the forecast period.

APAC Market Insights

The Asia Pacific calcium bromide market, amongst the market in all the other regions, is projected to hold the second largest share during the forecast period. The growth of the market can be attributed majorly to the fact that countries such as, India and China are also allotting a plethora of budgets for activities such as deep-sea exploration and deep-sea mining. Therefore, on the back of the rising investment in sea exploration activities, the global calcium bromide market is anticipated to exhibit remarkable growth during the forecast period. For instance, In China, has 5 deep-sea mining contracts issued by the ISA. Furthermore, 150,000 kilometers of the area was granted for deep-sea mining exploration in China in 2019 while Korea received a grant for approximately 100,000 kilometers.

Calcium Bromide Market Players:

- Weifang Rixing Chemical Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TETRA Technologies, Inc.

- Shandong Donglin New Materials Co., Ltd

- Albemarle Corporation

- Shouguang Hon Hai Chemical Co., Ltd.

- Lanxess AG

- Neogen Chemicals Ltd.

- Jordan Bromine Company

- IRO Group Inc.

- ICL Industrial Products Ltd.

Recent Developments

-

Shandong Donglin New Materials Co., Ltd to publish a report on the brominated SBS and its environment-friendly flame retardant properties which are expected to provide a green future for thermal insulation materials such as, EPS, XPS, and others.

-

Jordan Bromine Company to collaborate with the Civil Defence Department to demonstrate the field of training, emergency planning, community planning, and communication and to discuss the utilization of the company’s product.

- Report ID: 4159

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Calcium Bromide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.