Breathalyzer Market Outlook:

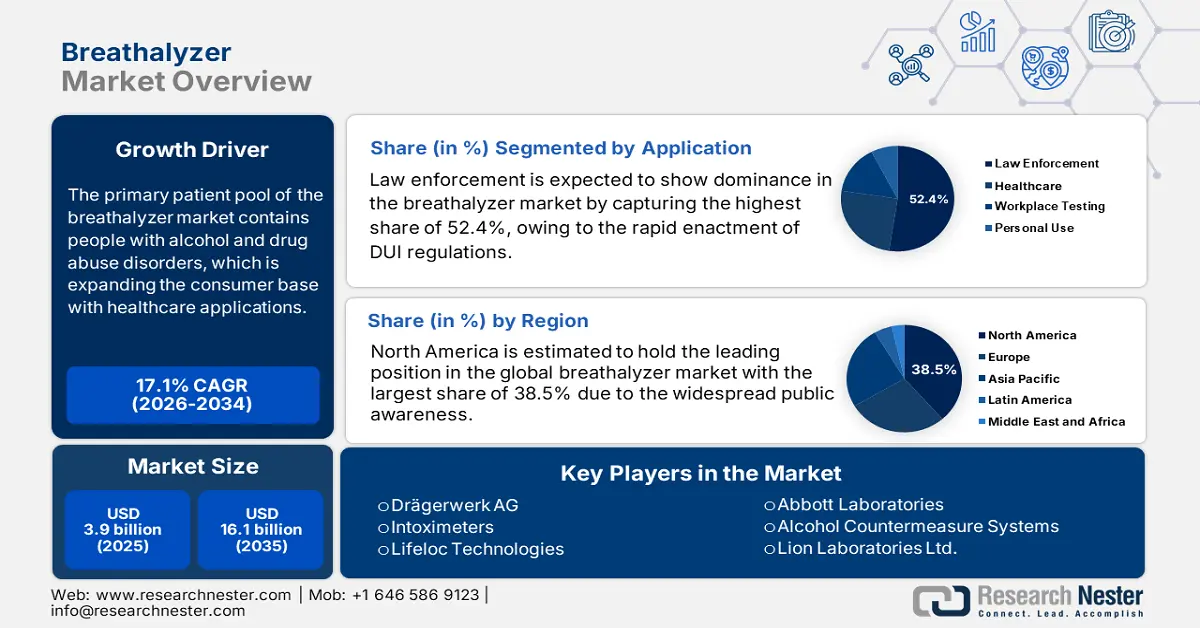

Breathalyzer Market size was over USD 3.9 billion in 2025 and is estimated to reach USD 16.1 billion by the end of 2035, expanding at a CAGR of 17.1% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of breathalyzer is assessed at USD 4.5 billion.

The primary patient pool of the market contains people with alcohol and drug abuse disorders. According to a report from the World Health Organization (WHO), more than 400 million global residents, accounting for 7% of the world’s population aged 15 years and older, were living with alcohol use disorder (AUD) in 2024. Thus, considering the future impact of excessive consumption of these substances on overall health, worldwide governing authorities are implementing strict measures to combat the epidemic. In addition, these tools are utilized in patient management for several chronic ailments, including respiratory diseases, diabetes, and metabolic disorders, which is expanding the consumer base for this sector.

The rising cost of laboratory instruments and testing reagents inflates the overall payers’ pricing of diagnosing associated illnesses, particularly in emergency situations. Thus, the rapid and cost-effective testing solutions available in the market are gaining traction in the field of healthcare diagnostics. This can be exemplified by the comparative analysis of diagnostic costs between breath analysis and laboratory screening for diabetic ketoacidosis (DKA), where a study established an IoT-based breathalyzer prototype to be promisingly accurate while priced as low as USD 20.0, as per the 2022 NLM publication. This can be a cost-effective alternative to routine DKA screening, costing around USD 14.0 thousand.

Key Breathalyzer Market Insights Summary:

Regional Insights:

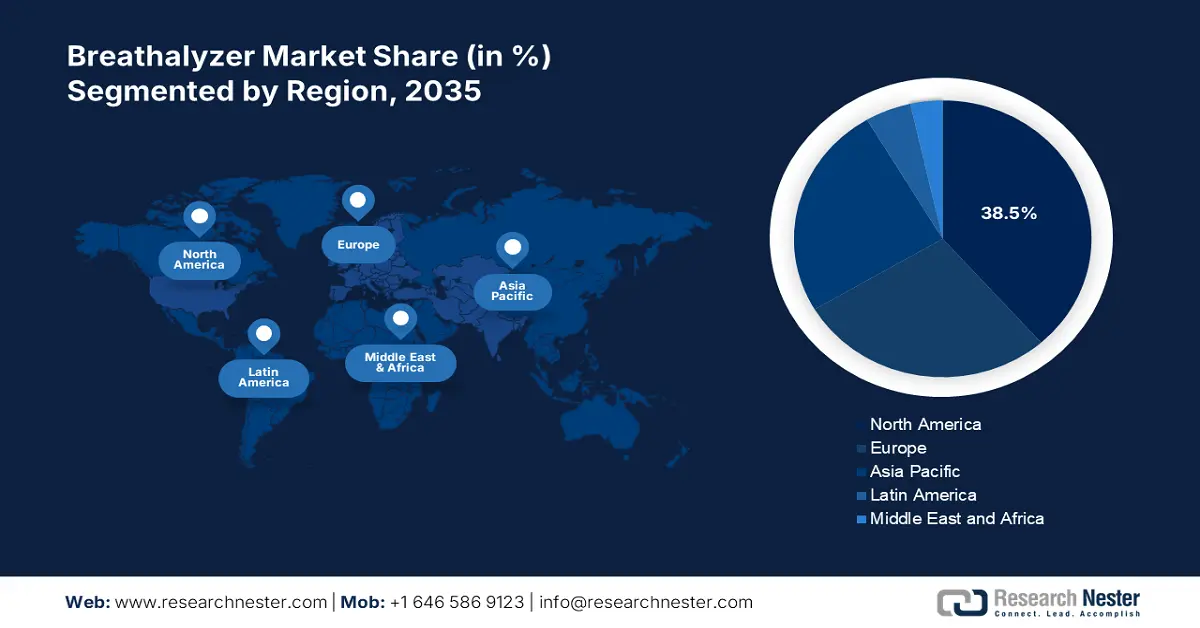

- By 2035, north america is projected to secure a 38.5% share of the breathalyzer market, upheld by stringent DUI regulations and expanding clinical innovation initiatives.

- Asia Pacific is anticipated to accelerate rapidly through 2026–2035, reinforced by rising vehicle ownership and intensified government-led DUI enforcement.

Segment Insights:

- The law enforcement segment is forecast to command a 52.4% share by 2035 in the breathalyzer market, sustained by stringent regulations and continuous federal funding for road safety.

- Fuel cell technology is expected to attain a 48.5% share by 2035, bolstered by its superior accuracy and increasing R&D investments.

Key Growth Trends:

- Integration of sensors and IoT technologies

- Expansion in medical and diagnostic use

Major Challenges:

- Stringent and heterogeneous regulations

- Limited reimbursement and payer coverage

Key Players: Intoximeters, Lifeloc Technologies, Abbott Laboratories, Alcohol Countermeasure Systems, Lion Laboratories Ltd., Alcolizer, Andatech, BACtrack, AK GlobalTech, AlcoPro, Quest Products, Inc., EnviteC-Wismar GmbH, DA Tech Co., Ltd., Tanita, Akers Biosciences, Inc., Shenzhen Bioeasy Technology, Alcovisor, Donglian Zhitong, TruTouch Technologies, Avalon GloboCare Corp.

Global Breathalyzer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.9 billion

- 2026 Market Size: USD 4.5 billion

- Projected Market Size: USD 16.1 billion by 2035

- Growth Forecasts: 17.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 3 September, 2025

Breathalyzer Market - Growth Drivers and Challenges

Growth Drivers

- Integration of sensors and IoT technologies: Tech-based innovations are increasingly improving the accuracy, detailed analysis, and response timelines for products available in the breathalyzer industry. The presence of various clinical studies establishing the enhanced functionality and affordability that come along with user-friendly and versatile designs is encouraging both payers and patients to invest more in this sector. As evidence, an NLM article published in January 2023 unveiled that an IoT-integrated breath analyzer delivered a remarkable overall accuracy of 98.1% in achieving alcohol concentration quantification values.

- Expansion in medical and diagnostic use: The field of utility in the market is extending beyond alcohol detection into broader healthcare use with technological advances. Researchers are continuously evolving the pipeline in this sector by developing cutting-edge sensors that can detect chronic diseases, such as diabetes, lung infections, and even cancer. Exemplifying this, in June 2025, a team of scientists at Indiana University, in alliance with IU Indianapolis, PreEvnt, and others, introduced a revolutionary breathalyzer for blood sugar detection, known as the Isaac device. It offers real-time advantages in regular diabetic patient monitoring. Such an increase in applicability subsequently results in higher adoption volume in this category.

- Growing demand for personal wellness: As people become more aware of personal health and accountability, opportunities in the market are amplifying. The sector’s step into the consumer electronics industry is led by the increasing use of portable and wearable devices for real-time health monitoring. These state-of-the-art devices enable seamless interaction and features for users to avoid legal issues or accidents, while being exceptionally affordable and compact in design, making them accessible to the general public. Additionally, the emergence of e-commerce retailing and smartphone connectivity is further boosting visibility and sales in this field.

Historic Trends in the Patient Pool Related to the Market Across Countries and WHO Regions

Summary of Alcohol Use and AUD Prevalence and Comorbidity (2020)

|

Metric |

Value / Insight |

|

Mean Lifetime Prevalence of Alcohol Use (All Countries) |

80% |

|

Range of Lifetime Alcohol Use Prevalence (Across Countries) |

3.8%-97.1% |

|

Average Lifetime Prevalence of AUDs (Total Population) |

8.6% |

|

Average 12-Month Prevalence of AUDs (Total Population) |

2.2% |

|

Lifetime Prevalence of AUDs (Among Non-Abstainers) |

10.7% |

|

12-Month Prevalence of AUDs (Among Non-Abstainers) |

4.4% |

|

Comorbidity: AUD with Lifetime Mental Health Disorder (MHD) |

43.9% of individuals with lifetime AUD had an MHD |

|

Comorbidity: MHD with Lifetime AUD |

17.9% of individuals with MHD had a lifetime AUD |

|

Sequence of Onset (AUD vs. MHD) |

MHD preceded AUD in most comorbidity cases |

|

Gender Differences in AUD Prevalence |

Much higher for men than for women |

|

Early Onset AUD (Before Age 18) |

15% of all lifetime AUD cases |

Source: WMH

Analysis of Medical Diagnostic Capabilities of Advanced Technologies Associated with the Market

Determination of Lung Cancer Exhaled Breath Biomarkers Using Machine Learning (2025)

|

Potential Lung Cancer Biomarkers (VOCs) |

Retention time(minutes) |

Molecular mass [base peak] (m/z) |

Variable Importance in Projection (VIP) score |

Detection Frequency |

|

|

Lung Cancer (%) |

Control (%) |

||||

|

2,3,6,7-Tetramethyloctane |

16.7 |

170.0 [43] |

1.5 |

50 |

13.6 |

|

2-Bromododecane |

22.3 |

248.0 [57] |

1.1 |

30 |

4.5 |

|

2,5,9-Trimethyldecane |

15.1 |

184.0 [57] |

1.1 |

25 |

0 |

|

4-Methylundecane |

17.3 |

170.0 [43] |

1.0 |

30 |

4.5 |

|

Ethanone,1-(2,4,6-trihydroxyphenyl) |

18.9 |

168.0 [153] |

1.7 |

30 |

0 |

|

O-cymene |

15.0 |

134.0 [119] |

1.3 |

40 |

9.1 |

|

Pentadecanal |

35.5 |

226.0 [82] |

1.5 |

55 |

18.2 |

Source: NLM Study

Challenges

- Stringent and heterogeneous regulations: The classification of devices availed in the market, particularly class II or III, often faces rigorous pre-launch evaluation. Thus, the elongated and expensive process of approvals for different standardization protocols becomes difficult for innovators and manufacturers in this sector. This also translates to higher payers’ pricing, which restricts patient access to these pipelines, discouraging investors and companies from investing in innovation and extensive R&D.

- Limited reimbursement and payer coverage: The cost inflation in the market also affects the consistency of financial backing in the market, as they fail to meet the cost-effectiveness threshold. This lack of insurance reimbursement for these tools, specifically personal and sobriety monitoring devices, becomes a major barrier to patient access in this field. Moreover, the limited coverage policies enacted by the public insurers shrink the scope of expanded therapeutic applications, limiting the sector’s penetration in healthcare.

Breathalyzer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.1% |

|

Base Year Market Size (2025) |

USD 3.9 billion |

|

Forecast Year Market Size (2035) |

USD 16.1 billion |

|

Regional Scope |

|

Breathalyzer Market Segmentation:

Application Segment Analysis

Law enforcement is expected to show dominance in the breathalyzer market by capturing the highest share of 52.4% by the end of 2035. The leadership is primarily fueled by stringent government regulations and sustained federal funding for road safety. Particularly, the laws related to driving under the influence (DUI) are contributing to the segment’s growth, evidently. Evidencing the consistent favorable advocacy, in April 2024, the Centers for Disease Control and Prevention (CDC) unveiled that the use of ignition interlocks reduced repeat drunk-driving offenses by about 70%. Besides, the annual state and federal budget allocations to the procurement of evidential breathalyzer units and roadside screening devices ensure substantial demand from police departments and judicial systems worldwide.

Technology Segment Analysis

Fuel cell is predicted to be the most preferred technology in the breathalyzer market, with a potential to hold a 48.5% share over the assessed period. The superior accuracy and specificity for ethanol detection, which are critical for producing court-admissible results, are collectively positioning this subtype as the gold standard for evidential purposes. As evidence, in September 2022, the National Institute of Justice (NIJ) awarded the Virginia Commonwealth University with around USD 416.4 thousand for the development of a colorimetric breath analyzer for identifying tetrahydrocannabinol (THC), which indicates the influence of cannabis. Such capital influx for R&D on improving the reliability and miniaturization of this technology is cementing the segment’s position in this sector.

End user Segment Analysis

Government & municipal agencies are poised to be the primary contributors to the breathalyzer market during the discussed timeframe, while acquiring 45.6% of the total revenue. The segment's strong presence in this sector is empowered by the widespread adoption of these tools in law enforcement, traffic safety, and public intoxication control initiatives. As the incidence of substance-influenced offenses and accidents rises, governments increasingly rely on these devices to maintain robust routine roadside testing, sobriety checkpoints, and legal DUI endpoints. Municipal agencies also use breathalyzers for regular public health monitoring, especially during festivals, sporting events, and emergencies, where crowd safety is a major concern.

Our in-depth analysis of the market includes the following segments:

|

Segments |

Subsegments |

|

Technology |

|

|

Application |

|

|

End user |

|

|

Portability |

|

|

Component |

|

|

Distribution Channel |

|

|

Price Range |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Breathalyzer Market - Regional Analysis

North America Market Insights

North America is estimated to hold the leading position in the global breathalyzer market with the largest share of 38.5% over the analyzed timeline. The major growth factors behind the region’s dominance over this sector include stringent DUI regulations, widespread public awareness, and rigorous innovations for clinical use. Such a progressive business environment can be exemplified by the strategic alliance formation between the National Institute of Standards and Technology (NIST) and the Gates Foundation in June 2024 to develop breathalyzers for non-invasive, rapid malaria and tuberculosis detection. The researchers associated with this R&D cohort also underscored the potential of these tools for diagnosing a wide range of conditions and diseases, including liver disease, multiple sclerosis, and cancer.

The U.S., in particular, is the epitome of regional progress and a wide consumer base for the breathalyzer market. By implementing mandatory alcohol testing programs, including the use of ignition interlock devices for DUI offenders, the country boosted demand in this sector across both public and private organizations. This surge primarily originates from the increasing clinical and economic risks of AUD, where the condition affected more than 27.9 million people aged 12 and older in the U.S. in 2023 alone, as per the 2024 National Survey on Drug Use and Health (NSDUH).

Growing adoption in workplaces and schools for safety compliance is positioning Canada as one of the biggest contributors to the regional revenue generation from the breathalyzer market. This is further coupled with technological advancements from domestic manufacturers, which reinforces the country’s position in this sector. Exemplifying the same, in May 2024, Cannabix Technologies launched its new alcohol detection device, Breath Logix Workplace Series, for indoor facilities and offices. The autonomous compact wall-mounted unit is designed for a range of workplace and commercial environments.

APAC Market Insights

Asia Pacific is anticipated to emerge as the fastest-growing region in the global breathalyzer market by the end of 2035. Rapid urbanization, increasing vehicle ownership, and rising concerns over road safety are the major propellers of the region’s pace of progress in this field. Besides, governments across developing countries, such as India, China, Japan, and Australia, are actively intensifying DUI enforcement and releasing contracts for bulk procurement, enabling a steady cash inflow from the merchandise. Particularly in metropolitan areas with high traffic density, the consumer base for these tools is enlarging remarkably. Furthermore, the rising burden of diabetes, cancer, and respiratory diseases is creating new opportunities for suppliers by amplifying unmet needs for scalable diagnosis.

China is witnessing expanded utilization in the breathalyzer market across workplaces, healthcare, and military industries, with a notable boom in urbanization. Evidencing the same, the International Institute of Environment and Development (IIED) unveiled that 65% of the population in China was living in urban areas in 2023. It also mentioned that within 25 years, the country’s urban population increased by an astounding 491.1 million. These figures, combined with regulatory and socio-economic factors, make China the engine of future growth in the APAC landscape.

India is also augmenting the market notably with the rising need for reinforcement for public safety and trust. The tightening of national drunk driving protocols, faulty equipment readings, and government-backed initiatives are collectively benefiting this sector with a sustainable consumer base. The active participation of public authorities in the future expansion of the merchandise can further be testified by the enactment of new draft rules for evidential breath analyzers for the measurement and display of alcohol mass concentration in June 2024. The upgrade mandated stamping and verification of these tools within one year to prevent wrongful penalties, creating a surge in more precise and scalable devices.

Factors Signifying Opportunities for the Market

|

Country |

Key Notes |

Year |

|

China |

Average per-capita consumption of pure alcohol among people aged ≥ 15 years accounted for 6.0 L, above the global average of 5.8 L |

2022 |

|

India |

Government commitment to reduce road fatalities & injuries by 50% by the year 2030 |

2024-2030 |

|

Australia |

Smart Start Interlocks installed over 30,000 Alcohol Interlocks |

2009-2023 |

Source: WHO, PIB, and Company Fiscal Report

Europe Market Insights

Europe is predicted to grow steadily in the breathalyzer market during the timeline between 2026 and 2035. Widespread adoption of zero-tolerance DUI policies and strong enforcement mechanisms across member states is the foundational pillar of the region’s augmentation in this sector. Particularly, routine roadside checks, supported by a well-equipped workforce, in developed countries, such as the UK, Germany, and France, are increasing the demand for these devices. Additionally, Europe is recognized as a global leader in implementing ignition interlock programs for repeat DUI offenders, which consolidates a prominent position in this category for the region.

The UK demonstrates lucrative potential for great revenue generation from the market, with a high usage in occupational safety, healthcare screening, and public transport systems. With continuous government support, rising public awareness, and a strong regulatory push for alcohol harm reduction, it maintains a mature yet steadily expanding territory for both traditional and next-generation breathalyzer manufacturers. Further, the potential demography can be displayed through a 2024 report from the Institute of Alcohol Studies (IAS), which revealed that the annual cost of alcohol harm to society in England alone totaled USD 32.0 billion.

Ireland represents a growing landscape of the Europe market, which is predominantly controlled by stricter DUI laws and increased focus on large-scale screening programs. The introduction of mandatory roadside alcohol testing and reduced legal BAC limits has led to widespread deployment of breathalyzers by the Irish police, which is ultimately propelling adoption in this sector. The intense rate of utilization can be evidenced by the incorporation of breathalyzer kisoks in the Road Safety Authority (RSA)-led research cohort on the nationwide alcohol levels, published in April 2025.

Economic Impact of Alcohol Harms: Creating Opportunities for the Market

(2024)

|

Country |

Cost of Alcohol Harm (in USD) |

|

Scotland |

5.8-11.6 billion |

|

Wales |

933.2 million |

|

Northern Ireland |

1.0 billion |

Source: IAS

Key Breathalyzer Market Players:

- Drägerwerk AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Intoximeters

- Lifeloc Technologies

- Abbott Laboratories

- Alcohol Countermeasure Systems

- Lion Laboratories Ltd.

- Alcolizer

- Andatech

- BACtrack

- AK GlobalTech

- AlcoPro

- Quest Products, Inc.

- EnviteC-Wismar GmbH

- DA Tech Co., Ltd.

- Tanita

- Akers Biosciences, Inc.

- Shenzhen Bioeasy Technology

- Alcovisor

- Donglian Zhitong

- TruTouch Technologies

- Avalon GloboCare Corp.

The competitive landscape in the market is intensifying with innovations focused on workplace safety, automation, and healthcare applications. Exemplifying the same, in October 2023, ALCO-Safe launched ALCONTROL Smart Connect, an advanced unmanned breathalyzer system, which is designed for seamless workplace integration. This system can be mounted on turnstiles or walls, enabling automated entry control and a self-testing feature for employees, enhancing both compliance and efficiency. Such product developments reflect a broader market trend toward contactless, real-time solutions tailored to the evolving industrial and commercial needs.

Such key players are:

Recent Developments

- In January 2025, AlcoPro signed a memorandum of understanding (MoU) with Cannabix Technologies to commence collaborative marketing of Cannabix Marijuana Breathalyzer (CMB) in the U.S. market. As per the agreement, the company aimed to establish itself as a leading CMB distributor with its large network of 70,000 businesses.

- In June 2024, Avalon GloboCare announced the commercial launch of KetoAir breathalyzer device and related accessories in the U.S. at the KetoCon 2024 Conference. The cutting-edge pipeline Hot App shareable technology with AI-enabled software, which is specifically engineered for ketogenic health management.

- Report ID: 423

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Breathalyzer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.