Brain Imaging and Neuroimaging Market Outlook:

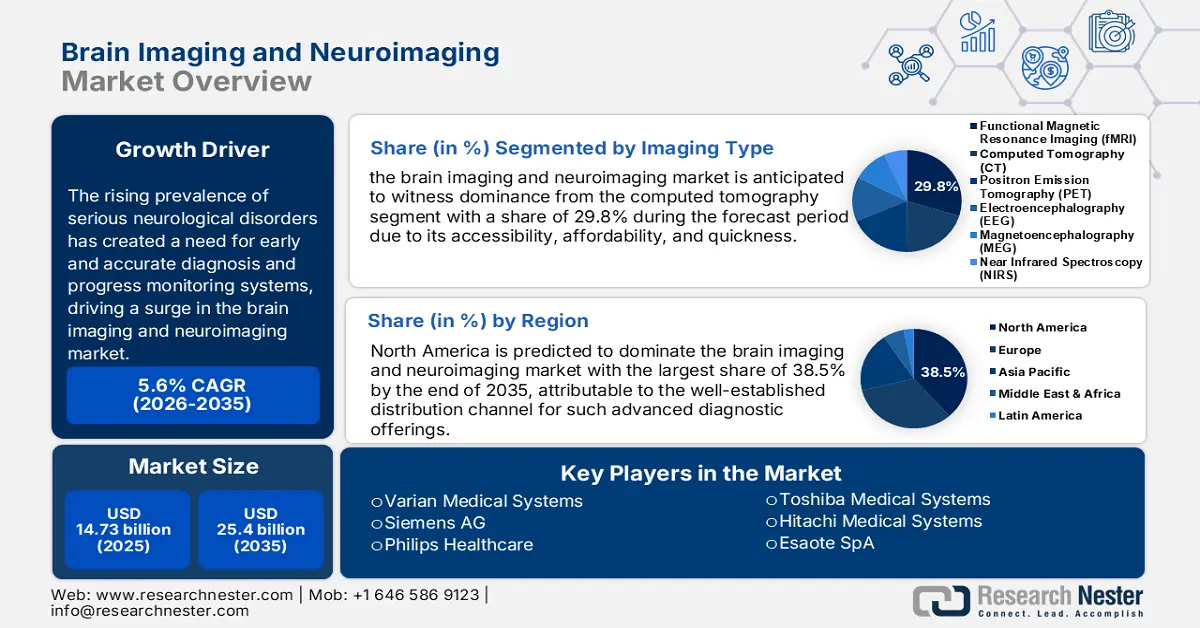

Brain Imaging and Neuroimaging Market size was over USD 14.73 billion in 2025 and is poised to exceed USD 25.4 billion by 2035, witnessing over 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of brain imaging and neuroimaging is estimated at USD 15.47 billion.

The rising prevalence of serious neurological disorders has created a need for early and accurate diagnosis and progress monitoring systems, driving a surge in the market. These offerings have a diverse range of applications in treating and detecting conditions such as Alzheimer’s, Parkinson’s, multiple sclerosis, and selective oncological diseases. The 2024 WHO report stated, that globally over 3.0 billion people were identified to have a neurological condition in 2021, making it one of the major causes behind worldwide deaths and disability cases. The report further highlighted an example of an 84.0% reduction in stroke DALYs by adopting preventive measures, which can be determined by these advanced detection tools.

Thus, the growing patient population and awareness are conjugately fueling demand in the brain imaging and neuroimaging industry. Particularly, after the integration of next-generation features and technologies in such diagnostic devices, the capabilities have been magnified significantly. These categories secured a remarkable revenue, penetrating progress in this field. For instance, in January 2024, Hyperfine, Inc. launched its FDA-approved and AI-powered portable MRI system, Swoop.

Key Brain Imaging and Neuroimaging Market Insights Summary:

Regional Highlights:

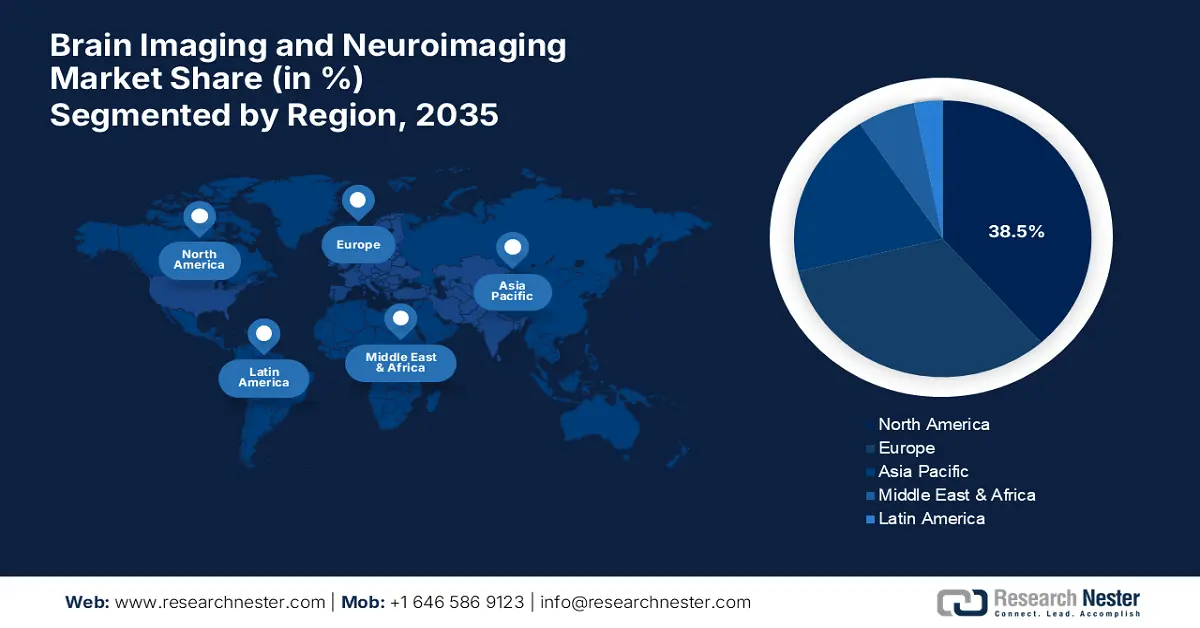

- North America leads the Brain Imaging and Neuroimaging Market with a 38.5% share, driven by well-established distribution channels and a healthy supply-demand cycle for advanced diagnostic offerings, ensuring strong growth by 2035.

Segment Insights:

- The Hospital segment of the Brain Imaging and Neuroimaging Market is projected to hold a majority share by 2035, supported by extensive investments in infrastructure and advanced neurological detection methods.

- The Computed Tomography (CT) segment of the Brain Imaging and Neuroimaging Market is forecasted to capture more than 29.8% share from 2026 to 2035, driven by its accessibility, affordability, and quickness in high-resolution brain diagnosis.

Key Growth Trends:

- Increasing adoption in research facilities

- Involvement in precision medicine discoveries

Major Challenges:

- Shortage of operating skills and dedicated funding

- Limitations in maximum adoption

- Key Players: Varian Medical Systems, General Electric Company, Siemens AG, Philips Healthcare, Esaote SpA, Sanrad Medical Systems Pvt. Ltd..

Global Brain Imaging and Neuroimaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.73 billion

- 2026 Market Size: USD 15.47 billion

- Projected Market Size: USD 25.4 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Brain Imaging and Neuroimaging Market Growth Drivers and Challenges:

Growth Drivers

- Increasing adoption in research facilities: Increasing investments and interest in neuroscience R&D at both pharmaceutical and academic levels have inflated the urge in the brain imaging and neuroimaging market. Considering its importance in evaluating the efficacy and safety of neurological therapeutics, research organizations are notably opting for these systems and services. For instance, in January 2025, a state-of-the-art neuroimaging facility, MindCORE was established at the Pennovation Works site by the School of Arts & Sciences. the new 3,200-square-foot MRI scanner room, facilitated by Siemens AG, is built to support in-house clinical studies, research, and education on the human brain.

- Involvement in precision medicine discoveries: Designing precision medicine requires a rigorous study of brain structure and function. It helps obtain necessary information about the probable reactions and characteristics of the drugs before commercializing them. Thus, the rise in drug development culture is contributing to a major portion of the market by assisting scientists in pioneering tailored and novel therapies. For instance, in January 2024, the Indian Institute of Science (IISc) inaugurated the Siemens Healthineers-Computational Data Sciences (CDS) Collaborative Laboratory for developing new precision medicines by automating operations with neuroimaging findings.

Challenges

- Shortage of operating skills and dedicated funding: The complexities of interpretations from advanced tools such as fMRI and PET machines often become a hurdle in acquiring trained professionals to conduct operations. Thus, the absence of sufficient specialized operators may restrict the optimum adoption in the brain imaging and neuroimaging market due to the risk of lag in utility. This issue has the potential to hamper the accuracy of analytics and data processing, resulting in delays or errors in the process, and hindering consumer trust in the product’s effectiveness.

- Limitations in maximum adoption: There is a possibility for healthcare organizations in rural areas to lack in offering services or instruments from the market. The inadequate facilities, situated in underserved regions often face disparities in accessing and supporting cutting-edge solutions from this sector. In addition, limited backhand funding for research or establishing high-end medical centers in these economically constrained demographics may shrink the market expansion.

Brain Imaging and Neuroimaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 14.73 billion |

|

Forecast Year Market Size (2035) |

USD 25.4 billion |

|

Regional Scope |

|

Brain Imaging and Neuroimaging Market Segmentation:

Imaging Type (Functional Magnetic Resonance Imaging (fMRI), Computed Tomography (CT), Positron Emission Tomography (PET), Electroencephalography (EEG), Magnetoencephalography (MEG), Near Infrared Spectroscopy (NIRS))

Computed tomography (CT) segment is poised to hold more than 29.8% brain imaging and neuroimaging market share by 2035. The major drivers behind this leadership are accessibility, affordability, and quickness. This type of scanner is also predominant in detecting hemorrhages, tumors, brain injuries, and other structural abnormalities of the brain, as they deliver high-resolution diagnosis in less time. Thus, the recent increment in cases of associated conditions such as stroke, tumors, and trauma has a close correlation with this segment’s growth.

End users (Hospitals, Ambulatory Surgical Centers, Clinics and Diagnostic Centers)

Based on end users, the hospital segment is projected to hold the majority portion of the total revenue of the brain imaging and neuroimaging market. The wide network of this segment is pledged with extensive investments in infrastructure upgradation, financed by various public and private health authorities. According to a 2021 NITI Aayog report, the hospital/medical infrastructure sub-sector in India represented around 600 investment opportunities, which accounted for USD 32.0 billion. The focus on increasing the availability of advanced detection methods and systems has stimulated the dynamics of these organizations. Moreover, the presence of every aspect of neurological accommodations has made hospitals the most viable option for engaging in trade.

Our in-depth analysis of the global market includes the following segments:

|

Imaging Type |

|

|

End users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Brain Imaging and Neuroimaging Market Regional Analysis:

North America Market Analysis

North America brain imaging and neuroimaging market is expected to capture revenue share of over 38.5% by 2035. The well-established distribution channel for such advanced diagnostic offerings has fostered a healthy supply-demand cycle, showcasing a lucrative business environment. This further inspires MedTech pioneers to navigate their globalization through this region. For instance, in February 2024, Ezra raised funding of USD 21.0 million to extend the reach of its full-body MRI scanning portfolio across North America. This addition made Ezra’s total expansion budget USD 41.0 million for its FDA-approved AI technology.

The U.S. market is fueled by ongoing discoveries and funded research activities. Being a hub of clinical advancements and a follower of the highest standard of healthcare practice are the backbones of its proprietorship in the global landscape. For instance, in January 2025, a team of stroke physician-scientists at Georgetown University Medical Center launched an AI-driven brain imaging platform, Acute Stroke Imaging Database (AStrID), in collaboration with MedStar Health. This tool is designed to address stroke health disparities by automating the processing of MRI findings.

Government-issued financial and regulatory subsidiary policies are the primary driving forces of the Canada brain imaging and neuroimaging market. The country is also meticulously working on the clinical research network to improve its general healthcare accessibility. For instance, in the 2024 National Budget, the Canada Brain Research Fund allocated a grant of USD 80.0 million over four years for Brain Canada, as a part of its total brain research investment plan of USD 160.0 million. Brain Canada is one of the largest investors in R&D for neurodegenerative diseases and mental illnesses in the country.

APAC Market Statistics

Asia Pacific is poised to register the fastest growth rate in the brain imaging and neuroimaging market throughout the assessed timeline between 2025 and 2035. The inflating burden of strokes in this region is one of the major propellors of this sector. The significance of imaging techniques such as CT and PET in emergency detection and early prevention of such degenerative neurological disorders has created a good flow of demand. According to a report from NLM, published in February 2023, the annual incidence of stroke in Asia ranges from 116 per 100,000 to 483 per 100,000. It further mentioned the per day cost of stroke-related care in Indonesia, Malaysia, and Singapore to be USD 135.5, USD 227.5, and USD 366.7 in 2019.

India is augmenting the market with government efforts to streamline R&D-based neurological developments. The country is utilizing its academic excellence to bring innovative brain care essentials, which are suitable for the national patient demographics. For instance, in November 2021, the DBT-National Brain Research Centre (DBT-NBRC) fostered a unique brain initiative SWADESH to make certified neuroimaging, neurochemical, and neuropsychological data and analytics easily available for researchers. The project was dedicated to the analysis of the large-scale multimodal neuroimaging database to advance brain disorders-related discoveries.

China is propagating in the brain imaging and neuroimaging market with its strong emphasis on medical device manufacturing and supply industry. With the world’s one of the biggest production outputs, this country presents a great scope of progress in this field. In addition, the courageous initiatives taken by the governing bodies of China play a crucial role in achieving the forefront position in this sector. Besides, the direct financial backup from these fundings has leveraged activities in associated R&D projects. For instance, in November 2021, NYU Shanghai and East China Normal University (ECNU) collaboratively launched the Center for Brain Imaging to empower the China Brain Project.

Key Brain Imaging and Neuroimaging Market Players:

- Varian Medical Systems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE HealthCare Technologies Inc.

- Siemens AG

- Philips Healthcare

- Esaote SpA

- Sanrad Medical Systems Pvt. Ltd.

Strings of the market is steadily revolutionizing by bringing artificial intelligence. Despite the humanized analysis being the top contributing segment, next-generation technologies are now notably penetrating into the mainstream. This is inspiring other tech leaders to create a distinguished healthcare pipeline, garnering diversification in this field. This also paves new pathways toward other lucrative sources of revenue, expanding market reach. For instance, in April 2024, Cortechs.ai announced a remarkable update on FDA 510(k) pending for its NeuroQuant v5.0, escalating the level of precision in neurological diagnosing and monitoring. Such key players are:

Recent Developments

- In November 2024, GE HealthCare earned FDA 510(k) clearance for its 3.0T high-performance head-only MRI scanner, SIGNA MAGNUS. The approval established the company’s footprint in neuroimaging innovations, where the new system showed advanced detection capabilities for neurological, oncological, and psychiatric issues.

- In November 2024, Royal Philips partnered with icometrix to unveil an AI-driven quantitative software for acquiring, reading, and reporting the results of MRI brain scans at RSNA 2024. The revolutionary technology can integrate with Philips’ BlueSeal MR scanners and Smart Reading capability to offer more accurate treatment and diagnosis.

- Report ID: 7109

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.