Braiding Machine Market Outlook:

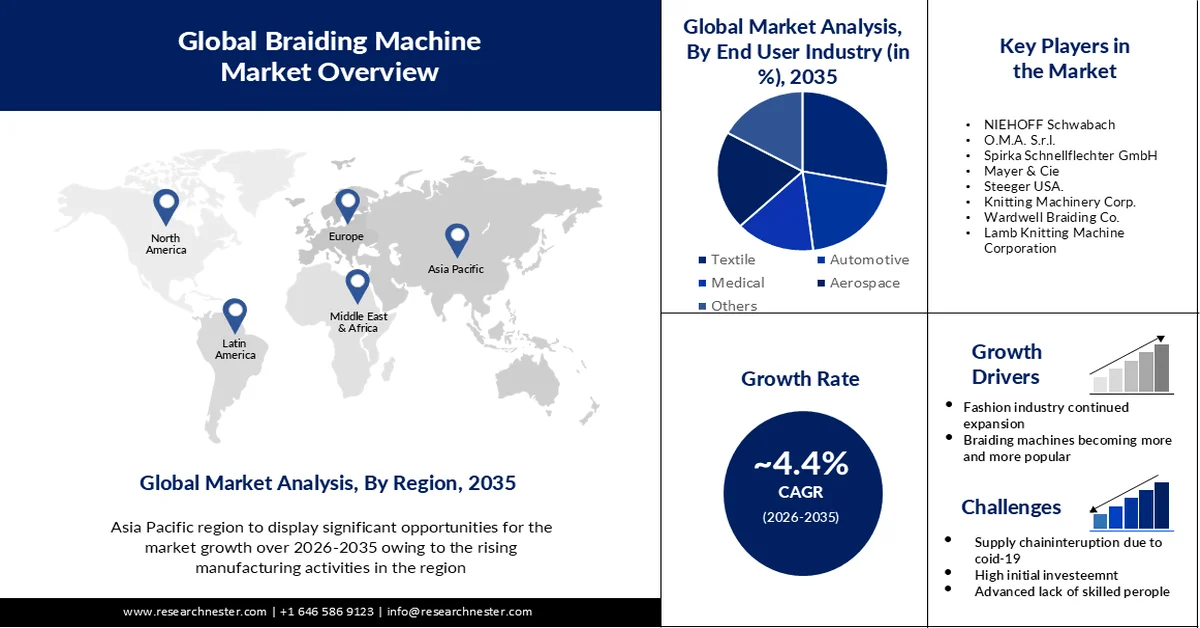

Braiding Machine Market size was over USD 628.66 million in 2025 and is poised to exceed USD 966.99 million by 2035, growing at over 4.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of braiding machine is estimated at USD 653.55 million.

Braided medical sutures and implanted devices are in higher demand due to the healthcare industry's emphasis on cutting-edge medical devices and surgical procedures, which is propelling the market expansion. Research indicates that the growing requirement for catheters and other braided tubes used in surgeries will cause global healthcare spending to expand at a pace of 5.4% during the projected period.

In addition to these, the increasing demand for durable, high strength products across various industries is driving the demand for braided materials. Braiding machines enable the efficient production of these products leading the braiding machine market growth.

Key Braiding Machine Market Insights Summary:

Regional Highlights:

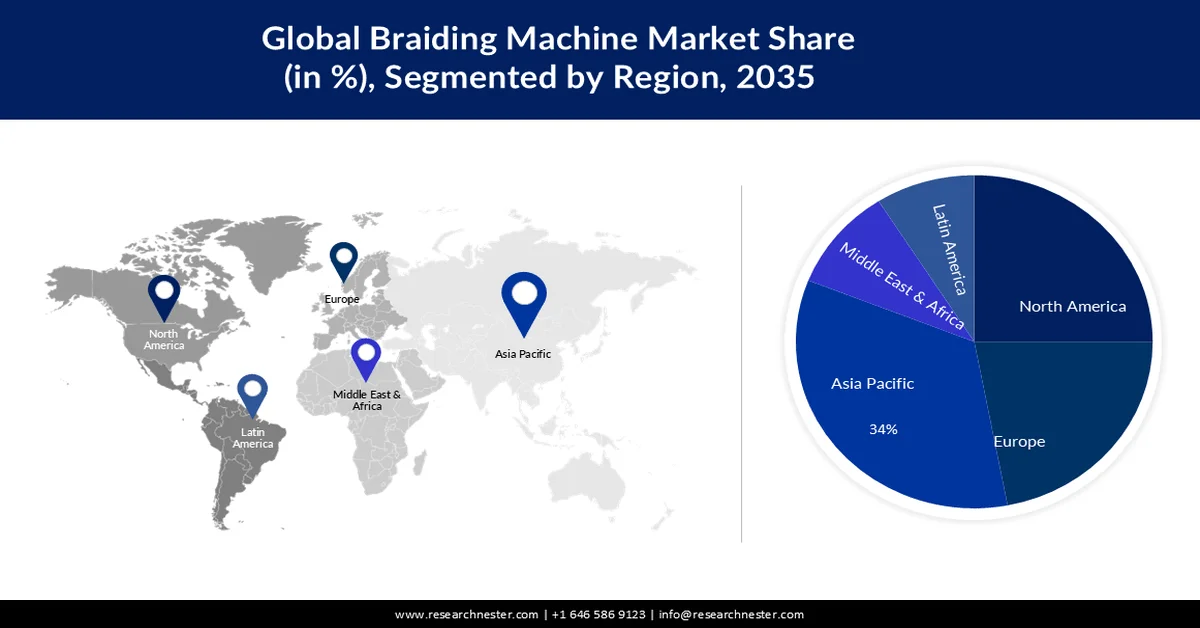

- Asia Pacific is projected to account for around 34% share of the braiding machine market by 2035, impelled by expanding manufacturing activities in China and India alongside rising foreign investments

- North America is anticipated to secure nearly 25% share of the market by 2035, fueled by robust demand from textile, automotive, construction, aerospace, and defense sectors in the United States

Segment Insights:

- The textile segment is anticipated to account for a 28% share of the braiding machine market by 2035, propelled by rising consumerism and accelerating demand for ready-made clothing in developing economies

- The horn gear braider segment is forecasted to command approximately 38% revenue share during 2026–2035, driven by its efficient automated engagement mechanism in automatic braiding machines

Key Growth Trends:

- Both Developed and Developing Nations Are Seeing an Increase In Industry and Urbanization

- The Fashion Industry's Continued Expansion

Major Challenges:

- Supply chain interruption due to COVID-19

- High initial investment required for purchasing and setting up braiding machines can be substantial, especially for advanced automated systems.

Key Players: Hefei TNJ Chemical Industry Co., Ltd., Dubi Chem, Lynx Software Technologies, Sisco research Laboratories Pvt. Ltd., Synthon-Chemicals GmbH & Co.KG, Jigs Chemical, Vineeth Chemicals, Spectrum Chemical Manufacturing.

Global Braiding Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 628.66 million

- 2026 Market Size: USD 653.55 million

- Projected Market Size: USD 966.99 million by 2035

- Growth Forecasts: 4.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, China, Japan, United States, Italy

- Emerging Countries: China, India, Japan, South Korea, Vietnam

Last updated on : 25 February, 2026

Braiding Machine Market - Growth Drivers and Challenges

Growth Drivers

-

Both Developed and Developing Nations Are Seeing an Increase In Industry and Urbanization- Growing urbanization and industrialization in both developed and developing nations is anticipated to propel the braiding machine market during the forecast period. This is because the number of industries contributing to development is on the rise, and the continuous expansion of automobile production is one of the key drivers of the global market. Approximately 4.4 billion people, or 56% of the world's population, live in cities today. By 2050, over seven out of ten people will live in cities as a result of this trend, with the urban population predicted to have more than doubled from its current level.

-

The Fashion Industry's Continued Expansion- In terms of demand, through 2022 and beyond, younger groups like Gen-Z and wealthier consumers from middle-class and up are anticipated to have the greatest hunger for leisure expenditure (including clothing, dining out, travel, entertainment, gadgets, and so forth). Sales in the Chinese fashion industry, which covers both luxury and non-luxury categories, have already recovered to levels seen prior to the pandemic. The intricate network of global supply lines that supports the garment industry is under unheard-of stress and upheaval. To keep products moving in line with customer demand, businesses need to reevaluate their procurement strategy while incorporating cutting-edge supply chain operations and maximum flexibility.

Challenges

-

Supply chain interruption due to COVID-19- The COVID-19 pandemic has caused the manufacture of a number of products in the braiding machine business to stop, mostly as a result of the extended lockdown in several key international nations. This has greatly slowed the braiding machine market growth in recent months and is probably going to do so in 2020. COVID-19 has already had an adverse effect on machinery and equipment sales in the first quarter of 2020, and it is probably going to have a detrimental effect on market growth all year long.

-

High initial investment required for purchasing and setting up braiding machines can be substantial, especially for advanced automated systems.

-

Advanced braiding machines required skilled operators who can handle complex programming and machine setup. The lack of skilled personnel poses challenge for market growth.

Braiding Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.4% |

|

Base Year Market Size (2025) |

USD 628.66 million |

|

Forecast Year Market Size (2035) |

USD 966.99 million |

|

Regional Scope |

|

Braiding Machine Market Segmentation:

End User Industry (Textile, Sporting, Automotive, Medical, Aerospace, Electrical, Marine Sector)

The textile segment is anticipated to hold 28% share of the global braiding machine market by the 2035. The rise in demand for ready-made clothing can be ascribed to rising levels of consumerism in developing nations like China, India, Thailand, and Indonesia. Furthermore, the textile sector is experiencing notable technical breakthroughs that are propelling the demand for automatic braiding machines worldwide. The expanding global market can be attributed to the burgeoning textile sector in developing nations like Bangladesh, India, and China. Around 24 million metric tons of textile fibers were produced globally in 1975. That amount had almost quadrupled by 2022 and exceeded 113.8 million metric tons. The manufacturing volume of natural fibers, such as cotton and wool, was 25.2 million metric tons, while the remaining 87.6 million metric tons were produced by chemical fibers. Chemical fibers include artificial cellulosic fibers like rayon and viscose, as well as synthetic fibers like polyesters and polyamides. Additionally, because automatic braiding machines perform better than traditional machines, the demand for them is expected to rise in industrialized nations.

Product Type (Horn Gear Braider, Wardwell Rapid Braider, 4track & Column Braider, Wire Braiding Machines)

The horn gear braider segment in the braiding machine market is expected to hold largest revenue share of about 38% during the forecast period. In automatic braiding machines, horn gear braziers are utilized to engage and disengage the drive train without the need for human interaction. To engage the machine, simply attach the desired chord or cable on either end of the brazier. The machine then snaps into place and shuts off. The brazier is a straightforward but efficient gadget made up of two revolving disks that are each attached to a cable or cord. The disks are placed at the top and bottom of the machine when the brazier is placed on it.

Our in-depth analysis of the global braiding machine market includes the following segments:

|

Product Type |

|

|

End User Industry |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Braiding Machine Market - Regional Analysis

APAC Market Forecast

Brading machine market in Asia Pacific region is attributed to hold the largest share of about 34% during the forecast period. The rise in manufacturing activities in China and India has resulted in a growing need for automatic braiders, which is the reason for the increase. Furthermore, it is anticipated that increasing investments from outside firms like Siemens AG and Hyundai Heavy Industries Co., Ltd. will propel the area market even further. The surge is attributed to rising fashion sector spending as well as a population that is expected to continue growing, especially in China. China was the world's largest exporter of textiles in 2021, with a valuation of over USD 118.5 billion. Bangladesh came in second place with an export value of about USD 38.73 billion, behind China. China's exports account for over 52.2% of Asia's entire textile export market.

North American Market Statistics

The braiding machine market in the North America region is projected to hold the second largest market share of about 25% during the projected period. The growth of the market in this region is due to the strong demand from end-use sectors in the United States, including textile and fabric, automotive, construction, aerospace, and defense. During the course of the forecast period, this regional market is anticipated to increase at a CAGR of more than 6%. This is explained by the product's outstanding qualities, including flexibility, moisture absorption, and tensile strength, which have led to an increase in demand from the textile and construction industries.

Braiding Machine Market Players:

- HERZOG GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NIEHOFF Schwabach

- O.M.A. S.r.l.

- Spirka Schnellflechter GmbH

- Mayer & Cie

- Steeger USA.

- Knitting Machinery Corp.

- Wardwell Braiding Co.

- Lamb Knitting Machine Corporation

- GLADDING BRAIDED PRODUCTS, INC.

- Geesons International

- Magnatech International, Inc.

Recent Developments

- Herzog exhibited its latest winding and braiding technology at the TECHTEXTIL/TEXPROCESS 2019 in Frankfurt. The variation braider VF1/ (4-32) – 140 is an improved version of braiding machine used particularly for medical and textile applications.

- NIEHOFF has developed large rotating braiding machine for stranding cables and wires using large cross sections. The well-known double-stroke machine of D and DSI series is embedded with NIEHOFF’s stranding Technology SL, that increases the wire quality useful for construction machinery.

- Report ID: 5430

- Published Date: Feb 25, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Braiding Machine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.