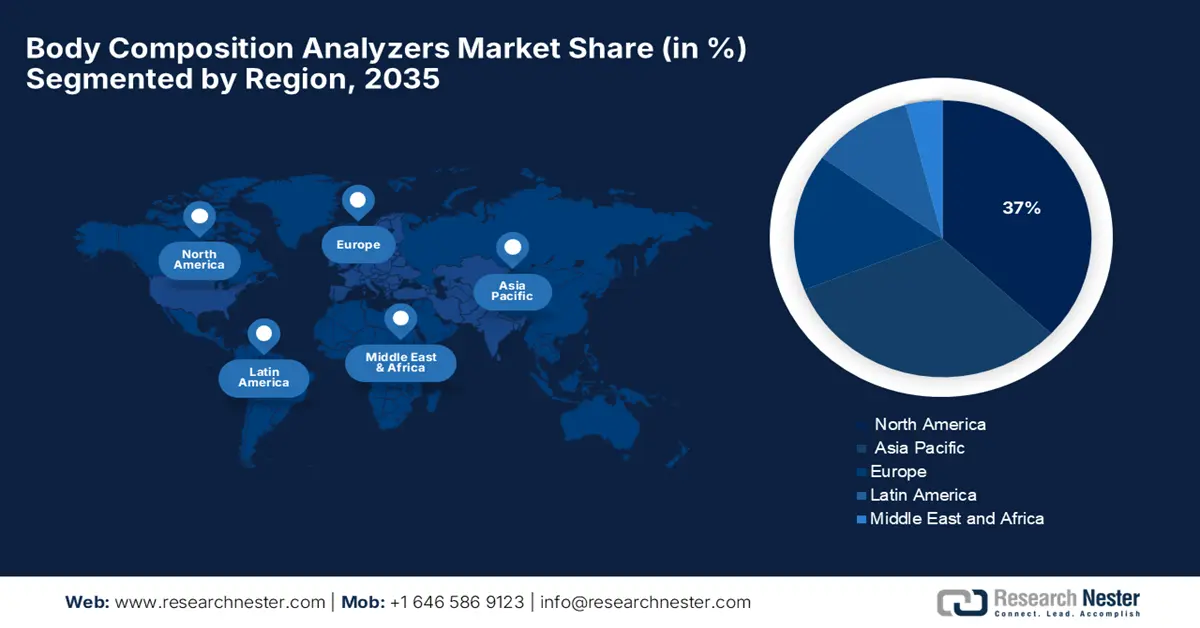

Body Composition Analyzers Market - Regional Analysis

North America Market Insight

The market in North America is anticipated to hold the largest market share of 37% throughout the forecast period. Growth is supported by the increased awareness among consumers for wellness and fitness, growing usage in medical, sports, and wellness environments, and persistent advancements in technology. Besides, market players provide equipment that monitors fat, muscle, bone, and water, thereby suitable for the overall market in the region. Additionally, supportive government initiatives and rising obesity rates further propel market demand.

The body composition analyzers market in the U.S. is growing increasingly influenced by the growing obesity rate and the need for accurate health diagnosis in clinical and wellness segments. As per a report published by the CDC in September 2024, with 40.3% of adults classified as being obese, doctors and gyms are implementing advanced body analysis devices to support patient treatment and program achievement. The trend reflects higher B2B opportunities for device manufacturers and digital health integrators.

The body composition analyzers industry in Canada is gradually growing due to heightened public interest in health indicators, rising obesity rates, and a greater focus on preventive care. Besides, the country contributes to wide-ranging studies that improve the precision and dependability of these devices. As per a report by the Government of Canada, June 2025, the percentage of adults in Canada with a BMI that qualifies as obese is 29.5%. A further 35.5% have a BMI that falls into the overweight category. This means 65% of adults fall into the combined categories of overweight and obese. The high incidence of overweight and obese individuals is fueling the demand for advanced body composition analyzers in both clinical and consumer wellness markets throughout Canada.

Europe Market Insight

The body composition analyzers market in Europe is expected to be the fastest-growing market during the forecast period due to growing awareness of health, obesity rates, and government support for preventive healthcare. The market is driven by favorable policies and investments in digital health technology, as well as the growing use of fitness monitoring devices. Demand is also spurred by ageing populations demanding enhanced management of health. As per a report by Eurostat July 2024, in the EU in 2022, the age group 16 to 24 years had the lowest percentage of overweight individuals at 20.3%, while the highest percentage was observed in the 65 to 74 years age group at 63.6%.

The body composition analyzers sector in the UK is growing tremendously on the back of raised health consciousness, rising prevalence of chronic diseases, and improving technology. The UK market is witnessing the growing application of body composition analyzers in healthcare centers for disease management and health clubs for performance monitoring. Government policies towards healthy living and preventive care are indirectly driving the growth of the market. The market experiences the utilization in aspects of weight control programs, sports optimization, and customized health monitoring.

The market in Germany is growing at a fast pace, driven by factors such as rising awareness of fitness and health, rising obesity ratio, and technological innovation. Governmental bodies as well as medical institutions are keen on preventive treatment and encouragement of well-being, adding further impetus to growth. Body composition analyzers are also being adopted in hospitals, sports medicine centers, rehabilitation units, and fitness clubs in Germany, fueling adoption across industries.

Asia Pacific Market Insight

The Asia Pacific body composition analyzers market is expected to grow steadily due to the increasing obesity rates, increasing health consciousness, and increasing fitness markets. Support from government policies and digital adoption also adds to the growth of the market. In addition, as per a report published by Focus CBBC in May 2023, the smart sports and fitness market, consisting of fitness apps, wearables, and smart exercise equipment, contributed USD 5.2 billion to the market in 2023. The market growth is propelled by higher investment in healthcare infrastructure and greater adoption of non-invasive body composition analysis for effective obesity and chronic disease management.

The market in China is growing fast, owing to the increasing health consciousness and widespread use of wearable fitness devices (WFDs). According to the May 2025 NLM report, With shipments hitting 33.7 million units in the first quarter of 2024 and smartwatches growing at 54.1% year-on-year (YoY), the need for sophisticated health monitoring devices is intensifying. Taking advantage of health technician and consultant affordances, these gadgets offer personalized health management, creating significant growth prospects for the manufacturers and healthcare providers in China’s preventive health ecosystem.

The body composition analyzers market in India is poised for significant growth, driven by the country’s position as the third-largest wearable device market globally. As per a report by NLM published in November 2022, with 62.2% of users adopting wearable devices for health management and increasing technological acceptance, the demand for advanced body composition analyzers is rising. This creates strong opportunities for manufacturers and healthcare providers to cater to the country’s growing focus on personalized health monitoring and fitness management.

Leading Exporters and Importers of Medical Instruments Asia Pacific (2023)

|

Exporters of Medical Instruments in 2023 |

Value (USD) |

Importers of Medical Instruments |

Value (USD) |

|

China |

12.3 billion |

China |

10.6 billion |

|

Japan |

7.2 billion |

Japan |

6.4 billion |

|

Malaysia |

2.7 billion |

India |

2.4 billion |

|

Israel |

2.5 billion |

South Korea |

2.3 billion |

|

Singapore |

2.4 billion |

Singapore |

2.2 billion |

|

South Korea |

2.2 billion |

Hong Kong |

1.6 billion |

|

Thailand |

1.4 billion |

Saudi Arabia |

1.6 billion |

|

India |

1.4 billion |

Chinese Taipei |

1.3 billion |

|

Chinese Taipei |

1.4 billion |

Turkey |

1.2 billion |

|

Vietnam |

1.3 billion |

Malaysia |

1.0 billion |

|

Turkey |

708 million |

Thailand |

842 million |

Source: OEC, August 2025