Blue-green Algae (BGA) Fertilizer Market Outlook:

Blue-green Algae (BGA) Fertilizer Market size was over USD 1.21 billion in 2025 and is anticipated to cross USD 8.41 billion by 2035, growing at more than 21.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of blue-green algae fertilizer is estimated at USD 1.44 billion.

With the rising interest in organic farming and the shift towards healthier and more sustainable food production methods, there is an increasing demand for organic fertilizers. Globally. Organic farmland increased by 3.0 million hectares (4.1 percent) in 2020. Blue-green algae-based fertilizers, being a natural and organic option, align well with the needs of organic farmers and can gain traction in this market.

Key Blue-green Algae (BGA) Fertilizer Market Insights Summary:

Regional Highlights:

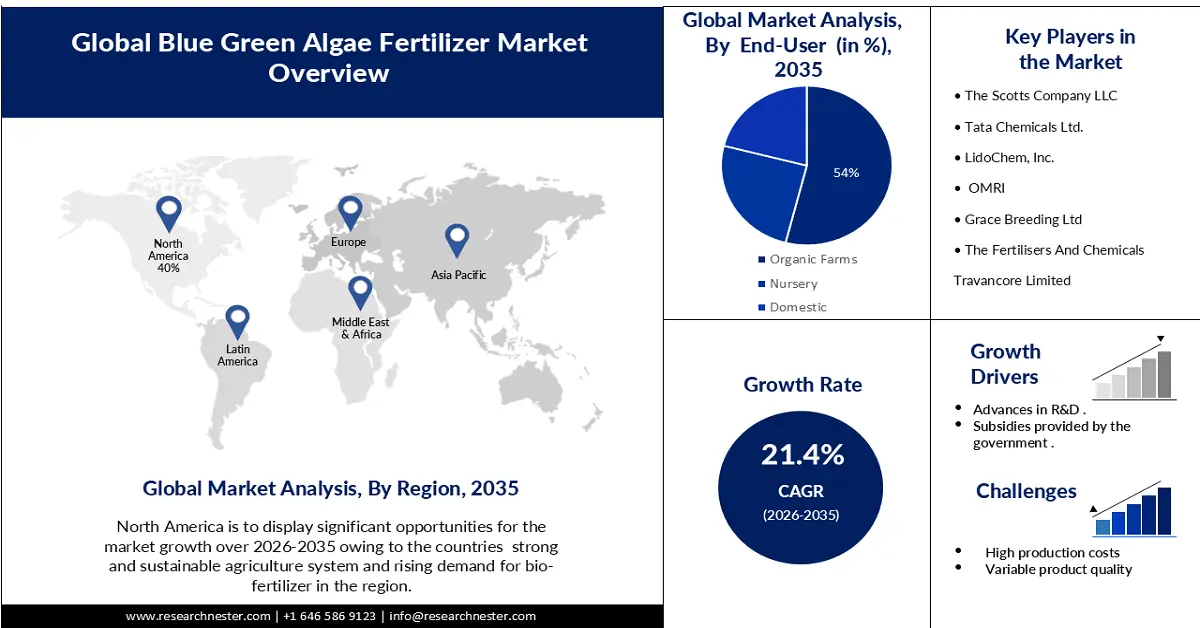

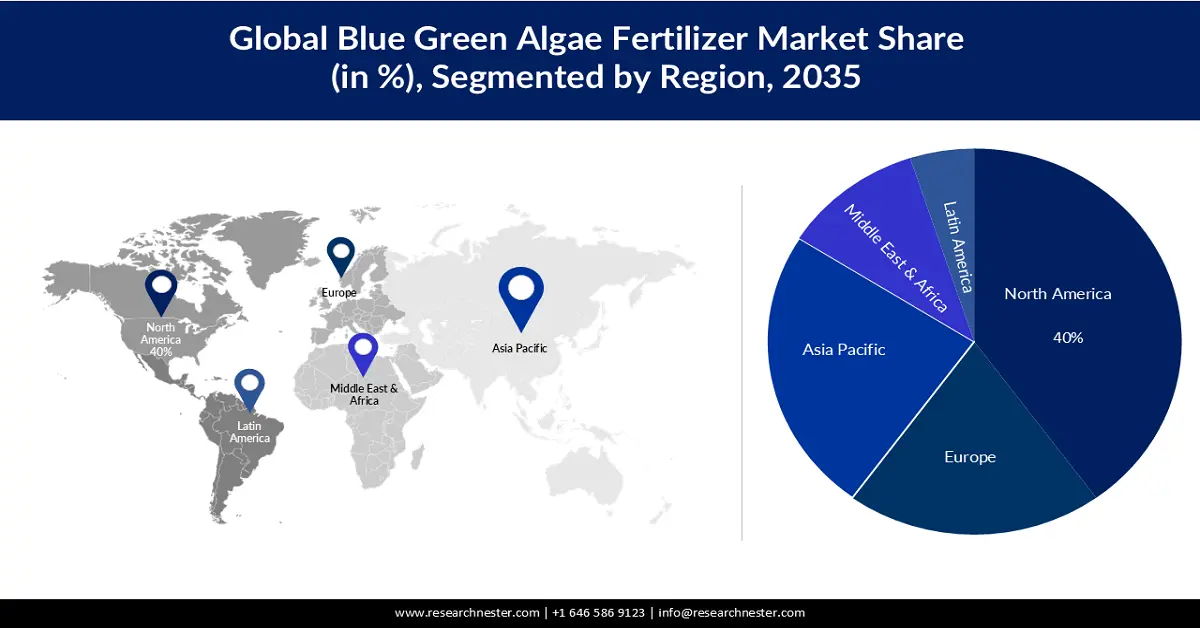

- North America is set to account for the largest revenue share of 40% by 2035, driven by a strong sustainable agriculture system, rising bio-fertilizer demand, and adoption in specialty crop regions.

- Europe is expected to grow at a significant rate during the forecast period, impelled by EU policies promoting biofertilizers, organic farming, and sustainable agriculture incentives.

Segment Insights:

- The grains and cereals segment holds a significant market share, propelled by the nitrogen-fixing capabilities of BGA fertilizers and the extensive cultivation of rice.

- The organic farms segment is expected to account for 54% share, driven by the use of BGA fertilizers to enhance soil organic matter and provide cost-effective nutrient solutions.

Key Growth Trends:

- Improved soil health and plant growth

- Advances in Research & Development

Major Challenges:

- Limited awareness and knowledge

- High production costs

Key Players: Coromandel International Limited, LidoChem, Inc., OMRI, Grace Breeding Ltd, The Fertilisers And Chemicals Travancore Limited, MADRAS FERTILIZERS LIMITED, Paradeep Phosphates Ltd., California Organic Fertilizers, Inc., Dimiagro., Incitec Pivot Fertilisers.

Global Blue-green Algae (BGA) Fertilizer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.21 billion

- 2026 Market Size: USD 1.44 billion

- Projected Market Size: USD 8.41 billion by 2035

- Growth Forecasts: 21.4%

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Canada, Brazil, Germany, France

- Emerging Countries: India, China, Mexico, Indonesia, Vietnam

Last updated on : 19 November, 2025

Blue-green Algae (BGA) Fertilizer Market - Growth Drivers and Challenges

Growth Drivers

- Improved soil health and plant growth- Blue-green algae fertilizers are known to enhance soil structure and nutrient content, promoting better plant growth and crop yields. As agriculture faces the challenge of feeding a growing global population, farmers are continually seeking more efficient and effective ways to improve crop productivity, making blue-green algae fertilizers an attractive choice.

- Advances in Research & Development - Ongoing research and development in the field of biotechnology and agriculture may lead to advancements in blue-green algae fertilizer formulations. If these advancements result in more cost-effective, efficient, and convenient products, they can drive greater adoption of such biofertilizers.

- Government support and incentives- Some governments offer incentives and subsidies to promote sustainable and eco-friendly agricultural practices. As part of their efforts to reduce chemical fertilizer usage and its environmental impact, governments may encourage the adoption of alternative fertilizers like blue-green algae-based products, thereby boosting the blue-green algae fertilizer market.

Challenges

- Limited awareness and knowledge-One of the primary obstacles to the blue-green algae fertilizer market is the lack of awareness and understanding among farmers and consumers. Many potential users may not be familiar with the benefits and proper application of blue-green algae fertilizers, leading to hesitancy in adopting these products.

- High production costs

- Variable product quality

Blue-green Algae (BGA) Fertilizer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

21.4% |

|

Base Year Market Size (2025) |

USD 1.21 billion |

|

Forecast Year Market Size (2035) |

USD 8.41 billion |

|

Regional Scope |

|

Blue-green Algae (BGA) Fertilizer Market Segmentation:

Crop Type Segment Analysis

Grains and cereals account for a significant market share due to the nitrogen-fixing capabilities of BGA fertilizer and low-cost inputs. With vast rice production, the BGA fertilizer market is experiencing significant growth. Rice production in 2021 was estimated to be around 212 million metric tons.

End-User Segment Analysis

Organic farms account for the majority of the blue-green algae fertilizer market share of 54% because BGA fertilizers are more commonly employed in organic farms since they produce compounds that increase the quantity of organic matter in the soil. These are great solutions because they assist both the environment and the economy while providing nutrients to crops at an affordable price.

Our in-depth analysis of the global market includes the following segments:

|

Crop Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blue-green Algae (BGA) Fertilizer Market - Regional Analysis

North American Market Insights

The blue-green algae fertilizer market in North America industry is set to account for largest revenue share of 40% by 2035. This is primarily accounted for owing to the country's strong and sustainable agriculture system and rising demand for bio-fertilizer in the region. Additionally, regions with a concentration of specialty crop production, such as Florida for citrus fruits or Idaho for potatoes, could also see increased adoption of blue-green algae fertilizers. The region’s environmentally friendly practices drive the demand for bio-based fertilizers in various crop types.

European Market Insights

Europe blue-green algae (BGA) fertilizer market is expected to grow at a significant rate during the forecast period, owing to the European Union's ongoing encouragement of biofertilizers as cost-effective, advising farmers to optimize the application of chemical fertilizers or replace them entirely or partially with eco-friendly ones to result in better economic returns. The EU Common Agricultural Policy encourages the use and adoption of bio-based goods and organic farming. It directs up to 30% of the money to farmers to preserve sustainable farming practices.

Blue-green Algae (BGA) Fertilizer Market Players:

- Coromandel International Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

Recent Developments

- A bioactive derived from "blue-green" algae (Cyanophyta) can uproot and accelerate growth in plants like soybeans and corn by up to 10%. This microorganism from the Pantanal basin has been used to create a product created by Embrapa Energia and the business Dimiagro. It sends a chemical signal to vegetables to support physiological processes, which increases their vitality and productivity.

- Evolva collaborates with Grace Breeding to replace chemical fertilizers with organic alternatives.

- Report ID: 3362

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.