Biscuits Market Outlook:

Biscuits Market size was valued at USD 125.8 billion in 2025 and is projected to reach USD 216.4 billion by the end of 2035, rising at a CAGR of 5.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of biscuits is estimated at USD 132.5 billion.

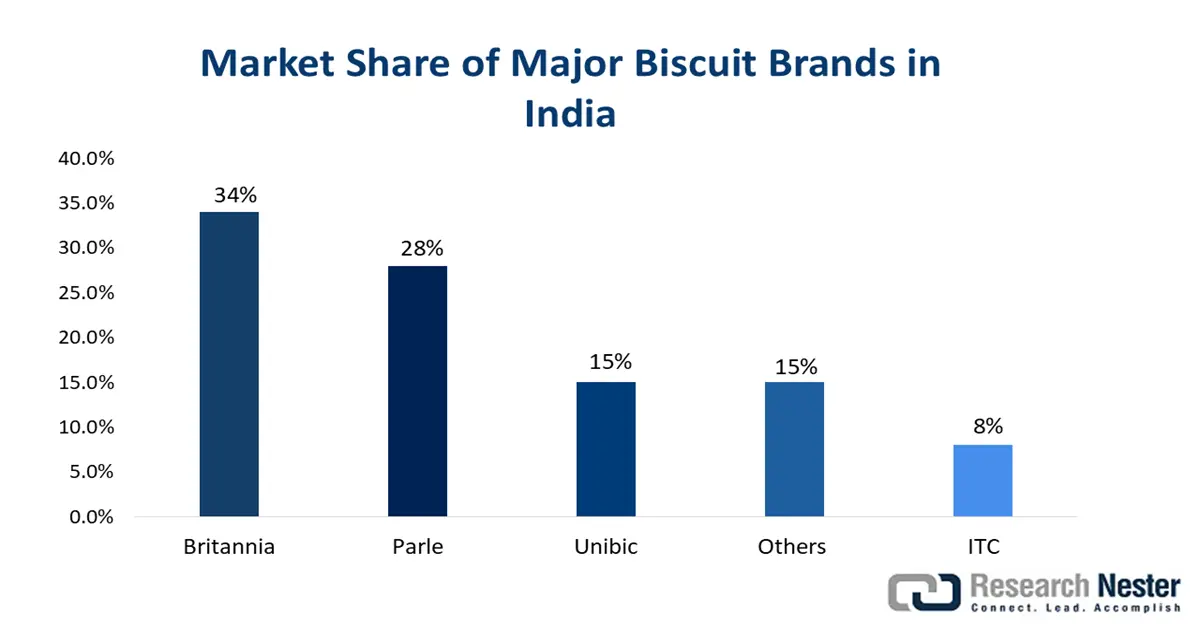

The worldwide market of biscuits is portraying tremendous growth owing to the rapidly evolving consumer preferences towards health and wellness, indulgence, and convenience. The report from Bio Conferences revealed that as of 2025, India is among the top three worldwide biscuit producers, wherein the yearly production surpasses 3.8 million metric tons. Besides, the organized sector captured 72% of production, with per capita consumption rising to 2.8 kg, indicating a stronger potential for market penetration in the upcoming years.

Furthermore, the digital and e-commerce channels, along with favorable government reforms, are evidently enhancing uptake in this field, making affordability an influencing factor. As per an article published by the government of India in October 2025, the recent GST reforms implemented in Arunachal Pradesh significantly boosted the local industries' potential with tax reduction from 12% to 18% to just 5% across key sectors such as agriculture, processed foods, textiles, and handicrafts. Hence, the move also made biscuits 11% cheaper, thereby improving profit margins for farmers, artisans, and MSMEs.

Key Biscuits Market Insights Summary:

Regional Highlights:

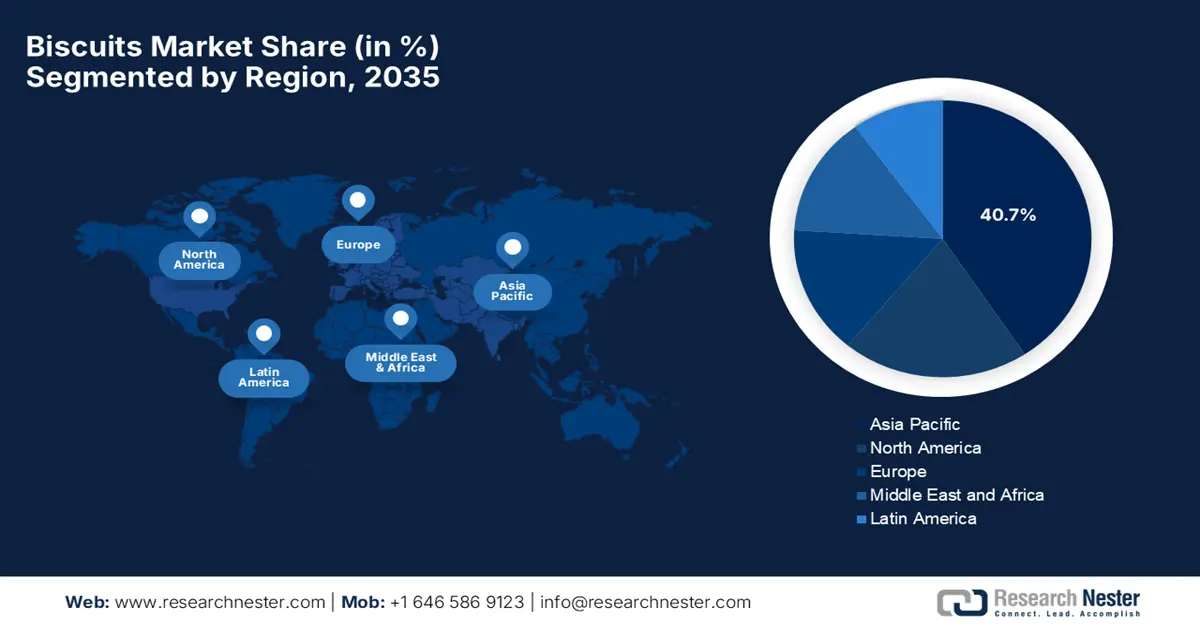

- Asia-Pacific is identified as the dominating region in the biscuits market, capturing a 40.7% revenue share by the end of 2035, driven by rapid urbanization, rising disposable incomes, and expanding retail infrastructures.

- North America is projected to witness notable growth by 2035, supported by evolving consumer preferences, a diverse product landscape, and increasing demand for health-conscious biscuit options.

Segment Insights:

- In the ingredient segment, wheat-based biscuits are forecast to secure the largest revenue share of 70.5% by the end of the forecast duration, reinforced by cost efficiency, high yield, and consumer familiarity.

- Within the product type segment, sweet biscuits are set to capture a significant revenue share of 63.7% by 2035, propelled by widespread audience demand and flavor innovation.

Key Growth Trends:

- Convenience & on-the-go consumption

- E-commerce expansion

Major Challenges:

- Health & nutrition concerns

- Raw material price volatility

Key Players: The Kellogg Company, Campbell Soup Company (Pepperidge Farm), Nestlé S.A., PepsiCo Inc. (Frito-Lay), Pladis Foods Ltd., Burton's Biscuit Company, Bahlsen GmbH & Co. KG, Barilla G. e R. Fratelli S.p.A., Lotus Bakeries NV, Yildiz Holding (Ülker), Grupo Bimbo S.A.B. de C.V., Parle Products Pvt. Ltd., Britannia Industries Ltd., Yamazaki Baking Co. Ltd., Lotte Confectionery Co. Ltd., Orion Corporation, Arnott's Biscuits Ltd., Munchy's Food Industries Sdn. Bhd., Hsu Fu Chi International Ltd.

Global Biscuits Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest region: Asia-Pacific (40.7% revenue share by 2035)

- Fastest growing region: North America

- Dominating countries: China, India, United states, Germany, United kingdom

- Emerging countries: Brazil, France, Japan, Canada, Australia

Last updated on : 15 October, 2025

Biscuits Market - Growth Drivers and Challenges

Growth Drivers

- Convenience & on-the-go consumption: The changing eating habits among the worldwide population, coupled with amplified adoption of snacking culture, are fostering a profitable business environment for the market. As per an NIH article published in March 2023, its review analyzed snacking behaviors among U.S. adults, which found that snacks contribute about 20% to 22% of daily energy intake, wherein most adults consume one to three snacks per day that provide essential nutrients and help regulate appetite, providing an encouraging opportunity for pioneers in this field.

- E-commerce expansion: There has been a rise in e-commerce platforms over the past few years, which positively impacts the market expansion across almost all nations. The report from UNCTAD in May 2021 revealed that the COVID-19 pandemic appreciably boosted worldwide e-commerce, with online retail sales increasing their share of total retail sales from 16% to 19% in 2020, which reached an estimated USD 26.7 trillion in a year, representing 30% of the global GDP. It also stated that business-to-business e-commerce dominated the market, accounting for 82% of all e-commerce sales, wherein business-to-consumer sales reached USD 4.9 trillion, growing 11% from the previous year.

- Rising disposable incomes: The ever-increasing disposable income in the emerging markets is one of the principal drivers for the biscuit market since it enables consumers to spend more on premium products. In this regard, FRED data as of September 2025 revealed that real Disposable Personal Income (DSPIC96) for August 2025 was reported at USD 18,097.2 billion chained 2017 dollars, seasonally adjusted at an annual rate. Therefore, this figure reflects the presence of inflation-adjusted income available to individuals after taxes, providing a key measure of consumers’ purchasing power.

Leading Biscuit Exporting Countries 2024

|

Country |

Shipments |

|

India |

334,330 |

|

Turkey |

140,789 |

|

South Africa |

71,956 |

Source: IBEF

Challenges

- Health & nutrition concerns: The ever-increasing consumer awareness about health and wellness poses a significant challenge to the upliftment of the market. Most of the biscuits available in the market are recognized to be high in sugar, fat, and calories, which can deter adoption among health-conscious buyers. On the other hand, due to the amplifying demand for low-calorie, sugar-free, and gluten-free options must adapt or risk losing market share to healthier snack alternatives and functional foods.

- Raw material price volatility: The biscuits industry heavily relies upon the raw materials such as wheat, sugar, and dairy, which results in the volatility associated with prices. The fluctuations in the prices of these raw materials owing to factors such as climate change, supply chain disruptions, or geopolitical tensions can lead to increased production costs, posing a major challenge for manufacturers from price-sensitive regions.

Biscuits Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 125.8 billion |

|

Forecast Year Market Size (2035) |

USD 216.4 billion |

|

Regional Scope |

|

Biscuits Market Segmentation:

Ingredient Segment Analysis

Based on the ingredient, the wheat-based biscuits segment is projected to garner the largest revenue share of 70.5% by the end of the forecast duration. Cost efficiency, high yield, established supply chains, and familiarity with consumer taste preferences are the key factors behind this leadership. For instance, in June 2025, the Punjab Agricultural University announced the launch of the wheat variety PBW Biscuit 1, specifically developed to improve the quality and nutritional value of atta biscuits, making them softer and crispier, hence indicating a positive segment outlook.

Product Type Segment Analysis

In terms of product type sweet biscuits segment is expected to capture a significant revenue share of 63.7% by the end of 2035. The growth in the segment is effectively attributable to the presence of wider audience demand from children to adults, which is allowing flavourful innovations in this field. In May 2023, ITC Foods declared that it had expanded its millet portfolio with the launch of Sunfeast Farmlite Super Millets cookies under its Mission Millet initiative, which is aimed at promoting nutritious and sustainable eating.

Distribution Channel Segment Analysis

Based on the distribution channel supermarket segment is anticipated to grab a considerable share of 38.5% during the analyzed timeframe. The organized retail formats offer broad reach, brand visibility, promotional strategies, bulk stocking, and consistent supply chain integration, all of which contribute to a wider segment scope. On the other hand, consumers are preferring one-stop shopping and in-store promotions, thereby reinforcing the segment’s dominance in this field.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Ingredient |

|

|

Product Type |

|

|

Distribution Channel |

|

|

Packaging Type |

|

|

Flavor |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biscuits Market - Regional Analysis

APAC Market Insights

Asia Pacific is identified as the dominating region in the biscuits market, capturing the largest revenue share of 40.7% by the end of 2035. The dominance of the region is effectively attributable to the rapid urbanization, rising disposable incomes, and expanding retail infrastructures are driving increased demand for biscuits. Testifying to this EIA in October 2023 reported that under the low oil price case, disposable income per capita in this region is projected to grow at an average of 3.3% on a yearly basis from 2022 to 2050. Therefore, this increase in purchasing power may positively impact consumer spending on fast-moving consumer goods, which also includes biscuits, particularly in emerging markets where economic growth is expected to remain strong.

China remains extremely strong in the regional biscuits market, backed by a robust domestic production, increasing export capabilities, and regional consumption differences. Besides, the country’s pioneers are blending local flavors with Western-style formats to cater to both traditional preferences and modern taste experimentation. Also, the presence of health and wellness trends is significantly influencing product formulations such as whole grain, sugar reduction, and functional additives, which is further enhancing consumer uptake in this field.

India has become the primary focus of investment in the worldwide biscuits market since they remain a deeply embedded part of everyday life, coupled with cultural association. Testifying to this, IBEF in July 2025 reported that in India, the biscuits along with biscuit, cookies, and crackers market is rapidly growing, driven by rising urbanization, health-conscious consumers, and digital disruption. The revenue is estimated to reach ₹1.65 lakh crore (USD 20.25 billion) by the end of 2030, wherein the demand is shifting from traditional glucose biscuits to premium, health-focused, and gourmet offerings, hence denoting a positive market outlook.

Key Importers of India’s Biscuit Exports by Shipments and Market Share 2024

|

Country |

Shipments |

Market Share (%) |

|

U.S. |

60,803 |

37% |

|

United Arab Emirates |

18,941 |

12% |

|

Australia |

13,416 |

8% |

|

Total (Top 3) |

93,160 |

57% |

Source: IBEF

North America Market Insights

North America is showcasing notable growth in the regional biscuits market owing to the rapidly evolving consumer preferences and the presence of a diverse product landscape. The region also benefits from health-conscious consumers who are explicit, leading to the introduction of biscuits with reduced sugar content. For instance, in October 2023, Kellanova, formerly known as Kellogg Company, declared that it had completed the separation of its cereal business in North America, WK Kellogg Co, resulting in two independent public companies focused on unlocking their full potential.

The U.S. is augmenting its leadership in the regional biscuits market owing to the heightened demand for both traditional and innovative products. The market is witnessing a strong growth in the e-commerce sector, which offers numerous products for doorstep delivery, allowing a steady cash influx in this field. A Census Bureau report published in August 2025 noted that the retail e-commerce sales in the country reached USD 304.2 billion in the second quarter of 2025, accounting for 16.3% of total retail sales worth USD 1.87 trillion. Besides, the 5.3% year-over-year growth is likely to transform the market by providing consumers with easier access to snacks online.

Canada is witnessing a gradual progression in the biscuits market since the private label biscuits are gaining traction, offering consumers affordable alternatives without compromising on quality. Simultaneously, the major firms in the country are collaborating due to a rise in demand for both domestically and internationally produced biscuits. In June 2021, a Ferrero-affiliated company announced an agreement to acquire Burton’s Biscuit Company from the Ontario Teachers’ Pension Plan Board, which owns popular brands such as Maryland Cookies and Wagon Wheels, thereby expanding Ferrero’s sweet biscuits portfolio.

Europe Market Insights

Europe hosts an influential landscape of the market, wherein consumers are showing growing interest in healthier and premium products. The increasing urban lifestyles and strong retail and e-commerce presence are also propelling the upliftment of the market in this region. For instance, in March 2022, the European Commission reported that it had approved the acquisition of Continental Bakeries Holding B.V., based in the Netherlands, by Biscuit Holding S.A.S., based in France, under the EU merger regulations. Continental Bakeries produces and supplies sweet biscuits, bread substitutes, and toasts primarily under private labels in Europe, wherein Biscuits International also mainly manufactures sweet biscuits under private labels.

Germany is maintaining a strong leadership in the regional market owing to the heightened demand for organic, natural, and specialty biscuits, such as vegan and gluten-free varieties. On the other hand, the country’s market is a blend of tradition along with health-focused innovation. In February 2025, Biscuit International announced that it is advancing its rebranding strategy across the region, with rebrands in Poland and the UK already done. The company recently updated its subsidiaries in France, Sweden, and Germany to Biscuit International France SAS, Biscuit International Germany GmbH, and Biscuit International Sweden AB.

The U.K. is a central player in Europe’s market, which is both competitive and well-established. The market is productively led by the presence of iconic brands and strong consumer habits such as tea time snacking. Besides the innovations around the flavous and healthier alternatives, it remains a key factor in the country, wherein the online sales and direct-to-consumer channels are expanding the reach of this sector. Simultaneously, the sustainability efforts in terms of packaging and sourcing are also propelling growth in this country’s market.

Key Biscuits Market Players:

- Mondelez International, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Kellogg Company

- Campbell Soup Company (Pepperidge Farm)

- Nestlé S.A.

- PepsiCo, Inc. (Frito-Lay)

- Pladis Foods Ltd.

- Burton's Biscuit Company

- Bahlsen GmbH & Co. KG

- Barilla G. e R. Fratelli S.p.A.

- Lotus Bakeries NV

- Yildiz Holding (Ülker)

- Grupo Bimbo, S.A.B. de C.V.

- Parle Products Pvt. Ltd.

- Britannia Industries Ltd.

- Yamazaki Baking Co., Ltd.

- Lotte Confectionery Co., Ltd.

- Orion Corporation

- Arnott's Biscuits Ltd.

- Munchy's Food Industries Sdn. Bhd.

- Hsu Fu Chi International Ltd.

The global market is extremely fragmented and competitive, characterized by the presence of leading multinational pioneers and strong regional players. The key competitors, such as Mondelez and Nestle, are driving progress in this field through their product innovations, thereby launching healthier options with reduced sugar, gluten-free options, and fortified nutrients. On the other hand, strategic acquisitions and profitable collaborations are an asset for this landscape, which are employed to debut into new emerging markets, thereby enhancing the product portfolios.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In September 2025, Britannia reported that it launched its Pure Magic Choco Tarts as part of its New Temptation campaign. This new addition to the Pure Magic range complements existing products like Choco Lush, Choco Frames, and Choco Stars, offering consumers a multi-layered, indulgent experience.

- In September 2023, Biscuit International announced that it had launched Donkis, which is a round, plain chocolate biscuit featuring fun Simpsons-themed designs aimed at engaging children.

- Report ID: 1300

- Published Date: Oct 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biscuits Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.