Bipolar Electrosurgical Device Market Outlook:

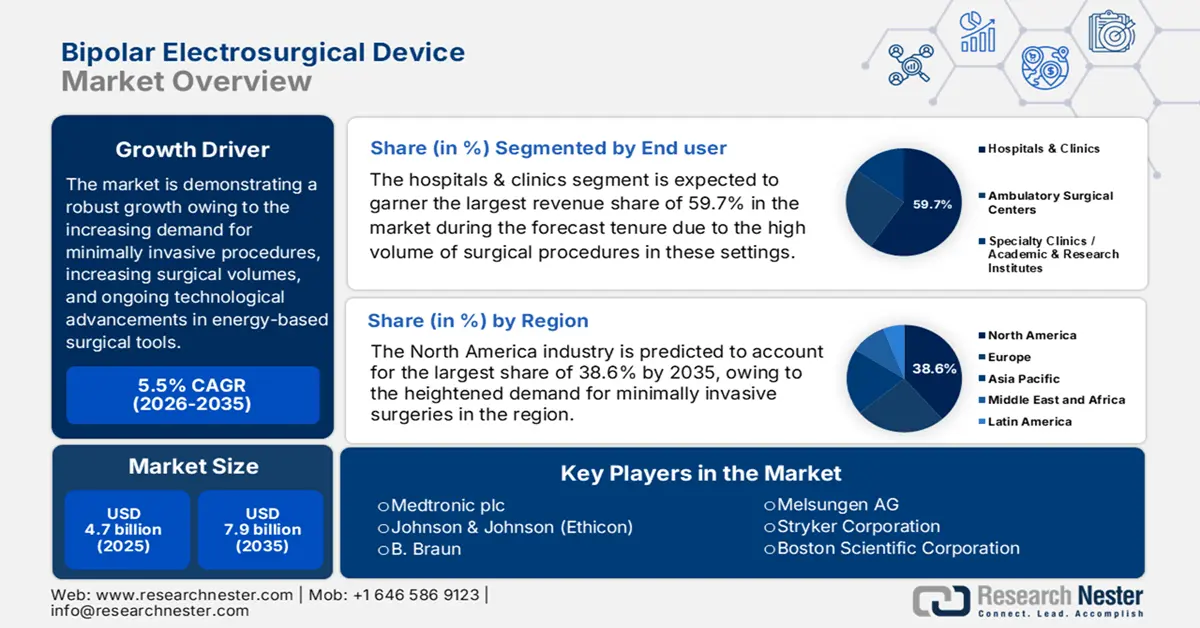

Bipolar Electrosurgical Device Market size was valued at USD 4.7 billion in 2025 and is projected to reach USD 7.9 billion by the end of 2035, rising at a CAGR of 5.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of bipolar electrosurgical devices is assessed at USD 5 billion.

The market is demonstrating a robust growth owing to the increasing demand for minimally invasive procedures, rising surgical volumes, and ongoing technological advancements in energy-based surgical tools. Since there is a constant rise in chronic disease burden, the need for minimally invasive surgical procedures also escalates. According to an article published by the Society of Gynecologic Oncology (SGO) in November 2024, there were around 114,810 new cases diagnosed and 34,020 mortalities as a result of gynecologic cancers in the U.S. in 2023. Hence, this epidemiological data underscores the presence of a reliable consumer base in the sector.

On the pricing and reimbursement front, the market is extremely benefited from the payers due to the cost-efficiency of the devices when compared to other traditional surgical technologies. Therefore, the article published by the National Institute of Health stated that switching to EES, including advanced bipolar and ultrasonic devices, resulted in annual savings of USD 824,760, especially due to reduced operating room time, shorter hospital stays, and lower disposable electrode usage. The model assumed price parity for advanced energy devices and included diverse surgical specialties such as colorectal, bariatric, gynecology, thoracic, and general surgery, hence highlighting the economic benefits of category-wide device adoption.

Key Bipolar Electrosurgical Device Market Insights Summary:

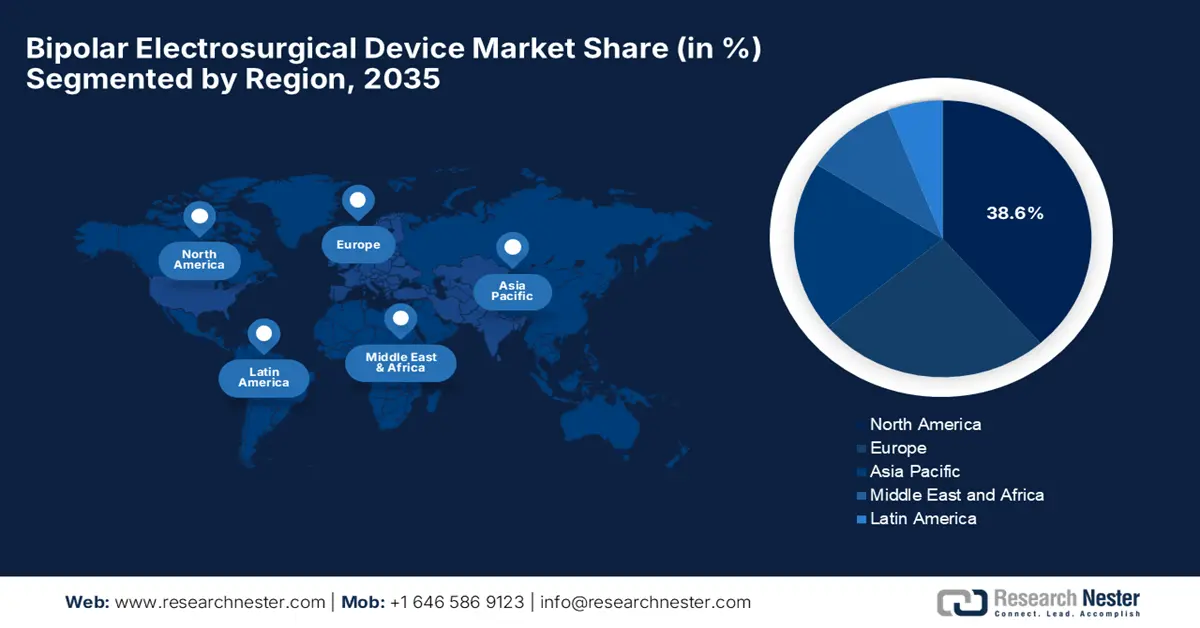

North America is projected to hold the largest revenue share of 38.6% in the bipolar electrosurgical device market globally by 2035.

Asia Pacific is anticipated to exhibit the fastest growth between 2026 and 2035 in the bipolar electrosurgical device sector.

Europe is set for substantial expansion in the bipolar electrosurgical device market.

The hospitals & clinics segment is predicted to secure the highest revenue share of 59.7%, based on end user.

The bipolar electrosurgical generators segment is projected to achieve a substantial market share of 47.6% based on product type.

Within the application category, the general surgery segment is on track to attain a revenue share of 40.8% in the bipolar electrosurgical device domain.

Key Growth Trends:

- Rising demand for minimally invasive surgeries

- Continued advancements in electrosurgical devices

Key Players:

- Medtronic plc, Johnson & Johnson (Ethicon), B. Braun Melsungen AG, Stryker Corporation, Boston Scientific Corporation, CONMED Corporation, ERBE Elektromedizin GmbH, KLS Martin Group, Bovie Medical Corporation, Smith & Nephew plc, Hologic, Inc., Karl Storz SE & Co. KG, Mizuho OSI, Aesculap (B. Braun), BOWA-electronic GmbH & Co. KG, Maxer Endoscopy GmbH.

Global Bipolar Electrosurgical Device Market Forecast and Regional Outlook:

2025 Market Size: USD 4.7 billion

2026 Market Size: USD 5 billion

Projected Market Size: USD 7.9 billion by 2035

Growth Forecasts: 5.5% CAGR (2026-2035)

Largest Region: North America (38.6% Share by 2035)

Fastest Growing Region: Asia Pacific

Last updated on : 20 August, 2025

Bipolar Electrosurgical Device Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for minimally invasive surgeries: Since numerous organizations have underscored the efficacy of minimally invasive solutions, the global market has become increasingly preferred. In June 2024, ISAPS revealed that in 2023, approximately 34.9 million aesthetic procedures were performed across all nations, marking a 3.4% increase from the previous year. Surgical procedures also grew by 5.5% to 15.8 million, with liposuction being the most common, seeing a 29% rise since 2021.

- Continued advancements in electrosurgical devices: This is a major benefiting factor for the bipolar electrosurgical device market that allows a steady cash influx. For instance, in April 2024, Medtronic introduced its Live Stream technology along with 14 new AI-driven Performance Insights algorithms to enhance laparoscopic and robotic-assisted surgeries. It also stated that the Touch Surgery Live Stream enables remote surgical observation and improved training opportunities, thus boosting efficiency and outcomes.

- Expanding geriatric population: This is a major influencing factor in the market of bipolar electrosurgical devices since it leads to a huge incidence of age-related diseases requiring surgical interventions. As per a February 2024 article published by NITI Aayog, the government of India undertook a special drive for cataract surgeries, targeting senior citizens to support the vision of achieving cataract blindness-free districts. Under this initiative, surgeries will be conducted annually across all districts in government hospitals or community health centers. Also, senior citizens holding BPL cards will receive free surgeries and medicines to ease the burden of rising cataract blindness.

Incidence Trends of Gynecological Cancers by Elderly Age Groups (2010 vs. 2020)

|

Age Group |

2010 Incidence % (Average) |

2020 Incidence % (Average) |

|

65-69 |

25.9 |

29.2 |

|

70-74 |

22.0 |

23.6 |

|

75-79 |

20.0 |

18.6 |

|

80-84 |

16.6 |

13.7 |

|

85-89 |

12.4 |

11.9 |

Source: NIH April 2024

Allocation Overview of India's Scheme for Strengthening the Medical Device Industry (2024)

|

Sub-Scheme |

Allocation (INR Crore) |

Allocation (Approx. USD Million) |

|

Common Facilities for Medical Devices Clusters |

₹110 |

~$13.25 |

|

Marginal Investment Scheme for Reducing Import Dependence |

₹180 |

~$21.69 |

|

Capacity Building and Skill Development |

₹100 |

~$12.05 |

|

Medical Device Clinical Studies Support Scheme |

₹100 |

~$12.05 |

|

Medical Device Promotion Scheme |

₹10 |

~$1.21 |

|

Total |

₹500 |

~$60.25 |

Source: India Press Information Bureau (PIB)

Challenges

- Risk of surgical complications: Despite the growing volume of surgical procedures, the bipolar electrosurgical device market still faces risks due to the complications associated. It can cause tissue damage, burns, or unintended thermal injury, which can lead to severe health concerns and affect clinician trust, thereby slowing market growth and device acceptance. Also, the existence of these risks can create hesitation among patients to leverage products from the market, thereby hindering adoption.

- Prolonged approval durations: The administrative bodies impose prolonged approval durations hamper manufacturer enthusiasm in the market. This ultimately creates a delayed product launch and adds robust development costs, posing significant barriers for the global firms. Therefore, the aspect of stringent regulatory requirements hampers market expansion in almost all nations.

Bipolar Electrosurgical Device Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 4.7 billion |

|

Forecast Year Market Size (2035) |

USD 7.9 billion |

|

Regional Scope |

|

Bipolar Electrosurgical Device Market Segmentation:

End user Segment Analysis

Based on the end user, the hospitals & clinics segment is expected to garner the largest revenue share of 59.7% in the market during the forecast tenure. The dominance in the segment is effectively attributed to the high volume of surgical procedures in these settings and their heavy investments in advanced surgical equipment. In March 2025, Caresyntax and Pristine Surgical announced a strategic alliance that aims to enhance surgical intelligence. The collaboration will integrate Caresyntax’s Clinical Data as a Service (CDaaS) with Pristine’s Summit 4K single-use arthroscope. The key emphasis of this collaboration is to grab real-world data from ambulatory surgical centers to improve efficiency and patient outcomes.

Product Type Segment Analysis

In terms of product type bipolar electrosurgical generators segment is expected to grow with a significant share of 47.6% in the market by the end of 2035. The growth in the segment originates from its critical power source for all instruments, which comes at a cost-intensive capital investment. In April 2025, Erbe introduced its two exclusive products, called VIO 3n and VIO seal electrosurgical systems, which enhance precision in surgical procedures. The company highlighted that the VIO seal is its first generator fully optimized for bipolar applications, enhancing compatibility with tools such as TriSect rapide.

Application Segment Analysis

Based on the application general surgery segment is poised to capture a revenue share of 40.8% in the bipolar electrosurgical device market during the discussed timeframe. The high surgical rates among the aging demographics aged 65 and above and widespread applications in hernia, gallbladder, and appendicitis are the key factors reinforcing the subtypes' leadership. As per a study by NIH in August 2023, after the evaluation use of the LigaSure bipolar device for appendiceal stump closure in pediatric laparoscopic appendectomies. Among 209 patients mean age of 9.7 years, the technique showed zero stump leakages and only 1% infection rate, hence a wider market scope.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Product Type |

|

|

Application |

|

|

Energy Type |

|

|

Usability |

|

|

Method |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bipolar Electrosurgical Device Market - Regional Analysis

North America Market Insights

North America is expected to capture the largest revenue share of 38.6% in the global market by the end of 2035. The primary fueling factors for this landscape include heightened demand for minimally invasive surgeries and a robust medical ecosystem. In this regard, Johnson & Johnson Medtech in March 2025 notified its launch of the DUALTO Energy System that can be utilized in surgical procedures. The company highlighted the products' simplified user experience and ease of use application, hence enabling a profitable business atmosphere in the region.

The U.S. is readily growing in the regional bipolar electrosurgical device market, mainly attributed to the rising chronic diseases that create sustained demand for surgical procedures. In this regard, Centers for Medicare & Medicaid Services data as of April 2025 revealed that ongoing post-operative visit tracking is refining payment for global surgical packages. Besides its collaboration with RAND, revealed discrepancies in expected and actual post-operational. Furthermore, CMS’s use of no-pay G-codes improves accuracy in reimbursement for device-dependent surgeries, hence benefiting both firms and consumers.

Canada’s market of bipolar electrosurgical devices is growing at a considerable rate on account of preceding advancements in surgical techniques and increasing adoption across outpatient centers. The country also benefits from continued innovations and profitable collaborations that enable wider clinical use. For instance, in February 2025, Aspen Surgical Products declared that Andau Medical will be the exclusive distributor of its surgical product portfolio across Canada. The report also stated that the partnership covers surgical markers, Symmetry instrumentation, Olsen electrosurgery devices, and laparoscopic tools as well.

Adoption Of Electrosurgical Devices in the U.S. 2021

|

Parameter |

Current (MED) |

Future (EES) |

Difference / Impact |

|

Annual Procedures |

10,000 |

10,000 |

N/A |

|

Procedures Involving Electrosurgery |

80% (8,000 procedures) |

80% (8,000 procedures) |

N/A |

|

Annual Cost |

Baseline |

$824,760 saved annually |

-$824,760 |

|

Cost Saving Per Procedure |

Baseline |

$101 saved per procedure |

-$101 |

|

Operating Room (OR) Time |

Baseline |

Reduced |

Significant reduction |

|

Hospital Stay Duration |

Baseline |

Reduced |

Significant reduction |

|

Disposable Electrode Usage |

Single-use disposables |

Reusable electrodes |

Reduced disposable usage |

Source: NIH

APAC Market Insights

Asia Pacific in the bipolar electrosurgical device market is expected to showcase the fastest growth in the tenure 2026 to 2035. This enhanced upliftment is efficiently propelled by increasing healthcare investments and a growing focus on minimally invasive surgical procedures. Besides, there has been an increased adoption of advanced surgical technologies, wherein the robust medical infrastructure and patient awareness also facilitate revenue in this field. Furthermore, the increasing collaborations between device manufacturers and regional healthcare providers enhance the product availability across the region’s vast geography.

China is augmenting its leadership in the regional market, owing to the presence of supportive government initiatives and strategic implementations by the manufacturers. For instance, in January 2022, MicroPort MedBot announced that it received NMPA approval for its Toumai Laparoscopic Surgical Robot, which marks the first four-arm system developed and commercialized in the country. The firm highlighted that the robot efficiently enhances precision in the minimally invasive procedures, hence suitable for market upliftment.

India in the bipolar electrosurgical device market is demonstrating notable growth due to the expansion of outpatient surgical centers and a huge emphasis on affordable yet high-quality care. In November 2022, Rajiv Gandhi Cancer Institute reported that it finished the preliminary clinical trials of SSI-Mantra, which is the country’s first-ever indigenously developed surgical robot. Besides, the robot demonstrated feasibility in complex procedures, advancing affordable robotic surgery, which marks a significant step toward self-reliant, cost-effective robotic surgery in the country.

Cancer Incidence and Mortality in the APAC Region 2022 (ASR: Age-Standardized Rates per 100,000)

|

Region |

Cancer Type |

Incidence (No.) |

Incidence (ASR) |

Mortality (No.) |

Mortality (ASR) |

|

Eastern Asia |

Cervix uteri |

167,528 |

13.4 |

62,094 |

4.3 |

|

Corpus uteri |

100,275 |

7.5 |

17,818 |

1.1 |

|

|

Vulva |

5,724 |

0.35 |

2,371 |

0.13 |

|

|

South-Eastern Asia |

Cervix uteri |

69,886 |

17.4 |

38,703 |

9.5 |

|

Corpus uteri |

26,601 |

6.6 |

7,936 |

1.9 |

|

|

Vulva |

2,239 |

0.54 |

813 |

0.19 |

|

|

South Central Asia |

Cervix uteri |

153,944 |

15.1 |

95,962 |

9.5 |

|

Corpus uteri |

27,172 |

2.7 |

10,143 |

1 |

|

|

Vulva |

4,086 |

0.4 |

1,997 |

0.2 |

Source: NIH August 2024

Europe Market Insights

Europe in the bipolar electrosurgical device market is poised for significant growth, which receives exceptional support from the regulatory frameworks that support both safety and innovation. In March 2025, Creo Medical notified the launch of its SpydrBlade Flex endoscopic device commercially in the UK and Europe, wherein St Mark’s Hospital in London as the first adopter. Also, the product is especially designed for precision in lower GI colorectal resections, thereby enhancing the minimally invasive endoscopy, hence benefiting overall market growth.

Germany is the leading player in the regional bipolar electrosurgical device market, facilitated by its technologically advanced healthcare system and high adoption rates. For instance, in October 2022, ZEISS Medical Technology stated that it received FDA 510(k) clearance for MTLawton, a new generation of disposable bipolar forceps designed to enhance electrosurgery. The product was developed in collaboration with neurosurgeon Dr. Michael T. Lawton. The instrument uses a copper-base alloy to reduce tissue adhesion and charring, hence supporting localized innovation.

France holds a strong position in the market, effectively fueled by increased focus on day-care surgeries and expansion of ambulatory surgical units. In November 2024, Halma announced that it acquired Lamidey Noury Medical for a total of €50 million manufacturer of electrosurgical instruments. The company further stated that this move aligns with rising demand for minimally invasive procedures in urology and gynecology. Therefore, this strengthens the country’s export potential for high-quality electrosurgical instruments through Halma’s global network.

Key Bipolar Electrosurgical Device Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson (Ethicon)

- B. Braun Melsungen AG

- Stryker Corporation

- Boston Scientific Corporation

- CONMED Corporation

- ERBE Elektromedizin GmbH

- KLS Martin Group

- Bovie Medical Corporation

- Smith & Nephew plc

- Hologic, Inc.

- Karl Storz SE & Co. KG

- Mizuho OSI

- Aesculap (B. Braun)

- BOWA-electronic GmbH & Co. KG

- Maxer Endoscopy GmbH

The international market is extremely competitive, which is dominated by Medtronic, Johnson & Johnson, and B. Braun. The key pioneers are readily making investments in robotic-assisted surgery integration, AI-based devices, and disposable instruments to enhance precision in the procedures. On the other hand, the firms from North America and Europe are augmenting in terms of innovation, whereas Japan-based organizations focus on miniaturization and endoscopic applications. Furthermore, the profitable collaborations and administrative support also propel growth in the bipolar electrosurgical device industry.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In September 2024, Medtronic notified its launch the first ever Robotics Experience Studio in Southeast Asia, which is located in its Customer Experience Center in Singapore. The firm also stated that the facility aims to advance robotics and AI adoption across the region’s vast geography.

- In June 2024, Konoike Transport Co., Ltd. stated that it acquired an 82% stake in SPD India Healthcare Pvt. Ltd., a firm focused on surgical instrument and equipment sterilization in India. It also underscored that the key goal of this step is to enhance sterilization logistics and service capabilities for hospitals and surgical centers.

- Report ID: 450

- Published Date: Aug 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.