Bioresorbable Coronary Scaffolds Market Outlook:

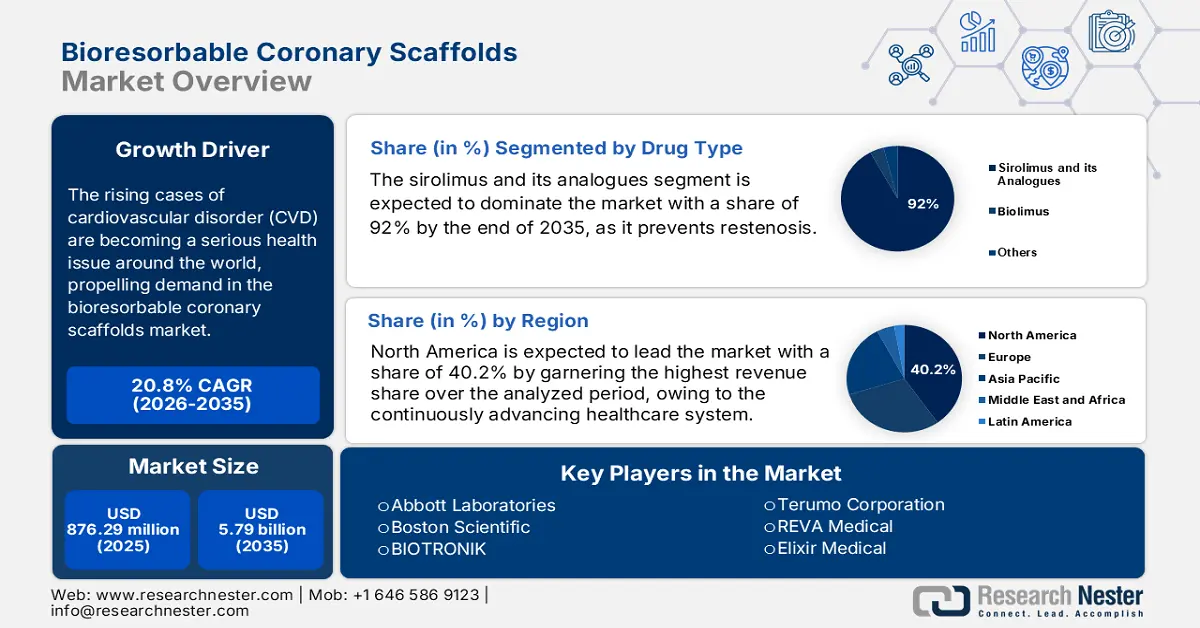

Bioresorbable Coronary Scaffolds Market size was valued at USD 876.29 million in 2025 and is projected to reach USD 5.79 billion by the end of 2035, rising at a CAGR of 20.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of bioresorbable coronary scaffolds is assessed at USD 1.05 billion.

The rising cases of cardiovascular disorder (CVD), particularly conditions such as angina linked to coronary artery disease, are becoming a serious health issue around the world, propelling demand in the bioresorbable coronary scaffolds market. In this regard, the WHO data in July 2025 reported that more than 19.8 million people died of this ailment globally in 2022. Other data published by the Centers for Disease Control and Prevention (CDC) in July 2024 states that the percentage of adults diagnosed with coronary heart disease is 5% in 2024. Additionally, in 2025, Germany was afflicted with peripheral artery disease (PAD), which received treatment with scaffolds. This demography reflects the multi-disciplinary application and sustainable cash inflow for offerings from this sector.

Various factors with economic uncertainty, such as production cost, expenses on material outsourcing, and variability in trade policies, have shown a considerable impact on the payers' pricing structure in the market. Advances in cardiac devices and indications for these devices have occurred during the past decade. These devices are widely used due to their tremendous monitoring and treatment results. Among various advancements, the recent one is the integration of AI for better results in monitoring heart-related problems. For example, in May 2024, Medtronic announced the AI integration into its Reveal Linq ICM devices, which was introduced in Europe by the end of 2024.

Key Bioresorbable Coronary Scaffolds Market Insights Summary:

Regional Highlights:

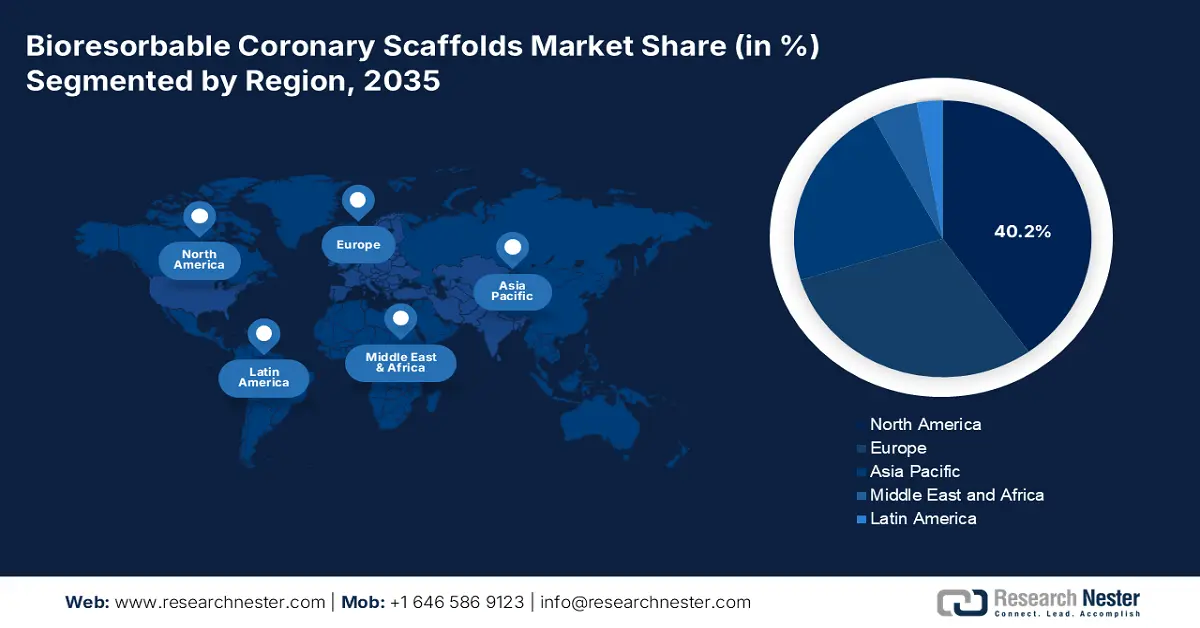

- By 2035, North America is anticipated to command a 40.2% share of the Bioresorbable Coronary Scaffolds Market, underpinned by rising patient volumes and an advancing healthcare infrastructure.

- By 2035, Asia Pacific is expected to expand at the highest CAGR, fueled by a rapidly aging population and escalating CVD prevalence.

Segment Insights:

- By 2035, the Sirolimus and its analogues segment in the Bioresorbable Coronary Scaffolds Market is set to attain a 92% share, supported by its well-validated ability to suppress neointimal hyperplasia.

- Across 2026–2035, the coronary artery disease (CAD) segment is expected to retain the largest share, owing to its higher prevalence and clinical priority within global CVD management.

Key Growth Trends:

- Investments in product-related R&D

- Tech-based innovations in intervention and production

Major Challenges:

- Economic hurdles in compliance and insurance

- Physician training and adoption issues

Key Players: Abbott Laboratories, Boston Scientific, BIOTRONIK, Terumo Corporation, REVA Medical, Elixir Medical, MicroPort Scientific, Meril Life Sciences, Kyoto Medical Planning, Lepu Medical, S3V Vascular Technologies, Arterius Limited, Amaranth Medical, Xeltis, QualiMed, Alvimedica, Optima Medical, Cardionovum, Vascular Concepts, Zenflow.

Global Bioresorbable Coronary Scaffolds Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 876.29 million

- 2026 Market Size: USD 1.05 billion

- Projected Market Size: USD 5.79 billion by 2035

- Growth Forecasts: 20.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Singapore

Last updated on : 29 September, 2025

Bioresorbable Coronary Scaffolds Market - Growth Drivers and Challenges

Growth Drivers

- Investments in product-related R&D: Both public and private investors are showing interest in upgrading the pipeline of the bioresorbable coronary scaffolds market, creating new business opportunities for global pioneers. For instance, the National Institute of Health (NIH) invested in research in this category in 2024, which was dedicated to polymer-based scaffold innovations. Similarly, the Invest India report in September 2025 depicts that USD 3.39 billion Value of medical devices exported in 2022-23, increased from USD 2.923 billion in 2021-22. These efforts to improve the functionality and cost-effectiveness of products available in this sector are also helping associated companies widen their consumer base.

- Tech-based innovations in intervention and production: The integration of advanced technologies in product designing and manufacturing has significantly improved the output in both quality and scalability in the bioresorbable coronary scaffolds market. Particularly, the current trend of factory automation in every industry, specifically in healthcare, is elevating the approach and quantification of produced goods. Additionally, investments in this aspect from several organizations are empowering parallel developments and production capacity in this sector.

- Rising prevalence of coronary artery disease: The expanding patient pool with coronary artery disease, especially among young adults seeks long term solutions, is a key driver. According to the British Heart Foundation report in August 2025, 640 million people are affected by cardiovascular disease across the world. This is the leading cause of deaths and ensures a steady flow of candidates for PCI. This large growing population creates a sustained demand for advanced treatment options such as bioresorbable coronary scaffolds.

Percentage of Angina in Adults with Age Above 18

|

Year |

Angina/angina pectoris |

|

2019 |

1.7 |

|

2020 |

1.5 |

|

2021 |

1.5 |

|

2022 |

1.6 |

|

2023 |

1.6 |

|

2024 |

1.6 |

Source: CDC September 2025

Challenges

- Economic hurdles in compliance and insurance: The pricing competency in the bioresorbable Coronary Scaffolds market is highly prone to be hindered by regulatory and reimbursement volatilities. In this regard, the Centers for Medicare & Medicaid Services revealed that the scaffold procedures performed across the U.S. were covered by Medicare till 2024. This reflects the gap in accessibility in this field. Additionally, the extended timeline for MDR clearance in Europe caused to the launch budget in 2024. The delay & financial losses in attaining authorized approval and the shortage of adequate financial support cumulatively raise the cost of the final product, making it less accessible for consumers.

- Physician training and adoption issues: Successful B implantation involves having a particular technique and training to prevent complications such as scaffold thrombosis. Overcoming the established clinical preference for familiar DES poses a significant commercial issue. The manufacturers need to spend significantly on physician education and proctoring programs, which are expensive and grow slowly. This retards adoption rates and extends the time to gain a return on investment since physicians remain cautious without extensive real-world data and experience with the new technology.

Bioresorbable Coronary Scaffolds Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

20.8% |

|

Base Year Market Size (2025) |

USD 876.29 million |

|

Forecast Year Market Size (2035) |

USD 5.79 billion |

|

Regional Scope |

|

Bioresorbable Coronary Scaffolds Market Segmentation:

Drug Type Segment Analysis

Sirolimus and its analogues are leading the segment and are expected to hold the share value of 92% by 2035. This dominance is due to their proven efficacy in suppressing neointimal hyperplasia, which prevents restenosis. Their mechanism of action, which halts the cell cycle, is well-understood and supported by decades of clinical outcomes data from permanent drug-eluting stents. The Centers for Disease Control and Prevention (CDC) recognizes restenosis as a key complication of PCI, making effective antiproliferative drug coating a critical determinant of device adoption and commercial success.

Application Segment Analysis

The coronary artery disease (CAD) segment is poised to capture the largest share in the bioresorbable coronary scaffolds market throughout the assessed timeframe. Its proprietorship is majorly attributed to the predominant occurrence of this CVD type, in comparison to PAD. Its higher rate of severity and mortality is also an influential factor in this segment, which secures a significant portion of the net capital influx from concerned organizations. Testifying to this, the CDC report in October 2024 revealed that approximately 1 in 20 adults with CAD across the U.S. require percutaneous coronary intervention every year. As a result, its clinical priority concentrated more on the total reimbursement for CAD-related BCS procedures in this category, solidifying its position for upcoming years.

End user Segment Analysis

Hospitals are dominating the segment because they are the specialized cardiac facilities that carry out the overwhelming majority of percutaneous coronary interventions (PCIs). They dominate as end-users because they have the requisite catheterization laboratories, special imaging hardware, and very trained interventional cardiologists. The May 2023 NLM study illustrates that the typical cardiac admitting patient has advanced congestive heart failure, at 74% of the study sample, followed by hypertensive heart disease, 48.5%. This concentration of complex cases further reinforces hospitals’ role as the primary setting for adopting advanced devices like bioresorbable coronary scaffolds.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub-segments |

|

Material Type |

|

|

Drug Type |

|

|

Application |

|

|

End user |

|

|

Absorption Rate |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bioresorbable Coronary Scaffolds Market - Regional Analysis

North America Market Insights

North America is predicted to show dominance over the market by garnering the highest revenue share of 40.2% over the analyzed period. The major drivers behind its forefront position are continuously magnifying patient volume and advancing the healthcare system across mature economies, including the U.S. and Canada. In this regard, the CDC data in October 2024 reported that the heart-related disease cost USD 417.9 billion in 2021, and 371,506 people in 2022 have died due to coronary heart disease. Besides, the ongoing integrations of next-gen technology in CVD interventions, with strong financial support from insurers empower the region's global significance as a lucrative landscape in this field.

The U.S. is augmenting leadership in the regional bioresorbable coronary scaffolds market with efforts to strengthen nationwide public access to advanced care. Recent expansions in Medicare coverage and provincial Federal funding are also making notable contributions to this cohort. The NLM article in November 2024 states that over five years, patients treated at COAP-participating hospitals incurred USD 3,861 less in downstream costs (95% CI: USD 1,794–USD 5,741), primarily due to reduced healthcare utilization during quarters when patients remained alive. Moreover, despite the persistent gap in accessibility, the country's efforts to improve such disparity are establishing a strong foundation for this sector.

The Canada market is defined by a single-payer system in which provincial health authorities decide on coverage based on health technology assessment (HTA). The main trend is the centralized evaluation process carried out by the Canadian Agency for Drugs and Technologies in Health (CADTH), providing provinces with reimbursement recommendations. Access to the market depends on demonstrating not only Health Canada regulatory approval, but also cost-effectiveness and clinical merit relative to permanent drug-eluting stents. This leads to a planned and evidence-based adoption strategy. Federal and provincial health expenditure, as monitored by the Canadian Institute for Health Information (CIHI), is concentrated on cost-effective interventions.

Cardiovascular death rate: crude versus age-standardized

|

Year |

Crude per 100,000 |

Age Standardization per 100,000 |

|

2020 |

275.7 |

133.0 |

|

2021 |

279.8 |

134.2 |

|

2022 |

276.6 |

129.5 |

Source: Our World in Data 2022

APAC Market Insights

The Asia Pacific bioresorbable coronary scaffolds market is estimated to propagate with the highest CAGR in the world by 2035. Its progressive pace of growth is highly fueled by the aging population, increased CVD occurrence & mortality, and government initiatives. For instance, the NLM study in August 2025 has stated that the prevalence of cardiovascular disease is set to rise by 90% from 2025. Similarly, the Ministry of Health, Labour and Welfare (MHLW) projected the proportion of older citizens, is expected to have a high prevalence of disease. This demography further pushes individual governments to reinforce advanced technologies and universal solutions in the cardiac care industry, securing a sustainable consumer base for both domestic and foreign pioneers in this sector.

China is embarking on its leadership in the APAC bioresorbable coronary scaffolds market with its exceptional domestic medical instrument manufacturing and raw material supplying abilities. With an aim to offer comprehensive pricing, the country is highly focused on enhancing the affordability of available products in this field. For instance, the NLM study in November 2023 depicts that the care cost for CVD ranges from 6,103 CNY to 98,637. Additionally, the country's expansion in this field is bolstered by government-mandated procurement programs that increase its ability to reach greater levels.

India is also dominating the region with the increasing prevalence of CVD making it with a significant growth potential. As per the NLM report in November 2024, the prevalence of cardiovascular disease in India is approximately 272 per 100,000 people. The Indian Council of Medical Research (ICMR) highlighted cardiovascular diseases as a major cause of mortality within the nation and motivated the government to improve cardiac care facilities and access, although cost is a major hindrance. This growing disease burden is expected to accelerate demand for advanced interventions such as bioresorbable coronary scaffolds in tertiary and specialty cardiac centers across India.

Europe Market Insights

Europe's market is propelled by the strong regulatory control by the European Medicines Agency and the diverse reimbursement environments across the member states. The market driver leading the market is the increasing incidence of coronary artery disease, with an increasing population of aging people requiring advanced interventional products. As per the WHO report in May 2024, nearly 42.5% of adults die due to CVDs, indicating 10,000 deaths every day. The main trend in the leading role of health technology assessment organizations, such as Germany's G-BA and France's HAS, critically assess on clinical benefit and cost-effectiveness prior to allowing market access and setting price.

Germany is expected to have the largest revenue share in Europe due to its EU-largest population and well-funded, fast healthcare reimbursement system. The Federal Ministry of Health manages a system under which mandatory benefit assessments are performed by the Federal Joint Committee (G-BA). A favorable G-BA result is the major determinant for success in the market since it negotiates prices directly with manufacturers. Germany's robust medtech sector and high rate of PCI procedures per capita further confirm its leadership, backed by strong healthcare spending and willingness to embrace new technologies that prove patient benefit.

France will continue as a leading market, defined by its centralized assessment process through the French National Authority for Health (HAS). The rising incidence of cardiovascular disease and the increasing use of advanced scaffold technologies are driving the market. As per the World Heart Federation report in 2025, nearly 152,728 deaths occurred in 2021. This growth aligns with the country’s value-based healthcare and rigorous reimbursement criteria via the French National Authority for Health. Further, the continuous R&D and positive clinical results highlight the long-term cost-effectiveness and patient benefits of bioresorbable scaffolds support market expansion.

Key Bioresorbable Coronary Scaffolds Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boston Scientific

- BIOTRONIK

- Terumo Corporation

- REVA Medical

- Elixir Medical

- MicroPort Scientific

- Meril Life Sciences

- Kyoto Medical Planning

- Lepu Medical

- S3V Vascular Technologies

- Arterius Limited

- Amaranth Medical

- Xeltis

- QualiMed

- Alvimedica

- Optima Medical

- Cardionovum

- Vascular Concepts

- Zenflow

The strategic initiatives and commercial operations of key players significantly control the current dynamics of the market. Testifying to this, premium pricing, accelerated regulatory approvals, and R&D involvement secured a collective dominance of Abbott, Boston Scientific, and BIOTRONIK in this sector. To achieve this milestone, BIOTRONIK introduced a magnesium-based scaffold, which further boosted the adoption in this field. Furthermore, in emerging marketplaces, such as India and China, leaders prioritize the scale and cost of production to make their pipeline more competitive against expensive options. This region-specific methodology induces distinct landscapes, broadening the scope of investment in this merchandise.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In April 2024, Abbott's Esprit received FDA approval for an everolimus-eluting bioresorbable scaffold for patients with below-the-knee (BTK) infrapopliteal disease. The system offers caffolding to address vessel recoil and dissection, with radial strength similar to a metallic stent within the first 6 months

- In February 2024, BIOTRONIK announced the launch and CE approval of Freesolve Resorbable Magnesium Scaffold. This third-gen RMS has been engineered to offer optimized vessel support and achieve magnesium resorption within 12 months.

- Report ID: 1110

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.