Biometrics for Banking and Financial Services Market Outlook:

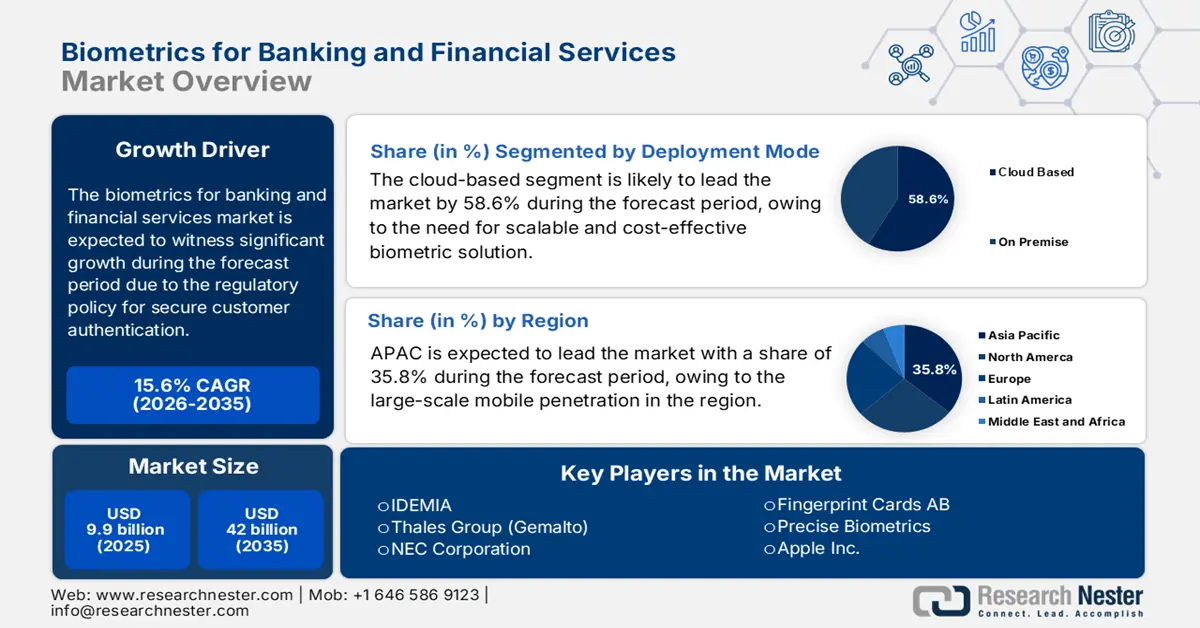

Biometrics for Banking and Financial Services Market size was valued at USD 9.9 billion in 2025 and is poised to reach USD 42 billion by 2035, registering a CAGR of 15.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of biometrics for banking and financial services at USD 11.4 billion.

The biometrics for banking and financial services market is expanding rapidly due to the regulatory policy for secure customer authentication and the necessity to fight against cyber fraud. The Federal Financial Institutions Examination Council (FFIEC) in the U.S. released a guideline strengthening the need for multi-factor authentication, establishing a methodical demand for layered security solutions with the use of biometrics. This is further surged by the scale of cybercrime, as the number of complaints registered increased by 10% and the losses increased by 22% from 2022, as stated in the FBI’s Internet Crime Report in 2023.

India's domestic cybersecurity market reached USD 3.76 billion in 2023, reflecting the increasing need for advanced software tools in India to protect digital ecosystems, including biometric and financial platforms. This growth depends on the global research, development, and deployment priorities aimed at improving system security and interoperability. Further, collaborative efforts among the public agencies and private firms are surging innovation in identity protection, encryption, and biometric data security across India’s financial and digital infrastructure.

Key Biometrics for Banking and Financial Services Market Insights Summary:

Regional Highlights:

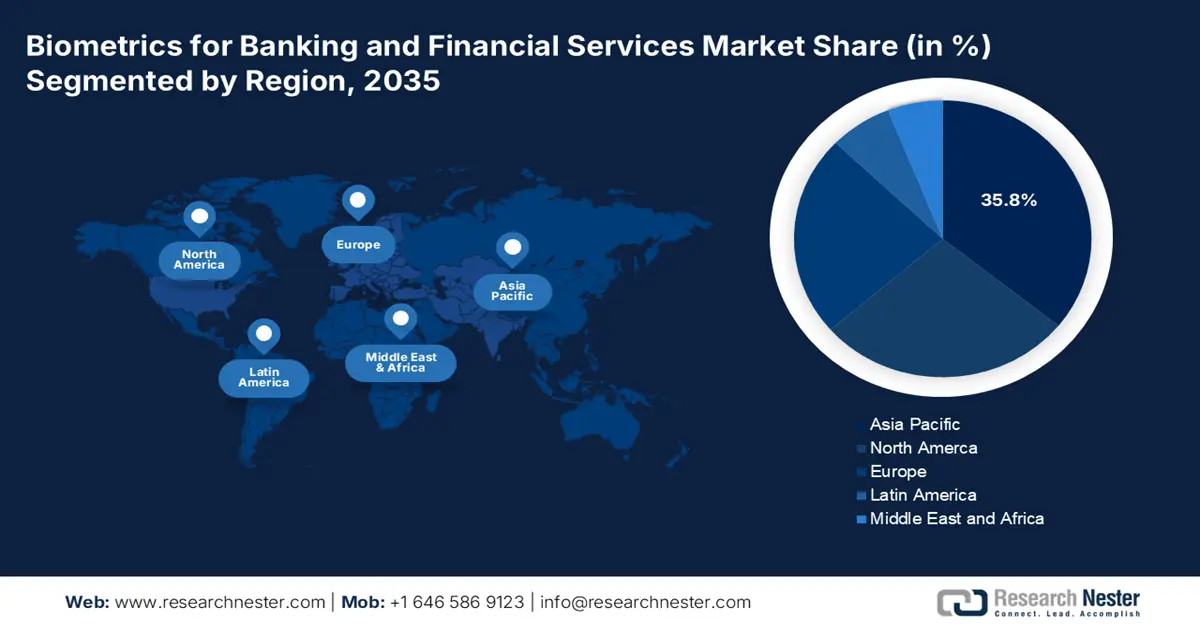

- The Asia Pacific region in the biometrics for banking and financial services market is expected to command a 35.8% revenue share by 2035, owing to extensive smartphone penetration and the implementation of national digital ID programs such as Aadhar and e-KTP.

- North America is projected to register the fastest growth at a CAGR of 7.8% from 2026 to 2035, stimulated by the widespread adoption of contactless and multi-factor biometric authentication across financial institutions.

Segment Insights:

- The cloud-based services segment in the biometrics for banking and financial services market is projected to capture a 58.6% share by 2035, fueled by the growing need for scalable and cost-efficient biometric security solutions amid rapid digital transformation in the financial sector.

- The software segment is anticipated to dominate through 2026-2035, propelled by the demand for sophisticated algorithms enabling authentication, liveness detection, and behavioral analytics.

Key Growth Trends:

- Escalating financial fraud and cybercrime

- Demand for frictionless banking

Major Challenges:

- Escalating complexity associated with biometric data privacy regulations

- Lack of global standardization and interoperability

Key Players: IDEMIA, Thales Group (Gemalto), NEC Corporation, Fingerprint Cards AB, Precise Biometrics, Apple Inc., Synaptics Incorporated, Aware, Inc., BioID, Mitek Systems, Inc., HID Global, Crossmatch (HID Global), Suprema Inc., Egis Technology Inc., IDEX Biometrics ASA, Nuance Communications, Inc., Zwipe, SecuGen Corporation, SpeechPro (A Voice Biometrics Co.), Daon.

Global Biometrics for Banking and Financial Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.9 billion

- 2026 Market Size: USD 11.4 billion

- Projected Market Size: USD 42 billion by 2035

- Growth Forecasts: 15.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Japan, United Kingdom

- Emerging Countries: Indonesia, Brazil, Mexico, South Korea, United Arab Emirates

Last updated on : 10 October, 2025

Biometrics for Banking and Financial Services Market - Growth Drivers and Challenges

Growth Drivers

- Escalating financial fraud and cybercrime: The cost due to cyber attack is the primary driver for biometric adoption. The FBI’s Internet Crime report in 2023 reported that USD 12.5 billion loss occurred due to cyber threats, a significant portion from business email compromise and phishing attacks targeting banks. This has enabled a powerful, quantifiable argument for biometrics to avoid cyber frauds. Financial institutions are seeking solutions for one-time codes, strong passwords making for advanced biometrics to protect bother consumer and bank assets.

- Demand for frictionless banking: Nowadays people expect for instant results and transactions from their bank. As per the IIMB report in September 2022, nearly 280 million people have opened their bank account via online bank opening and online or mobile banking as their primary method. This demand has surged the adoption for advanced biometrics that enable instant logging and transaction approval without passwords.

- National governments driving public-private G2P payments: The national governments are driving the increase in bank-led biometric usage by linking public payments to biometric authentication. The G2P frameworks associated with the World Bank, and implemented by emerging economies such as Indonesia and India, require banks to verify recipients through fingerprints or iris scans at micro-ATMs. The implementation is at its early stages, and is expected to significantly expand and add to the surging volume of biometric transactions by the end of this decade. The trends signify the onset of tremendous opportunities for vendors supplying biometrics for banking and financial services.

Global Transactions for Biometric Digital Identity

|

Region |

2024 |

2025 |

|

APAC |

219,120 |

284,610 |

|

Europe |

36,696 |

53,022 |

|

Latin America |

25,806 |

36,821 |

|

Middle East and Africa |

26,928 |

45,477 |

|

North America |

29,964 |

53,302 |

|

Total |

338,514 |

473,132 |

Source: The Biometric Digital Identity Prism Report 2024

Challenges

- Escalating complexity associated with biometric data privacy regulations: A key challenge of the global biometrics for banking and financial services sector is the intensifying complexity associated with changing data privacy regulations from one regional market to another. For instance, the GDPR provisions, along with the UK Data Protection Act, have contributed to increasing the compliance costs for BFSI firm’s YoY. Additionally, the regulatory burden is detrimental to the cross-border payment providers reliant on biometric authentication for KYC, as it increases the risk of penalties.

- Lack of global standardization and interoperability: The lack of universal technical standards in one country differs in another country. This change in the market forces manufacturers to give country-specific variants, increasing R&D costs. Governments and cross-border payment providers lack interoperability delays in the creation of seamless global financial networks. Further, the initiative by the World Bank emphasizes the requirement for interoperable digital ID systems, noting that the issue of standardization is a major barrier in achieving financial inclusion and limiting biometric solutions.

Biometrics for Banking and Financial Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.6% |

|

Base Year Market Size (2025) |

USD 9.9 billion |

|

Forecast Year Market Size (2035) |

USD 42 billion |

|

Regional Scope |

|

Biometrics for Banking and Financial Services Market Segmentation:

Deployment Mode Segment Analysis

The cloud based services dominate the segment and is expected to hold the share value of 58.6% by 2035. The segment is fueled by the need for scalable, cost-effective, and easily integrated security solutions due to the rapid digital transformation in the financial sector. As per the IBEF report in January 2024, in India, cloud adoption is rapidly expanding, and the cloud market is growing at a CAGR of 23.4%. Cloud-based Biometrics-as-a-Service (BaaS) platforms allow banks, especially those with digital-first models, to quickly deploy advanced authentication capabilities like facial or voice recognition without significant upfront investment in on-premise hardware and maintenance.

Component Segment Analysis

Software dominates the component segment and is propelled by the necessity of complex algorithms that drive authentication, liveness detection, and behavioral analytics. This comprises the AI engines that distinguish between a live user and a photo or video replay attack. Government initiatives such as the National Cybersecurity Center of Excellence project on Mitigating Synthetic Identity Fraud represent the dependence on advanced software solutions. The transition to cloud-based biometrics-as-a-service deployments also drives software revenue, as banks are looking for scalable, subscription-based offerings as opposed to huge capital outlays in hardware.

Application Segment Analysis

In the application segment, Customer authentication & onboarding hold the largest share as it is the primary point of interaction between a bank and a customer. The global drive for financial inclusion and digital customer acquisition necessitates fast, secure, and fully remote onboarding. As per the LLOYD Law College report in 2022, nearly 72% of people in the global are using face verification for safe transactions. On the other hand, the massive scale of India's Aadhaar system uses biometrics to authenticate billion citizens for banking services, is a real-world example of the immense volume and demand in this sub-segment.

Our in-depth analysis of the global biometrics for banking and financial services market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Component |

|

|

Application |

|

|

Deployment Mode |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biometrics for Banking and Financial Services Market - Regional Analysis

Asia Pacific Market Insights

The APAC biometrics for banking and financial services market is set to hold a dominant revenue share of 35.8% during the forecast timeline. A key factor contributing to APAC’s expansion is the considerably large smartphone penetration, and digital ID initiatives such as e-KTP of Indonesia and Aadhar of India, highlighting the successful use cases of biometrics. A primary trend is the seamless integration of national digital IDs with banking services, for instance, paperless onboarding. The trends have created surging opportunities for global biometrics vendors.

The China's biometrics for the banking and financial services market is poised to maintain a leading revenue share during the anticipated timeline. The market’s expansion is supported by the state-backed digital identity initiatives. The People's Bank of China is the key driver, mandating robust authentication for all online payments. As per the China Internet Network Information Center report in August 2022, nearly 227 million people are using mobile payments, which is nearly 77.5% of rural people use online payments.

India is at the forefront of the biometrics for banking and financial services market, and is defined by the Aadhaar digital identity initiative. According to the Protean data in 2025, almost 1.3 billion Aadhar cards have been issued so far, this is testifying the demand for the market. Additionally, the UPI transactions passed ₹25.14 lakh crore in May 2025. This digital identity and payment system adoption is surging the integration of biometric authentication in banks and fintech platforms.

Adoption of Biometrics in Banks

|

Country |

2023 |

2024 |

|

India |

95% of the population is enrolled in Aadhaar |

Over 1.3 billion Aadhaar biometric IDs issued |

|

China |

296.163 electronic transactions are processed |

Domestic mobile payment reached ¥373.3 trillion |

Source: UIDAI 2024, Protean 2025. PBC 2023, CIW 2025

North America Market Insights

North America is the fastest-growing region in the biometrics for banking and financial services market and is growing at a CAGR of 7.8% during the forecast period 2026 to 2035. The expansion of the regional market is attributed to the surging deployment of contactless and multi-factor biometric systems across payment terminals and banking apps. In terms of investments, major financial institutions such as Wells Fargo have been at the forefront of investing in biometric upgrades to meet the changing customer demands.

The U.S. biometrics for banking and financial services market is projected to expand during the forecast timeline. The regional market is driven by stringent regulatory insight and high-value fraud prevention mandates. As per the FDIC report in November 2024, 94% of households were using online banking in 2023. Further, the deployment of advanced multimodal systems by the major banks in the U.S. under the aegis of the Bank Secrecy Act has expanded the scope of deployments in the regional market. Additionally, with the fintech adoption accelerating, the U.S. market is slated to expand its biometric ecosystem across Tier 1 banks.

Canada’s market is shaped by the consumer-driven banking framework that mandates user-consented data sharing, to be secure by creating a biometric verification. This aligns with national digital identity programs that is driven by the Digital Identity and Authentication Council of Canada to provide a trusted pan Canadian environment. According to the CISION report in February 2025, the Canada government has announced a new National Cyber Security Strategy in 2025, which is aimed at protecting data from cyber threats. The initial funding for this initiative announced was USD 37.8 million over 6 years for programs under this strategy.

Europe Market Insights

The biometrics for banking and financial services market in Europe is characterized by a complex regulatory policy. The region is primarily driven by a strong authentication requirement of the Revised Payment Service Directive. This adopts multi-factor authentication by creating a vital role for biometrics in safeguarding electronic payments and online banking. Key drivers also include digital-only banks and fast growth in fintech that uses biometrics for seamless customer onboarding, and escalating efforts to combat advanced phishing and identity fraud.

The UK biometric for banking and financial services market is fueled by the mature fintech sector and regulatory guidance supporting secure customer authentication. As per the UK Finance report in 2025, the fraud losses in authorized push payment reached £459.7 million, underpinning the requirement for strong security using biometrics. The UK government, via its National Cyber Strategy, has committed to investing in cybersecurity programs that bolster financial services security infrastructure, indirectly supporting biometric adoption.

France market is driven by the national support for fintech startups and a rate of adoption of biometric payment cards. The National Cybersecurity Agency in France certifies solutions for secure remote enrollment and transaction signing. The French government’s broader investment plan France 2030 allocates €500M in Deeptech startups, provides investments to the development of nnext gen biometric technologies for the financial sector.

Key Biometrics for Banking and Financial Services Market Players:

- IDEMIA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thales Group (Gemalto)

- NEC Corporation

- Fingerprint Cards AB

- Precise Biometrics

- Apple Inc.

- Synaptics Incorporated

- Aware, Inc.

- BioID

- Mitek Systems, Inc.

- HID Global

- Crossmatch (HID Global)

- Suprema Inc.

- Egis Technology Inc.

- IDEX Biometrics ASA

- Nuance Communications, Inc.

- Zwipe

- SecuGen Corporation

- SpeechPro (A Voice Biometrics Co.)

- Daon

The biometrics for banking and finance services market is highly competitive and fragmented, characterized by international technology leaders and dedicated biometric companies. Large players are embarking on strategic moves to secure their market positions. These efforts are focused on AI and liveness detection innovation to fight fraud, creation of strategic partnerships, and acquisitions to broaden technological offerings and geographic presence. The industry is also experiencing a convergence of biometric modalities with multi-factor authentication for protecting online banking interfaces and payment transactions from sophisticated cyber threats.

Below is the list of some prominent players operating in the biometrics for banking and financial services market:

Recent Developments

- In October 2025, Razorpay has launched India's first biometric-ready Access Control Server (ACS) in partnership with Yes Bank, an innovation that puts fingerprint and face ID scan at the heart of every online transaction.

- In September 2025, NEXT Biometrics, the leader in advanced high-security fingerprint sensor technology, has received the first mass production from the Sri Lanka, C3 Labs.

- In July 2025, Federal Bank, in collaboration with MinkasuPay and M2P, introduced India’s first biometric authentication for E-com card transactions to reduce the transaction time and replace it with fingerprint or face ID with OTPs.

- Report ID: 3797

- Published Date: Oct 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biometrics for Banking and Financial Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.