Next-Gen Biometric Authentication Market Outlook:

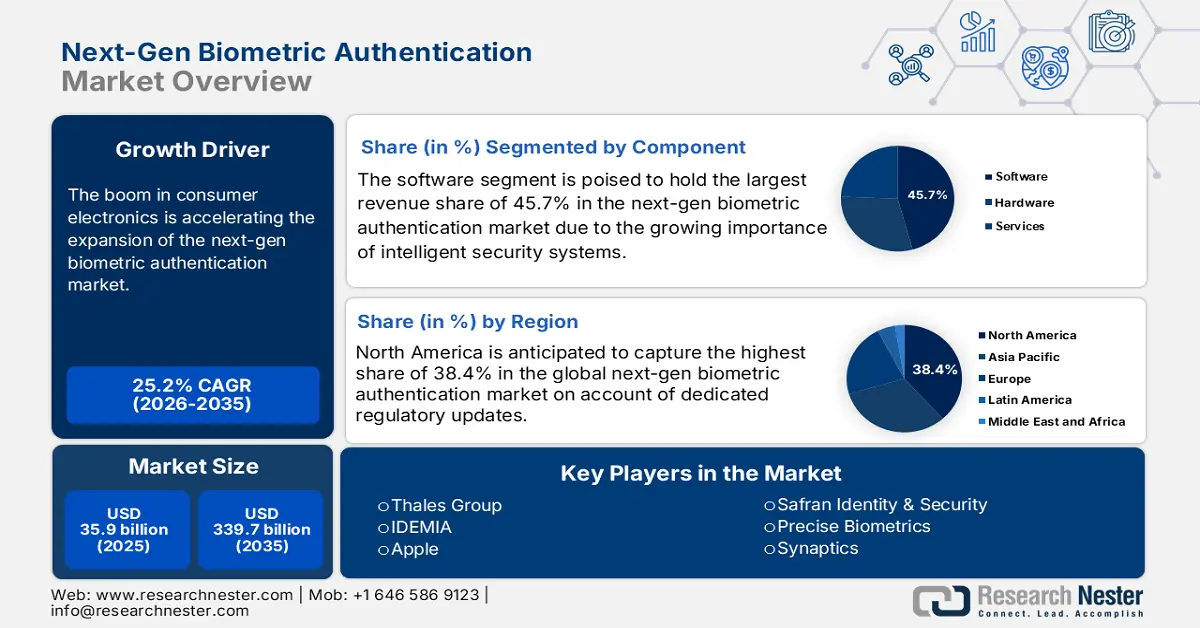

Next-Gen Biometric Authentication Market size was over USD 35.9 billion in 2025 and is estimated to reach USD 339.7 billion by the end of 2035, expanding at a CAGR of 25.2% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of next-gen biometric authentication is assessed at USD 44.9 billion.

The widespread adoption of consumer electronics and mobile devices is one of the primary factors expected to fuel market growth. The proliferation of smartphones and IoT devices has normalized additional biometric features such as fingerprint and facial recognition, driving market expansion through seamless user experiences and hardware innovations. This is especially evident in the consumer sector, where biometrics is a standard for unlocking devices and authorizing payments.

Furthermore, government-backed biometric identification programs and e-governance initiatives are expected to fuel market growth during the forecast period. National and regional governments are using large-scale biometric systems for citizen identification, border control, and public services, creating substantial demand and standardizing next-gen technologies, namely multi-modal biometrics. In May 2025, Singapore's Home Team Science and Technology Agency (HTX) launched next-generation clearance concepts using AI-integrated multi-modal biometrics such as face, iris, and fingerprint for on-the-move airport scanning, enabling faster enrollment and authentication to optimize travel.

Key Next Gen Biometric Authentication Market Insights Summary:

Regional Insights:

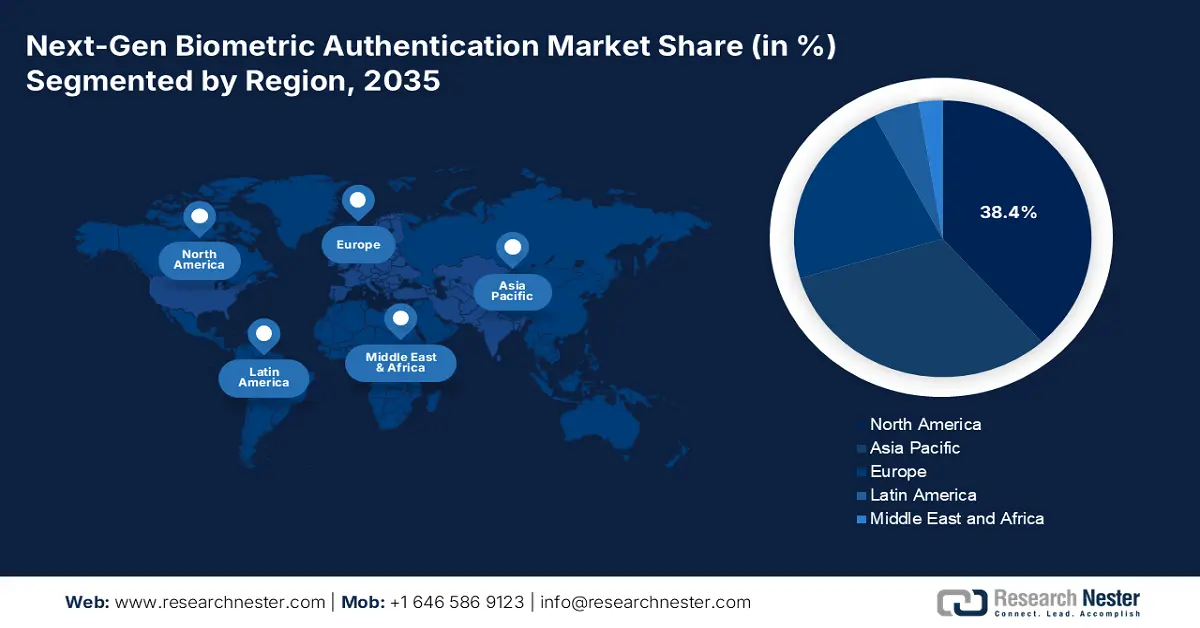

- North America is projected to lead the Next-Gen Biometric Authentication Market with a 38.4% share by 2035, supported by robust technological infrastructure, high consumer awareness, and the early adoption of biometric systems across financial, healthcare, and government sectors.

- Asia Pacific is expected to witness the fastest growth by 2035, fueled by digital ID programs, widespread AI integration, and the rapid expansion of mobile banking that enhances demand for secure authentication solutions.

Segment Insights:

- The software segment is predicted to command a 45.7% share by 2035 in the Next-Gen Biometric Authentication Market, propelled by the growing adoption of AI algorithms, machine learning, and embedded platforms in building scalable and secure authentication systems.

- Facial recognition is set to capture a 38.5% share by 2035, impelled by advancements in deep learning and artificial intelligence that enhance accuracy and reliability across diverse applications such as e-governance and financial services.

Key Growth Trends:

- Rising cybersecurity threats and demand for advanced security

- Smartphone and IoT proliferation

Major Challenges:

- Infrastructure readiness gaps

- Pricing competition from legacy systems

Key Players: IDEMIA, Thales Group, Safran Identity & Security, Apple, Precise Biometrics, Synaptics, Suprema Inc., HID Global, BioEnable Technologies, Daon, Nuance Communications, ZKTeco, M2SYS Technology, NEC Corporation, Fujitsu, Panasonic, Hitachi, Sony.

Global Next Gen Biometric Authentication Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 35.9 billion

- 2026 Market Size: USD 44.9 billion

- Projected Market Size: USD 339.7 billion by 2035

- Growth Forecasts: 25.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Singapore, Brazil, Indonesia

Last updated on : 8 October, 2025

Next-Gen Biometric Authentication Market - Growth Drivers and Challenges

Growth Drivers

- Rising cybersecurity threats and demand for advanced security: The rising frequency and sophistication of cyberattacks and data breaches are encouraging organizations to take up advanced biometric solutions for robust identity verification, reducing reliance on vulnerable passwords. This is supported by the need for fraud prevention in digital transactions and sensitive data protection in finance and healthcare sectors. In response to increased security threats, the integration of liveness detection technologies to counter spoofing has gained popularity. For example, in August 2024, AuthenticID developed Smart ReAuth, a selfie-based reauthentication tool that verifies identities in under one second, improving fraud prevention for financial services.

- Smartphone and IoT proliferation: The boom in consumer electronics is accelerating the expansion of the next-gen biometric authentication market. In this regard, the International Telecommunication Union (ITU) stated that by 2024, around 5.5 billion people, equivalent to 68% of the global population, were connected to the Internet. This marks a sharp rise from 2019, when just 53% of people were online, with about 1.3 billion new users added over the five years. Familiarity with this technology is being driven by flagship technologies, such as Face ID and ultrasonic fingerprint sensors, already in use for smartphone users. On the other hand, the deepening penetration of the Aadhaar system in India, having over 1.4 billion users, is proving the scalability for mass IoT integration.

- Trend of digitalization in healthcare: The medical industry is emerging as a sustainable consumer base for the market. Thus, both MedTech leaders and clinical service providers are showing interest in the integration of such identification tools. Moreover, efforts from governments to enable complete digitization, particularly in emerging economies, are escalating adoption in this sector. In healthcare, remote solutions are booming. For instance, in April 2025, Vivalink introduced its Intelligent Biometrics Platform on AWS, using medical-grade sensors for real-time patient monitoring and secure authentication, promoting telemedicine growth amid rising demand for data-protected health insights.

Challenges

- Infrastructure readiness gaps: As real-time identification systems require robust 5G and edge computing capabilities, many organizations lack such amenities in emerging landscapes, impacting the penetration of the next-gen biometric authentication market in those regions. This digital divide also creates deployment bottlenecks for latency-sensitive applications, such as facial recognition and behavioral authentication.

- Pricing competition from legacy systems: Economic barriers remain a significant hurdle to the market. Due to being cost-effective than biometric systems, traditional two-factor authentication (2FA) is still more desirable in the majority of price-sensitive regions. To resolve the issue, minimization of upfront investment is required to retain widespread implementation, despite the technology's superior security benefits, creating a key challenge for vendors needing to demonstrate long-term ROI to cost-conscious businesses.

Next-Gen Biometric Authentication Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

25.2% |

|

Base Year Market Size (2025) |

USD 35.9 billion |

|

Forecast Year Market Size (2035) |

USD 339.7 billion |

|

Regional Scope |

|

Next-Gen Biometric Authentication Market Segmentation:

Component Segment Analysis

The software segment is predicted to hold a 45.7% share during the analyzed tenure. This dominance is reflected through the critical role of AI algorithms, machine learning models, and embedded platforms in identification tools. Thus, the use of software in building a strong and reliable security system with facial recognition, behavioral analytics, and liveness detection has become essential. Moreover, the growing importance of intelligent and automated processing capabilities in enabling secure, accurate, and scalable biometric authentication systems across industries is empowering the segment's forefront position in this field.

Technology Segment Analysis

Facial recognition is poised to establish itself as the dominant sub-segment in the next-gen biometric authentication market with a 38.5% over the assessed period. It is rapidly emerging as one of the most dynamic segments, driven by its ability to deliver both convenience and security. At the same time, advancements in artificial intelligence and deep learning have significantly improved the accuracy of facial recognition, allowing reliable matches even under challenging conditions such as poor lighting or varied angles. This growing reliability has expanded its adoption across critical sectors, including government exam verification, e-governance, financial services, border control, and public distribution systems, where quick and scalable identity checks are necessary.

A recent example that emphasizes this trend is the Union Public Service Commission’s (UPSC) pilot study of AI-enabled facial authentication during the NDA & NA II Examination 2025 and the CDS II Examination 2025. In this initiative, candidate images captured during registration were authenticated against live facial scans at exam centers, cutting the verification process down to just 8–10 seconds per individual, according to the Press Information Bureau. This deployment highlights the growing role of facial recognition in high-stakes environments, proving its speed, efficiency, and security.

End user Segment Analysis

The BFSI segment is predicted to capture a 32.8% share by the end of 2035, owing to the urgent need to secure digital transactions and customer data amid rising cyber threats and fraud. Growth in this segment is propelled by regulatory pressures for stronger authentication, the surge in mobile and online banking, and consumer demand for frictionless yet secure access, with biometrics such as facial and voice recognition replacing vulnerable passwords. The leadership is also solidified by the 2024 guidelines issued by the Federal Financial Institutions Examination Council (FFIEC). The FFIEC published guidelines showcasing the need for multifactor authentication (MFA), layered security measures, and risk-based controls to strengthen online banking services. This indicates that the segment is growing substantially, as more financial organizations seek secure and frictionless customer authentication to minimize the risk of cyber breaches and improve user experience.

Our in-depth analysis of the market includes the following segments:

|

Segments |

Subsegments |

|

Component |

|

|

Technology |

|

|

End user |

|

|

Authentication Mode |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Next-Gen Biometric Authentication Market - Regional Analysis

North America Market Insights

North America is anticipated to be the leader in the next-gen biometric authentication market by capturing the highest share of 38.4% throughout the discussed timeline. The next-generation biometric authentication market is driven by its strong technological infrastructure, consumer awareness, and early adoption across various sectors, including government, healthcare, and finance. This trend is bolstered by the widespread adoption of biometric systems in mobile devices, financial services, and healthcare, where smooth and secure user experiences are paramount. The integration of biometric authentication methods into banking systems promises secure transactions and compliance with strict regulations, demonstrating the region's commitment to advanced security solutions.

The U.S. is experiencing a surge in biometric authentication applications, particularly in automotive, healthcare, and finance sectors. This growth is dependent on the rising demand for improved vehicle security through biometric authentication methods such as fingerprint and facial recognition. For instance, in August 2025, Ituran launched a new biometric vehicle security system that replaces conventional immobilizer codes and key fobs with smartphone-based facial and fingerprint recognition. Named Ituran KEY, the solution allows drivers to unlock and start their cars using biometric authentication, removing the need for physical keys or manual PIN entry. Thus, this showcases a major expansion in biometric applications across various industries.

The Canada next-gen biometric authentication market is expected to expand at a robust pace during the forecast period. Next-gen biometric authentication is growing in Canada due to the need for enhanced security against growing cybersecurity threats, a government focus on digital identity and security for border control and law enforcement, and the increasing demand for convenient, contactless solutions in healthcare and everyday transactions, all supported by Canada's advanced digital infrastructure and strong emphasis on cybersecurity. Advancements such as AI-powered liveness detection and 3D facial recognition improve security and accuracy, further encouraging adoption for digital identity, e-governance, and secure payments.

APAC Market Insights

Asia Pacific is expected to emerge as the fastest-growing region in the market by the end of 2035. This explosive progress is primarily attributable to the widespread digital ID programs and rapid AI adoption across the region. The rollout of mobile banking is further accelerating demand for secure authentication solutions. Thus, businesses are capitalizing on this opportunity by integrating behavioral analytics into their fraud detection platforms. Moreover, the region's unique combination of tech-savvy populations and digital transformation initiatives creates an ideal environment for both domestic and foreign pioneers in this sector.

China is poised to lead the regional next-gen biometric authentication market with a 36.8% revenue share by 2035. The country's dominance is accomplished through massive financial support from both public and private organizations. Next-generation biometric authentication is growing rapidly in China owing to large-scale government surveillance and smart city initiatives. The widespread adoption of digital payments and fintech, rising cybersecurity threats, the country's leadership in AI and machine learning, and the demand for passwordless security in both public and private sectors also play a remarkable role. These factors have made biometrics a foundational technology for identity verification and access control in daily life, from unlocking phones to e-governance services and national ID systems.

India’s progress in this sector is largely driven by the massive Aadhaar 2.0 digital identity program and the booming mobile phone industry. This plays a key role in advancing the next-generation biometric authentication market. Mobile production has increased from USD 2.16 billion in 2014–15 to USD 65.4 billion in 2024–25, making India the world's second-largest mobile phone producer with more than 300 facilities, including 47 in Tamil Nadu, supported by MeitY initiatives. Manufacturing more than 330 million phones annually and maintaining approximately a billion active devices, the country is driving huge demand for built-in biometrics such as fingerprint and facial recognition, boosting the adoption of advanced authentication technologies.

Europe Market Insights

The Europe next-gen biometric authentication market is poised to maintain a strong growth between 2026 and 2035. The landscape is predominantly led by Germany, the UK, and France. The region's expansion is fueled by the growing scale of digital transformation initiatives. Moreover, major adoption drivers in Europe include government digital ID programs and the development of AI-powered facial recognition and contactless fingerprint authentication. For instance, biometric authentication is set to increase growth in Europe as the European Union will introduce the Entry/Exit System (EES) on 12 October 2025. By replacing conventional passport stamping with biometric registration, the system will boost border security, improve transparency, and allow real-time tracking of travel. Covering 29 countries and aiming for full operation by April 2026, this initiative is aimed at boosting demand for advanced biometric technologies, making travel more efficient while reducing overstays and unauthorized entries.

The UK next-gen biometric authentication market growth can be attributed to the increasing prioritization of digital security across the nation. In the UK, the next-generation biometric market is expanding as government agencies and law enforcement adopt advanced systems. The Home Office is piloting smartphone-based remote fingerprint and facial enrolment for immigration applications, cutting down the need for in-person visits. At the same time, police forces are deploying live facial recognition (LFR) vans, with 10 new units being rolled out across seven forces under strict, intelligence-led guidelines. Efficiency reforms also aim for faster fingerprint and facial matching. These efforts demonstrate the UK’s aim for secure, scalable, and intelligence-led biometric systems in public safety and border control. Moreover, the nation's sustained investment and tech-based integrations position it as the continent's second-largest adoption base in financial services and critical national infrastructure sectors.

Germany is set to dominate the Europe market with a 30.7% revenue share by 2035. The growth in next-gen biometric authentication is fueled by regulatory guidelines, law enforcement use, and policy initiatives to improve identity verification and public safety. Since May 2025 onwards, Germany has mandated biometric photos for all official identity documents, such as passports, IDs, and immigration documents, replacing old-style photos and tightening security against forgery and manipulation. There is also increasing deployment of live facial recognition by police in places such as Berlin and Saxony, using high-definition cameras that can process facial images with a short delay, especially for cross-border gang crime investigations. All these factors, legal requirements for secure ID photos, heightened policing powers, and stronger policy/regulatory oversight, are pushing the adoption of facial recognition, fingerprint, and other biometric technologies across both public and private sectors.

Key Next-Gen Biometric Authentication Market Players:

- IDEMIA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thales Group

- Safran Identity & Security

- Apple

- Precise Biometrics

- Synaptics

- Suprema Inc.

- HID Global

- BioEnable Technologies

- Daon

- Nuance Communications

- ZKTeco

- M2SYS Technology

- NEC Corporation

- Fujitsu

- Panasonic

- Hitachi

- Sony

The market is characterized by intense competition among established pioneers and emerging innovators. Testifying to this scenario, leaders in Europe and tech giants in Japan predominantly generate revenue from government contracts and smart city projects, whereas firms in the U.S. capitalize on consumer and enterprise solutions. On the other hand, key players from Asia, such as Suprema and BioEnable, are making strides in cost-sensitive regions through competitive pricing. The current dynamics in this sector are being reshaped by strategic acquisitions, rapid adoption of contactless technologies, and increasing R&D investment in blockchain-based identity verification.

Such key players are:

Recent Developments

- In April 2025, Thales announced that it is behind one in every three smart civil IDs delivered globally each year. The company's Civil Identity Suite enables citizens to enroll biometrically in seconds and use their identity both online and in person. This initiative supports governments in delivering secure, trusted identities to their populations, facilitating digital inclusion and enhancing access to services.

- In January 2025, IDEMIA Public Security announced its top-ranking results in the Department of Homeland Security’s (DHS) Science and Technology Directorate (S&T) and Remote Identity Validation Technology Demonstration (RIVTD) evaluation for excellent biometric accuracy and fairness.

- In February 2024, NEC introduced a breakthrough in facial recognition technology, NeoFace Reveal 4.0, delivering superior accuracy even in challenging low-light environments. The solution saw rapid adoption across Tokyo's retail sector, being deployed in over 203 convenience stores for seamless cashierless payments.

- Report ID: 7978

- Published Date: Oct 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.