Biomass Market Outlook:

Biomass Market size was valued at USD 79.26 billion in 2025 and is expected to reach USD 157.38 billion by 2035, expanding at around 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biomass is evaluated at USD 84.32 billion.

Supportive regulations, feed-in tariffs, and subsidies are encouraging investments in biomass projects worldwide. For instance, in August 2021, Mitsui & Co., Ltd. announced an investment of USD 4.1 million in a leading biomass supply-chain management company in India, Punjab Renewable Energy Systems Pvt. Ltd. Furthermore, in May 2024, Malakoff Corporation Berhad launched a Biomass Co-Firing project in Pontian, Johor. This initiative, a flagship project of the National Energy Transition Roadmap, supports the national target of reducing carbon intensity by 45% by 2030 and increasing the Renewable Energy capacity mix from 40% to 70% by 2050.

Additionally, abundant availability of agricultural and forestry waste is enabling a reliable supply of raw materials for energy generation, making biomass a practical and sustainable option. Gasification and anaerobic digestion, along with the growing popularity of decentralized and off-grid energy systems, are also shaping the market. Increasing urbanization and industrialization, in addition to biomass’s support in rural development by creating local employment opportunities and promoting energy access in off-grid areas, making it a socially inclusive energy solution.

Key Biomass Market Insights Summary:

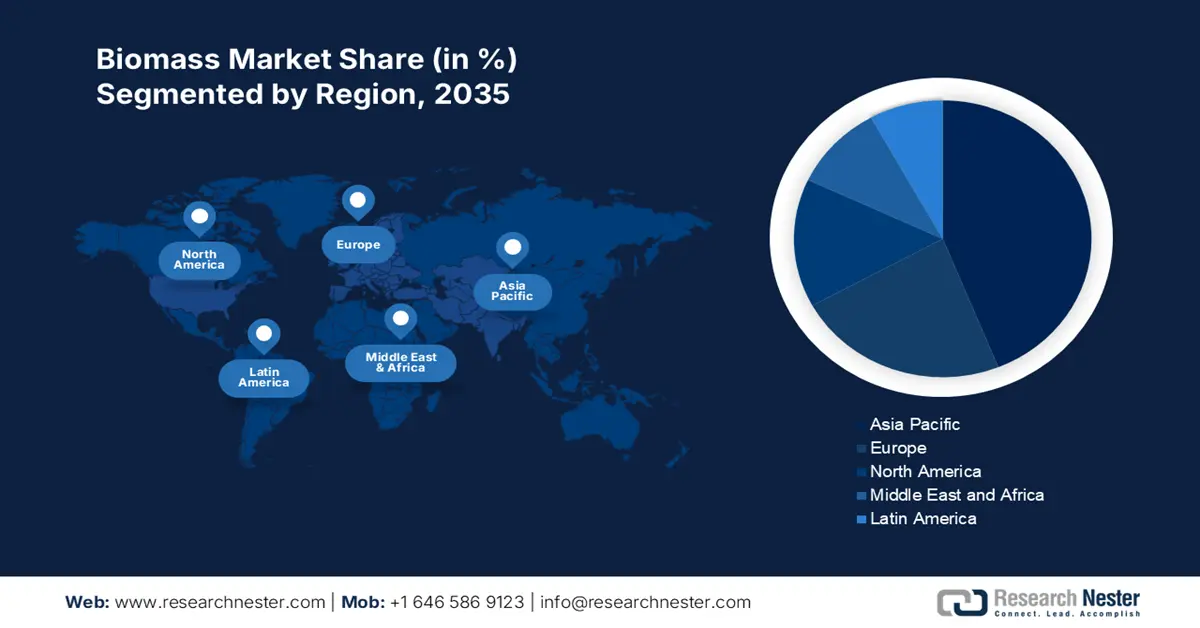

Regional Highlights:

- Asia Pacific biomass market projects tremendous growth by 2035, driven by eco-friendly energy initiatives and strong regulations for CO₂ footprint.

- Europe market will achieve considerable CAGR during 2026-2035, driven by sustainable energy policies and advancements in biomass conversion technologies.

Segment Insights:

- The residential application segment in the biomass market is anticipated to achieve a 78% share by 2035, influenced by cost-effective and eco-friendly heating alternatives supported by incentives.

- The hvac systems segment in the biomass market is anticipated to capture a significant share by 2035, propelled by efficiency, automation, and alignment with sustainability goals.

Key Growth Trends:

- Rising demand for renewable energy

- Waste management solutions

Major Challenges:

- Relatively expensive as compared to other fuels

Key Players: Drax, Alstom, Siemens, Foster, Wheeler, A A Energy Ltd, A S NaturEnergie GmbH, ABI Energy Consultancy Services, AE E Lentjes GmbH, AES Corporation.

Global Biomass Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 79.26 billion

- 2026 Market Size: USD 84.32 billion

- Projected Market Size: USD 157.38 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Brazil, China, United States, India, Germany

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Biomass Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for renewable energy: Countries and industries worldwide are seeking cleaner alternatives to fossil fuels. With global commitments to carbon neutrality and sustainable development, biomass is gaining traction for its ability to provide reliable, dispatchable energy while reducing greenhouse gas emissions. Its compatibility with existing infrastructure, especially in the power and heating sectors, makes it an attractive choice in the renewable energy mix.

- Waste management solutions: By turning organic and agricultural waste into valuable energy sources, the market is also experiencing significant expansion. These systems help reduce landfill use, lower methane emissions, and address growing waste disposal concerns in both urban and rural areas. This dual benefit of energy production and waste reduction makes biomass an increasingly popular solution for sustainable waste management strategies.

Challenge

- Relatively expensive as compared to other fuels: The high cost of biomass fuel limits its competitiveness against conventional fossil fuels and other renewables. Sourcing, processing, and transporting biomass is expensive, especially in regions lacking local feedstock or infrastructure. Additionally, fluctuating supply and seasonal availability of raw materials add to price volatility.

Biomass Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 79.26 billion |

|

Forecast Year Market Size (2035) |

USD 157.38 billion |

|

Regional Scope |

|

Biomass Market Segmentation:

Type Segment Analysis

The HVAC systems are projected to register a significant share owing to their efficiency, automation, and alignment with sustainability goals. These systems are prevalent in regions including Europe and countries such as India, where government subsidies and policies support renewable energy adoption. In February 2024, ABB India launches its next-generation compact drive, ACH180, for HVACR (heating, ventilation, air conditioning, and refrigeration) equipment, ACH180, enabling expert control of high-efficiency motors while utilizing a compact design for space savings, lower capital expenditure, and easier commissioning.

Application Segment Analysis

The residential segment is anticipated to register a considerable share in the biomass market. Homeowners are turning to biomass boilers and stoves as cost-effective and eco-friendly alternatives to traditional heating fuels, motivated by rising energy costs and environmental concerns. Government incentives and subsidies for renewable energy installations further encourage this shift. The IEA Bioenergy 2021 stated that biomass represents 78% of fuel consumption in residential applications in India. Advancements in biomass technologies have made these systems more accessible and user-friendly.

Our in-depth analysis of the global biomass market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biomass Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific is also expected to showcase tremendous growth in the biomass market, backed by increased initiatives for the provision of funds from private and government organizations in the eco-friendly energy system. Additionally, rising economies, coupled with strong regulations for low CO2 footprints, are leading reasons for the successive growth of the global market in the region.

The market of India is propelled by several drivers, including initiatives by the government. According to the Ministry of New and Renewable Energy, in July 2024, annual biomass production is around 750 MMT in the country, out of which 228 MMT is surplus biomass. The country’s vast agricultural sector generates substantial biomass feedstock, including crop residues and organic waste, offering a reliable energy source for the country.

Europe Market Insights

Europe is expected to register considerable growth in the market owing to the improved sustainable energy system. Moreover, governments' support for issues related to carbon emissions in countries such as Germany, the UK, and Italy is supporting the successive growth of the region’s market. Advancements in biomass conversion technologies, such as gasification and pyrolysis, have enhanced efficiency and cost-effectiveness in the regional market.

Germany’s commitment to renewable energy has fostered a conducive environment for biomass energy development. Furthermore, the country’s focus on sustainable and efficient biomass utilization underscores its commitment to climate protection. According to Clean Energy Wire, in February 2025, Germany aims to reach net greenhouse gas neutrality by 2045. It has set interim targets of cutting emissions by at least 65 percent by 2030 and 88 percent by 2040, and net-negative emissions post-2050.

Biomass Market Players:

- Drax

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alstom

- Siemens

- Foster

- Wheeler

- A A Energy Ltd

- A S NaturEnergie GmbH

- ABI Energy Consultancy Services

- AE E Lentjes GmbH

- AES Corporation

Companies in the market are typically adopting strategies including investing in advanced technologies for efficient biomass conversion. Forming partnerships with agricultural sectors for sustainable raw material sourcing, expanding into emerging markets with high energy demands, and diversifying their biomass product portfolio. Many also focus on enhancing supply chain logistics and aligning with government regulations and incentives to promote renewable energy initiatives. Some of these companies include:

Recent Developments

- In January 2025, Panasonic Corporation announced the launch of the OASYS Residential Central Air Conditioning System, the first of its kind, in the US market, consisting of a Mini Split AC, ERV, and transfer fans using DC motor-driven ventilation fans.

- In March 2024, Trane Technologies launched its new residential product portfolio, including R-454B refrigerant, Refrigerant Detection System technology, Trane Link, Trane Home app, and more, with innovative design upgrades to its highly efficient heat pumps and air conditioners, including next-generation refrigerant with 78% less global warming potential.

- Report ID: 1355

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biomass Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.