Biologics Contract Development Market Outlook:

Biologics Contract Development Market size was over USD 8.66 billion in 2025 and is poised to exceed USD 21.46 billion by 2035, growing at over 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biologics contract development is estimated at USD 9.4 billion.

The heightened popularity and benefits of contractual services in the pharmaceutical industry are fueling the biologics contract development market. As the worldwide prevalence of chronic diseases rises, the demand for biologics increases. According to an NLM article, published in October 2023, this widespread consisted of 369 forms and territories across 204 countries around the globe. Further, another NLM study reported that the expenditure on habitats with these complex conditions, such as cancer, diabetes, and Alzheimer’s, is expected to reach USD 47.0 trillion by 2030. This testifies to the growing need for cost-effective and efficient therapeutics.

The biologics contract development market is a highly preferable option for companies, seeking an affordable way to create new product pipelines. The biologics industry faces high competition with generic drugs in offering fair payers’ pricing due to the disparity in R&D and production cost. On this note, a study, funded by Christopher Bianco and BioScience Communications, published in February 2022, revealed that developing a synthetically derived small molecule drug is less expensive, compared to biosimilars. This difference may impact the product pricing strategy and sales volume while marketing and retailing. This indicates a surge in contract development and manufacturing organization (CDMO) services, as they can reduce these additional costs with their optimized methodologies.

Comparative Presentation of Development Cost Between Generics and Biosimilars (2022)

|

Type of Drugs |

Duration (in years) |

Range of Cost (in million) |

|

Generic |

2 |

1.0-4.0 |

|

Biosimilar |

7-8 |

100.0-250.0 |

Source: Seminars in Arthritis and Rheumatism February 2022

Key Biologics Contract Development Market Insights Summary:

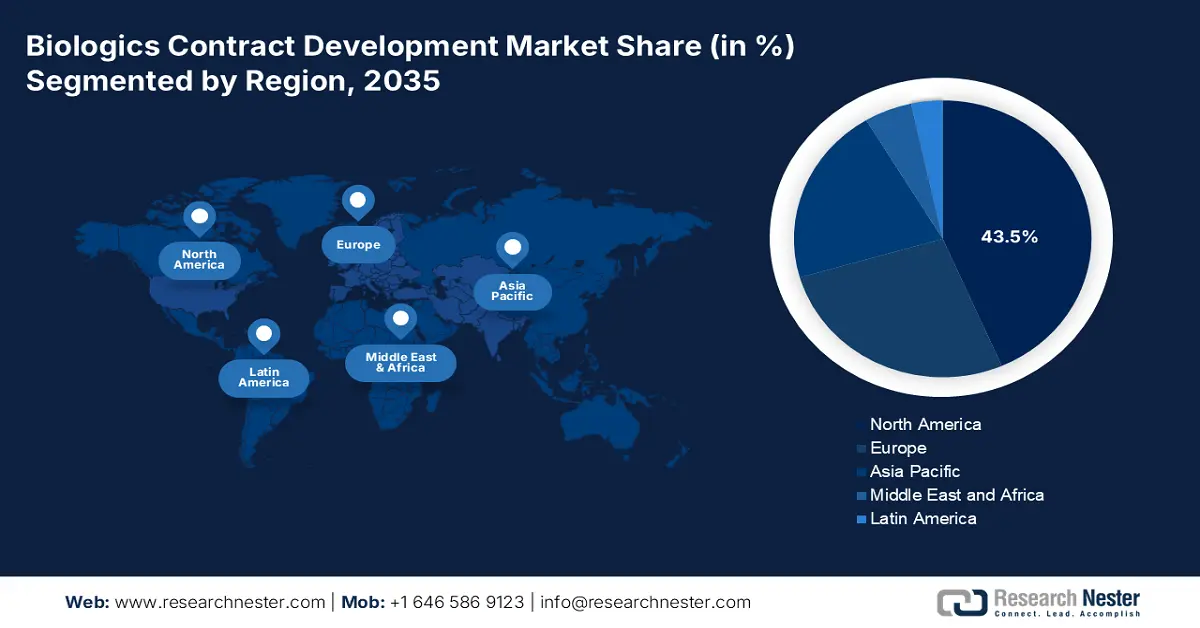

Regional Highlights:

- North America commands a 43.5% share in the Biologics Contract Development Market, propelled by the rapid expansion of the biopharmaceutical industry and growing cancer burden, ensuring robust growth through 2026–2035.

Segment Insights:

- The mammalian segment is anticipated to hold a 55.6% market share by 2035, fueled by high demand for monoclonal antibodies and therapeutic proteins.

- The Oncology segment of the Biologics Contract Development Market is poised to dominate by 2035, fueled by the rising global prevalence of cancer and increasing demand for targeted biologic therapies.

Key Growth Trends:

- Boom in the economic impact of biologics

- Advancement and elevation in development quality and quantity

Major Challenges:

- Associated dispute and risk on intellectual property (IP)

- Volatility in supply chain and resource availability

- Key Players: WuXi Biologics, Thermo Fisher Scientific Inc., Genscript, Bionova Scientific, Inc..

Global Biologics Contract Development Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.66 billion

- 2026 Market Size: USD 9.4 billion

- Projected Market Size: USD 21.46 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: China, India, Singapore, South Korea, Brazil

Last updated on : 12 August, 2025

Biologics Contract Development Market Growth Drivers and Challenges:

Growth Drivers

- Boom in the economic impact of biologics: As the patient pool enlarges, the purchase rate of biologics heightens. In this regard, the American Chemical Society revealed that the gross sale value of these therapeutics is predicted to gain USD 120.0 billion globally by 2027, surpassing the innovative line of small molecule drugs. It also concluded a 9.2% growth rate in the global biologics industry till 2027, accounting for USD 569.7 billion and capturing a 55.0% share in the total sale volume of innovative medicines worldwide. This is a direct indication of the rising urge for assistance in such large-scale development processes, boosting the market.

- Advancement and elevation in development quality and quantity: Growth in the biologics contract development market is highly dependent on technological integrations. The glorifying capabilities of the biotechnology industry are providing cutting-edge solutions to accelerate the pace of R&D in this sector. For instance, in November 2024, Samsung Biologics introduced a high-concentration formulation platform, S-HiCon, with abilities to manage pH levels, enhance stability, and optimize drug delivery capacity. This tool is specifically designed to empower high-dose drug development and to improve the pathway of administration.

Challenges

- Associated dispute and risk on intellectual property (IP): The highly competitive scenario of this industry may raise concerns about protecting IP proprietorships, affecting the reliable image of the biologics contract development market. Preparing a suitable arrangement between service providers and customers is a difficult task to overcome, particularly in ensuring complete confidentiality in contracts. Further, the risk of leaking the individual’s proprietary information may result in competitive disadvantages, discouraging companies from investing in this sector.

- Volatility in supply chain and resource availability: In comparison to the calculated demand, the biologics contract development market often witnesses disruptions in essential supplies. Large-scale productions require a big workforce and a reliable reservoir of raw materials, which may get hindered due to political disputes, natural disasters, and regulatory hurdles. This has the potential to create a delay in deliveries, loosening the customer’s trust and future deals. This may dilute the interest of newcomers and investors in this field.

Biologics Contract Development Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 8.66 billion |

|

Forecast Year Market Size (2035) |

USD 21.46 billion |

|

Regional Scope |

|

Biologics Contract Development Market Segmentation:

Source (Mammalian, Microbial, Others)

Based on source, the mammalian segment is set to account for biologics contract development market share of more than 55.6% by the end of 2035. These cell systems are the major source of monoclonal antibodies and therapeutic proteins, making them the most preferable option for drug producers and research institutions. On the other hand, the rising demand for these types of biologics is inflating. For instance, the global therapeutic monoclonal antibody industry is expected to reach USD 300.0 billion by 2025, as per June 2024 NLM estimation. This implies growing the urge for this sub-type. Moreover, its high quality and complex mechanism help in developing humanized components, desired for high-end clinical and commercial settings, which attracts more drug producers to invest in this segment.

Indication (Oncology, Immunological Disorders, Cardiovascular Disorders, Hematological Disorders)

Based on indication, the oncology segment is predicted to dominate the biologics contract development market throughout the forecasted timeframe. This segment’s progress is driven by the heightening prevalence of cancer around the world. As per GLOBOCAN projections, the population of cancer patients worldwide accounted for 20.0 million and 9.7 million new and death cases in 2022. With the highest mortality rates and enlarging financial burden, this medical category is dragging the focus of international public health authorities on cultivating sufficient and accessible resources. This is subsequently igniting a surge in this segment. Furthermore, the contribution of biologics in producing cell-based targeted therapies gained traction over the past decade, securing a stable business flow in this disease type.

Our in-depth analysis of the global biologics contract development market includes the following segments:

|

Source |

|

|

Service |

|

|

Indication |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biologics Contract Development Market Regional Analysis:

North America Market Analysis

North America biologics contract development market is set to capture revenue share of around 43.5% by the end of 2035. This region is pledged with the rapid expansion of the biopharmaceutical industry, particularly in biological discoveries. In addition, the growing cancer burden in developed countries such as the U.S. and Canada is propelling the need for more specific and tailored treatment. These combined factors are making North America a primary marketplace for CDMOs in this sector. For instance, in October 2023, Tanvex BioPharma launched a new U.S. subsidiary for contractual services, Tanvex CDMO, to offer developmental assistance to the domestic field of biopharma with novel mammalian and microbial-based therapeutics.

The U.S. is facing the consequences of emphasizing economic load from rising expenditure on cancer, where the biologics contract development market is standing strong with cost-effective solutions. According to an NLM report, published in March 2021, the monthly spending on cancer drugs by patients across this country was USD 288.0. It also mentioned that the expenses for adult residents and caregivers per month ranged between USD 180.0 and USD 2600.0, during the same timeline. This out-of-pocket spending is pushing the national government to implement more accessible commodities, fueling this field.

Canada is also following the path of improved availability, which is fostering a favorable environment for the biologics contract development market. The country is utilizing its broad genomic culture and well-established healthcare infrastructure to avail a reliable distribution channel for pioneers in this merchandise. The public-private collaborations are proactively participating in this cohort by allocating hefty funds and grants. For instance, in May 2023, AbCellera released CA$701 million (USD 490.1 million) funding as a co-partner of the government of Canada and British Columbia to construct an adequate antibody-based medicines development and manufacturing facility.

APAC Market Statistics

Asia Pacific is poised to become one of the fastest-growing regions in the biologics contract development market over the assessed timeline. This region contains a chronicle patient population with high mortality rates and weak economic background, which is pushing pharma pioneers to introduce methods of optimizing the development cost of required drugs. In addition, the wide acceptance for contract-based pharmacological services is presenting a pre-established scenario for leaders. For instance, the pharmaceutical contract manufacturing and research services industry in APAC is predicted to dominate the global landscape with the largest share of 42.9% by 2035. Further, the efforts to increase the availability and affordability of essential therapeutics are fueling this sector.

India is augmenting the biologics contract development market with its strong emphasis on bio-economy and pharmacology. According to IBEF, the biotechnology industry in India was valued at USD 70.2 billion in 2020, which is poised to attain USD 150.0 billion by 2025 and USD 300.0 billion by 2030. Similarly, the biologics business in this country is exhibiting a CAGR of 22.0%, showing promising signs to reach USD 12.0 billion by 2025. This is subsequently attracting pharma giants to invest. For instance, in March 2024, Syngene International, a leading CDMO, announced the upcoming inauguration of its new biologic facility, Unit 3, in Bangalore by mid-2024, featuring capacity of 20 KL and a specialized development suite.

China is parallelly propagating the biologics contract development market with technological excellence and ongoing clinical discoveries. The MedTech leaders, originating from this country, are meticulously expanding their territory and resources to cultivate a domestic network of contractual services. For instance, in March 2025, WuXi Biologics introduced a proprietary E. coli expression system, EffiX, for accelerating the development process of recombinant proteins and plasmid DNA. The next-generation platform is designed to cope with the rising demand for microbial-derived products. Such innovations are solidifying the nation’s predominant captivity in this field.

Key Biologics Contract Development Market Players:

- WuXi Biologics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abzena Ltd.

- KBI Biopharma

- Thermo Fisher Scientific Inc.

- Curia Global, Inc.

- Genscript

- Bionova Scientific, Inc.

- BioXcellence (Boehringer Ingelheim Biopharmaceuticals GmbH)

- STC Biologics

- Tanvex BioPharma, Inc.

- Avid Bioservices, Inc.

The tech-based pioneers in the biologics contract development market are embarking their leadership across the world. Their revolutionary technologies are helping to reduce the pricing of essential components such as monoclonal antibodies and proteins. They are also focusing on globalizing their services and commodities to expand their territory. For instance, in February 2024, Eurofins CDMO Alphora inaugurated its latest pilot scale biologics development facility in Mississauga, Canada. The 3,300 square feet unit is dedicated to provide a range of services, including upstream & downstream development and cGMP quality documentation, with a 200 L fed-batch capacity. Such key players are:

Recent Developments

- In February 2025, Avid Bioservices announced its acquisition by GHO Capital Partners LLP to expand its territory across the CDMO value chain. The company expected this acquisition to combine GHO’s technological capabilities with its biologic development expertise, bringing new possibilities through a stable capital influx.

- In January 2025, Tanvex BioPharma acquired Bora Biologics Co., Ltd. to escalate its track record of over 100 successful cGMP manufacturing batches. The company planned to merge its expertise in biosimilar development and commercialization with Bora’s extensive global early-stage biologics CDMO capabilities in Taiwan through this acquisition.

- Report ID: 7332

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.